Consumer confidence is sliding, home sales are sliding, and delinquencies and bankruptcies are rising. Could it negatively impact the banks? It's for regionals, for sure. Stock markets are rolling over. The prospect of shrinking household budgets amid the erosion of consumer confidence continues to support the positive consumer response to value retailers such as Dollarama Inc., that has reported increased sales, rising EBITDA, higher income, expanded store openings and share repurchases, that pays a dividend, and that is held in the Enriched Capital Conservative Growth Strategy.* The NASDAQ has given a sell signal. The MAG7 doesn't look so magnificent anymore. Could a crash happen? The potential is there. Even gold is going through a correction. But when the dust clears, gold is the first to start rising. Long-term interest rates have rallied recently. Can it continue? Over 5% for the U.S. 10-year spells trouble. The US$ Index looks lower and has a history of poor performance under Republican presidents.

In a sign that says batten down the hatches, Warren Buffett is not only sitting on a cash pile, but he's raised more unloading his S&P ETFs. Berkshire Hathaway has hit new highs. But Musk's Tesla is crashing already down 40% from its highs, and it's taking Musk's net worth down with it. Is the market about to follow?

It's March. Spring is coming. But it is still below zero centigrade (below 32 F for U.S. readers). Spring can't come soon enough.

Have a great week.

DC

* Reference to the Enriched Capital Conservative Growth Strategy and its investments, celebrating a 7-year history of strong growth, is added by Margaret Samuel, President, CEO, and Portfolio Manager of Enriched Investing Incorporated, who can be reached at 416-203-3028 or msamuel@enrichedinvesting.com

“Press on. Nothing in the world can take the place of persistence. Talent will not: nothing is more common than unrewarded talent. Education alone will not: the world is full of educated failures. Persistence alone is omnipotent.”

—Calvin Coolidge, 30th president of the U.S. 1923–1929, 29th vice-president 1921–1923, 48th governor of Massachusetts; 1872–1933

“The authority of a thousand is not worth the humble reasoning of a single individual.”

—Galileo Galilei, known just as Galileo, astronomer, physicist, engineer, polymath, from Pisa in the Dutchy of Florence, father of observational astronomy and modern era classical physics; 1564–1642

“Lack of money is the root of all evil.”

—George Bernard Shaw, Irish playwright, critic, political activist, polemicist, major works Man and Superman (1902), Pygmalion (1913), Saint Joan 1923 (1925), Nobel prize in literature; 1856–1950

We have been longtime subscribers to The Economist magazine. We’ve always appreciated their stance on economic liberalism, particularly free markets, free trade, and globalization. No, we don’t always have to agree with them, particularly their editorial stance, but over the years, one appreciates their lack of reporting bias and their editorial fact-checking. It is something we have tried to emulate.

It is probably no surprise that The Economist has come out swinging against U.S. President Donald Trump’s desire for an imperial presidency (“The Would-be King” – The Economist, February 22–28, 2025). He and his administration claim they are there to clear up waste, fraud, and abuse, but instead, they appear to be taking a wrecking ball approach to anything they don’t like or anyone who doesn’t swear ultimate loyalty to Trump.

He has shattered long-held alliances through threats like wanting to annex Canada and Greenland and to take over the Panama Canal. He has also threatened alliances in Europe and has withdrawn from a number of international organizations where the U.S. was viewed as a leader. He largely ignored the legislature, or they were too cowered to challenge him (Republican controlled Congress and Senate), which in turn could lead to a constitutional crisis or autocracy. He is also threatening judges and threatening to ignore any judicial decision with which they don’t agree, including possibly the Supreme Court. Tariffs, budget deficits, and tax cuts are ultimately inflationary. But countering that is an assault on the bureaucracy that could lead to a large upswing in unemployment and an economic slowdown. Stagflation?

We are entering a period of economic turmoil and uncertainty. Or, as we’ve said many times, it's a period of chaos and volatility. Has that happened before? Of course it has, notably in the 1930s, the 1970s, and the 2000s.

What were their characteristics? The stock market crashed (Dow Jones Industrials (DJI)): 1929–1932 down 89%, 1973–1974 down 45.1%, and 2007-2009 down 53.8%. So, if it was a dangerous period to own stocks, what was the safe haven? No surprise—gold. Gold was fixed during the 1930s, but Homestake Mining HM (today included with Barrick Gold) rose 105% from 1929–1932 during the same period that the DJI was falling 89%. Eventually, HM was up 1,000% by 1936. From 1970 to 1980, gold rose over 1,900%, and from 2000 to 2011, gold was up 462%. We are referring to gold, the metal, and not gold stocks, except in the case of HM during the 1930s. Gold, unlike stocks, has no liability. Gold stocks had strong runs in both the 1970s and 2000s.

