While I generally lean away from conspiracy theories and certainly don’t want to risk creating one of my own that turns out to be wrong, I couldn’t shake a couple of dark thoughts last week:

1) There is no way the nation’s new Treasury Secretary, Scott Bessent, and those working with him could not know that trashing all trade around the world would trash the US dollar as the global TRADE currency as well. Greatly reduced trade on a global scale means greatly reduced need for a trade currency. Therefore, much less demand for the US dollar, especially when all the currency troubles originate from US actions. It’s really as simple as that.

That also had to mean greatly reduced demand for those US money bags we call “Treasuries,” which banks actually use to move the currency that moves the world, and that could even crash the national debt. How did Bessent & Co. not see the risks of that immensity coming when I predicted this as a likely outcome back in January, before Trump was even inaugurated, based on what he promised to do with tariffs? Bessent, after all, oversaw a big hedge fund that traded Treasuries all the time. So, how could he not see this was coming from the hugely broad tariff war he was planning with the president?

2) Scott Bessent started down the road to billionaireville through working for globalist George Soros exactly when Soros crashed the British pound and made his first billions, too. The British pound, of course, was the global trade currency that preceded the dollar, and so, Bessent and Soros helped finalize the loss of the pound’s global reign. In short, Scott Bessent knows how to make a world-class fortune by crashing a global currency. He’s actually one of the best at it.

Since Bessent almost had to see the troubles coming for the dollar and Treasuries that dominated financial news for the last two weeks, I had to wonder if he and his billionaire boss/mentor decided it was time to crash the biggest of all global currencies and become the world’s first trillionaires by finding ways to short the dollar or bet on its alternatives. What better way to work that out than by getting right into the very heart and brain of currency control for the global currency?

Of course, hitting Bessent with guilt by association over his deep ties with Soros, one of the world’s major architects in global unrest and currency takedowns, is a logical fallacy. So, while it begs me to ask whether Bessent is at it again, it also begs a lot more research to see how many arrows might be pointing in that direction.

What I found over the weekend looks truly dark for the dollar. In my search, I’ve dislodged a lot of non-trivial facts that lead me to wonder all the more seriously if US Treasury Secretary Scott Bessent and a small number of collaborators in the White House are actually trying to collapse the US dollar.

He’s sooo Soros

Let’s start, however, with Bessent’s Soros connection because of what the facts reveal about Bessent. Soros is a man so infamous among conservatives for driving wedges into democracies to bust them open, I probably don’t need to say anything about him. Democrats, on the other hand, know Soros as a major donor. I’m not going to use Bessent’s association with Soros as evidence that Bessent is up to the same thing again, but to lay out how skilled and willing and ABLE Bessent, himself, is to engage in currency crashing when he sees the troubles a currency is already in. In fact, it looks like Bessent was more the lead on the pound’s takedown than either Soros or the storied billionaire who more famously aided Soros in that task, Stanley Druckenmiller.

Before he founded Key Square Group, Bessent was a partner at Soros Fund Management, a company that, among other things, widely invests in sovereign bonds.

In the week leading up to September 16, 1992, or "Black Wednesday," Quantum Funds [which Soros co-owned with Jim Rogers] earned $1.8 billion by shorting British pounds and buying German marks. This transaction earned Soros the title of "the Man Who Broke the Bank of England.” On the other hand, British government policy in the period before the ejection of the pound sterling from the Exchange Rate Mechanism of the European Monetary System had been widely criticised for providing speculators with a one-way bet. (Wikipedia)

Bessent was the head of Soros Funds’ London office, where the shorting the pound was orchestrated. So, he was directly in charge.

In this role, he was a leading member of the group [Quantum] that successfully bet on the 1992 sterling crisis, generating over $1 billion in profit for the firm. (Wikipedia).

The company Bessent founded after leaving Soros Fund Management, Key Square specializes in using geopolitics and economics to make macro investments. So, working the geopolitical angles, just as Soros has always done and continues to do, has remained Bessent’s own modus operandi. Moreover, Bessent’s new company began with a $2-billion anchor investment by George Soros. So, the two remained connected in business at the hip by Soros’s blessing. This is more than an association. It’s essentially a partnership.

Key Square has lost billions in assets under management in recent years through bad investments that have caused investors to pull out, so one might reasonably wonder if its founder was ready to return to the kind of plays that made him and his mentor their original billions. For whatever reason, he got out of Key Square. In 2018, he returned Soros’s original investment as was provided for in a pre-arranged deal, and took aim at becoming Treasury Secretary. That was when Bessent announced he would sever ties with his own rapidly declining company, possibly good timing to sell while it still had appreciable assets to manage of around half a billion (from its high of over $5 billion).

