The Fall mining convention season is upon us. It is a time when many companies are making the rounds in an attempt to raise capital. This year, however, has proven to be challenging for many companies…with one notable exception.

New Pacific Metals Corp. (TSX-V: NUAG) (NYSE American: NEWP) recently closed a $35-million (CDN) financing in the middle of one of the toughest markets for precious metal exploration companies.

The closing of this financing is a testament to the quality of the world class projects in the company’s portfolio, the management team and the expertise in overcoming and opening a new country for mining.

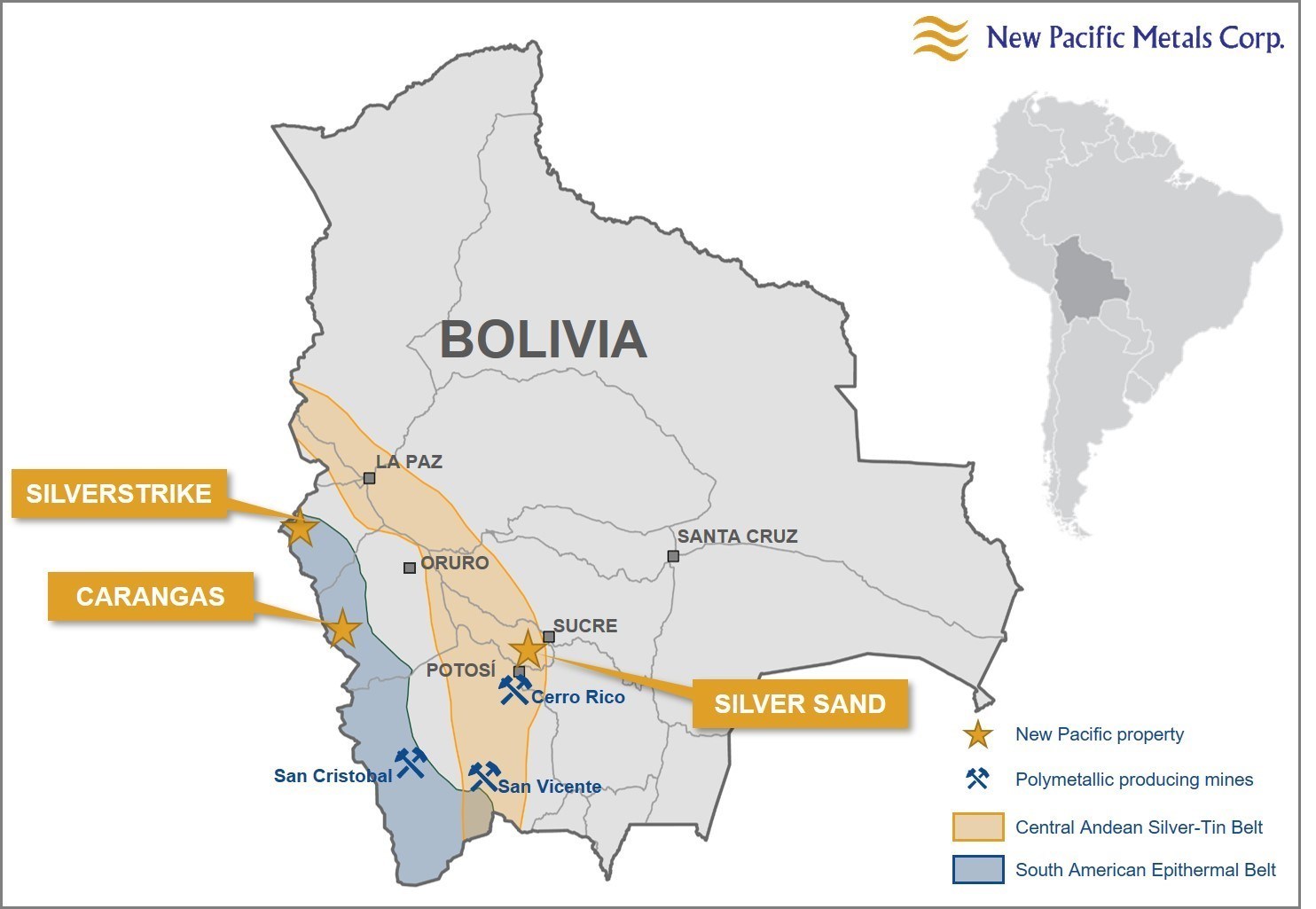

New Pacific Metals has made three significant discoveries in Bolivia, which is exceptional for one company. These discoveries are a result of the combination of the excellent geological potential of Bolivia and the company’s ability to identify and acquire highly-prospective projects, then advance them through exploration.

With silver prices and share prices trading near their three-year lows, New Pacific is presenting a unique buying opportunity for investors as the country of Bolivia discovers its mineral wealth and the world rediscovers silver’s inherent value.

Cashed Up: Financing Amidst Market Malaise

The company raised a total of $35 million (CDN) with 13,208,000 common shares placed at $2.65 (CDN) per share. The offering was led by brokers Raymond James and Eight Capital. The financing brought in further support from the biggest names in silver mining.

Pan American Silver Corp. (TSX, NYSE: PAAS) participated in the financing by subscribing for 5,083,780 shares, representing approximately $10-million (U.S.) or ~$13.5 million (CDN) in gross proceeds. Pan American now owns ~11.6% of the outstanding common shares.

Silvercorp Metals Inc. (TSX, NYSE American: SVM) participated in the offering by subscribing for 2,541,890 shares, representing approximately $5-million (U.S.) in gross proceeds. As of the closing, Silvercorp owns approximately 27.4% of the outstanding shares of New Pacific.

The company intends to use the financings to advance exploration and development at the company's Silver Sand and Carangas projects and for operating expenses.

Proven Track Record with Creating Frontier Opportunities

The company’s flagship project is the Silver Sand Project, located in Bolivia. New Pacific is also conducting regional exploration at its Carangas and Silverstrike projects.

Silver Sand

Silver Sand is Bolivia’s largest silver discovery in the last 30 years. It is also one of the most significant silver discoveries globally in the last decade.

