It’s been two decades of pain with interim bullish flashes in gold stocks, and the herds are painfully aware. They’ve learned their lesson and now they’ll miss a coming opportunity

Herds herd. That is what they do. Herds follow well established trends. Herds subscribe to convention and that which sounds the most normal in relation to their experience. Herds herd. Sheep herd. Humans herd.

Today the herds are herding to a well established narrative that gold stocks suck. Why not just buy gold? Gold stocks have under-performed their product metal for years. Everybody knows that.

100% correct, dear herds! Bravo. But weren’t you the same herds buying gold stocks because your perma-bullish guru advised so? Weren’t you buying gold stocks because of inflation? Because the Fed is inflating?? Welcome to a new paradigm that you may herd to several years down the road, but not any time soon.

With some important indicators NFTRH uses to stay aligned with the macro backdrop having either aborted their major trends or registered unsustainable extremes, the herds bred of the last two decades’ trends may find themselves off sides. Does it pay to be a “Sheeple”, as some gold bugs call those not enlightened to the concept of real money and real value in a paper/digital system gone mad and choking on debt? No. Never be a Sheeple. They herd.

Ah, but are not some gold bugs also Sheeple? They are if they are extrapolating forward the last couple of decades of gold miner under-performance to gold based on the macro that was instead of the macro that will be. To this point over those 20 some odd years they have believed the inflation touts justifying investment in gold stocks because… INFLATION!!! That was wrong-headed analysis during those cyclical inflationary years and now as an era of either deflationary pressure or economically ineffective/corrosive inflation (Stagflation) engages and brings on a counter-cyclical environment (i.e. the long-term “everything bubble” bursts) the rules will have changed and by extension, so will outcomes.

But herds herd. They follow their instincts, ignoring new paths forward.

This article does not focus on the indications that the bubble is finally unwinding. They’ve been covered routinely in NFTRH, and on occasion publicly here at nftrh.com and in our fledgling foray into video making (you can subscribe to the channel here) as I’ll be adding solid content that will be long on valid macro views and short on hype, going forward).

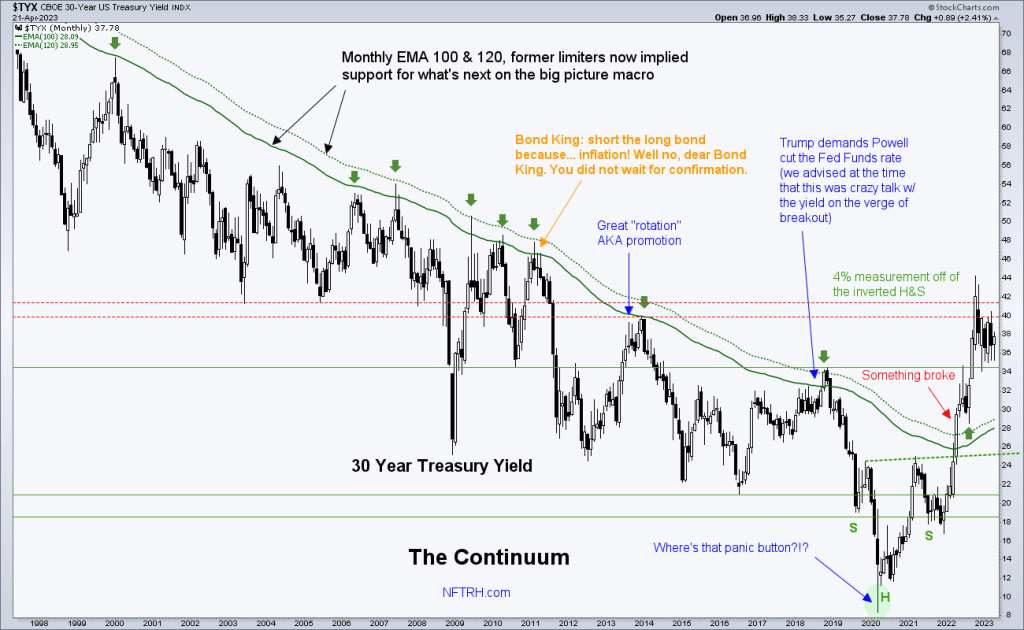

But as one primary example, let’s review once again what I feel is the most visually stunning picture of big picture macro change – and quite possibly a primary indicator to the end of the bubble age – the Continuum AKA monthly chart of the 30 year Treasury bond yield – breaking the gentle trend of disinflationary signaling against which the Federal Reserve routinely manufactured inflation. The bond market gave license to the inflating Fed over the decades of declining long-term bond yields. That bubble making is all done now, from this perspective.