Like Soros, Bessent has been a major donor to high-and-mighty Democrats, including Al Gore, Barack Obama, and Hillary Clinton. In fact, he supported Democrats for decades, but he also donated $1 million to Donald Trump in 2017 and another million to Trump’s 2024 campaign. So, like Trump, he seems to be one who routinely throws big money to both sides to buy favor with whichever side wins, rather than an ideologue trying to sway politics either more liberal or more conservative, such as, say, Soros to the Left or the My-Pillow guy to the Right. Bessent also hosted a fundraiser in Palm Beach, Florida, that raised $50 million for Trump’s campaign. Bessent has been in with the Trump family for years, even prior to getting involved in politics.

I’d look at all of that and say it looks like Bessent paid a handsome price to become politically appointed as the Secretary of the US Treasury—the political seat of the US dollar. Given the millions he spent on some of the nation’s most powerful liberals, it certainly doesn’t appear he paid his way into political influence to steer the nation in a more conservative direction. Nor did he do it to lobby the big powers for the interests of his business, given that he got out of the business. Call me jaded, but I don’t know why else someone would exit the firm he founded while it was running downhill and spend millions of dollars supporting the campaigns of big names on the both sides of the aisle with no apparent ideological commitment behind his gifts and no company left that needed to lobby politicians … other than to curry personal favors.

He be sent

It was Bessent who was most centrally involved in creating Trump’s economic plan. Right after Trump was elected, the President-Elect announced he would be nominating Bessent for the position of US Treasury Secretary. Bessent’s economic plan included tariffs as a central component, which Bessent personally championed before the United States Senate Committee on Finance on January 16, 2025, just before Trump’s inauguration.

The three main legs of his plan were to impose tariffs, support tax-cut extensions, and establish tougher economic policies against China and Russia. His nomination was approved by a wide, bipartisan plurality in the Senate.

It was Bessent who gave Elon Musk & the DOGE Bros. full unvetted access to the Treasury payment system, allowing Musk & Men to shut down numerous government payments at will. Bessent also became head of the Consumer Financial Protection Bureau and immediately shut it down, himself, and he was tasked by Trump with implementing a United States Sovereign Wealth Fund, which it has been said will include major investments in cryptocurrencies, possibly including those just founded by members of the Trump family.

Anything smell funny so far? We’re barely getting started. A lot more came up in the digging.

Probably nothing smells funny if you like Trump because that is how that works. Change his name to Biden, and the same person would be disgusted or outraged. Otherwise, a little sniff test on what all of this is leading to might seem reasonable to the average Joe. With all those articles flooding recent mainstream news about the dollar’s collapse, as I’ll show below, I have to wonder who is looking to milk the United States for all they can in order to benefit from the possible dollar collapse that everyone is suddenly writing about? Follow the money.

As a champion of the Trump Tariffs in April,

Bessent told "every country": "do not retaliate, sit back, take it in, let's see how it goes, because, if you retaliate, there will be escalation." Stocks then fell by over $6 trillion, but Bessent said: "I see no reason that we have to price in a recession."

Apparently, that was all according to plan, as it didn’t faze him, so people should just trust him. He even said stocks needed to fall (not that I’d disagree with that, but it’s not the usual thing you hear from an investment guy or a member of the government unless he’s shorting the market).

Bessent has advocated pushing for concessions from U.S. trading partners to restrict their economic relationships with China in order to isolate China and gain leverage over it in potential trade talks.

Maybe he’s going to hedge his bets against the US dollar (if he has any) by crashing the yuan, too. Crash both at the same time, and really multiply your money. Or maybe not. We’ll keep sniffing.

Bessent has argued that tariffs against China "are a means to finally stand up for Americans." They are also now verifiably proven as an excellent way to crash both the dollar and the yuan simultaneously, robbing the average American or Chinese person of the wealth they thought they had stored. Suddenly most large financial publishers are asking if the tariffs are going to crash the dollar and if they are going to crash the yuan and one of its global competitors—something no one in the mainstream press was asking just a month ago … though I was more than three months ago, as the cause-and-effect from tariffing the whole world seemed obvious to me.

