The drumbeats of war are picking up the pace of inflation. Inflation, as I’ve argued here for some time, was certain to rise for months to come; but you’ll see in the various inflation notes below that sanctions made in response to the war are increasing inflation even more, as could be expected, and shortages due to the war are driving up costs as well.

Some is from the war, itself; some is from our responses to it. What follows is a broad picture of the most notable areas where either background inflation (rising producer costs) or consumer inflation is rising significantly: (Producer costs, of course, eventually get passed on to consumers, so they are the CPI jolts of tomorrow.)

Oil is an inflation gusher

Oil, of course, impacts the price of just about everything, and there is no cavalry here that is going to come to the rescue for anyone, in spite of Biden’s biddings:

Saudi Arabia Hikes Oil Prices Further Into Record Territory

Saudi Arabia raised oil prices for customers in all regions as Russia’s invasion of Ukraine continues to reverberate through markets….

Saudi Aramco increased its Arab Light crude for next month’s shipments to Asia to $9.35 a barrel above the benchmark it uses. That’s a jump of $4.40 a barrel from April, when the key grade was already at a record. The move was roughly in line with a Bloomberg survey of traders and refiners last week.

Oil has soared to more than $100 a barrel in the wake of Moscow’s attack, which has roiled financial markets across the world. Many buyers are avoiding cargoes from Russia, despite them being offered a steep discounts….

Aramco made its decision after OPEC+ on Thursday opted to continue raising output only gradually. The 23-nation group, led by Saudi Arabia and Russia, has resisted calls from major importers including the U.S. to accelerate production increases and bring down global fuel prices….

“It’s a massive [price] increase,” said Giovanni Staunovo, a commodity analyst at UBS Group AG. “Extra volumes from Saudi Arabia will only come at a high price.”

And not all of the rise in fuel prices is due to the rise in costs seen by refiners. Exxon has boasted about its massive increase in profits due to the shortages created from Russian sources being taken offline for much of the world:

Exxon Mobil Corp. signaled its highest profit since 2008 as Russia’s war in Ukraine upended global commodity markets. Exxon’s announcement that first-quarter results may have reached almost $11 billion augurs booming profits across the oil industry as trade sanctions, shipping disruptions and surging demand strain supply lines.

So a little price gouging or profiteering going on there, not just a passthrough of higher costs to consumers, but a pass-through of exploding profit margins as well. Apparently shortages are good for business … at least for some businesses — the ones with their own ample supplies, who see gushers of profits in times like these.

The windfall doesn’t come without risks, however. Key Democrats in the U.S. House of Representatives demanded Exxon and peers Chevron Corp., Shell Plc and BP Plc immediately halt dividends and share buybacks until the war’s conclusion, and scolded them for “profiteering off the crisis in Ukraine….”

Exxon “is charging outrageous gas prices while seeing record profits,” Senator Ed Markey, a Massachusetts Democrat, said in a Facebook post. “We should tax Big Oil’s windfall profits and return that money to the working people of this country.”

What? Oil companies, slimy profiteers? Who could have seen that coming?

Facts on food could be fatal for some

Not so much in the US, perhaps, but we’ll still feel the hit to our food budgets as others that already border on starvation take the full fall.

France’s Foreign Affairs Minister Jean-Yves Le Drian said the EU must get to grips with the prospect that the war in Ukraine could prompt an “extremely serious” global food crisis.

The White House is also worried about famine overseas due to the Russia-Ukraine war, one of its economic advisors says:

The war is complicating efforts to plant and export these key crops. Higher energy and fertilizer prices compound the problem.

“We’re working with our international aid agencies to ensure there’s some humanitarian aid because we are concerned, particularly in the Middle East, parts of Africa and the Far East … about famines and shortages in those parts of the world.”

Of course, financial aid doesn’t fill bellies in places where food doesn’t exist due to lack of fertilizer and/or due to crops not being planted in the major food-producing nations for the world as well as within those nations. What helps is food shipments, and food shipped from the US to other nations to prevent starvation inevitably means some food shortages in the US on a smaller scale and certainly higher prices as people scrabble to get their hands on the limited food that is available.

This all comes on the back of food shortages already created by the global supply chain problems created by closed ports and disrupted transportation and locked-down production in various parts of the world under the Covidcrisis, some of which have been made worse from the war and by shipping sanctions:

The war in Ukraine has further increased food prices after two years of disruptions related to the coronavirus pandemic….