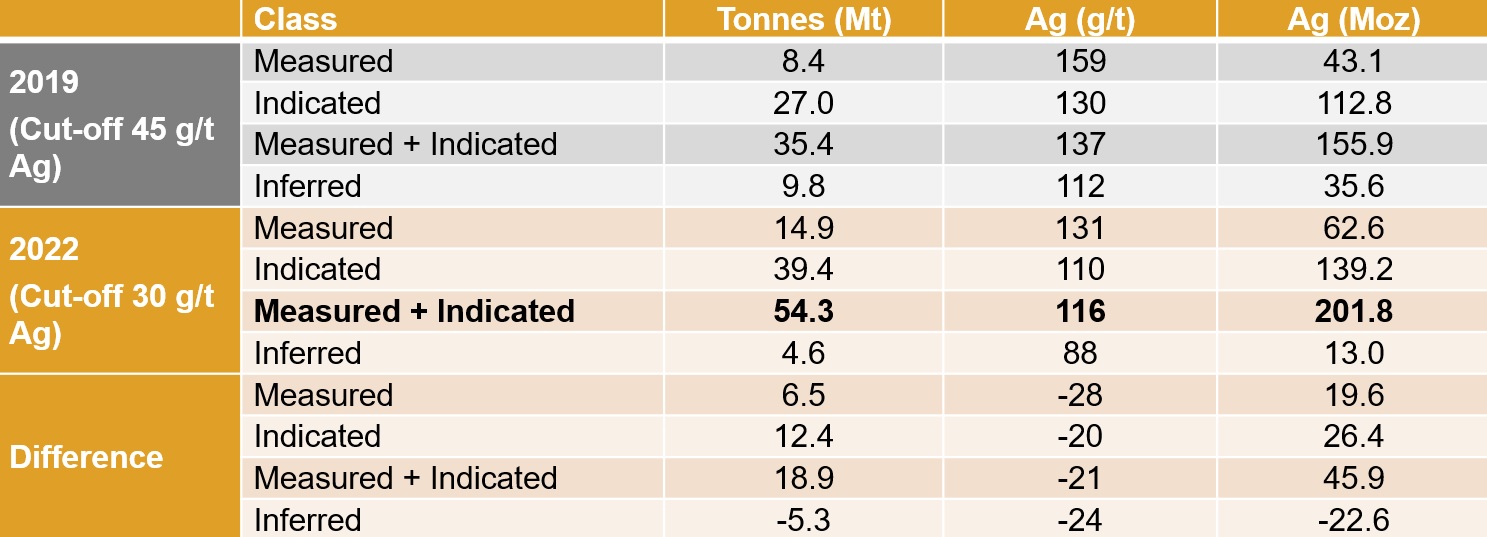

The company has been consistently advancing the project over the years and published an updated resource estimate in November 2022. The estimate outlined Measured & Indicated Mineral Resources of 54.26 Mt with a grade of 116 g/t Ag for 201.77 Moz, representing 94% of the total estimate.

On January 9, 2023, the company released a preliminary economic assessment (PEA) for the Silver Sand Project which outlined Initial capital costs of $308 million.

The PEA study confirms the potential to develop an open pit mine at Silver Sand, producing on average 12 million ounces of silver annually over 14 years, producing approximately 171 million ounces of silver.

The PEA presented a base case Pre-Tax NPV (5%) of $1.1 billion with an internal rate of return of 52%, and Post-Tax NPV (5%) of $726 million and an IRR of 39% ($22.50/oz silver). The average life of mining (LOM) operating cash cost is $8.45/oz with a total all-in sustaining cost of $10.42/oz silver.

With the country’s natural gas reserves depleting, threatening the country's revenues, Bolivia is realising it needs foreign capital and mining knowledge to revitalise its mining sector and state revenues.

With the country’s natural gas reserves depleting, threatening the country's revenues, Bolivia is realising it needs foreign capital and mining knowledge to revitalise its mining sector and state revenues. The Bolivian mining industry and the Silver Sand project are well-positioned to fill this void.

Carangas

The Carangas project is located ~190 kilometres southwest of Oruro, Bolivia, within the well mineralized South American Epithermal Belt, which hosts large precious metal deposits and operations in neighbouring countries but remains under-explored in Bolivia.

The property comprises three claims (Granville I, Granville II and Colapso) covering a total area of 40.75 square kilometres, and is road accessible.

The company has future plans for the property and entered into a contract with a private Bolivian corporation in April 2021. Under the terms of the deal, the company will pay for a 100% of future expenditures for exploration, mining, development, and production activities and will receive 98% of operational profits once Carangas moves into production.

