Measured by the common man (or common girl), we’re on the road to ruin. The US has been in decline for decades, but you can’t see that by looking at stocks. You can’t tell it from those who lie about the economy to make their living, but look at longterm real numbers, and you see an empire in decline that just got its wobbly legs kicked out by COVID-19.

The clamor of false profits

Listen to the kinds of false narratives being spun to claim the economy is largely recovering. Call it the relentless and unrealistic belief in a V-shaped recovery narrative or whatever you want to call it, but the nonsense is still flourishing, though not the economy.

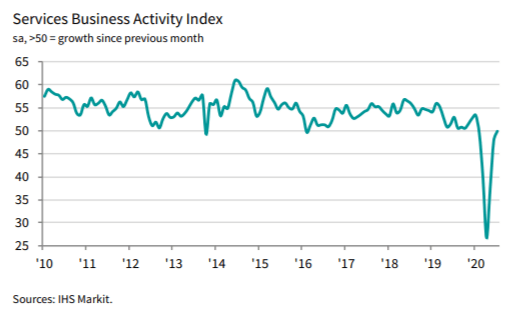

I’m going to start telling of our longterm decline by illustrating the falsehood via a stock advisor who wrote an article today to complain that the IHS Markit survey cannot possibly be correct in stating that the services sector of the economy is not improving but has merely stabilized; i.e., the survey says the business economy is neither falling any further nor is it recovering.

This investment advisor argues that the survey is clearly false because it tells him what he doesn’t want to be told. I’ll demonstrate that by tearing apart his own fake argument:

Services are some 80% of the US economy and so we can take their growth or contraction as a pretty good proxy for the economy as a whole….

Seeking Alpha

On that much, we can agree, but …

The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 50.0 at the start of the third quarter, up from 47.9 in June and improving on the ‘flash’ estimate of 49.6, to signal a stabilization in service sector business activity.

Really?

YEAH, REALLY!

Do a walkabout!

I went to our local mall yesterday for the first time since the economy was shut down. Now two full months after reopening, more than 50% of the shops remained closed. Of those, 80% were stripped bare. That calculates out to no hope that, at least, 40% of all the businesses in the mall are EVER coming back.

Almost all of those are service businesses, since even retailers are classified as services because most of them do not produce the products they sell. (There are a few exceptions at the mall of companies that retail only their own products.) What I saw closed was a bank, a coffee shop, a couple of food-court counters, hair stylists, and a couple of massage places as well as some boutique retailers. Even restaurants are classified as services because what they are really offering you is the preparation of something you could prepare for yourself, even though they are producing food items from resources they buy.

So, pay attention to what your eyes tell you. The real economy on the ground — Main Street — matches perfectly with what the IHS Markit Survey is showing for service businesses.

Yet this guy, who apparently has a stock market he wants to keep propping with a false narrative claims,

Service providers recorded the first increase in employment since February in July, as pressure on capacity due to COVID-19 restrictions on business processes causing delays to the handling of order books. Although only marginal, the expansion in payroll numbers signalled a turnaround from the marked contractions seen in April and May.

Pay attention to what the jobs numbers tell you! Only about 25% of the jobs that were lost have come back after two months. And that is by the Bureau of Lying Statistics false-positive standard. (See “Labor Dept. Trumps its Own Numbers.”) A deeper look at the numbers reveals that as many people are newly losing jobs (or re-losing the same jobs they lost a couple of months ago) as are going off of unemployment.

What does that mean? Those jobs that did not come back after two months of reopening, are not coming back! The job numbers match the shop closings; so does the IHS Markit survey, so it DOES add up.

Businesses aren’t remaining closed at the mall because they’re just waiting for things to get a little better before they reopen. Many are clearing out their shelves and taking down their signs. They’re not coming back, and neither are their jobs. If these businesses COULD reopen and re-employ people, they would. They died. Give up the fantasy that they will reopen.

Yet, the false narrative persists and people buying stocks continue to believe what they preach because they want to:

Firstly, as we know substantial parts of the service economy have only recently opened up again. And the PMIs should be about output, business etc from the immediately preceding period. So, the June numbers should show what has changed since May and so on. they are *not* supposed to be about changes from normal. The idea that as the economy opens up in July that the service sector is only flatlining from June seems most, most, odd.