Bessent has even proposed a way that Trump could sideline Jerome Powell if he cannot fire him. That would be if Powell does not play along with the plan. Did Bessent propose a path to pounce on Powell because he thinks Powell is the inept head of the inept Fed, which I wouldn’t disagree with either, or just in case the apparently uncontrollable Powell gets in the way of whatever intentions Bessent had for becoming Treasury Secretary, ending the Consumer Financial Protection Bureau and starting up a US Sovereign Wealth Fund (in that Trump would not have likely have chosen Bessent to start such a fund if Bessent had not been championing that idea as well)?

Pow! to Powell

Prior to his confirmation, Bessent made a bold claim that Trump would not be pressuring Powell to lower interest rates:

Bessent says Trump is focused on the 10-year Treasury yield and won’t push the Fed to cut rates

The Trump administration is more focused on keeping Treasury yields low rather than on what the Federal Reserve does, Treasury Secretary Scott Bessent said.

While in the past President Donald Trump has implored the Fed to cut its benchmark rate, Bessent said Wednesday that the current strategy is using the levers of fiscal policy to keep rates low. The benchmark the administration is using [to control interest rates] will be the 10-year Treasury, not the federal funds rate that the central bank controls, he added…. (CNBC)

The president, in other words, would achieve his own interest-rate objectives by having the US Treasury manipulate the interest rate of the 10YR bond, which it can do just by deciding to issue fewer or more bonds of that maturity; thereby controlling absolutely the supply side of 10YR bond prices. He can shrink the size of the big bond pond of 10YRs so as to require a lot fewer buyers for that particular maturity (and issue more for other maturity’s to cover the Treasury’s financing needs) because .... the 10YR is the benchmark peg for many of the nation’s private/corporate credit rates. The others are not.

Bessent indicated that Trump will not be hectoring the Fed to cut, as he did during his first term.

“He wants lower rates. He is not calling for the Fed to lower rates,” Bessent said.

That was a false or odd assurance, considering Trump has been doing exactly that! One wonders what other blind assurances Bessent might speak just because they are convenient, which ultimately turn out to be far from the truth. In fact, pummeling Powell has come back into being Trump’s favorite pugilistic sport:

Trump renews call for interest rate cut, says rates would be lower if Fed chief Powell ‘understood what he was doing….’

“If we had a Fed Chairman that understood what he was doing, interest rates would be coming down, too,” Trump said. “He should bring them down….”

White House economic adviser Kevin Hassett said Friday that Trump and his team are assessing whether they can remove the Fed chair.

The team seems intent on getting rid of him, and that sure goes well beyond merely heckling him!

Kevin Hassett, chair of the White House National Economic Council, backed away from his previous concerns about Powell’s firing and said the White House was looking for ways to replace the Fed chief.

“The president and his team will continue to study” if Powell can be fired, Hassett told reporters at the White House. (The Hill)

One of those sly ways is, in fact, the Bessent plan to sideline Powell by having Trump appoint Powell’s successor ahead of the end of Powell’s term so the successor can start undercutting anything Powell does that Team Trump doesn’t like. A designated appointee, for example, can pull against Powell’s lever of “forward guidance” by immediately countering what Powell says with his or her own forward guidance, neutering Powell’s effectiveness by saying he or she will do the opposite after gaining the office.

That kind of chaotic, internecine battle at the top of US finance certainly ought to be able to destroy any lingering faith in the dollar. It’d be like having two popes—one of them dying and the other his pre-chosen replacement—giving opposing papal decrees at the same time. In Pope Powell’s case, People would think the Eccles “Temple of Finance” had become a house divided against itself. Maybe that is the intention of Bessent’s odd plan to undermine the head of the Fed, despising decades of Fed heads and Treasury heads working in close consort. It certainly raises an eyebrow as to what these guys are up to.

Trump posted on Truth Social on Thursday that “Powell’s termination cannot come fast enough.” His post included the nickname of “Too Late” for Powell, a continuation of Trump’s habit of giving satirical titles to political rivals. (CNBC)

But the dollar demolishers might not even need to use Bessent’s sidelining workaround:

Hassett said on Friday the administration will look at if there’s “new legal analysis” that would allow for Powell’s firing.

The main point here is that both Bessent and Trump will make certain Powell does not stand in the way of their plans, whatever those plans are for the dollar, cryptos, sovereign-wealth funds, etc. (Yet, those plans are the part we know nothing about, and why don’t we? Why does the transition require secrecy about what we are transitioning to?)