The situation in East Africa, in particular, is worrisome because Russia and Ukraine are responsible for about 90% of the wheat imported to the region, according to the United Nations’ World Food Programme.

Africa already had shortages due to the recurrent droughts that are typical there:

Even before Russia invaded Ukraine in late February, the UN estimated that roughly 13 million people who live in the Horn of Africa were severely hungry each day. The area is facing a serious drought that has affected crops and killed livestock in countries such as Kenya, Somalia and Ethiopia, according to the UN.

We are living in a time where one calamity seems to come immediately on the heals of another.

Germany is already feeling the rheumatoid touch of its old Weimar Republic days.

Just days after Germany reported the highest inflation in a generation … giving locals a distinctly unpleasant deja vu feeling even before the Russian invasion of Ukraine broke what few supply chains remained and sent prices even higher into the stratosphere … Germany will take one step toward a return of the dreaded Weimar hyperinflation, when according to the German Retail Association (HDE), consumers should prepare for another wave of price hikes for everyday goods and groceries with Reuters reporting that prices at German retail chains will explode between 20 and 50%.…

“We will soon be able to see the impact of the war reflected in price labels across all the supermarkets.”

Europe is already rationing food, a situation reminiscent of World War II.

Countries all over the world, especially in Europe, have started implementing policies that ration food and fuel. Europe’s struggles with its food and fuel supplies began after most nations on the continent imposed economic sanctions on Russia following its invasion of Ukraine. This threatened the flow of already-critical commodities in Europe and threatened to collapse already-struggling global supply chains.

Do you see a theme starting to develop here? In a time when one calamity — the Covidcrisis — hit the entire world (with the economic impacts largely due largely to our national responses to Covid) another calamity — war — hits the entire world (partially due to our global responses to it). Each calamity, along with the baked-in inflation already fueled by years of central-bank profligacy, weakens our ability to absorb the next one.

I find myself wondering what global calamity after this will fly in like a black swan to take everything down because we have exhausted our resilience all over the world and seem hell-bent on continuing to do so with wars and sanctions no one can afford. However, we needn’t go to the future for trouble, as the the present troubles are already doing the job:

In Spain, the country started experiencing sporadic shortages of different products like eggs, milk and other dairy products almost immediately following the outbreak of the war in Ukraine. In early March, major supermarkets like Mercadona and Makro began rationing sunflower oil.

Shortages and rationing are rapidly materializing all over the world, and we haven’t even gotten to the time when this spring’s crop failures due to lack of ability to plant Ukraine will impact actual availability. What we are seeing right now is more of a response to what people anticipate is coming and due to transportation issues made worse by the war, but probably mostly due to sanctions, removing last year’s available stored crops from many parts of the world. You cannot get stored crops out of a nation with its roads, rails and bridges bombed to bits, nor out of nations sanctioned out of reach.

In Greece, at least four national supermarket chains have started rationing food products like flour and sunflower oil due to critically low supplies caused by the crippled supply chains coming out of Russia and Ukraine. The supermarkets claim the current rationing is only a preventive measure that will be rolled back once Greece’s supplies of flour and sunflower oil stabilize.

“The reason for the cap on these products is only precautionary, as our customers are concerned about the war in Ukraine,” said one official from supermarket chain Alfa-Beta Vassilopoulos. “We want to ensure we will be able to serve our customers’ needs in the future too.”

So, as I say, the shortages are not due … yet … to crops that underproduce this year (due to fertilizer shortages) or don’t get planted (due to war tearing up the landscape) or even entirely due to lack of immediate unavailability under sanctions. Some of it is rationing being put in place by governments and businesses in order to assure essential supplies remain available as those other problems emerge. Some of the rations are caps put in place by grocery stores to curtail hoarding that would create immediate shortages and more drastic price rises. They are attempts to keep the pressure to stock up for the future from creating immediate shortages for others.

If you wait too long to stock up, you may not be able to once you see the shortage starting to materialized because so many others will have the same idea. That is why you may be glad if you took my advice at the start of last fall and started laying in extra supplies by purchasing a couple extras of every item you bought over the course of the months since then. That way, you easily made sure that you were stocking all the items you usually use and only those items so as not to over-prep. If you did, then you now have a pretty good stock built up without having made a major hit to your cash flow because you did it a bit at a time each time you went to the store.

At the time I started giving that advice, of course, I did not see war making things even worse. I was just giving that advice based on the problems I could already foresee due to the Covid lockdowns and all the damage those lockdowns had already created (and are still creating as they continue to happen in places like Shanghai). That, however, is what prudence is all about. When you can see things will be short based on the problems you know are coming, you prep because there is always (especially in the world now, it seems) the possibility of another crisis coming alongside (or of some worse form of the same crisis — Covid in that particular case — cropping up).