It doesn’t seem even slightly odd if you take a walk around your local mall and look at how much has closed for good. Now, it may not be the same way everywhere. Some people may live where their malls are doing fine. Ours is not, but I’m sure some are OK.

The full and proper employment numbers … are showing substantial gains in employment. So substantial that they can’t be happening in manufacturing alone as the sector’s not really big enough to absorb that many people.

No, they’re not. They’re showing gains that match up perfectly with what my eyes tell me about my nearest city. Less than half of the mall has reopened for business. Job gains have stabilized, as in flatlined. Businesses that have reopened, are probably running at major losses because the mall I walked through only had, at most, 1 person per 100 feet space in front of me. A room normally filled with people at tables had two people at one table.

The huge rebound quit as soon as it began, and the numbers of new hires are now just matching with the numbers of new layoffs. That’s if you look at real numbers and not just the BLS hype about its numbers. (As I wrote about in the article just referenced.)

More than half of the restaurants that have closed have not reopened. Most report on Yelp they are closed permanently. Those are services businesses that will never be rehiring their laid-off employees. So, real statistics add up with what my eyes tell me from a walkaround at the mall and what service businesses on Yelp are reporting.

Wake up!

The jobs are not coming back.

Or, as Paul Krugman has put it, economies have to add up.

Paul Krugman simply doesn’t know how to add. He may have gotten a Nobel Prize in economics, but his head can’t wrap around arithmetic. Thus, he’s been wrong about everything he’s said about the real economy, and he never saw any of the major downturns of the past twenty years coming. Not exactly a man who lives in economic reality. His head is a sack of sugar.

We do end up having to decide, on our own really, how the economy is doing given these problems with detailed numbers. My opinion is that the economy is growing about as fast as it ever has done.

US on the road to ruin

There, too, is an example of complete blindness.

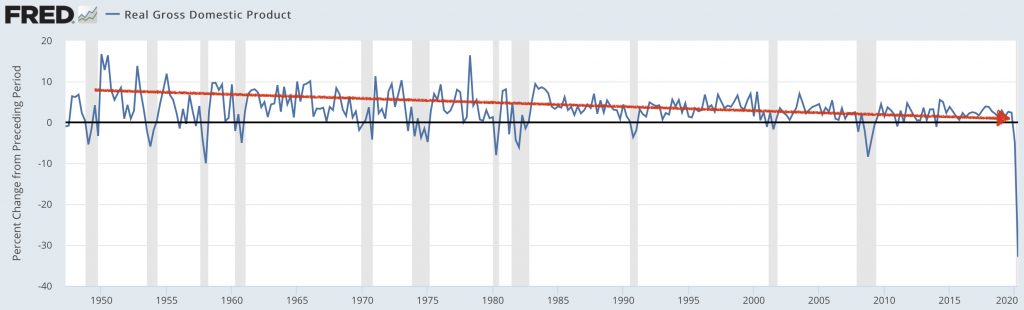

If you mean as fast as it has ever done in the last twenty years, that’s not very fast. That is barely keeping its head above recession. For the last ten years, it has barely averaged more than 2% growth. That barely keeps up with inflation. Add population growth, and we were losing ground the whole time. Add in the fact that GDP is cooked to look better than reality (see Shadowstats), and you know that GDP growth was horrid for the last twenty to thirty years.

That’s why no income gains trickled down to the average man. It doesn’t matter whether we were under a Republican congress or a Democrat one. Doesn’t matter whether we were under a Republican president or a Democrat one:

As you can see, real GDP growth (i.e., adjusting for inflation) has been on a steady downtrend for decades. I would postulate that is partly because our whole economic model is based on debt expansion, and the service of debt is eating all our surplus energy. There are a lot more reasons I’ll list below — things that must be corrected in order to see longterm gain of wealth across the economy and not just in the pockets of the 1%.

First, we live in a world where real petro energy is increasingly more expensive to extract.

Second, we live in a world where businesses spend a lot more time focusing on how to pump their stock prices up for short-term gains than how to build their business up for longterm profits.

Clearly, the chart above shows we were already on a crash course toward permanent recession. (Anything below the blue line is in recession. We were just about to get to where our average was below recession before COVID hit.)