Powell, after all, was already countering Trump’s and Bessent’s claims that tariffs are not inflationary by saying they definitely are. Sweeping global tariffs have just demonstrated they are an excellent tool for taking down the dollar faster than anything ever seen, immediately dwarfing any claims that Russia, China, and the other BRICS nations were going to attempt the nearly impossible. If tariffs are to continue being used toward that end, then turning the dollar’s demise into an inside operation carried out by the President with the aid of his Secretary of the Treasury and trade negotiators, having a Fed chief in office who does not speak against the tariff plan might be helpful, especially when the present Fed guy is saying that tariffs might force the Fed to going back to fighting inflation. After all, high inflation would help to tear down the dollar, especially if inflation got all hyper on us. You cannot get to that level without first convincing everyone in the nation that it will never happen, or they’ll never let you go there.

Even Elizabeth Warren, long a Powell critic, rushed to his defense (not too surprising because her criticism never seemed to run deep):

“Understand this: If Chairman Powell can be fired by the president of the United States, it will crash markets in the United States,” Warren said on CNBC.

Oddly, it wasn’t just she who said that, but Trump’s own guy Hassett, except that Hassett said it during Trump’s last term and no longer says that.

Another sign that crashing markets may be part of the plan is that Trump and Bessent have both repeatedly assured the nation that a little market pain might be necessary. Well, I have no doubt that market pain will be necessary just if we were to right the many economic wrongs of the past; but I can also see where pain might be necessary for the objectives described above because there is nothing like a good dollar collapse and overall economic collapse to ready the way for a replacement rescue currency. It would be a blessing if you had some personal ownership in that currency.

And, of course, Trump lashing out at the CEO of the Federal Reserve also helps weaken the dollar by increasing distrust in those who mismanage the dollar. There is no bigger bully pulpit from which to take down a guy of Powell’s financial stature. If the president of the United States says you’re doing a crumby job of managing the national currency, that might lead others in other nations toward thinking the dollar is in jeopardy, too. If you like Powell, you’ll see the dollar jeopardized by the possibility of his being removed. If you don’t like him, you’ll feel confirmed in distrusting the dollar as you hear the president berate his ineptitude.

It was just after Trump’s previous term, Hassett let everyone in the US know he had warned the president that ditching Powell would crash markets:

Hassett recounted in his 2021 memoir that he and other Trump advisers warned the president that firing Powell may not actually be possible and would likely crash financial markets regardless of its legality. (The Hill)

Yet, New Hassett has claimed markets are different recently and would not crash over the political removal of the Fed Chair, showing just how much the positions of those in the White House have flip-flopped:

When pressed on that opinion Friday, Hassett said “the market was in a completely different place” at that time, and his comments were limited to the first Trump White House’s legal analysis.

Well, apparently New Hassett doesn’t understand as well as Old Hassett did, given that Trump decided to go after Powell some more and crashed markets some more because he sounded all the more likely to get rid of the Fed’s old man. In other words, so much for the market being in a completely different place this time:

Wall St ends sharply lower amid Trump's tirade against Fed's Powell

U.S. stocks suffered steep losses on Monday as U.S. President Donald Trump ramped up his attacks on Federal Reserve Chair Jerome Powell, prompting investors to worry about the central bank's independence even as they grapple with the effects of Trump's ongoing, erratic trade war.

All three major indexes tumbled, with big losses in the "Magnificent Seven" group of megacap growth stocks weighing heaviest on the tech-laden Nasdaq.

Trump escalated his criticism of Powell on Monday, saying the U.S. economy is headed for a slowdown "unless Mr. Too Late, a major loser, lowers interest rates NOW," in a bellicose Truth Social post which raised concerns over the Fed's autonomy.

"Countries that have an independent central bank grow faster, have lower inflation; they have better economic outcomes for their people," said Jed Ellerbroek, portfolio manager at Argent Capital Management in St. Louis. "And politicians trying to influence the Fed is a really bad idea, and it's very scary for the market."

Ellerbroek added. "What makes it dispiriting, I think, is the fact that this is like self-inflicted; we're in this situation by choice, by this administration's choice."

So, maybe they want to crash the stock market, too, but must do it without looking like it is deliberate because Bessent had said earlier that some downward reset of the market was necessary. I don’t disagree with that, but I’m suspicious about what they’re up to that makes them want to crash it. I don’t think most of us have ever thought of the dollar’s collapse as a good thing … but it might be good for some. For the rest of us, it was just something to be prepared for.

