Strengths

- The best-performing precious metal for the past week was platinum, up 4.92%. Collective Mining shares jumped 8.2% after investors learned Agnico Eagle Mines agreed to subscribe to 4.74 million shares at C$11.00, nearly $2 above the prior closing price, and concurrently exercised 2.25 million warrants early at a price of C$5.01 per share. Agnico will now own 14.99% of Collective Mining, which has had exceptional copper and gold intercepts on its Guayabales Project in Caldas, Colombia.

- The World Gold Council notes that “Global physically backed gold ETFs saw significant inflows in February totaling $9.4 billion, the strongest since March 2022. North American flows flipped positive following two consecutive monthly outflows, recording one of its strongest months on record. Asian demand was also strong while European inflows narrowed.”

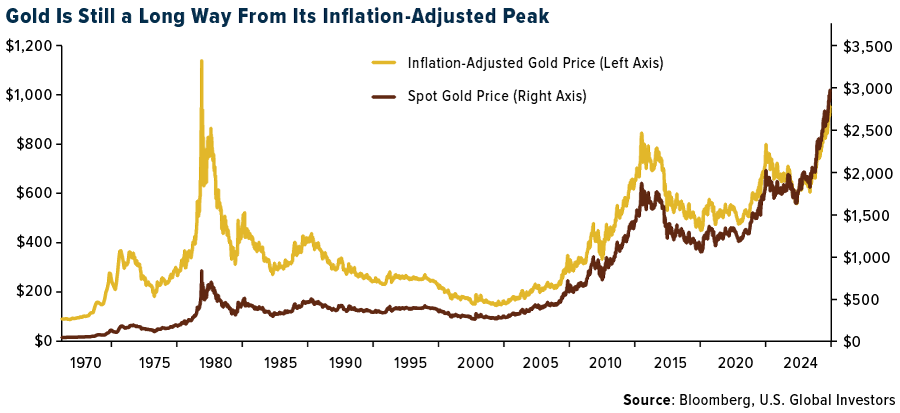

- Gold broke $3,000 this week and is currently flirting just under that all-time high mark! The yellow metal surpassed $3,000 an ounce for the first time, driven by central bank buying, economic fragility, and President Trump's trade policies. The rally has been fueled by investors seeking a store of value in turbulent times, with central banks buying bullion to diversify away from the dollar and China's economic worries contributing to the surge. And if you are getting wimpish on this gold rally (that the price can’t get any higher), take note that the peak inflation adjusted price in 1980, as shown in the chart below, was $3,800 per ounce.

Weaknesses

- The worst performing precious metal for the past week was palladium, however still up 1.83%. Palladium was the best performing precious metal last week and still had a bit of room to run for upside this week. There are initiatives in the U.S. and China giving grants toward finding industrial or scientific uses for the precious metal, according to Bloomberg.

- According to Bank of America, precious metals refiner Heraeus notes that “Central bank purchases in January were down 60% year-on-year to 18.5 tons. Only 11 central banks bought gold in January – the lowest monthly count since January 2021.”

- Gold prices have surged to unprecedented levels, briefly breaking through $3,000 an ounce for the first time this week, while silver prices have lagged, resulting in the gold-silver ratio reaching all-time highs. This divergence in precious metal performance is evident in recent ETF activity, where gold holdings have increased significantly while silver holdings have decreased on a year-to-date basis.

Opportunities

- Gold's impressive run since late February 2024 has largely been driven by official sector purchases driven by the U.S. fiscal deficit, wars, and widespread economic uncertainty, reports Bank of America, with the recent record highs driven by uncertainty surrounding U.S. trade policies. The group forecasts gold to average $3,000 per ounce for 2025.

- Gold’s burgeoning safe-haven allure may see it surge to a record high of $3,500 an ounce during the third quarter, according to Macquarie Group analysts. Bullion could average $3,150 an ounce over that period, analysts led by Marcus Garvey said in a note. The precious metal — which was trading around $2,940 an ounce on Thursday — will get further support from concerns about a potentially growing U.S. deficit, they said.

- Bolivia’s new state gold trading firm plans to quadruple purchases this year as a way of boosting reserves of the high-flying metal for the nation’s struggling central bank. Known as Epcoro, the company has already bought a ton of gold this year from small-scale Bolivian producers, compared with a total of 2.4 tons last year, reports Bloomberg.

Threats

- Heraeus adds that “Poland, the dominant player in 2024, added 89 tons to its reserves. However, in January this year Poland ranked only fourth, buying just 3.1 tons – less than half its monthly average for 2024. Based on current reserves and gold prices, Poland would need to purchase less than 50 tons in 2025 to hit that target, explains Bank of America.

- Ramelius Resources' updated mine plan for Mt Magnet has generally disappointed analysts, leading to downgrades in near-term production forecasts and increased capex expectations, while also sending shares sharply lower by 17.2%. The revised plan incorporates a mill expansion to 3Mtpa and a cutback of the Eridanus open pit, but lower than expected ore grades, particularly at Eridanus, have driven down production estimates for FY26 and FY27. This, coupled with higher costs and capital outlays, has resulted in reduced earnings forecasts and a negative impact on its net present value (NPV).

- Royal Gold issued guidance by individual metal—and when RBC converts these figures to gold-equivalent production using spot commodity prices, 2025 guidance is an implied 267-298K GEO, 5% below its 298,000 GEO forecast.