Let’s lead off with a snapshot of how shaky the stock market is right now. The S&P 500 rose, but it put in an extremely volatile session with some of the biggest names diving the hardest and staying down as others rose. Additionally, fourth-quarter economic growth was tepid.

Investors were a bit cautious to buy after fourth-quarter GDP growth came in at just 2.3%, missing expectations.

UPS shares crashed a full 15% after its report. Microsoft dropped 6% after disappointing investors with its revenue outlook for the first half of the year. That was Microsoft’s worst day in more than two years.

“Microsoft has proven they can drive a Cloud business, and now they have shown they can drive the largest AI business via a combination of high-quality Gen AI inferencing and Gen AI apps,” wrote Bernstein’s Mark Moerdler, adding that management needs to pivot toward the core Azure business independent of AI.

Comcast fell 12% on larger-than-expected broadband subscriber losses. Caterpillar shares also fell due to a revenue drop projected for 2025.

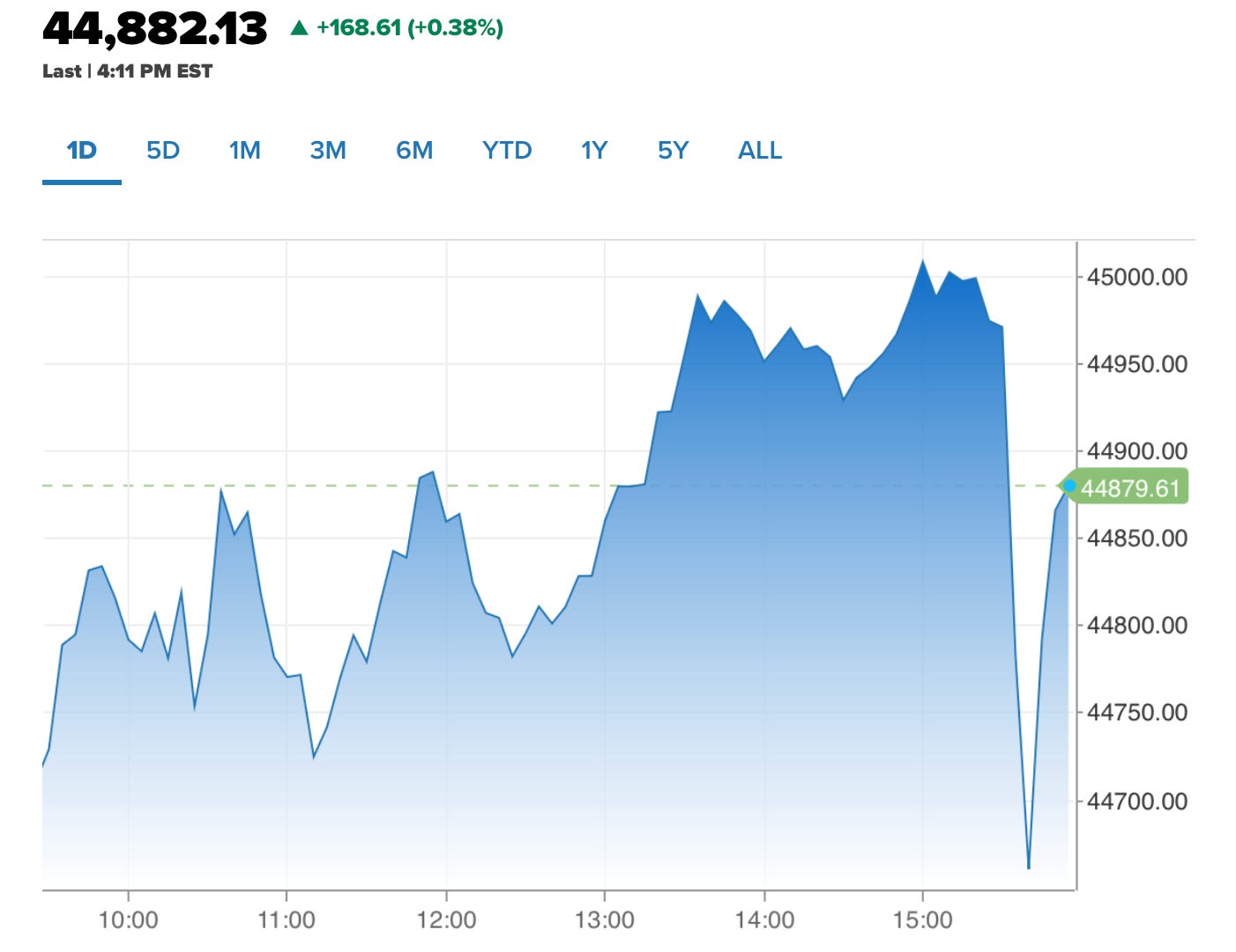

Stocks closed the day with each major index taking a bizarre plunge into the negative zone when Trump announced whopping 25% tariffs on Canada and Mexico (with whom he had said during his last term he had resolved all trade disputes victoriously with deals good for everyone), proving how quickly a Trump move can undo the market, and then, just as quickly, rebounding a little more than halfway back into the positive. Was that the Plunge Protection Team to the rescue after the tablecloth got yanked or just an instant resolution to a multi-national trade war?