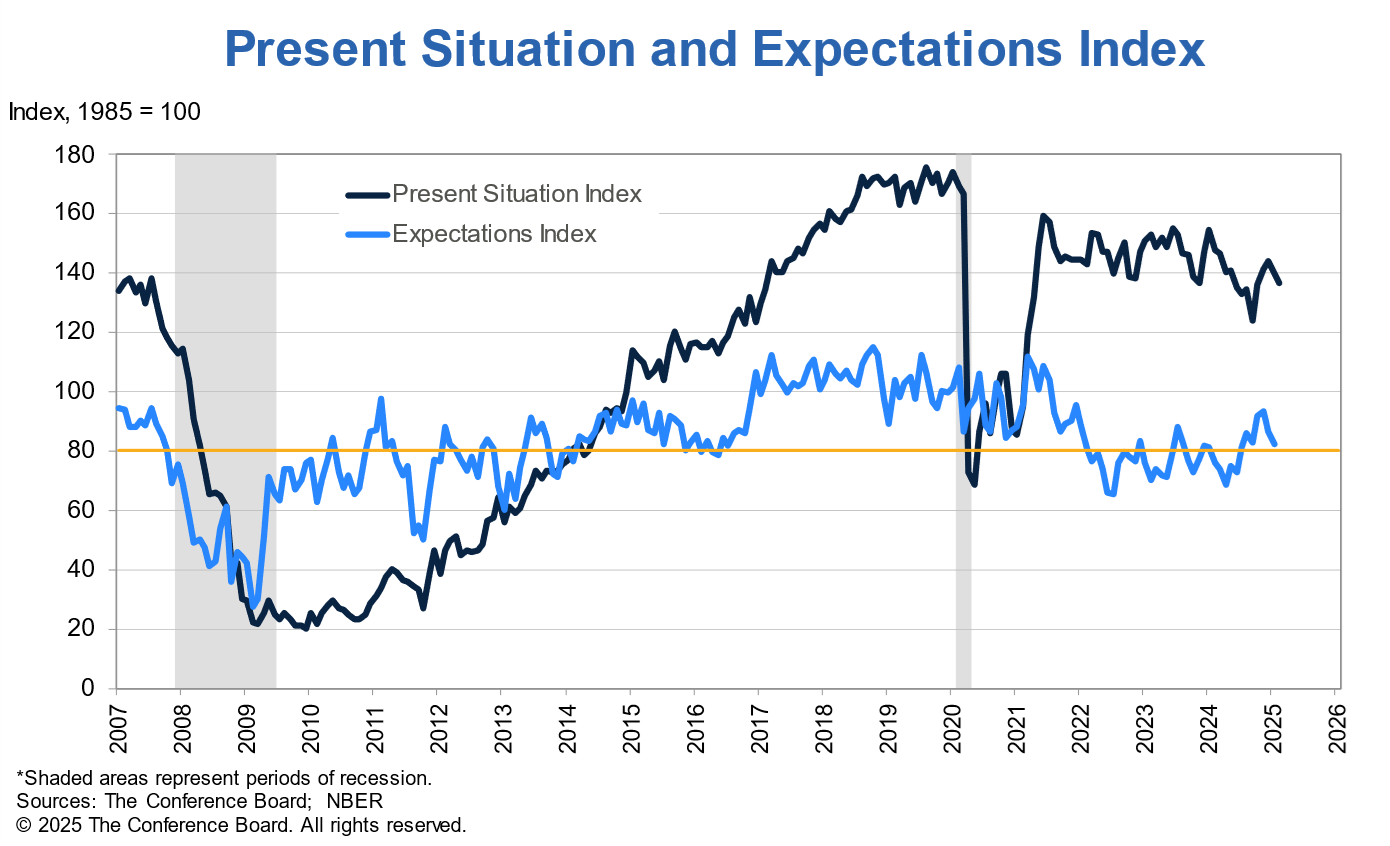

Conference Board Consumer Sentiment and Expectations 2007–2025

Source: www.conference-board.org

Consumer sentiment is fading. This is probably no surprise, given what is going on with attempts to fire thousands of federal workers, impose tariffs, and more. The recent Conference Board February report noted that consumer sentiment had its biggest drop since 2021. The expectations index fell below 80, which is usually a threshold for a recession. Labour market conditions are weakening. Note that initial weekly claims jumped to 242,000 this past week, well above the expected 225,000 and the previous week’s 220,000. The Conference Board’s consumer sentiment came in at 98.3 vs. January’s 105.3 and expectations of 103. Confidence fell across all income levels. This coming week, we get the February jobs report, and the expectation so far is for nonfarm payrolls to rise 133,000 and the unemployment rate to remain at 4%. Would we be surprised if the numbers were worse? Probably not. Better? Absolutely.