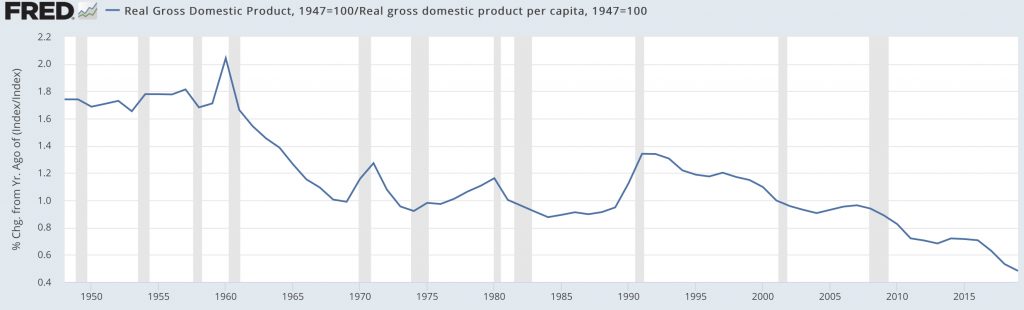

Worse still, if you adjust for population growth due largely to rampant immigration, then on a per-capita basis our longterm decline in GDP growth looks far worse:

That means your share of GDP has been getting smaller and smaller. At the same time, your share of the national debt has been getting larger and larger.

So, if we should expect to see that “the economy is growing about as fast as it has ever done,” then we should expect to see economic growth is MISERABLE! Absolutely, freakin’ miserable! If the last graph were the hospital chart of one individual, we would assume he is now seconds away from death.

However, the truth is that economic growth now is much worse than what it has ever done because while quarterly GDP growth will likely show the economy rebounded when third-quarter results come in, the above graph is for year-over-year change, and the amount the economy rebounded in the third quarter due to reopening will be FAR, FAR less than the amount by which it fell over the first two quarters. So, expect the graph above, which is year-over-year change, to finally go through the floor by the end of this year.

When the U.S. economic shutdown began in March, we were told to expect a “V- shaped” recovery. The consumer and the economy were originally expected to be fully recovered by the end of 2020 at the latest. Now the grim realities are starting to show. McKinsey Global Institute and Oxford Economics recently released a study on the economy after the pandemic. Their models showed that under two scenarios, it could take five years or longer for all U.S. business sectors to recover. Among the small businesses that were studied, recovery is expected to take longer than five years for some and many fear that they will never reopen.

MarketWatch

Oh, and those graphs are the ridiculously and overtly over-positive picture. They are put out by the Fed based on its NEW ways of measuring GDP. Look at the Shadowstats reference to see who much worse the numbers would be if the Fed had not more than once since the 70’s massively changed the way it calculates GDP in order to try to give it more boost. I used the Fed graphs just to show how bad it really is, using the most optimistic numbers available!

The obvious facts, if your eyes are open, are that businesses at street level look like this: (It’s what I saw when I looked around. I suspect you will, too, depending on your location.)

Big companies are going bankrupt at a record pace, but that’s only part of the carnage. By some accounts, small businesses are disappearing by the thousands amid the Covid-19 pandemic, and the drag on the economy from these failures could be huge….

Closures “are going to be well above normal because we’re in a disastrous economic situation,” Dunkelberg said.

Yelp Inc., the online reviewer, has data showing more than 80,000 permanently shuttered from March 1 to July 25. About 60,000 were local businesses, or firms with fewer than five locations….

While the businesses are small individually, the collective impact of their failures could be substantial. Firms with fewer than 500 employees account for about 44% of U.S. economic activity, according to a U.S. Small Business Administration report, and they employ almost half of all American workers….

About 58% of small business owners say they’re worried about permanently closing, according to a July U.S. Chamber of Commerce survey.

The Washington Post

And that looks exactly like IHS Markit indicated. So, a lot of people still need to get their heads out of the sand regarding the real state of the economy. Their understanding or our present situation is no better than their understanding of our longterm decline. It’s all economic denial.

Fed failed. Republicrats failed.

In terms of how the economy does, the difference between Republicans and Democrats is the difference between Frick and Frack. There is no period in the above charts that stands out as one government doing better than another or as any indication the Fed has ever done any good at all for the economy with its maisterplans.

You can see the results have clearly declined throughout every kind of government we’ve had — all-Democrat, all-Republican, and mixed. We did see a boost in real GDP per capita under George H.W. Bush, but not under Reagan and not under H’s son. So, I’m not sure what that short boost was about, but it quickly went away, and has never returned. Even H’s term ended in recession with real GDP per capita back in decline.

