Strengths

- The best-performing precious metal for the past week was palladium, up 5.44%. Recent ETF buying of palladium reflects investor interest in the metal amid geopolitical uncertainties, with holdings rising by 2,384 troy ounces in the latest session, even as Russian supply risks remain a key factor in price volatility.

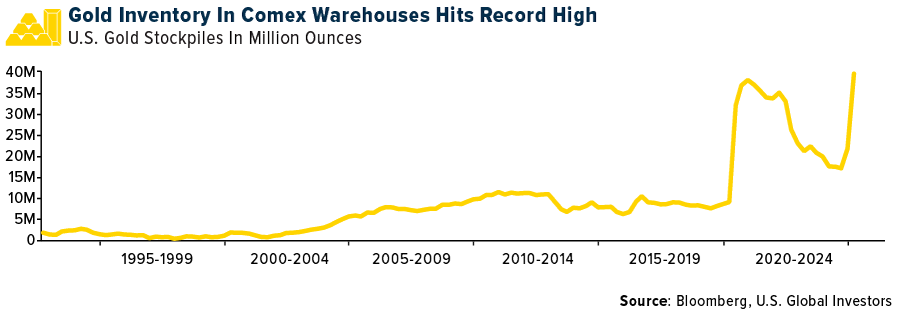

- Record-high U.S. gold stockpiles of 39.7 million ounces, worth approximately $115 billion, have been amassed in exchange warehouses due to a tariff-driven surge in U.S. gold prices. This unprecedented accumulation, driven by lucrative arbitrage opportunities, demonstrates gold's enduring appeal as a safe-haven asset and its ability to attract significant capital flows during periods of economic uncertainty.

- Gold received another monthly bid, marking the fourth consecutive month that China’s central bank added to its reserves, purchasing 160,000 ounces in February—despite the precious metal trading near all-time highs. Fresnillo reported strong FY24 results, with group EBITDA rising 5% compared to Bloomberg consensus. The total FY24 dividend of $0.74 per share exceeds consensus estimates of $0.24 per share by 200%, representing an 8% yield, according to JPMorgan.

Weaknesses

- The worst-performing precious metal for the past week was gold; however, it was still up 2.84%. Gold was the best-performing precious metal last week and remains positive, but speculators this week bought up the other precious metals at a faster pace week-over-week, even outpacing the record inflows of gold into the U.S.

- According to CIBC, Fortuna Mining reported headline earnings of $0.04 per share, below consensus of $0.16 per share. Headline earnings had to be adjusted for several items, including a write-off of mineral properties, to arrive at adjusted earnings of $0.12 per share, but still below consensus. Q4 all-in sustaining costs (AISC) came in at $1,772 per gold equivalent ounces (GEOs), higher than their estimate of $1,701 per GEO.

- The retirement of Paul Voller, HSBC's head of precious metals for the past 12 years, represents a significant loss of expertise and leadership in the bank's precious metals business. This departure could potentially impact HSBC's operations in the global gold market, where it plays a crucial role as one of only four clearing members whose vaults underpin billions of dollars in daily trades in the London gold market.

Opportunities

- The recent Bitcoin price drop, despite the announcement of a U.S. strategic reserve, highlights the volatile nature of cryptocurrencies and reinforces the appeal of gold as a stable store of value. Bitcoin fell from around $90,000 to as low as $84,000 following President Trump's executive order, demonstrating that even positive developments can lead to unexpected market reactions in the crypto space, Bloomberg reports.

- Wheaton Precious Metals announced the winner of its inaugural Future of Mining Challenge. ReThink Milling Inc. has been awarded $1 million for its Conjugate Anvil Hammer Mill (CAHM) and MonoRoll technologies, which have the potential to revolutionize the milling process. This innovative grinding technology demonstrates immense potential to deliver greater efficiency with significantly lower energy use, leading to reduced greenhouse gas emissions and operating costs.

- The platinum market is set for its third consecutive deficit following a shortfall of almost a million ounces last year, according to an industry report. The gap in the supply of critical materials will amount to about 848,000 ounces in 2025, or 11% of total demand, according to a report by the World Platinum Investment Council, a trade association.

Threats

- According to RBC, Endeavor Mining reported an earnings per share (EPS) miss versus consensus, with higher free cash flow (FCF) generation on pre-released production, AISC and guidance. Previously released guidance for FY25 was essentially in line with consensus estimates, with the first full year of production from the Sabodala Biox expansion and Lafigue leading to +7% higher YoY production at the mid-point and lower expected total capital spending.

- According to RBC, Ghana’s Environmental Protection Authority reported that a tailings incident previously occurred at AngloGold’s Iduapriem mine. Tailings-related matters carry high sensitivity due to the potential for both environmental and safety-related risks. There are no direct injuries reported from the tailings incident, and they interpret the severity of the matter to be moderate, while an investigation into the matter is reportedly ongoing by Ghana's EPA.

- Standard Chartered suggests the U.S. could sell a portion of its $760 billion gold reserves to fund the newly established Strategic Bitcoin Reserve, potentially undermining gold's status as a premier reserve asset. This strategy, if implemented, could trigger a significant shift in reserve holdings, potentially leading to decreased demand for gold and increased interest in Bitcoin as a strategic asset, Bloomberg reports.