For many, the reality of food shortages will be surprising or even frightening because they have not mentally prepared for the fact that such things can and DO happen, even in a nation like the US. While this is not the first time the US will have faced food shortages, it is for many people:

“For the first time, this generation is going to go into a store and not be able to get what they want,” [BlackRock’s] Kapito said at conference held in Austin…. “And we have a very entitled generation that has never had to sacrifice.”

The economy is reckoning with what he dubbed “scarcity inflation,” or the fallout from a shortage of workers, agricultural supplies and housing, and of oil in some regions.

“I would put on your seat belts because this is something that we haven’t seen,” Kapito said.

I hope you made the effort to get ready. You may not be fully prepared, but any preparation you madewill ease your passage through the coming times.

I noted last fall, when I was encouraging everyone to stock up, that the natural-gas crisis, which was already forming prior to the war, was going to create a fertilizer shortage. Now that is materializing and creating a large rise in fertilizer costs. That may put some farmers out of business in some parts of the world or cause them to grow with less yield. We now see all of that playing out:

US Farmers Facing Skyrocketing Fertilizer Prices Due to Russia-Ukraine War

Since early 2021, fertilizer prices have rocketed as much as 300%. Amid shortages, inflation and the war between Russia and Ukraine, the cost of this essential product for farmers is continuing to rise, according to Modern Farmer….

As a result of the higher costs, it can be difficult to sell products likes fertilizer at the moment, said Grower’s Supply owner….

The war in Ukraine has made the situation worse.

And, so, we see on calamity amplifying a problem that began under the previous calamity.

That’s how these times form. You should not expect that it doesn’t happen or think someone is being an alarmist by suggesting modest preparation. The last bit in that quotation about it being difficult to sell fertilizer at the moment due to high inflation that has to be passed along tells us something beyond its face value. It means those farmers that would normally be stocking up in fertilizer now are either deciding not to plant or are planning to grow without fertilizer or with less fertilizer, meaning lower yields or no crops at all on some farms:

An increase in world fertilizer prices is adding to worries about food security across sub-Saharan Africa, where small-scale farmers depend largely on imports if they even use additional nutrients at all….

Many farmers are considering whether to forego purchases of fertilizers this year. That leaves a market long touted for its growth potential set to shrink by almost a third…. That could potentially curb cereals output by 30 million tons, enough to feed 100 million people…

“We are likely to see a scenario where yields are depressed….”

Sub-Saharan Africa already has the world’s lowest fertilizer application rates…. With usage set to fall as input costs rise, the threat to regional food security and political stability is growing, according to agriculture experts.

Sanctions are adding to the problem that was already building last fall:

Russia is a key global player in natural gas, a major input to fertilizer production. Higher gas prices, and supply cuts, will further drive fertilizer prices higher. Russia is one of the biggest exporters of the three major groups of fertilizers (nitrogen, phosphorus and potassium). Physical supply cuts could further inflate fertilizer prices.

Do you think that problem isn’t going to hit home if you live in the US?

“This is headed for a supply crunch that will be hard to resolve,” said Todd Hultman, lead grain market analyst for agricultural data service DTN. Corn is an especially fertilizer-intensive crop. Higher fertilizer prices mean that American corn farmers, who largely grow the crop to feed animals, will have a hard time being profitable…. This will be additional cost for the row crop farmers as well as the ranchers, feed lots and dairy farmers.

So, all those items are going up a lot more in prices than what you’ve already seen because the impacts from fertilizer prices will not be fully felt until the crops that used or would have used those fertilizers come in and then get processed through the food chain … or don’t come in or come in at reduced levels of food production. So, we are talking an effect that will take months to play out … as right now we are living off of last year’s stored crops and frozen meats.

Those higher costs will, in turn, be passed along to restaurants, retailers and, ultimately, consumers.

And this is building on last year’s calamities, which were manifold:

Hultman said higher animal feed costs also have the potential impact of pinching the beef and pork supply, at a time when demand remains high and supply has already dropped because of issues like drought last summer, an increase in viral pig diseases like porcine reproductive and respiratory syndrome, and even the bottlenecks at meat-processing facilities at the beginning of the pandemic that left some cattle and pig farmers without a place to have their animals slaughtered. The bottleneck caused the big meat companies to pay less per animal to ranchers, which in turn caused many of them to shrink their herds.