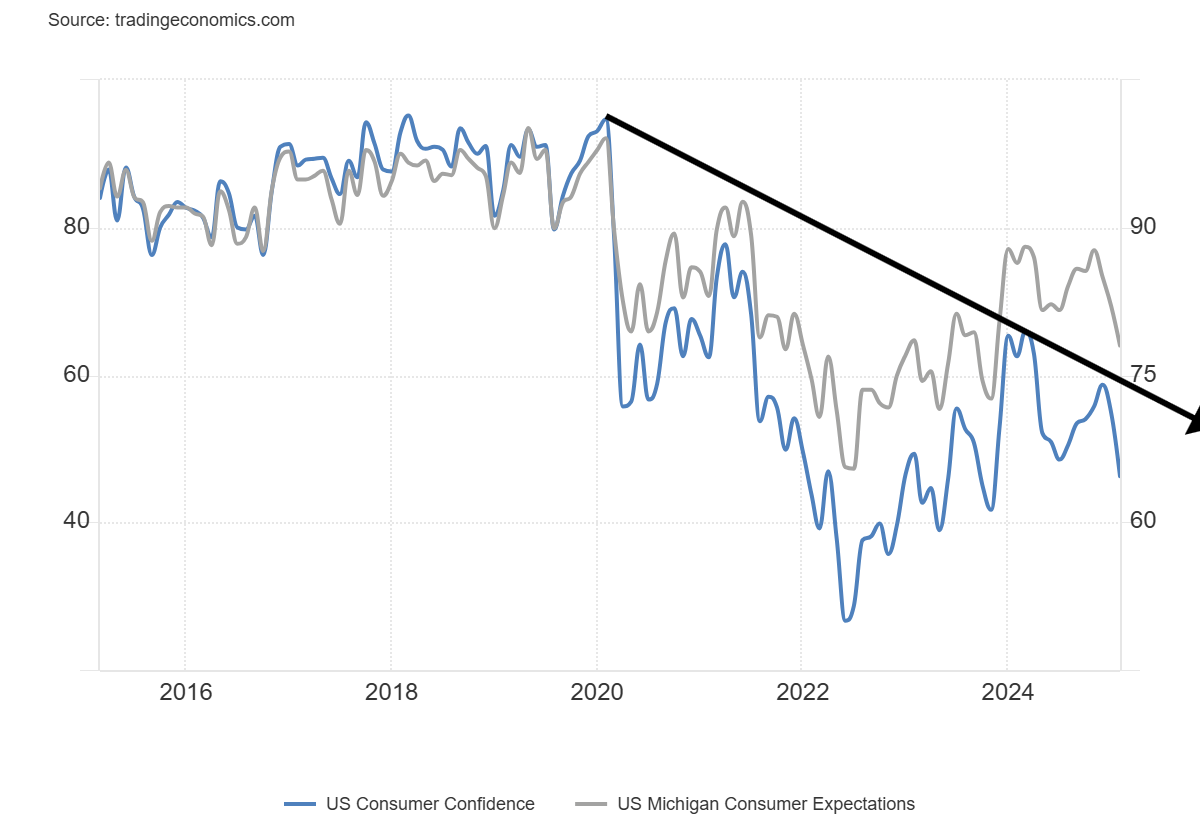

The University of Michigan Consumer Sentiment Index is also falling. The final came at 64.7, well down from the 67.8 that was recorded at the beginning of the month. It was down across all age groups, income groups, and wealth groups. Earlier January retail sales fell 0.9%, far below the expected 0.1% drop. Add in the chaos since January 20, 202,5 and no wonder sentiment is falling. Not helping consumer confidence is the slumping housing market. Pending home sales have turned negative. Existing home sales are down sharply, approaching levels seen in 2010, while new home sales are down but not yet near the 2010 and 2020 lows.