Major banks stall over Trumpian economic changes

Several central banks—the Bank of Canada, the Bank of England, and the Federal Reserve—stated they are carefully assessing their policies in light of the Trump Tariffs. They seem unsure as to whether they will need to increase interest rates in order to counter the inflation they expect from tariffs or decrease rates in order to counter the recession they expect from tariffs.

The bank gyrations include this odd note:

While normally the FT does not bother with reports about gold, and certainly not global flows of gold, this time it made an exception, observing that in recent months there has been a unprecedented "shortage of bullion in London" (which as a reminder for new readers is ground central of the LBMA which stands for London Bullion Market Association) as a result of which "the wait to withdraw bullion stored in the Bank of England’s vaults has risen from a few days to between four and eight weeks, according to people familiar with the process, as the central bank struggles to keep up with demand."

“People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” said one industry executive. “Liquidity in the London market has been diminished….”

The FT's thesis is that LBMA physical gold has fled the UK market for two reasons:

fears of Trump admin tariffs, and

translatlantic price arbitrage

The article lays out a number of possible reasons for this anomaly in gold at central banks; but, to the first point about it being due to tariff fears, because Trump’s announced economic changes are sweeping, the risk-benefit calculations (not just for gold but for everything) are far more complicated than they normally are; however, laid out in simple, broad strokes, they look something like this:

-

Huge tax cuts should help stimulate business.

-

Sweeping deregulation will stimulate business, too, but could also result in more disastrous major bank failures further down the road as deregulation did back in 2008 a few years after Glass-Steagall was repealed. (It takes a while for those unwatched problems to fester.)

-

Huge government spending cuts should reduce incomes among government workers, reduce their spending, and reduce government contracts with private businesses, hurting businesses and slowing the economy.

-

On the other hand, spending cuts will also slow the growth of government debt, slowing the impact of government financial needs on all other finance that the government competes with … but that benefit is well down the road and won’t feel like a benefit so much as less harm than we would have otherwise had.

-

Trump may be able to use the Defence Production Act and deregulation to increase oil production, which should drop the price of oil, but it would be many months down the road before that oil hits the tank farms, but it would eventually be stimulating for the economy by cutting business costs and consumer inflation.

-

Tariffs inevitably wind up getting added to prices. The only question is to what degree? How much will businesses absorb these added costs via reduced profit margins, and how much will Mexican businesses shave off of the price they receive in order to avoid losing market share? No matter what, some of each tariff, if not most of each tariff, will get added to consumer prices, which will slow the economy with the cost of inflation.

-

Tariffs should, on the other hand, drive manufacturing back to the US. That will stimulate the US economy, but it will take years to play out due to the enormous efforts and initial costs required to create new factories or expand existing ones and due to the slowness of many companies to respond because they aren’t sure whether these tariffs will last past the current administration.

-

The president plans to slash the migrant labor force. That will have two particularly big effects: 1) Production and services will definitely decline due to a significant reduction in available labor to do the work, stagnating the economy. 2) To attract hundreds of thousands, if not millions, of citizens into those jobs, wages will have to rise considerably. That will raise all wages to compete for those limited workers. That increase in wages will drive inflation higher.

-

Much of this will be fought over in court cases about the limits of executive power to curb the spending Congress has ordered, which will delay a good part of it and likely prevent some of it; but Trump also has a supreme court that he practically owns, though some cases may take awhile to work their way up to the supreme court.

Stagflation on the menu

The overall impact of these forces sounds like it will lead to stagflation in the short term where costs, and hence prices rise, causing consumers to roll back, while production shrinks, at least this year, leading to an economic slump. However, everything depends on how drastic Trump’s actual actions are how quickly they are carried out, and the degree to which the parts that survive court battles happen together.

Even Trump does not likely know any of that because his own plans depend on how other governments succumb to his demands as well as what courts decide. For example, a very small increase in tariffs can likely be absorbed by foreign businesses and the profit margins of US businesses without cutting production or raising prices; but a huge increase in tariffs (as Trump has been talking about in a number of cases) would be impossible to absorb, so it would all get passed along to consumers. From there, you have to guess how much consumers would cut off buying those products or services, how much they would switch to US counterparts, and how much they would just cut back on all purchases as much as possible to survive the inflation, shrinking the economy in a hurry.

All of the above can then be compounded by how other nations decide to fight back against the US and how much damage they can inflict on US companies in exchange for the damage being done to them by Trump. If other governments fight back, Trump may fight even harder with larger tariffs than he has mentioned. Trade wars via tariffs have been seen at times to become quite destructive to all economies.

The potential of so much all at once is hugely destabilizing, but that is just potential. We won’t know what Trump is going to do until Trump knows what he is going to do, which he won’t know until he sees how other nations respond to his threats and actions. Michael Every of Rabobank refers to all of this as “the year of living dangerously.”

Sounds like he called it.