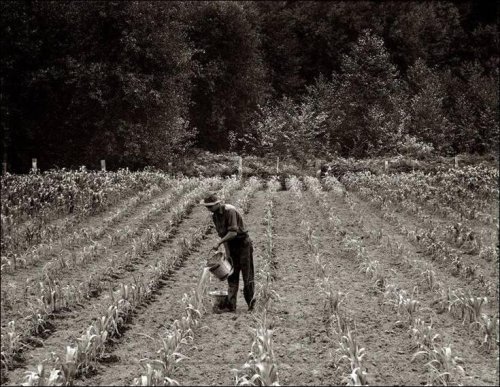

Withering corn crops during the US “dust bowl” drought of the Great Depression

Withering corn crops during the US “dust bowl” drought of the Great Depression

We’ve been there before, so we know it can happen. Let’s hope we don’t have extensive droughts in the US again this summer to make it all worse by fall … or farm problems like this one that just cropped up:

Iowa’s bird flu death toll tops 13 million

Two more poultry flocks in Iowa — including one with more than 5 million egg-laying chickens — were infected by a deadly and highly contagious avian influenza, the Iowa Department of Agriculture and Land Stewardship reported Friday … and in a flock of about 88,000 turkeys in Cherokee County….

It was billed as…

…the first month of such outbreaks in the state this year … a total of 12 detections in nine counties that affected at least 13.2 million birds.

And that’s just the first month. Hopefully, they’ve got it under control, or your breakfast omelettes or fried-chicken picnics are also going to double in price this year for reasons having nothing to do with fertilizer shortages and resultant chicken-feed shortages, which were already going to push up prices. (And the Fed said inflation was “transitory!” Do you believe me now … IF you didn’t earlier?)

In the real world, you don’t bet on “best-case scenarios.” You try to prepare fore realistic possibilities because always prepping for worst-case scenarios may overdo it. I don’t mean panic possibilities, but if you prepared last fall, knowing full well some things were getting worse and knowing the real-world sometimes delivers bad luck in threes, you’ve, at least, got a hedge against all of this. If no shortages materialize where you live, you lived with a slightly tighter budget over the fall and winter, did with a few less frills, but will now save a small fortune on food in the months ahead. That’s if the supply shortages don’t materialize in your neck of the woods and you start digesting your stores before their shelf-life expires. On the other hand, you’ll save an even bigger small fortune if it turns out the shortages due materialize in your area.

Ah, but just when you were hoping no new droughts would come along this year, China announced that its winter-wheat harvest looks to be the worst in its history. And, in global markets, shortages in one area do impact prices in others by shifting demand to other available supplies.

Housing market starts to slide as prices stop rising but cost to buy soars

And good luck if you’re planning on eating in but haven’t bought your home yet because, while prices look like they could be topping in some areas, that is only because mortgage rates have been on a tear, squeezing the price of homes down to keep payments at a level that is still, apparently, unaffordable:

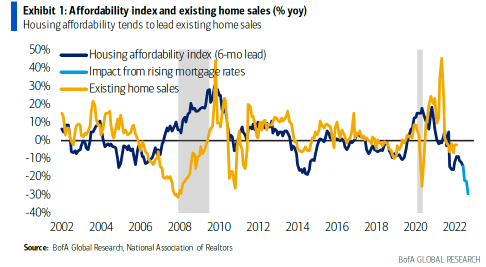

30 Year fixed mortgage rates have jumped 160bp this year … with the latest Freddie Mac data showing an acceleration in mortgage rates which jumped a quarter point in just the past week… The move higher in rates means that an already record affordability shock will be even worse!

Here is how that all adds up at present:

Clearly, existing home sales have a ways to fall if they keep tracking with the affordability index.

That, of course, will eventually contribute to the housing-bubble bust I wrote about for my Patrons. If may not affect you if you’re already locked in with a fixed-interest mortgage. As an owner, you can weather this out and pay no heed, but it will affect you if you are a renter or a buyer. (Sorry to say as I’ve been there, but this may be good news down the road if you can wait it out: you may see lower prices and a return eventually to lower interest someplace down the road to repair the once-again crashed economy … as I also benefited from after the 2007-2011 housing crash.)

