I try to point out risks I believe most people do not want to see or cannot see because they don’t fit the norm by which people construct their perception of reality. I am accustomed, therefore, to being scoffed at because I am out of step with the thinking of the time, and the majority must be right … as must the experts.

Presently, the scoffing has been over my brazen claim that recession is already on our doorstep. I’ll lay out the evidence for the recession that is invisibly surrounding us in my next article — just as it was when Ben Bernanke infamously claimed there was no recession anywhere in sight after the Great Recession had already begun. The greatest experts, it turns out, can miss seeing the greatest recessions even when they are standing knee-deep in the middle of one because the recession doesn’t fit the way they are accustomed to seeing reality. Before I lay out the evidence of recession, however, I want to dig away at the economic misconceptions involved in the scoffing.

Scoffers line up to caw like crows on a wire

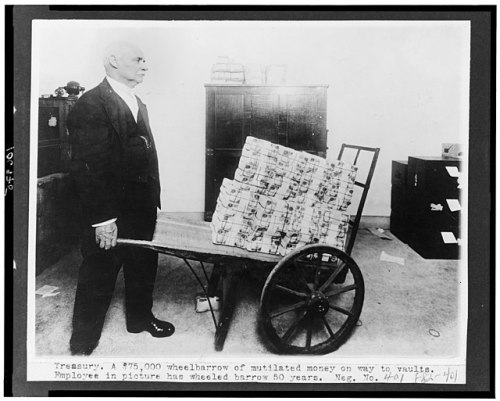

The scoffing is based, in good part, on the idea that a recession is not even possible when consumers are sitting on wheel barrows full of cash with 10-million job openings at 3.9% unemployment. That is normal thinking applied to utterly abnormal times in which consumers actually brought spending forward to lay in supplies for bad times and are now hunkering down.

More on that in my next article, but one must get their heads outside of normal to understand abnormal, and these times are about as abnormal as they get. So, if you apply normal ways of understanding, you are going to seriously misunderstand your situation.

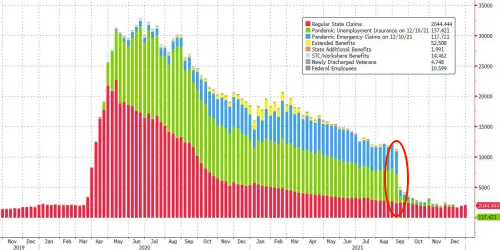

Unemployment right now is nothing but a mirage: normally one believes the unemployment rate is super low because the economy is scorching hot so that job openings are high because the economy needs additional workers to ramp up production to new highs to meet intense demand. Normally, one would be right. These COVID times are far outside of the norm. As I’ve pointed out before, unemployment fell off a cliff the second extended benefits ended with the termination of government COVID stimulus plans. People thought the termination of “stimmies” would bring the workers back — that easy money was the only thing keeping them from working. They were mistaken.

Did everyone suddenly go back to work? Is that why unemployment fell off a cliff? No. The unemployment rate plunged like no time before because suddenly no one was eligible for unemployment benefits because they were well past the normal period of eligibility as soon the extension ended. It was as simple as that. While many did go back to work, many did not.

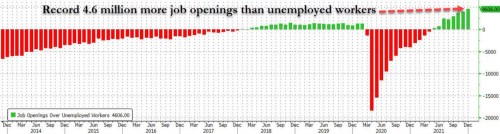

Evidence is abundant that says millions of disenfranchised people abandoned the workforce for good. Suddenly we saw a huge gap up in job openings. Was it because the economy started booming? Were new factories being created? New service companies opening up? All the stuff that means we cannot be going into recession on the basis that and expanding economy is tightening up employment?

No. It was solely because millions of people did not return to work, including 3.5 million new retirees, so those employers that reopened after the lockdowns had to relist those jobs to find help. Evidence of that is heard from the witness of countless employers complaining about how they cannot find workers even after they raise wages rapidly. When unemployment benefits ended, many workers said “I’m packing it in. I’m done with this nonsense. I’m not going back to an infected workplace,” etc.

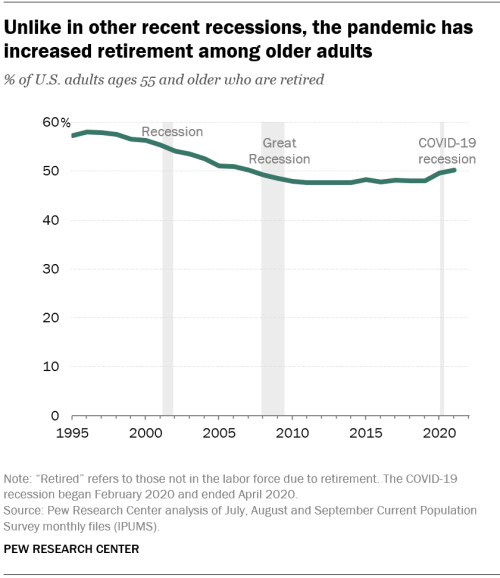

The Great Resignation is actually happening among both young and old, but here are the facts related to people choosing early retirement:

As employers contend with growing numbers of younger employees quitting in the great resignation, the COVID-19 recession and gradual labor market recovery has also been accompanied by an increase in retirement among adults ages 55 and older.