University of Michigan Consumer Sentiment and Expectations 2015–2025

Source: www.tradingeconomics.com, www.umich.gov

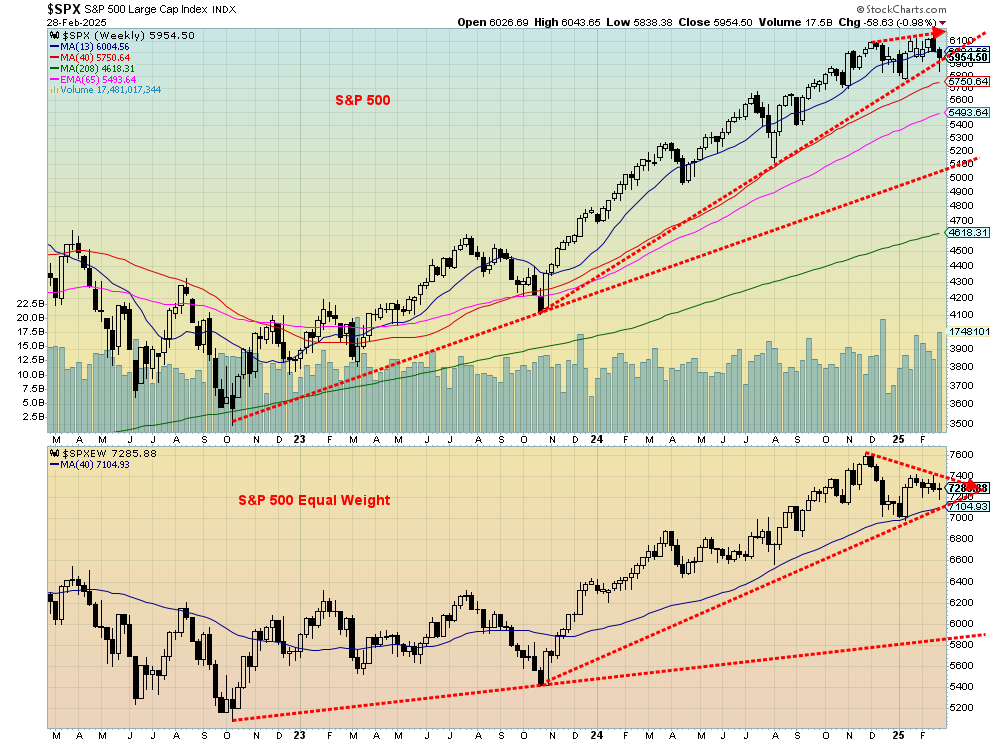

The stock market is now beginning to wobble. After making an all-time high, the S&P 500 has now fallen about 3.1%. It could have been worse except for Friday, when we witnessed a strong rebound. Buying the dip? Or rallying on bad news? However, the S&P 500 did close under 6,000. The next stop could be 5,800 and, below that, 5,700. The S&P 500 Equal Weight Index has underperformed the S&P 500, making a lower high, while the S&P 500, weighed heavily by the MAG7, had made new highs. The S&P 500 Equal Weight Index is now down 4.3% from its high.

The Dow Jones Industrials (DJI) has fallen about 3%, and the NASDAQ, home to the MAG7 and many other tech stocks, is down 6.7%. Of the MAG7 stocks, Tesla has fallen the most, down 40% from its all-time high set in December 2024. That’s solid bear market territory. We suppose the only good news is that it is approaching its 200-day MA and is oversold. Elon Musk may still be the richest man in the world, but his net worth has plummeted by over $100 billion from its high. The other billionaires are also seeing their net worth trimmed. Just so they don’t feel left out, the Dow Jones Transportation (DJT), which continues to diverge with the DJI, is down 12.4% from its all-time high set way back in November 2021.

