Chairman Powell of the People’s Bank of the USSA would have you believe inflation is no concern because the Federales are in control. The bond vigilantes, with their pistols shoved into his back, would have you believe Powell is their prisoner and is being hauled off to the stockade where his friends in stocks are looking a bit worried about their futures.

I’ve been slow in getting things written this month because we moved off our farm, and my wife broke her leg at the same time; so I had her share of the packing, moving and organizing to do on top of my own plus her caregiving and an all-day hospital journey for her surgery, though I got some much-needed help from family members. With the move now behind us, hopefully, I can get back on track. (Just don’t want you to think I gave up on this blog.)

The intro below was the opening of my last Patron Post — a summary of the recent moves in stocks and bonds, which I’ll share now with all readers before I update how the battle of the bond vigilantes against the stockade is proceeding. Patrons who read the last Patron Post may want to skip the intro, but note I’ve updated it near the end (the section in red print).

Introduction

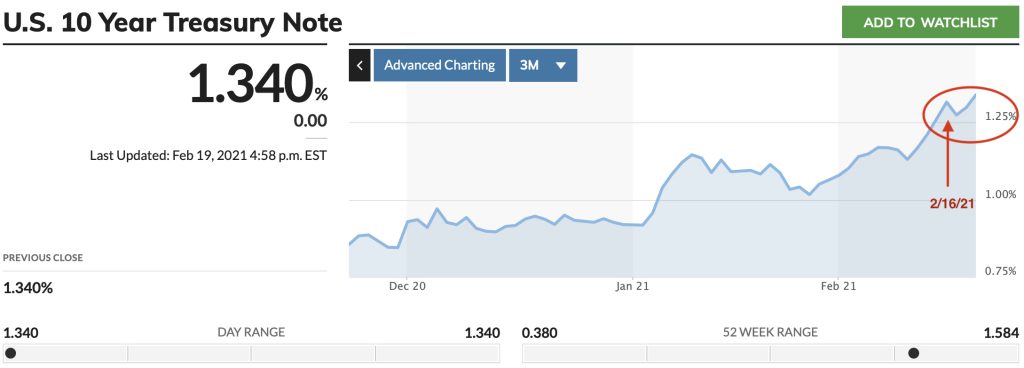

As I noted in an earlier Patron Post, we are entering the first period since I began writing this blog years ago when I am actually concerned about inflation blowing up. In my last article about all the variables creating insanity in the housing market, I noted that inflation (or expectation of it) has started to drive up bond yields at a blistering pace, which in turn are starting to lift mortgage rates. Prior to that, I had stated that, if the ten-year bond broke above 1.25%, it would start to create downward pressure on stocks by competing for investor money.

