In November of 2018, it looked like the stock market’s rough year was finally behind it. October had taken stocks down, but November lifted then back up in a beautiful ascension to set things up for a lovely December Santa-Claus rally because everyone knows December is a generous month for stock gains. However, December of 2018 had an entirely different scenario in store. Stocks plummeted off a hair-raising cliff that eventually had the US Treasurer telling the world from his vacation swimming pool that he had called all the major banks to see if they had enough money and everything was fine! That triggered the sharpest plunge of all, taking the entire year negative on all indices.

Another awful auction for US Treasuries today gave us a view of the hostile horizon to which the US debt problem is bound. Will it hit the markets in time for Christmas. That, I do not know, but today’s auction showed the big bond bust likely has plenty of bad weather to deliver, regardless of how beautiful November looked. While yields were down on these new 7YR issuances because the starting point for the auction was set lower by where the market on existing Treasuries has taken yields over the past few weeks, the resistance by buyers at that level was higher, meaning the dealer banks had to soak up a lot more of the auction because there were fewer bidders.

Becoming a dealer bank for fresh US Treasuries means committing to buy up all the auction that you can’t sell. The bid to cover — a ratio of the number of actual bidders v. number of bonds on sale — was the lowest since last April; so, dealers had to take 20.3% of the total auction on their own shoulders this time versus only 11% at last month’s auction, almost double. That was in large part because foreign buyers plunged from taking 70.6% a month ago to 63.9%.

So, the new bonds priced lower because of where the existing bond market has gone over the past month, but dealer banks got stuck taking a lot more of the bloated auction because of declining foreign interest at today’s yields, and bids priced up two basis points by the auction’s tail end.

Overall, this was a piss poor auction, one which was ugly on all verticals, and a start [sic.] reminder to the market that even if the US enters a soft landing - as today's dovish sentiment clearly hopes - there is still the issue of trillions and trillions in debt issuance on deck that will have a big problem getting funded at current levels.

Declining investor numbers and large tails on the price when issued have been a new trend setting in for the Treasury market that says the government’s big deficits are finding a harder time getting enough interested buyers now that the Fed is out of the bond-buying game.

Regional southern recession in play

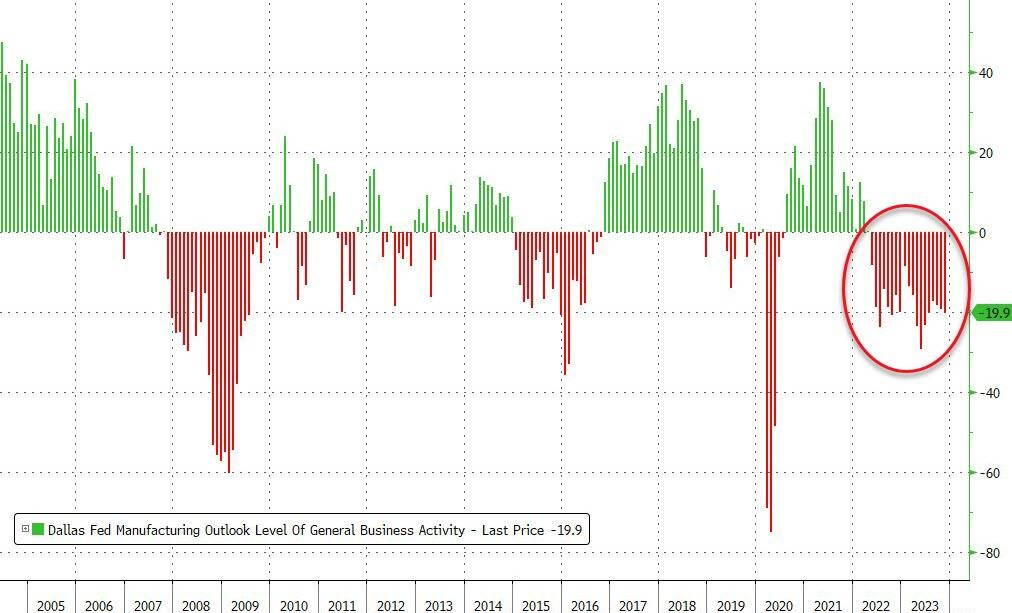

Other darkening skies today were seen in the Dallas Fed’s Service Sector Outlook Survey, which showed the service sector of that region’s economy has gone back into contraction. That news came one day after the Dallas Fed’s Manufacturing Sector Outlook Survey put in its nineteen straight month in the red zone with the last four months dropping sequentially further:

With the two combined, one could say the full economy of that region of the US is in recession.

Respondents to the survey were overwhelming downcast in tone. Here is a sampling of their comments:

-

We feel that we are headed for a recession

-

There is still no sign of when this slowdown in the tech sector will turn and begin to improve.

-

Probably we're already in a rolling recession.

-

The general level of business activity has continued to slow month over month, and we do not see this improving.

-

We are seeing defaults increasing.

-

Business has unexpectedly slowed over the last several months. We think the average consumer is overextended and is cutting back.

-

It looks like we are poised to enter recession.

-

We're seeing a significant month-over-month drop in orders and sales. The downward trend started in August.

-

Tremendous economic slowdown. It seems customer sentiment is extreme worry.

-

Customers’ inventories are lower, yet they are not buying.

-

Customers are hammering down prices by getting competitive quotes and pushing back on pricing.

-

We have been in the residential mortgage industry for more than 30 years. We think by this time next year, 85 percent of existing lenders and 50 percent of real estate agents will be gone. Many middle-class jobs will be gone.

-

and … There is nothing encouraging on the horizon.

So, stocks may have been soaring through much of November, but try to remember the rise in November, 2018, back when the market plunged in October, rose strongly in November and then fell even harder in December. There were much different dynamics in play, so that predicts nothing, but it does show how fully investors can be caught off guard.

That one was for nostalgia for all, but another video appears below for paid subscribers about where we are heading in 2024 (“a stock market crash and a depression,” says one prognosticator in the commodities business).