S&P 500 and S&P 500 Equal Weight 2022–2025

Source: www.stockcharts.com

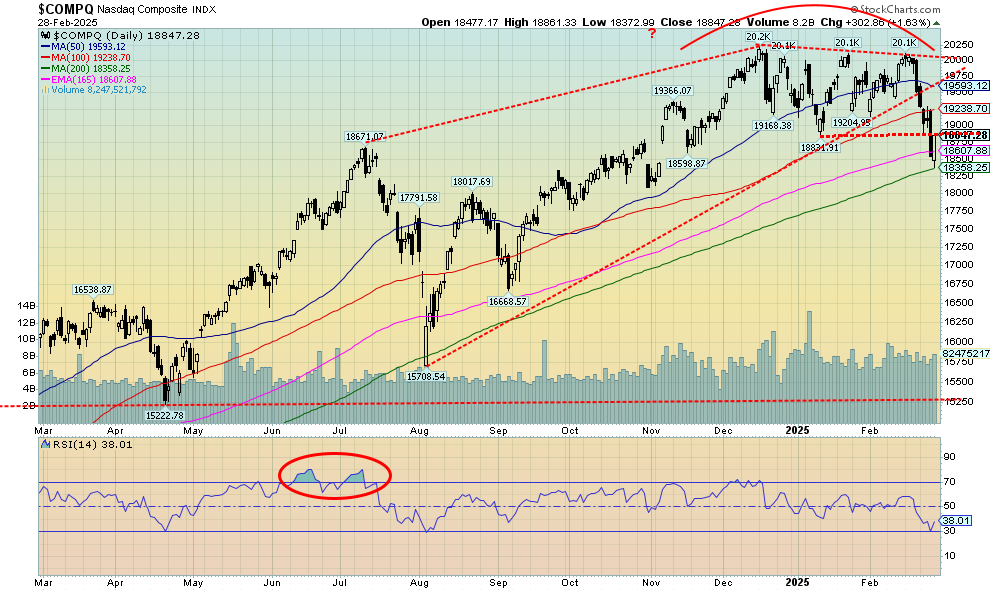

So far, the NASDAQ has been the only major index to break its recent low. The NASDAQ has broken its trendline, up from the August 2024 low, and has now broken its low of January 13, 2025. The S&P 500 up trendline from October 2023 that connects with the August 2024 low was penetrated but continues to hold for the moment. The January 2025 low remains intact. The NASDAQ has given us a sell signal, despite Friday’s strong bounce back as it came back to the breakdown line.

Source: www.stockcharts.com

Gold appears to be correcting its recent run-up to over $2,900. Gold has failed to take out $3,000, with a high thus far of $2,974. We have now broken back under $2,900 and could now have potential targets down to $2,700/$2,750. Interim support would be seen at $2,850 and $2,800. Still, we appear to be on a fresh upward wave from lows seen in November/December 2024. Since then, we are up roughly 12.1%. We maintain targets up to $3,600, but it won’t be a straight-up move. This is the first correction since the lows in December 2024. As noted, we would not want to see a breakdown under $2,700 as that could signal the end of the current bull market.

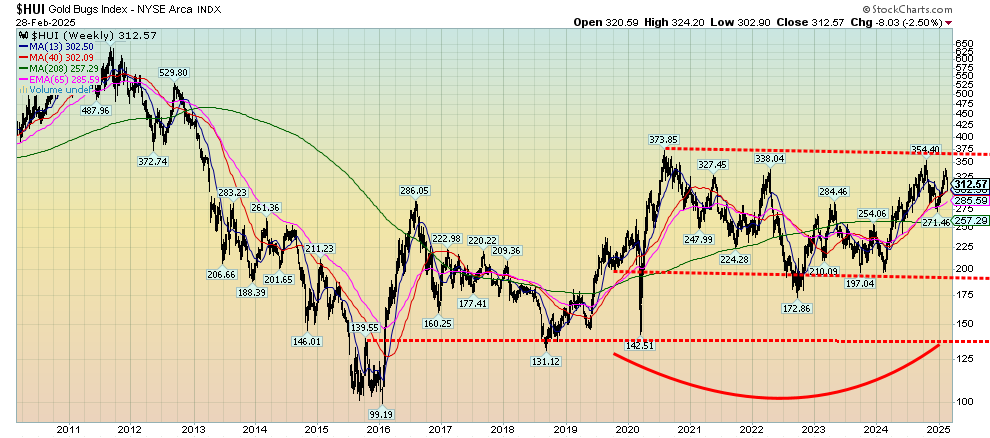

Potentially more compelling are the undervalued gold stocks. While gold has gone to record multiple new all-time highs, the gold stocks remain moribund, undervalued, and underappreciated. This is occurring even as they are up from their more recent lows seen in 2023. The Gold Bugs Index (HUI) remains down a huge 51% from its all-time high in 2011. The TSX Gold Index (TGD), on the other hand, is down just over 12% from its all-time high in 2011. Since 2020, the HUI, the weakest of the two gold stock indices, appears to be forming a large sideways pattern that ranges roughly from 200 to 370. The pattern is shown on the weekly chart below. These sideways patterns tend to be consolidation patterns, not topping patterns. Ultimately, it should break to the upside. The breakout point would come at around 375. Potential targets then could be up to 575. The risk is a breakdown under 250. Then, the lower end of the sideways pattern could be underway.

Gold Bugs Index (HUI) 2010–2025

Source: www.stockcharts.com

The junior gold mining exploration stocks, which trade primarily on the TSX Venture Exchange (CDNX), are even more undervalued. Many are trading under the value of their gold holdings or valuations of under $100/ounce of gold in the ground.

The most recent Personal Consumption Expenditures (PCE) prices, which the Fed tends to rely on, showed a gain of 2.5% year over year (y-o-y), which was as expected. That was only marginally better than the 2.6% rise the previous month. Month-over-month PCE prices were up 0.3% in February, below the expected 0.4%. Still, inflation rates remain sticky and definitely not under the Fed’s target of 2%. This suggests to us that the Fed has little incentive to lower interest rates just yet. We continue to expect a clash at some point between President Trump and Fed Chair Powell. It probably won’t be a pleasant one, and it could have a negative impact on the US$ Index, bond yields, and the stock market. The Fed is not answerable to the White House or Congress but does report on its operations and outlook to Congress.

