Strengths

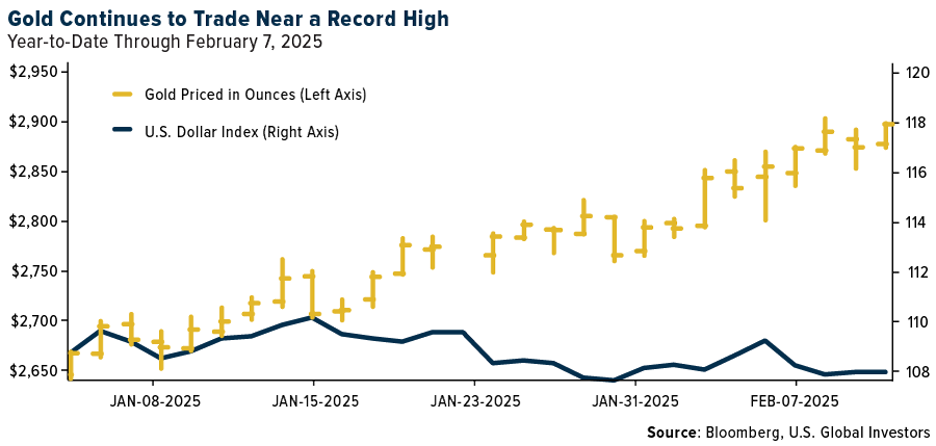

- The best-performing precious metal for the past week was gold, up 1.86%. Gold is showing strength this week, hitting a fresh record high as trade war worries bolster demand and the potential for tariffs reigniting inflation adds to its appeal. In addition, China announced it had expanded its gold reserves for a third month in January despite a series of record-high prices. China’s National Financial Regulatory Administration also just cleared the path for insurance companies in China to invest in gold-related businesses as medium- and long-term investments to optimize their asset allocation, Bloomberg reports.

- Major bullion dealers like JPMorgan Chase & Co. are working to deliver over $4 billion of gold against futures contracts in New York amidst a rush to ship metal to the U.S. before potential import tariffs take effect. There’s unease about what lies ahead. Gold dealers in London were selling gold at more than a $5 discount to spot prices in a scramble to move the gold to New York.

- Russians bought a record amount of gold last year as they sought to protect their savings amid sanctions, obtaining the equivalent of about a fourth of the country’s annual output. Consumers purchased 75.6 metric tons (2.7 million ounces) of the yellow metal in bullion, coins, and jewelry in 2024, the fifth biggest figure among all nations, according to World Gold Council data published last Wednesday.

Weaknesses

- The worst-performing precious metal for the past week was palladium, down 8.66%, after climbing above $1,000 per ounce last week. Anglo American Platinum Ltd. said profit last year fell by as much as 52% after the price of palladium and rhodium slumped. Profit in 2024 is likely to decline to between 6.3 billion rand and 7.6 billion rand, from 13 billion rand the previous year, according to Bloomberg.

- The plummeting demand for diamonds and a refusal to lower prices last year has left the owners of De Beers in a difficult place. Competition from synthetic stones has also capped prices in the once-lucrative industry of diamond production and marketing. China was the second largest market for diamonds, but demand there has dropped 50% since before the Covid pandemic.

- Barrick Gold Corp. Chief Executive Officer Mark Bristow said the company is “making progress” in its dispute with Mali’s military regime, but the advances have not come as fast as expected. The Canadian company last month suspended operations at the vast Loulo-Gounkoto complex in Mali after the government started removing gold from the nation’s biggest mine in the latest escalation of a months-long dispute, Bloomberg explains.

Opportunities

- The Silver Institute released its Silver Market Forecast, forecasting a significant deficit in 2025, with industrial demand as the main driver. Global silver demand is expected to remain stable in 2025 at 1,200 million ounces, with gains in industrial applications (700 million ounces). Global silver supply is expected to grow by 3% to 1,050 million ounces, driven by a 2% rise in mine production (844 million ounces).

- The World Gold Council said in a report on Wednesday that demand for gold in the fourth quarter rose to a new quarterly high and that the outlook for 2025 was bright. “Central banks and ETF investors [are] likely to drive demand with economic uncertainty supporting gold’s role as a risk hedge,” the WGC said. “Emerging market banks are very committed to gold and well positioned to purchase more. Strategically, they will continue to be buyers,” said Joe Cavatoni, senior markets strategist with the World Gold Council, in an interview with Barron’s.

- “Record High Profitability, Record Low Valuations: A Coiled Spring in 2025” is the title of a recent research report penned by Don MacLean, Senior Analyst at Paradigm Capital. Don notes gold sector equities are off to a good start in 2025, with all tiers – including the explorers –outperforming gold for the first time since 2020. In addition, Don expects further outperformance to come. Every gold equity tier still has a lot of catching up to do with the metal.

Threats

- The Malian government’s overhaul of its extraction industry risks deterring companies from investing in the nation that is home to the world’s second-largest gold mine, according to Anglo American Plc Chief Executive Officer Duncan Wanblad. Mali’s military rulers have demanded a greater share of income from the nation’s gold and other resources since seizing power four years ago, according to Bloomberg.

- Pandora A/S has suspended the rollout of lab-made diamonds in new markets due to a lack of demand, according to the Danish jeweler’s chief executive officer. Alexander Lacik, whose company makes more pieces of jewelry than any other in the world, said it has proved very difficult to introduce the lab-grown stones in new countries and the company will instead “double down” on existing markets such as North America, Bloomberg writes.

- Eldorado Gold has released an update on the Skouries project which was highlighted by a delay of first production until Q1/26, with commercial production mid-2026, and $143 million increased capex estimates. With this release, the company has also provided updated three-year guidance, which demonstrates decreased production estimates compared to previous guidance and increased 2025 costs compared to BMO’s estimates.