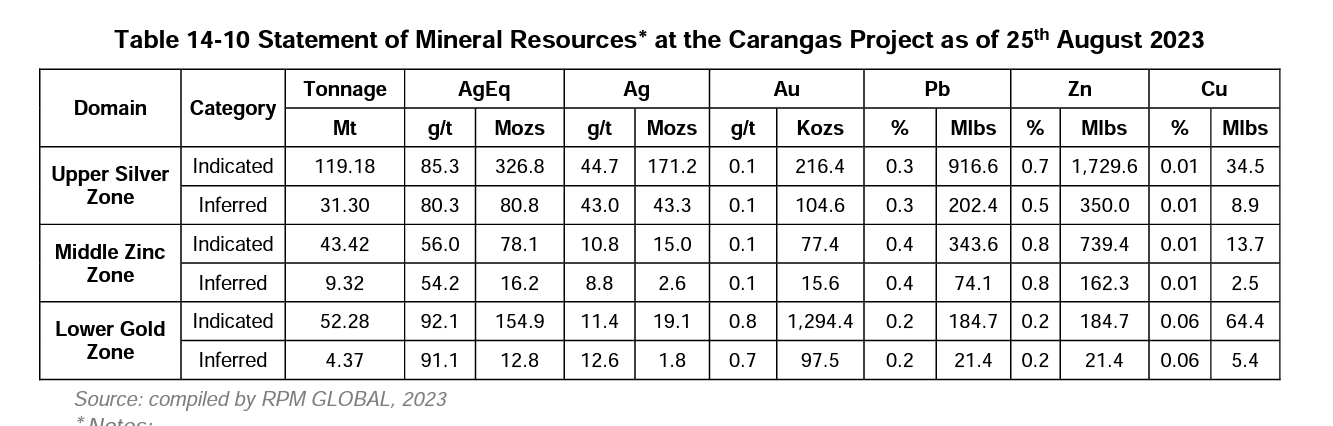

The Carangas project has an estimated 205.4Moz of silver, 1,588.2 Koz of gold, 1,444.9 Mlbs of lead, 2,653.7 Mlbs of zinc, and 112.6 Mlbs of copper.

Silverstrike

In December 2019, the company acquired the Silverstrike Project from a private Bolivian corporation for $1.35 million (U.S) for a 98% interest. The project is located ~140 km southwest of La Paz, Bolivia, or 450 km northwest of New Pacific’s Silver Sand project.

The property covers 44.5 km² and sits at an elevation of 4,000 to 4,500 meters. Access to the project is convenient, with 150 km of paved Highway 19 from La Paz and 30 km of gravel road to the project site.

In 2022, the company completed a 3,200-meter drill program at Silverstrike. Results were released September 12, 2022 and November 1, 2022.

Drill hole DSSk0001 intersected 195.05 metres grading 0.96 gram per tonne gold and six g/t silver (Ag), including an interval of 111.39 m grading 1.54 g/t Au and eight g/t Ag, and a higher-grade near-surface subinterval of 36.06 m grading 3.97 g/t Au and 20 g/t Ag.

The second hole, DSSk0002, drilled 223.52 metres grading 0.97 gram per tonne (g/t) gold and four g/t Ag, including an interval of 86.13 m grading 2.18 g/t Au and seven g/t Ag, which also included a higher-grade subinterval of 3.98 m grading 29.75 g/t Au and 23 g/t Ag.

There is little new on this property as the main focus is Silver Sand and Carangas, but with a fresh financing, New Pacific will be sure to follow up and work to uncover value through drilling and further discovery.

The Right Time to Invest?

Shares in New Pacific are currently trading at its lowest point over the past three years, largely as a result of declining prices in silver. However, this has not phased investors or the underlying fundamentals of the company that has continued to add silver ounces to its discovery portfolio.

Eight Capital analyst, Felix Shafigullin, summarized the value proposition succinctly:

"An investor buying New Pacific Metals at the current share price of $3.35 would acquire exposure to the Silver Sand project that we value at $3.27/share while getting exposure to Carangas essentially for free. We therefore view New Pacific Metals as fundamentally undervalued: based on our estimates, investors buying the stock today are getting two large-scale silver projects with total resources of 884 Moz AgEq for the price of one."

With New Pacific trading close to $2/share after the recent silver and gold market drops, New Pacific Metals is an even more appealing value today than in any recent past.

A strong treasury is in place and world-class silver projects are being developed even through difficult market conditions.

I believe the company is well positioned to be a market outperformer as silver prices look to move higher in 2024 driven by near-record silver demand persisting into the foreseeable future.

Disclosure: GoldSeek.com employees own shares of New Pacific Resources

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Additional Disclosure: The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise outside of the trading timeframe listed above. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The companies mentioned herein may be sponsor of GoldSeek.com. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.