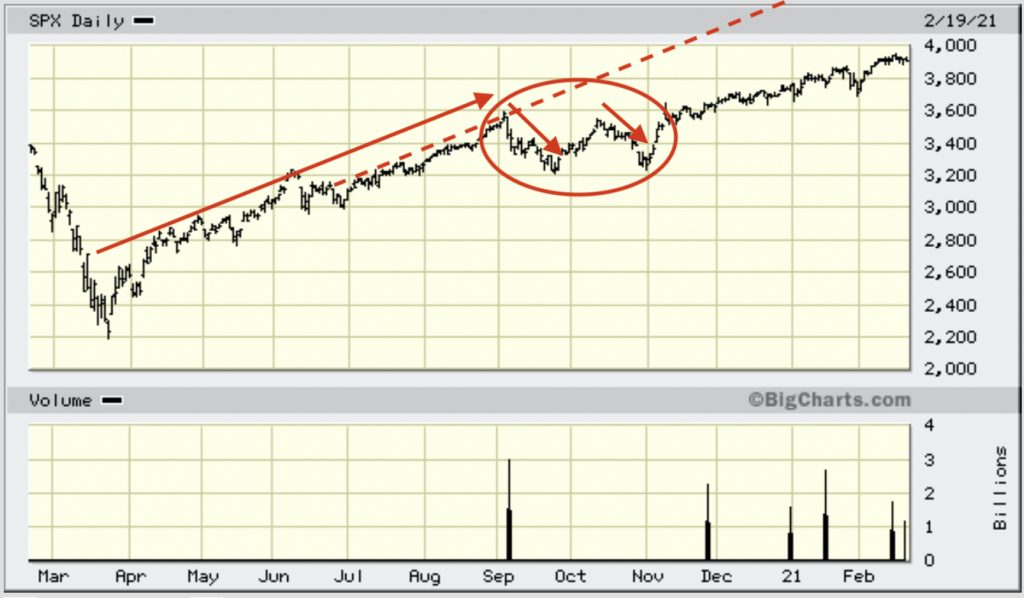

The stock market’s troubles continue to happen at the points where I’ve said the stresses would show up. We did, for example, get two ~10% corrections in September and October of last year, both of the months when I said we would most likely see the market fall. That breakdown, while not as big as I anticipated, was significant in how it re-aimed the market’s trajectory and looks like this:

Even though the market recovered after October; you can see it did not recover back to trend. It not only remains far from the trend line it had been on, even after the most recent insanity, it has also been rising at a slower (less steep) rate of ascent ever since.

If you look at where the US 10-year treasury bond first broke and held above a 1.25% yield …

… you see that market mania in the S&P 500 topped out (for the moment anyway) at the same point, as I had said we could expect. It has been churning slowly downward since then as stock investors start to struggle over what to make of yields that are holding above one-and-a-quarter due to inflation concerns:

Added note: That graph ends where the stock market stood at the time of the Patron Post. Here is where it stands now:

You can see the market has been quite volatile since that breaking point, particularly after the day on which I published that post. That, in hindsight, now proves the following quote I included in the original article:

TIP rates are rising, adjusting for higher inflation rates. This is likely to cause a great deal of volatility as stocks re-price for these higher rates. The options market appears to already be pricing in some of these added risks….

Rates on the 10-year started rising at the beginning of August. But 10-Year TIPS [Treasury Inflation-Protected Securities] traded sideways until just recently. That has allowed the spread or the inflation breakeven rate to widen to its widest point since October 2018. Now, as inflation rates climb, it seems likely that those 10-Year TIPS will need to rise sharply….

Mott Capital, Seeking Alpha

TINA (There Is No Alternative) has been a major stock-market accelerant. With inflation pushing mortgage rates higher and making bonds more competitive with stocks, there suddenly is an alternative — bonds. So, TINA is losing out to her budding competition. Inflation clearly has the power to break both the insanely exuberant stock market and bond market. So, how bad is it and what are the risks that inflation spreads and rises faster?

Where we stand

Within a month of publishing the above statements and graphs, bonds started putting up competition for investor money as fear of inflation caused the 10-year yield to continue to rise. TINA was no longer the only girl in town.

The competition began as soon as the 10-year broke above 1.25% just as anticipated, but the bigger number where the market will really give way is at 2%. (It’s at 1.63% as I write this.) That’s where those in stocks will start to realized the bond vigilantes have arrived to stay and are taking over the town. At that point, Marshal Powell will have a fight on his hands.

The Patron Post that I borrowed the intro from noted it would be the rate of rise in bond yields that would spook markets the most, and I laid out the reasons for that. Regardless, breaking 2% will be like breaking the sound barrier because the competition starts to look rough at that level.

Bond investors are demanding this higher yield for two primary reasons:

1) The government is about to issue almost two-trillion dollars more in debt, and investors are anticipating rates will have to rise to attract enough investors to fund the government (increasing supply of anything (including bonds) results in falling prices (a.k.a. rising yields). Investors are starting to price in the coming glut of bonds.

2) So much of the new money the government is issuing via this debt is going directly into the hands of consumers where it is much more likely to cause inflation, and investors are pricing in what they will lose on inflation as they wait to get their money back. That is precisely what I began laying out months ago, especially in Patron Posts, as the most likely macro-economic path we’d see emerging as we closed 2020 and moved into 2021.

The rest of the Patron Post laid out key factors showing where inflation was already starting to rise and what current facts would cause inflation to rise in other areas in the next few months.