Those are the facts, and that is, as I say, a very rosy picture created by deliberated positive distortions in Fed stats that have been added in over the years.

Some will say this longterm secular decline in the US is all due to oil. Some will say it is all due to being off the gold standard. Some will say it is all due to immigration. Some will say it is all due to the Fed’s economic manipulation. Some will say it is all due to Democrats. Some will say it is all due to Republicans. Some will say it is all due to the national debt.

I would suspect it is all due to all of that! Everything we are doing serves the greedy 1% and not the common man (the per capita man or woman). The above graphs show that the average person under any kind of administration has been on a long-term road toward being … well, screwed to put it frankly! (Others could think of a harsher term that says the same.)

If you think either party is going to save you, you’re in denial of fifty years of recorded economic history!

Wake up!

Longterm decline due to short-term greed

In this historic cartoon by Udo J. Keppler (1872-1956) Wall Street tycoon J.P. Morgan blows bubbles labeled as “inflated values” to desperate investors. The cartoon was ironically titled “Wall Street bubbles – Always the same.” Sure enough. Because of our greed, we learn nothing.

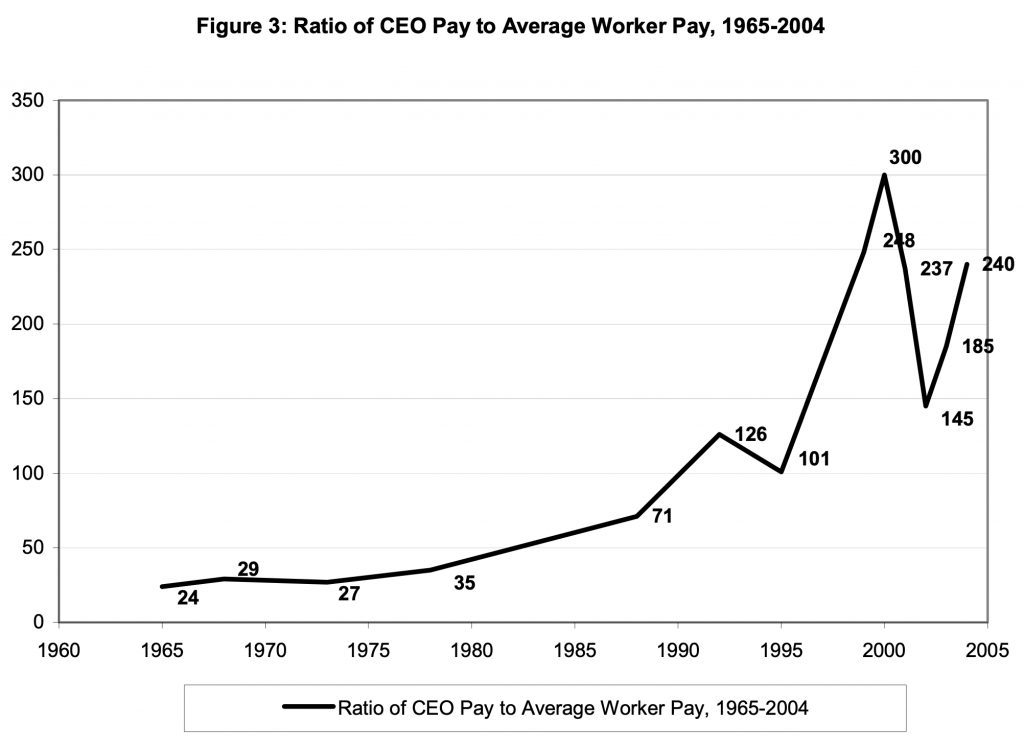

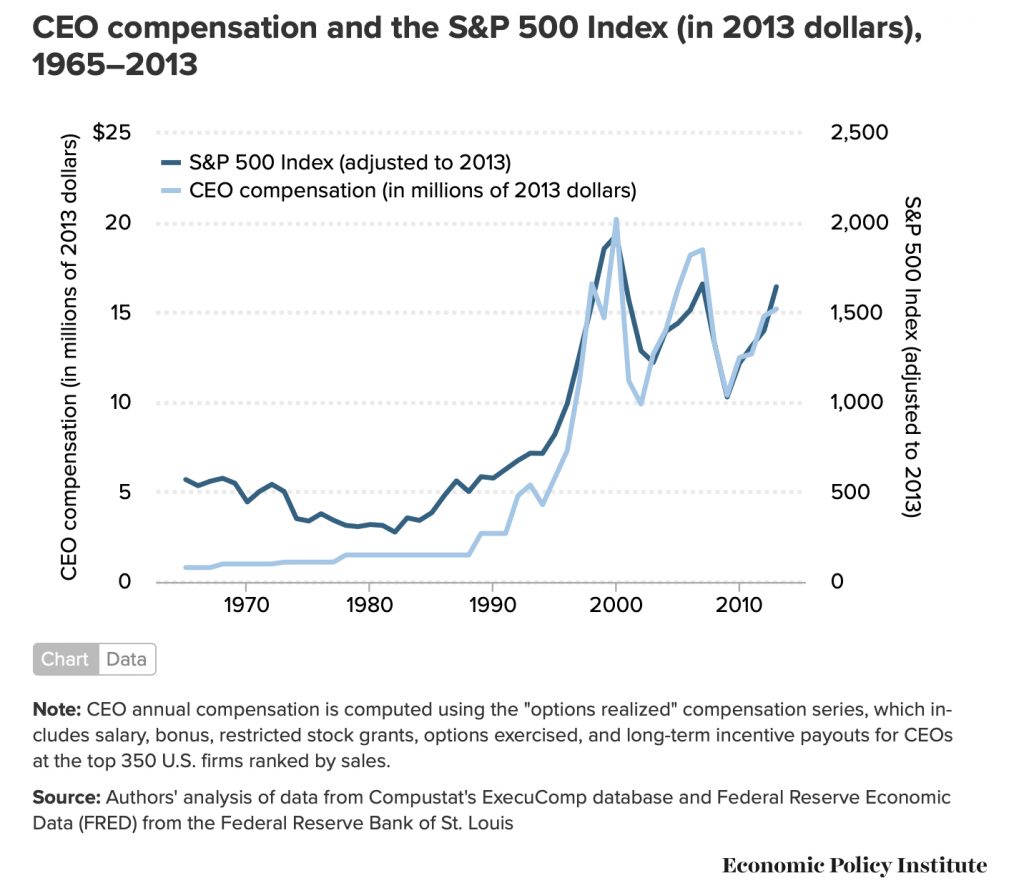

Oh, but have you noticed all the bankers and corporate CEOs are making more money than ever? The amount of money being made per individual person in the country is lower year after year, decade after decade, but the amount being made per CEO? Just about OFF THE CHARTS!

And why is that?

Obviously, it has a little something to do with how CEOs can manipulate their stock values since much of their compensation comes directly from stock sales and since their salary is usually also based on how their stocks are doing.