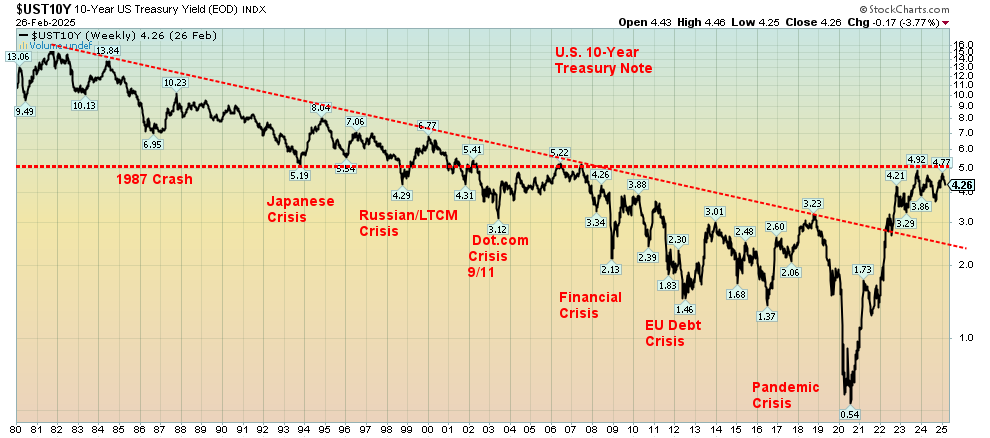

The Fed can control the short end of the market but not the long end, which is the purview of the bond market. The bond market cannot be controlled, primarily because it is too big and diverse, and there is no one party in charge like the Fed. Right now, the bond market is being helped by the promise to slash the U.S. budget. Currently, the U.S. budget deficit is roughly 6.6% of the GDP, the highest in the G7. A combination of budget cuts and tax hikes could bring the budget deficit more in line. Instead, they prefer to make huge tax cuts that will mainly benefit the wealthy and slash the civil service, which could put upward pressure on unemployment as well as disrupt government services. The result, at least in the short term, is that bond prices are rising while yields are falling. The question is, will it last?

Globalization had a dampening effect on inflation. De-globalization will do the opposite and could cause inflation to rise, which in turn feeds into the actions of the Fed and the bond market. If the bond market sees higher inflation for a longer time, then inevitably yields will rise and prices will fall. Tariffs, combined with the geopolitics of tariffs, limit the flow of goods and stall the movement of labour. Tariffs beget tariffs and, ultimately, devastating trade wars that were behind the Great Depression (with the Smoot-Hawley Tariffs of 1930). All this tends to make inflation structural, even as the economy may slow as a result of rising unemployment. In a word, stagflation.

The U.S. 10-year treasury note backed off from 5%. Thus, 5% could prove to be a breakout point if interest rates were to turn back up. We have noted that the U.S. alone has some 33%, or about $9.5 trillion, of its public debt maturing in 2025. That’s a lot of refinancing. Foreign buyers have been pulling back. As of December 2024, foreign holdings were up $574 billion in the past year. China’s holdings are down $57 billion, while Japan's is down $55 billion. China and Japan are the two largest holders of U.S. Treasury bonds. Some of the slack has been picked up by other G7 countries. But if foreigners become nervous about what is going on in the U.S., they could refuse to buy their treasuries or, worse, sell off their holdings for gold, a move that would ultimately put upward pressure on long-term yields but be very beneficial for gold.