Forward March

As we enter the “Eids of March,” we are moving into that time of rising inflation I was writing about. I’m sure many helium-headed stock investors believe the lilly-livered Fed will turn tail and run from its goal of letting inflation rise as soon bonds begin to clobber stocks more seriously. (The bond market, being by far the biggest gang in town, that can easily overpower the comparatively small stock market when bonds decide to turn, which they apparently have.)

I am more inclined to agree with the following author (and clearly have been of this mind all along as I’ve written about the path we are now marching down.) I believe the Fed is more committed than ever to raising inflation as it has been saying it wanted to do for years. Of course, if it chooses to round up even more bonds in order to pull them off the market, it can keep bond rates down. So far, it has not chosen to do that, and it will have to do a great deal of it to make that work.

“Markets be damned!”: Fed standing firm on inflation fears

Skittish investors have see-sawed between celebration about the expected US economic recovery and nail-biting over a possible price spiral, but the Federal Reserve is standing firm on keeping interest rates low….

Analysts are expecting the Fed’s policy-setting Federal Open Market Committee (FOMC) to maintain its very “dovish” stance when it holds its two-day policy meeting next week.

“I think it’s ‘markets be damned’ at this point,” said Robert Frick of Navy Federal Credit Union.

“The Fed has said that until the real improvement in employment and in the economy, they’re not going to budge,” Frick told AFP. “I really don’t think they’re going to waver….”

While the jump back to [the 10-year’s] early 2020 level could be viewed as something of a market freak-out, there are real-world consequences of rising Treasury yields, since lending rates for home mortgages and car loans are linked to them.

Mortgage rates have begun to creep up, which could price some buyers out of an already-hot housing market, while existing homeowners will find it harder to refinance their loans, said Kathy Bostjancic of Oxford Economics….

“The reopening economy is going to be turbocharged by this $1.9 trillion fiscal stimulus, so there’s no doubt” inflation will rise, Bostjancic told AFP….

Powell has acknowledged that [bond] prices will move up but he pledged the Fed would not withdraw stimulus until the economy had returned to maximum employment — which is unlikely this year — and inflation was both above the 2.0 percent goal and on track to remain there “for some time.”

All of this means the stock market is now going to have running competition for months to come, and stocks, as I stated back in December, have never been more precariously perched. A month after I made a similar statement at the start of 2020, the market experienced one of it’s historically monumental crashes.

With all of that said, the Fed has proven again and again that it loses its spine as soon as the market crashes 20%, so I imagine it will leap into saying and doing whatever it has to at that point to artificially stem the flow of blood; but I doubt it will do much to prevent the market from falling before then. The Fed has shown it has a number of tricks for rigging the bond market to match the price controls of the central planners and rigging the stock market if the plunge gets scary enough, especially now that it has the help of the federal government.

Fed out of control?

The Fed’s control is being questioned … again. (It has been questioned many times by me, and it did each time prove it could not do what it said it could easily do.)

Fed Chair Powell had the opportunity to put to rest concerns he is losing control of the yield curve: he didn’t. The rhetoric was that he hasn’t seen anything to worry him yet in markets; that the policy focus has to be on those who are left behind; and that he sees no inflation threats….

But here’s an ugly picture for you: markets pushing US (and global) bond yields higher. There was so much shorting of US Treasuries yesterday that they traded negative on repo; and at the longer end, 10-year yields hit 1.57%, up 9bp on the day, and over 40bp in a month.

(There is that rate of rise that I said would give the stock market jitters, coming in right on schedule.)

However, it appears the Fed is going to wait until stocks crash or inflation bolts before stepping in with some form of de facto Yield Curve Control and jawboning – let’s call it Operation Twist and Shout.

Bond yields spiked. The stock market threw a tantrum. Reuters analyst Dhara Ranasinghe called it “a tussle over borrowing costs.”

The Fed won round 1, thanks to a little help from the Aussies. But even the mainstream seems to have noticed that this wrestling match isn’t over and the Fed may be forced to take real action soon. As Ranasinghe put it, “Round Two, and perhaps even Round Three, are inevitable, and they may require policy action rather than just words.”