As of the third quarter of 2021, 50.3% of U.S. adults 55 and older said they were out of the labor force due to retirement, according to a Pew Research Center analysis of the most recent official labor force data. In the third quarter of 2019, before the onset of the pandemic, 48.1% of those adults were retired.

(The above graph shows moves in one-year steps, not quarterly or weekly, so the move up at 2020 is the jump for that whole year, not a slope leading up to 2020.)

The leading edge of the Baby Boomer generation reached age 62 (the age at which workers can claim Social Security) in 2008. Between 2008 and 2019, the retired population ages 55 and older grew by about 1 million retirees per year. In the past two years, the ranks of retirees 55 and older have grown by 3.5 million

The pace of retirement just about doubled during the COVIDcrisis.

So, the labor market is NOT tight because the economy is strong. It is tight because the economy is broken. By “the economy” I do not mean the usual falderal of economic statistics. I am talking the actual skeletal structure and musculature of the economy — the things that make it work. It’s badly broken. Labor is not coming back, so there will be no improvement on the production end for a long time unless labor rates rise so much that they can entice the newly retired back into the game or until automation catches up or if retirement benefits get wiped out again and force them back.

That will take time, at best. We have’t got that kind of time in order to avoid recession because the reason the breakdown in the labor market is structural at a deep level is that it is also part of longterm demographic trend that simply accelerated because that is what viral events do — they shock the system and expedite changes that were close to a tipping point, such as extinguishing dinosaurs to make room for newer mammals. Though the extinction-level event opens the environment to new life, it is not without a lot of death and pain. So, the virus shifted existing trends to happened abruptly, and we are going through an adjustment period, not without its pains.

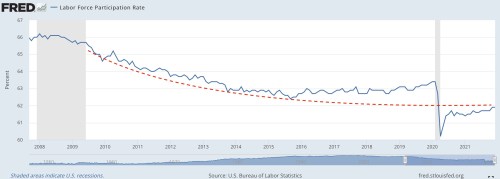

As you can see in the following Federal Reserve graph, the labor-force participation rate had been declining along a demographic curve since the Great Recession as baby boomers retired. Retirement flatlined (as seen in the graph above) around 2010 (until 2020 changed the game) because people could not afford to retire during and after the Great Recession. The overall labor-force participation rate (below) slowed it decline along a curve as those retirements stopped and then even moved up a little as retirees actually moved back into the work force because they couldn’t afford to fully retire. Then it suddenly crashed during the COVID years and has not recovered since: (Red trend line is my addition.)

Federal Reserve Bank St. Louis

Federal Reserve Bank St. Louis

Pew explains the labor force change as follows:

During that period – December 2007 to June 2009 – there was a steep decline in the value of financial assets as well as home prices. The resulting loss of wealth induced some older workers to remain in the labor force and postpone retirement. In contrast, household wealth has been rising since the onset of the pandemic. House prices have been rising in most markets. The stock market did have a sharp sell-off in March 2020 but reached new record highs by August 2020.

The boost of wealth from rising stocks and rising home values and government stimulus checks made retirement finally possible for those who had either held off or had actually returned to the labor market, so they jumped off the bandwagon in 2020 with not intention of returning again.

The retirement uptick among older Americans is important because, until the pandemic arrived, adults ages 55 and older were the only working age population since 2000 to increase their labor force participation. Labor force participation for the entire working age population declined from an annual average of 67% in 2000 to 63% in 2019. This partly reflects a steep drop in participation among 16- to 24-year-olds (66% to 56%) as young people increasingly pursued schooling rather than employment…. The overall decline in labor force participation would have been larger if adults 55 and older had not increased their labor force participation (from 32% in 2000 to 40% in 2019).

Now they’re out again, and the resulting loss to the overall labor force, while great for those who can finally retire or return back to retirement, is true economic damage in terms of the nation’s ability to produce. All the improvement in participation that happened from the start of 2016 on due to retirees return or people postponing retirement got flushed away, and we fell back to where the downward trend would have taken us if all those improvement years had not happened. We lost ground from a productive labor standpoint, while the population we have to support with that reduced labor force is greater, and that means shortfalls in supply of products and services.

Now, it’s possible that a crashing stock market and crashing housing market, if those materialize, will drive people back out of retirement once again out of necessity; but, by then, the damage to the economy is all in.

How can inflation rise when the economy declines?

