Gold’s record run has been nothing short of astounding, and it appears the bulls have plenty of strength left in them.

Since the beginning of the year, the price of gold is up by over 25 percent. That’s on top of a 26.5 percent increase in 2024. The yellow metal is by far the best-performing asset of the year.

According to Metals Focus, “considerable” fresh inflows from institutional investors have been a major factor in the latest leg of this bull run. We see this trend in significant flows of gold into ETFs. According to the latest data from the World Gold Council, gold-backed funds accumulated 226 tonnes of gold in the first quarter, the largest quarterly increase since the third quarter of 2020 at the height of the pandemic shutdowns.

ETF demand has been strong across all regions, and while Western investment continued to dominate global ETFs, demand has ramped up in China and India as well. Gold ETFs in China added 29 tonnes of gold in the first eleven days of April. That surpassed total inflows in Q1.

Can the Bull Keep Running?

According to analysts at Metals Focus, the bull run still has plenty of momentum behind it.

“Uncertainties are likely to remain elevated for some time, and this looks likely to drive prices to new highs in the coming months.”

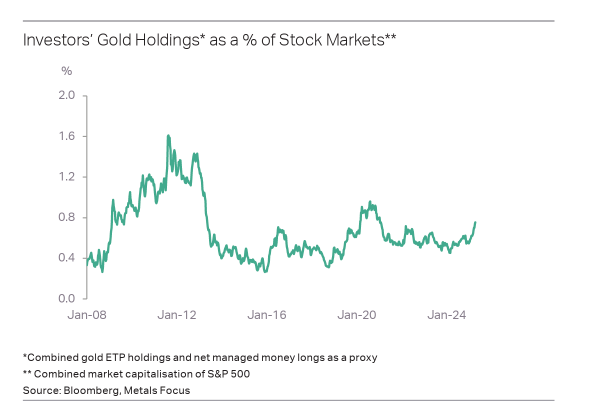

Despite rising investment inflows, investor gold allocations remain below levels seen at the height of the pandemic and well below the Great Recession.

“This leaves considerable room for further investment inflows, particularly among those investors with a medium-to-long-term view.”

Higher gold prices have created some headwinds in the gold market, particularly in jewelry demand. Metals Focus analysts argue that this market tightness will eventually ease.

“As physical markets become accustomed to higher prices and become convinced the uptrend is here to stay, gold’s fundamentals should improve.”

What is driving this gold bull market?

The simple answer is the trade war and. But it’s important to remember that gold started climbing long before President Trump moved into the Oval Office, and there are other factors in play, including de-dollarization, geopolitical instability with military conflicts in Ukraine and the Middle East, and inflation worries.

However, tariffs are currently in the spotlight. Metals Focus noted, “President Trump’s hardline trade policies have rekindled fears of stagflation, which subsequently led to a sharp pullback in U.S. equities.”

Federal Reserve Chairman Jerome Powell even raised the specter of stagflation during a speech earlier this week.

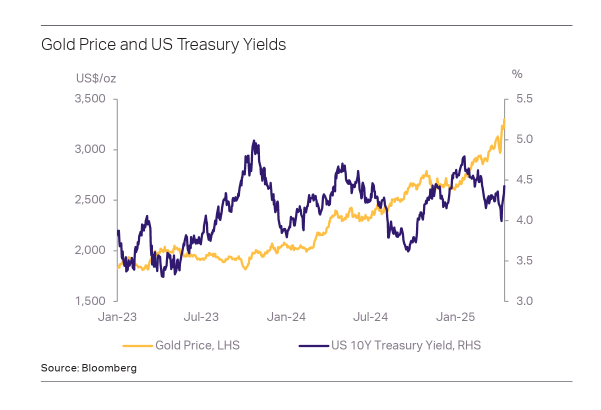

It’s interesting to note that gold was the last safe haven standing during the stock market rout last week. Metals Focus pointed out that other haven assets, including bonds and the U.S. dollar, have not fared well.

“Unlike previous equity routs, when the dollar and Treasuries typically benefited due to their safe haven appeal, both have suffered massive sell-offs in early April. It is worth noting that, prior to the latest bond market rout, US debt had already attracted increasing attention, as both high debt levels and interest rates make servicing them expensive. Trump’s unpredictable policies have undoubtedly exacerbated concerns as to whether the US dollar and Treasuries should still be viewed as the ultimate risk-free assets.”

Monetary easing has also created tailwinds for gold. Central banks in India, New Zealand, and the Philippines all cut rates last week, and the European Central Bank delivered another cut this week. While the Federal Reserve has held rates steady, the markets have priced in three rate cuts this year. That assumes no major economic meltdown. If the economy crashes, as many now expect, the U.S. central bank will almost certainly slash rates to zero and relaunch quantitative easing, unleashing another tidal wave of inflation.

Central bank gold buying has supported this gold rally from the beginning. Central banks globally have added over 1,000 tonnes of gold to their reserves for three straight years. To put that into perspective, central bank gold reserves increased by an average of just 473 tonnes annually between 2010 and 2021.

Metals Focus notes that “factors that had encouraged central banks to diversify portfolios in recent years have remained intact so far this year.”

“If anything, uncertainty surrounding U.S. foreign and trade policies and recent Treasury market volatility all justify an accelerating pace of de-dollarization, which tends to benefit gold.”

Metals Focus maintains a “positive view” toward gold prices in the coming months, with economic and geopolitical uncertainty remaining high.

“Despite a 90-day pause and some relief, current U.S. tariff rates still stand at their highest in the post-war period. A short-term slowdown appears inevitable, considering the likely inflationary effects and the resulting hit to purchasing power.”

Metals Focus said it is too early to forecast a recession, but it doesn’t seem to be factoring in the bubble economy blown up by the Federal Reserve's monetary policy into its analysis.

However, it is considering the broader ramifications of U.S. trade policy.

“The Trump administration’s economic policies are likely to raise more questions about the prospects for U.S. assets, including equities, Treasuries, and the dollar. Against this backdrop, diversification is often seen as a prudent strategy, as does an allocation to gold.”

Keep in mind that while the overall environment is extremely bullish for gold, it won’t likely be a ride straight up.

“Near-term corrections are likely to occur as tactical players take profits or perhaps experience margin calls triggered by another round of equity liquidations. The downside, however, should be limited, as there are still investors sitting on the sidelines waiting for opportunities to enter the market.”