By policy action, they mean upping quantitative easing.

It seems like a long time ago when the Fed failed at its vain promise that unwinding quantitative easing would prove to be as boring as watching paint dry. The Fed reversed itself quickly back then when drying paint turned out to be very exciting, yet still assured us all the world would not see another financial crisis in Janet Yellen’s lifetime. (Apparently she lived longer than she expected to.)

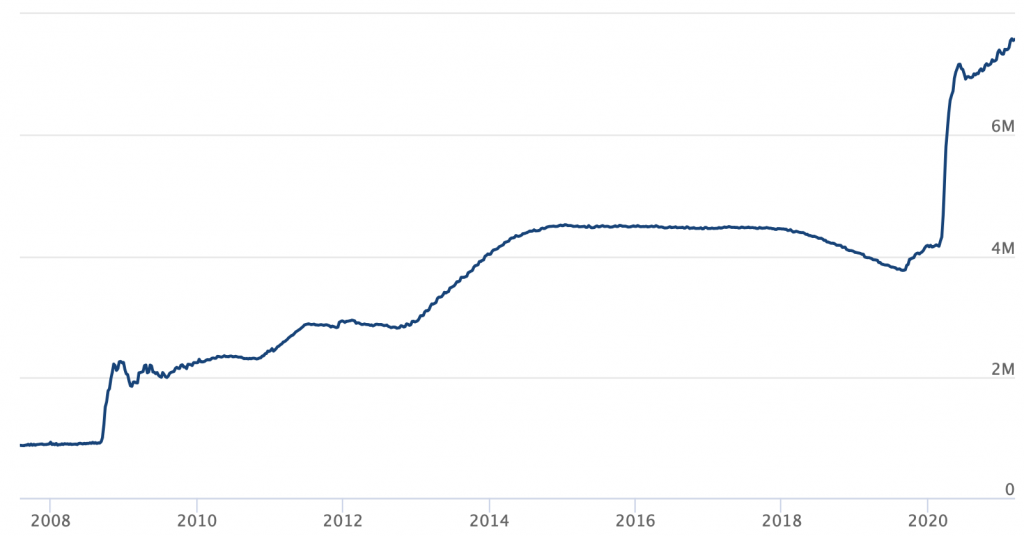

What I am getting at now is that the Fed, having realized way too late that it cannot ever unwind its balance sheet, may be reluctant to return to the full-on QE it formerly hoped it could actually unwind now that it knows it cannot.

We saw just how reluctant it was to do exactly that in order to end the 2019 Repocrisis (or “Repocalypse”), which was caused by the Fed’s attempt to unwind its balance sheet. I called it the “Great Rewind” facetiously when the Fed was attempting it because I had predicted it would likely end in a massive repo crisis that would hit in late 2019, which it did. The Fed caused the Repocalypse.

When the Fed finally figured out on its own that the Repocrisis was forcing it to do as I said it would have to do and replace very bit of the QE expansion it had tried to rewind, it tried to convince everyone it was “not QE” by claiming it was just temporary monetary management of repo loans. However, we all observed that the Repocalypse did not fully end until the Fed fully restored the balance sheet to its former peak at the start of the COVIDcrisis.

The Fed said it was “not QE” because it was embarrassed to have people realize it never could unwind QE without killing its QE-based recovery from the Great Recession. It was very disempowering to the Fed’s belief that it could manage all of this.

At the very start of its recovery program, I stated the Fed’s inability to unwind would prove to be a resolute fact. It finally did burst into massive QE when COVID gave it the cover it needed. Because it still has that cover, it continues with as much under-cover QE as it did openly when climbing out of the Great Recession because the stock market’s continued rise is dependent on it:

I say “undercover” because the Fed is much quieter about its QE now than it was before.

The graph alone indicates the Fed doesn’t want to go higher faster than it already is if it can avoid it. You can sense that by noting the methodical match now to the rate (angle) at which the Fed’s balance sheet climbed during the QE of 2011 and 2013 and at its first attempt to get out of the Repocrisis.