CEOs have accomplished a lot of that in recent years through converting massive amounts of company cash and credit into stock buybacks. Do you think that, if CEO’s and shareholders are milking their companies dry of all they produce that might also account a little for why real GDP growth by any measure is in longterm decline?

Think about it: If you keep milking ever cent a company makes for short-term greed, you’re going to take businesses and the US economy into decline. the amount taken out for outlandish profits via stock buybacks greatly exceeds the growth in real profits. So, add that to all the reasons people will turn to above for explaining the secular decline of the US economy.

And I still say it is all of the above. In other words, there is no easy road out of our longterm national decline, and that’s why politicians on either side are never going to deliver you out of this economic morass and why the nation will never vote in such a way as sto get out of it. No one wants to struggle with hard answers that require massive changes on many fronts.

The nation would rather just all fight with each other over whose party is right when neither party is even close to right. No one wants difficult answers. Unless you can wake an entire nation up to the widespread economic changes that need to happen on every front, it’s not going to get better. And neither Democrats nor Republicans have any interest in doing that. Jumping’ Joe isn’t going to save you. Neither is Trumpeting Trump.

Those are easy-answer pipe dreams, and the Dumocrat-Retardican divide is just there to keep us fighting with each other so we don’t fight with the banksters and CEOs who have the whole system rigged in their favor.

The above graphs prove neither party has ever taken people to their dreams. Until you start looking for real answers and stop looking to parties or champions, this longterm down trend is not going to change. The nation is running down a long economic decline — as are most nations in the world — and the parties have us each fighting with each other over whose champion will save the day!

Dream on!

Dream all you want, but you’re on the road to ruin. Try another route for once.