10-Year U.S. Treasury Note 1980–22025

Source: www.stockcharts.com

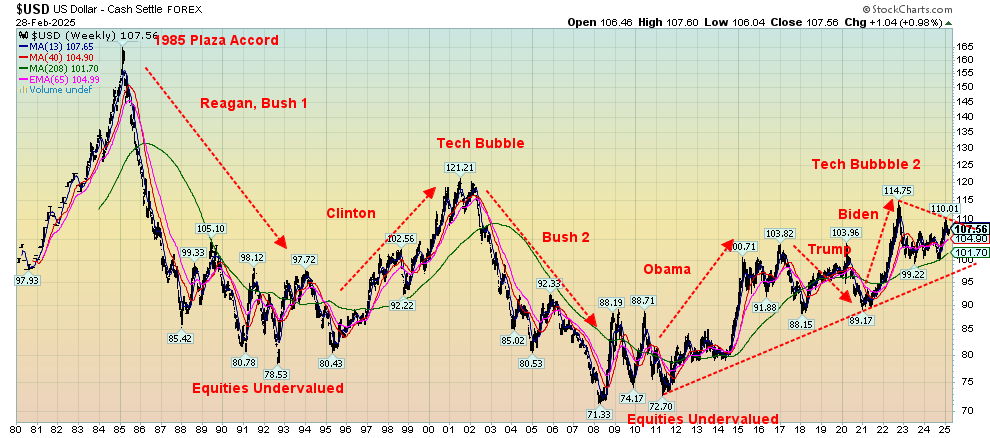

What’s key to watch could be the U.S. dollar. The US$ Index, after topping recently at 110, has fallen roughly 3%. Doesn’t sound like a lot, but in the world of currencies, it’s significant. At 110, it was a lower high than the previous high of 114.75. A breakdown of the U.S. dollar, while it could be positive for foreign holders of U.S. debt, could prove troublesome for holders of U.S. treasuries. While the evidence may be circumstantial, we can’t help but notice that the US$ Index tends to be strong under Democrat administrations and weak under Republican administrations. The US$ Index fell under Reagan/Bush 1, rose under Clinton, fell under Bush 2, rose under Obama, fell under Trump, and rose under Biden. The current Trump administration believes that tariffs are good for the U.S, and a lower U.S. dollar is also good.

US$ Index 1980–2025

Source: www.stockcharts.com

Under the Trump administration, things are beginning to implode both domestically and internationally. The actions of the Trump administration are impacting international relations (see the weekend “brawl” between Trump and Zelensky), by pulling out of international institutions such as WHO, and threatening to pull out of the WTO, NATO, and even the U.N. They are threatening to take over nations such as Canada, imposing tariffs that stall globalization, potentially leading to a severe recession or worse, firing potentially thousands in the U.S. civil service which would not only negatively impact delivery of government services but also directly negatively impact other businesses. It then feeds on itself.

Many are already feeling the negative impacts of the White House’s actions. Unemployment claims are rising, interest rates remain sticky, real estate markets are under pressure, the housing market is faltering, delinquencies are rising on a host of consumer debt, consumer sentiment is falling along with retail sales, commercial real estate is under pressure, and inevitably, the banks will be under pressure. Finally, protests are rising. Could they turn violent?

Yet on Friday, despite bad news elsewhere and the brawl between Trump and Zelensky, the stock market rose, then it fell, then surged ahead as the DJI finished up 600 points. Volatility reigns. Is Friday’s action a sign we’ve bottomed? Not likely. We are reminded how, in 1987, the stock market topped in August, then fell into a low on September 21. September 22 saw the market make a mild new low, then it rebounded with the DJI up over 3%. Yes, we rallied for the next eight days, but that was it. No new highs. On October 6, 1987, the market turned down sharply, and what followed was the record-breaking collapse of October 1987, culminating in the October 19 stock market crash. A crash in March? We are reminded of the gyrations in March/April 2000 when things unraveled for the dot.com/high-tech market of the 1990s. Today, it’s the MAG7 and AI. Friday’s sharp gain for the DJI was only 1.4%. Nonetheless, a 600-point move was dramatic after being down earlier. The DJI is outperforming the other indices in this downtrend. A sign of flight to quality.

The stock market appears to have made a potentially important top, but the major breakdown zones lie ahead. Bitcoin is breaking down, having plunged under $90,000. Even gold is faltering, despite being a safe haven. In past sharp declines, gold has tended to follow the market down, but then it is the first out of the chute. We saw that, especially in the 2008 financial crisis panic and again in the 2020 pandemic crisis. Oil prices are under pressure from a global supply glut, and all is quiet for now on the geopolitical front, which could impact oil.

Chaos and volatility continue. But a warning. Warren Buffett dumped all his S&P 500 ETFs, and then Buffett’s company Berkshire Hathaway (BRK.A) made all-time highs. Buffett is sitting on a mountain of cash, even as the broader market of funds, etc., are at their lowest cash position in years.

Markets and trends follow. There has been a lot of red ink this past week.

