Having written about President Trump’s imperial plans in my latest Deeper Dive, I’ll give the man a break on his inaugural day and just talk about one of the economic obstacles he will face for any plan that would increase the national debt. This is a problem already baked in by every president from Reagan to the present (and to an infinitesimally smaller degree by some who came before), and the total debt added during Republican administrations actually exceeds that added in Democratic admins, but no president was a laggard in the debt department.

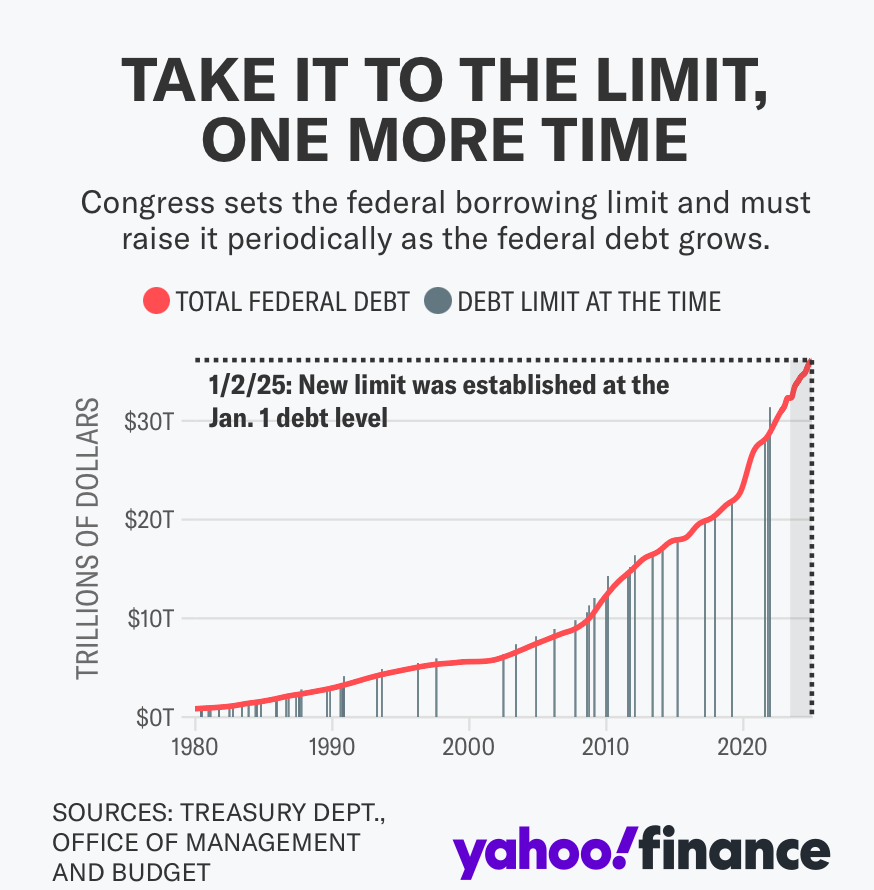

The national debt will exceed $36 trillion when he takes office on Jan. 20, up from $20 trillion when he started his first term in 2017. As a percentage of GDP, debt held by the public has jumped from 75% in 2017 to 96%. These numbers will only get worse.

This stark problem, which just keeps climbing more steeply, will have to be faced squarely by the Trump administration sometime during this term.

The main question is when markets will start punishing Uncle Sam for profligate borrowing — and it might already be happening.

Since last September, the Federal Reserve has cut short-term interest rates by a full percentage point, yet long-term rates have risen by a full point.

Bonds are likely responding to two key factors: 1) They don’t like inflation, so they try to price it in. 2) The endless ramp-up in US Treasury borrowing means the bond market has to attract a great many more buyers of debt in order to finance all of that, which requires higher and higher interest to attract investors, especially now that the Fed is no longer acting as the buyer of first resort for all of it. (Though that is exactly the Fed-funded profligacy that enabled—and even enticed—governments to climb that mountain. It was practically a free lift to get them up the steep slope..)

Neither of those pressures is going to abate in 2025, and the battle is going to show up pretty quickly for two reasons:

First, the government has hit its borrowing limit, which means Congress will need to raise the limit by late spring or early summer….

Second, a debt ceiling showdown could trigger another downgrade of US debt

And there is no slack on the latter because three credit agencies have already downgraded US credit:

Standard & Poor’s downgraded US debt one notch after a debt-ceiling standoff in 2011. Fitch did the same after a similar showdown in 2023, and Moody’s changed its US ratings outlook to negative from stable that same year. Downgrades haven’t damaged US creditworthiness yet, but markets are getting more prickly.

This could make it hard for Trump to even renew his tax cuts because doing only that—unless he finds an equal amount in expenses to cut with no increase in spending— will add another $ 5 trillion to the projected national debt.

We are close to hitting that wall where the size of the national debt clearly matters. It’s already costing all of us an arm and a leg, and interest is eating close to 100% of our gross domestic output, but now we’ll see it starting to trouble our economy.