What I’m getting at is the changes in the labor market mean production and transportation in the US will be broken for some time. That brings us to the next thing that is far outside the norm. NORMALLY, we think inflation is hot because the economy is hot. That is not always the case and certainly is not now. In fact, the worst inflation known to humankind has generally happened when economies are dying. Hyperinflation in Zimbabwe certainly did not happen because the economy was hot. Neither did inflation in the German Wiemar Republic.

The Wiemar Republic when money was carried by the basketful and even wheelbarrows

The Wiemar Republic when money was carried by the basketful and even wheelbarrows

just to buy handfuls of groceries.

However, people in the US are used to thinking that is always why inflation runs hot to where, if the Fed has to fight inflation, it must be that it needs to cool the economy. And they find the metrics that support that, but they do not look under the hood to see if something is truly broken.

As I know I’ve said a lot: inflation comes from too much money chasing too few goods. Those shortages can happen on the demand side because everyone is rich in a grand economy so all are demanding more goods, while the economy cannot bring production up fast enough to meet the soaring demand. It can happen for those reasons, and a lot of people right now mistakenly think those must be the reasons for today’s inflation.

Without a doubt the Fed and feds poured a huge amount of money into the economy. So, the too-much-money factor in the inflation equation is fully in place. Yet, the too-few-goods part of the equation (the shortage) is less a problem of demand outstripping production right now than it is of production and transportation being shut down — a supply-side problem. Hence the constant talk by the Fed and others about “supply-line problems” and “supply shortages” and “transportation bottlenecks.”

While production and transportation will continue to hampered by COVID shutdowns around the world and COVID-caused sick leave adding to the problem, the main problem is that labor has no intention of coming back! People are glad to finally be retired.

That means production and services will remain below demand in the face of all that money that can bid up the price of scarcer goods and services. Inflation will remain hot while the economy remains less productive. That is the exact chemistry for a stagflationary recession where all the excess money the Fed and feds have pumped into savings does not jack up the economy because the economy is broken in ways that cannot be fixed just by throwing money at it, which is the solution the US became dependent on throughout the Great Recession and the Fed’s Great Recovery program.

I know it is hard for investors to believe money doesn’t fix everything, but the Fed can do NOTHING about the shortages that are keeping inflation high. And here is what makes it even worse: those product shortages are, in themselves, a factor, over and above labor shortages, in the slowdown of production. They form a vicious circle, as we saw in auto manufacturing all of last year, where production is not just slowed down by a lack of available labor, but also by a lack of essential components due to the slowdown in production elsewhere.

The Fed cannot fix any of that. So, as I put out my next article that shows how rapidly evidence is changing to show we ARE going into a recession right now, bear in mind that the usual way of looking at a tight labor market and inflation as a sign of economic vibrancy, is not applicable at all right now. The Fed is not moving into a tightening regime to fight inflation that is resulting from an overheated economy, even if it might falling to the same mistaken line of thought that says, “We have inflation; the economy must be hot.”

This inflation is due to economic decline caused by the COVID lockdowns that shifted labor demographics considerably in addition to temporarily closing down production facilities and transportation ports. The latter can bounce right back, but the actual available labor side of the economy did not rebound, even though it appeared to because a great number of unemployed people suddenly fell off unemployment rolls as soon as extended benefits ended.

The kind of instant drop-off shown in the graph can only happen because benefits suddenly ended, cutting people off the unemployment count, not because millions of people instantly leaped back to work. People don’t all move in one massive bolt like that on a national scale. Sure, some fall-off was from people returning to work, but most was from a data shift to simply not counting millions. That created an illusion of employment recovery that is mostly an artifact of data reporting, not a proof of recovery.

Zero Hedge notes that, as of January, there are…

4.6 million, more vacant jobs than unemployed workers in December, confirming that the US labor market remains woefully, perhaps irreparably cracked.

“Unemployed workers,” of course, does not count people who have left the job force altogether and are not interested in finding work. The permanency of the transformation to a smaller labor force is now becoming apparent to employers everywhere, and it assures production and service shortages right at a time when the government and its central banker are trying to fix the economic problems the way the Weimar Republic did — by throwing a lot of money at it.

We are moving into a stagflation recession like the Weimar Republic because we keep trying to fix our economic problems with more economic stimulus. I’m not saying inflation will get that hot, but I think we are already in a situation like the seventies. IF the Fed and federal government don’t back off from stimulus, we will be in another Wiemar Republic because that is where continuing to try to fix structural economic breaks by throwing money at them gets you.

However, the Fed is backing off from stimulus. If it actually tightens as Fed Chair Paul Volcker did, we will avoid hyperinflation; but we will not avoid the recession that is already forming. In fact, Fed tightening will drive us harder into recession, just as it did then. There is no escaping the pain we have already set up for ourselves. There is only a matter of whether we’re going to make it worse by returning to monetary stimulus that cannot fix the problem — Wiemar-Republic style — or stay the course Paul-Volcker style.

Liked it? Take a second to support David Haggith on Patreon!