Copyright David Chapman 2025

Markets & Trends

|

|

|

|

% Gains (Losses) Trends |

|

||||

|

|

Close Dec 31/24 |

Close Feb 28/25 |

Week |

YTD |

Daily (Short Term) |

Weekly (Intermediate) |

Monthly (Long Term) |

|

|

Stock Market Indices |

|

|

|

|

|

|

|

|

|

S&P 500 |

5,881.63 |

5,954.50 |

(1.0)% |

1.2% |

down |

up |

up |

|

|

Dow Jones Industrials |

42,544.22 |

43,840.91 |

1.0% |

3.1% |

neutral |

up |

up |

|

|

Dow Jones Transport |

16,030.66 |

15,986.49 |

(0.3)% |

0.6% |

down |

up |

up |

|

|

NASDAQ |

19,310.79 |

18,847.28 |

(3.5)% |

(2.4)% |

down |

up (weak) |

up |

|

|

S&P/TSX Composite |

24,796.40 |

25,393.45 |

1.0% |

2.7% |

neutral |

up |

up |

|

|

S&P/TSX Venture (CDNX) |

597.87 |

614.64 |

(3.2)% |

2.8% |

down |

up |

neutral |

|

|

S&P 600 (small) |

1,408.17 |

1,363.73 |

(1.1)% |

(3.2)% |

down |

down (weak) |

up |

|

|

MSCI World |

2,304.50 |

2,447.54 |

(1.3)% |

6.2% |

up |

up |

up |

|

|

Bitcoin |

93,467.13 |

84,237.84 |

(11.9)% |

(9.9)% |

down |

up (weak) |

up |

|

|

|

|

|

|

|

|

|

|

|

|

Gold Mining Stock Indices |

|

|

|

|

|

|

|

|

|

Gold Bugs Index (HUI) |

275.58 |

312.57 |

(2.5)% |

13.4% |

neutral |

up (weak) |

up |

|

|

TSX Gold Index (TGD) |

336.87 |

400.17 |

(0.6)% |

18.8% |

up (weak) |

up |

up |

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

U.S. 10-Year Treasury Bond yield |

4.58% |

4.21% |

(5.0)% |

(8.1)% |

|

|

|

|

|

Cdn. 10-Year Bond CGB yield |

3.25% |

2.92% |

(6.7)% |

(10.2)% |

|

|

|

|

|

Recession Watch Spreads |

|

|

|

|

|

|

|

|

|

U.S. 2-year 10-year Treasury spread |

0.33% |

0.21% |

(8.7)% |

(36.4)% |

|

|

|

|

|

Cdn 2-year 10-year CGB spread |

0.30% |

0.34% |

(12.8)% |

13.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currencies |

|

|

|

|

|

|

|

|

|

US$ Index |

108.44 |

107.56 |

0.9% |

(0.8)% |

down (weak) |

up |

up |

|

|

Canadian $ |

69.49 |

.6913 |

(1.6)% |

0.5% |

down |

down |

down |

|

|

Euro |

103.54 |

103.74 |

(0.8)% |

0.2% |

neutral |

down |

down |

|

|

Swiss Franc |

110.16 |

110.71 |

(0.7)% |

0.5% |

up (weak) |

down |

neutral |

|

|

British Pound |

125.11 |

125.79 |

(0.4)% |

0.5% |

up |

down |

neutral |

|

|

Japanese Yen |

63.57 |

66.41 |

(0.9)% |

4.5% |

up |

neutral |

down |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Precious Metals |

|

|

|

|

|

|

|

|

|

Gold |

2,641.00 |

2,848.50 |

(3.6)% |

7.9% |

up (weak) |

up |

up |

|

|

Silver |

29.24 |

31.50 |

(4.6)% |

7.7% |

neutral |

up |

up |

|

|

Platinum |

910.50 |

937.90 |

(5.0)% |

3.0% |

down |

down |

neutral |

|

|

|

|

|

|

|

|

|

|

|

|

Base Metals |

|

|

|

|

|

|

|

|

|

Palladium |

909.80 |

911.90 |

(8.0)% |

0.2% |

down |

down |

down |

|

|

Copper |

4.03 |

4.55 |

(0.2)% |

12.9% |

up |

up |

up (weak) |

|

|

|

|

|

|

|

|

|

|

|

|

Energy |

|

|

|

|

|

|

|

|

|

WTI Oil |

71.72 |

69.76 |

(0.9)% |

(2.7)% |

down |

down |

down |

|

|

Nat Gas |

3.63 |

3.83 |

(10.3)% |

5.5% |

up (weak) |

up |

neutral |

|

Source: www.stockcharts.com

* New All-Time Highs

Note: For an explanation of the trends, see the glossary at the end of this article.

New highs/lows refer to new 52-week highs/lows and, in some cases, all-time highs.

GLOSSARY

Trends

Daily – Short-term trend (For swing traders)

Weekly – Intermediate-term trend (For long-term trend followers)

Monthly – Long-term secular trend (For long-term trend followers)

Up – The trend is up.

Down – The trend is down

Neutral – Indicators are mostly neutral. A trend change might be in the offing.

Weak – The trend is still up or down but it is weakening. It is also a sign that the trend might change.

Topping – Indicators are suggesting that while the trend remains up there are considerable signs that suggest that the market is topping.

Bottoming – Indicators are suggesting that while the trend is down there are considerable signs that suggest that the market is bottoming.

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.