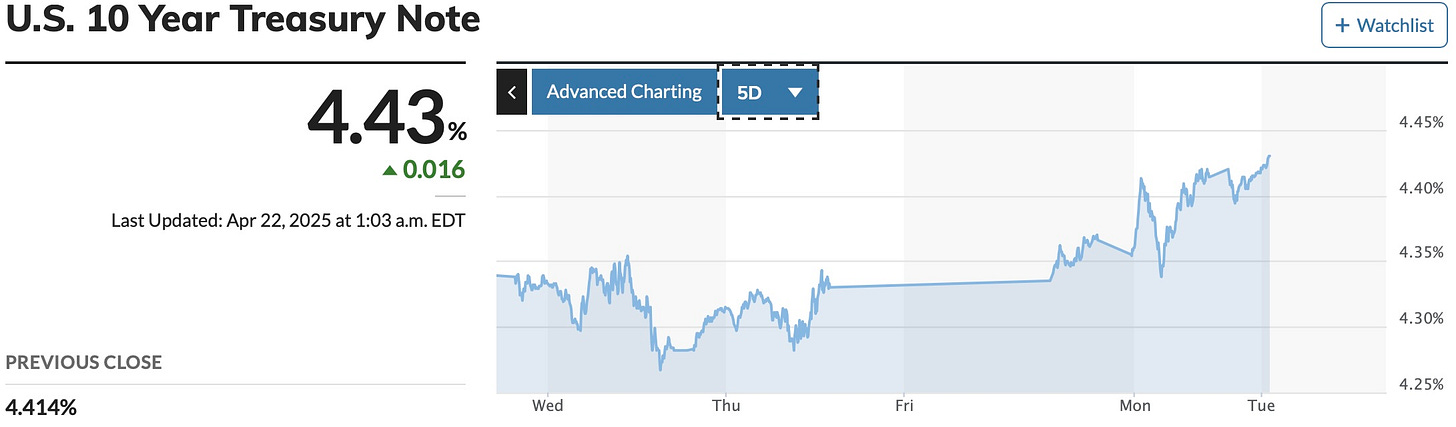

Trump’s post that brought down stocks and bond values (yields up) at the same time was an odd move to make, given one of Bessent’s earlier statements that claimed the Trump administration really wanted to keep 10YR bond rates down. (It soared quite a lot recently.)

Treasury Secretary Scott Bessent can’t stop talking about 10-year bond yields. In speeches, in interviews, week after week, he states and restates the administration’s plan to push them down and keep them down. (Yahoo!)

But the recent nosedive in stocks accomplished the same kind of spike in bond yields that supposedly scared Bessent to talk Trump into backing down on his extraordinarily high tariffs only a couple of weeks ago. :

Before the April 9 stock-market rebound, a weak U.S. dollar and soaring Treasury bond yields proved that the “bond vigilantes” were in charge….

The gossip on Wall Street is that Bessent and U.S. Commerce Secretary Howard Lutnick had to tell Trump that the bond vigilantes were net sellers of both U.S. Treasury bonds and the U.S. dollar, and that Trump had to “shock the system” with a 90-day tariff suspension. (MSN)

Here is what the Treasury market did again in response to Trump’s criticism of Powell: (You can compare the level the 10YR settled back down to last week upon Trump taking Bessent’s advice after bonds went out of whack over his tariffs in the week before, to how it spiked back up recently when Trump went after Powell, causing both stock and bond markets to shiver:

This situation of bond yields rising when money flees stocks, recall, is the inverse of the normal relationship because, when money flees stocks and goes to bonds to find a safe haven, the higher demand for bonds allows those selling bonds to raise their price (which means lower the yields they are offering). So the recent moves look, once again, like a flight of capital from both major markets—stocks and Treasuries—to find safe haven in something else, such as gold, cryptos, cash, commodities, whatever. Anything but bonds.

Did Trump forget that threatening to oust Powell again, when markets are so embroiled already, would, as Hassett had warned him during his last tenure, badly damage markets, or does he just want Powell out of the way so he can directly control the Fed himself? Does he want control so badly that he’d throw both markets under the bus, just as stocks and bonds had shown a tiny sign of settling down late last week?

Can’t have that! If Trump and Bessent are truly focused on lowering interest rates through bond manipulation, then why do they still need Powell out of the way to such a degree that it’s worth crashing markets again? Was that just Trump’s mercurial temperament needing to vent to no purpose? Lowering 10YR bond rates to take all the interest rates that are pegged on the 10YR down clearly didn’t work for them.