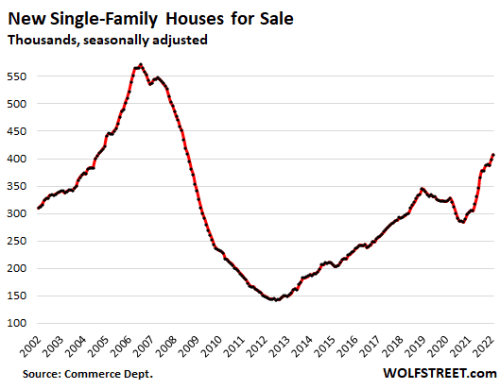

As a result of this plunging affordability, we are seeing the inventory of available housing reverse from a severe shortage to a rising trend, but it is not because builders are building more houses, which would help soften prices:

It’s because fewer people are buying the houses that are there because soaring mortgage rates are pricing already unaffordable homes far out of reach. The rising rates are raising the cost of buying a house faster than prices are falling to offset rates. So, it is quite the opposite of an improving situation of more new homes coming online. In fact, there are other matters making it worse due to inflation, too:

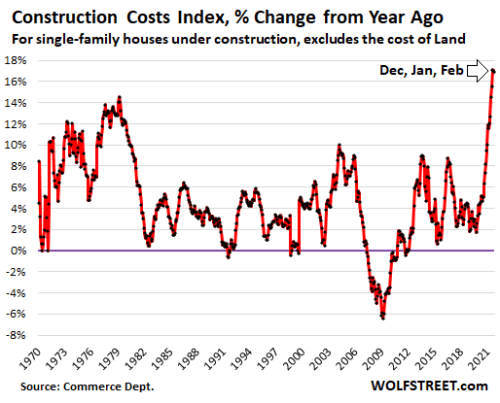

Homebuilders are facing historic spikes in costs, and they’re hobbled by shortages of materials, supplies, and labor that have been stalling construction projects and impeded the completion of projects. Potential buyers are hobbled by surging mortgage rates and prices that last year spiked into the sky. This is turning in to a problematic mix. Sales of new houses in February fell … 6% year-over-year.

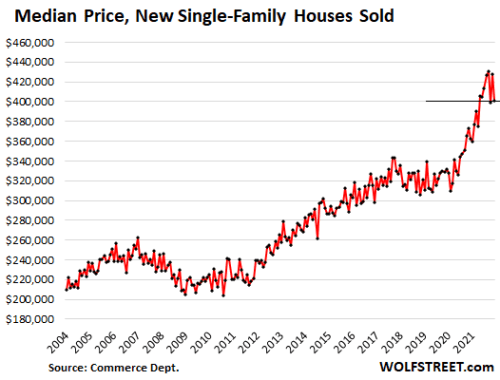

As a result, prices appear to be finally topping out nationally:

So, while there is some reprieve on house prices, it’s not helping anyone because it is only due to the rocket-ride we’ve taken in mortgage rates, pushing the cost of payments higher than ever.

It’s not like builders are seeing any reprieve (or are about to) to where they can drop the prices of news homes either:

Meanwhile, the resulting slowdown in construction as inventory builds due to people walking away from houses they cannot afford, the rising construction costs and rising prices, resulting in walkaways from home purchases, all adds to the likelihood of a huge construction slowdown, feeding the recession scenario I’ve been talking about, given the US economy is largely built around the housing industry.

It also adds to the likelihood of that housing bubble bursting as prices will have to fall a lot more because mortgage rates are still going to rise a lot more due to already soaring bond yields at a time when the Fed hasn’t even begun to try to offload some of the trillions in bonds it sopped up from the market over the past decade, which will drive up bond yields even further and which all begins soon (and likely ends soon in a calamitous failure). With soaring construction costs now topping this all off, there is no hope for the housing bubble. Implosion by way of market seizure and crashing prices in the face of soaring mortgage and construction loan interest are inevitable.

Those are my additional predictions (or enhancement of old predictions) for the time being.

With all of that already happening all around us, maybe it’s time we stop piling calamity on calamity by taking extreme actions nationally at a time when we are already hurting from our previous extreme actions, nationally and globally. There is only so much you can take on and not damage yourself. I think with a fuel crisis, a food crisis, and the bursting of bubbles due to our previous economic wreckage and badly-framed economic reconstruction ideas, we’ve already done enough to ourselves for now.

Let us hope we stop trying to save ourselves with meaningless money printing and start actually changing the deeply flawed aspects of how our economy functions. Alas, I think we are far from breaking through the greed that informs, politically controls and endlessly reinforces those structures and are close to our own warlike natures consuming us while far, for the same reason, from being able to agree on answers.

Liked it? Take a second to support David Haggith on Patreon!