The Fed simply can’t stop; but, even at a rate of climb matching former periods of QE, bond interest rates have been rising vigorously, rather than sinking as they used to during former QE. That is due to the diminishing returns I said the Fed could expect in the next crisis.

As further evidence of those diminishing returns, look at the difference in scale between the initial bump it applied to getting out of something as globally catastrophic as the Great Recession in 2009 and the initial bump applied to power us through the COVIDcrisis in the early part of 2020!

Those interest rates will keep rising because the Fed clearly is not soaking up bonds fast enough to keep interest down even with the present strong QE support. All the new government issue of bonds this year assures a much higher rate of Fed purchases is necessary.

The bond vigilantes have the Federales encircled!

And we already got a foretaste of what that battle will be like:

The bond market got clobbered on Friday. As prices fell, the yield on the 10-year Treasury pushed as high as 1.61% and the 30-year hit 2.4%. These rates aren’t high by historical standards, but Peter said it was one of the biggest interday moves in the bond market that he’s ever seen. Up to that point, stock markets hadn’t reacted much to rising interests rate, but on Friday, they sat up, took notice, and threw a tantrum. The Dow dropped some 480 points….

A lot of people actually believe the Fed is going to reverse course on its monetary policy. But Fed officials have been working diligently to jawbone this notion away….

Because they’d rather not go there!

But Peter says there is a reality out there that nobody wants to acknowledge. Bond yields are not spiking because the economy is strong. They are spiking because of inflation – Powell’s assurances notwithstanding. “Bond yields are going up because there is a massive supply of bonds because we have massive deficits. And even though the Fed is buying a lot of bonds, they ain’t buying enough. So, those extra bonds, there’s no buyer, and so the price keeps falling.”

Powell can keep saying inflation is not a problem, but the vigilantes aren’t buying it.

So, I expect the Fed will cave in and greatly increase its bond purchases at some point, but not without pressure from a stock-market collapse and from rising mortgages threatening its recovery efforts. You see, the Fed doesn’t want to see interest rise, but the market is raising interest on its own. The Fed won’t be thinking about increasing interest to cool inflation. It will be thinking about how to keep interest down and let inflation run a little hot. A world bloated on debt has no stomach for even marginally higher interest.

The Fed could be put to the test sooner rather than later. Next week, the Fed will auction 3-year and 10-year bonds. The last debt sale saw lackluster demand and there’s no reason to think investors are going to suddenly be starving for US bonds.

Meanwhile, the Fed is locked in an endless game of rigging and counter-rigging stock and bond markets to save the world from its previous rigging actions. The side effect has been the destruction of those markets. As Jim Grant of Grant’s Interest Rate Observe remarked,

The Fed has “left us with a bond market that all but has been destroyed with respect to the proper functioning of a bond market….” It’s not just the Fed, Grant says, it’s a “worldwide regime of interest rate suppression and manipulation…. I think it’s not everyday that you get 4,000 year lows in rates…. We have a broad money supply growing 26% year over year and we have fiscal stimulus upon stimulus well in excess, in dollar terms … of the lapse in GDP owing to the lockdown. These monetary actions are truly gigantic….. Where this may end is an unscripted inflation that will surprise the bond market, which is still trusting the Fed, and as the bond market sells off and rates go up, high flying stocks come down. It’s then I’ll say to Chairman Powell: ‘What did you expect?'”

Powell wants to have his inflation and eat it, too. We’ll see how that works out for him, but I am certain each intervention he and his Federales make eventually requires a greater intervention of some other kind. Now the volatility in stocks is rising while the volatility in bonds has become worse and the interventions to keep all this running have become historically “gigantic,” according to a guy who has long specialized in reporting and analyzing interest rates.

It looks like we are entering those times I said were coming when the plate spinner can’t keep everything spinning and up in the air. I say that because the gyrations are looking wobbly on a grand scale now. Nevertheless, I expect at this week’s Fed meeting, Powell will tell everyone that he hasn’t any concern about inflation or interest, but just remember he’s got a gun in his back.