Okay, so the macro is changing. What does that imply for gold stocks?

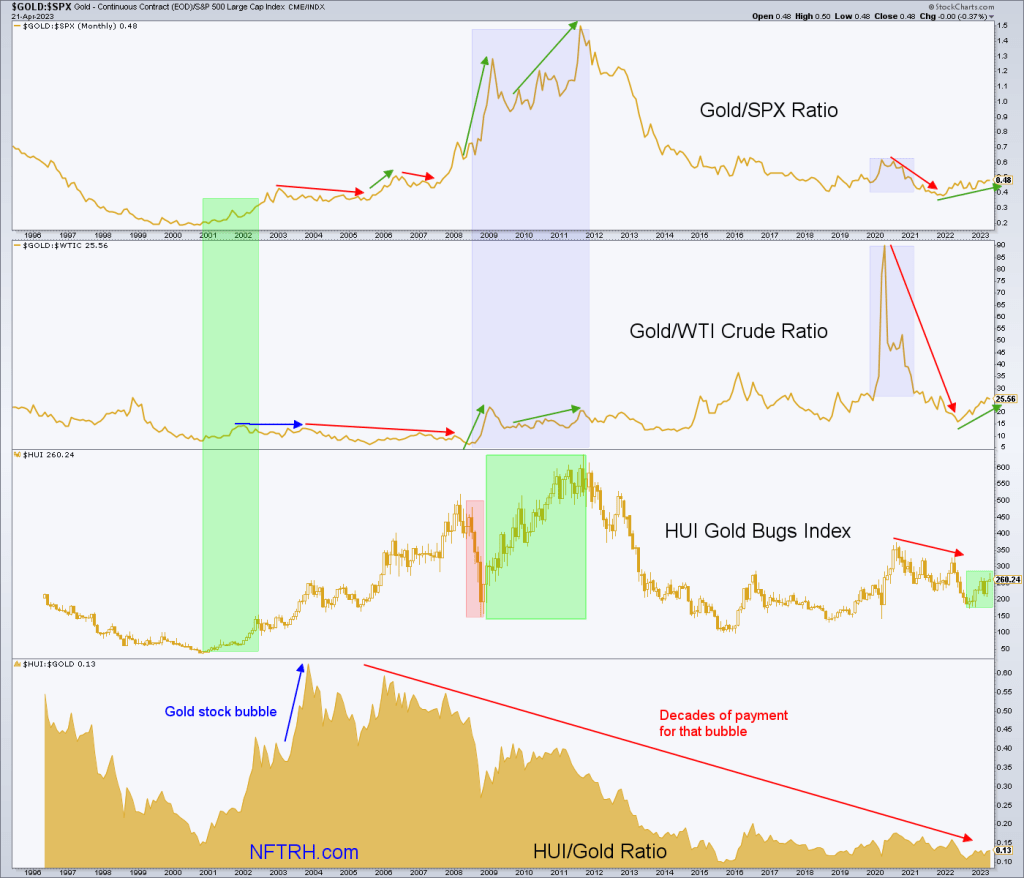

Well, I am glad you asked. Gold stocks leverage the price of gold. But leverage is a thing that works both ways, positively and negatively. Without trying to over explain my artwork on the chart below, I’ll ask you to take it in, consider it and think about history…

- Those occasions that the inflated macro created a dangerous valuation bubble in gold stocks (much of the 2003-2008 phase) as gold flat-lined vs. broad stocks (SPX) and under-performed commodities, including mining cost input crude oil.

- The harsh and well earned resolution in the form of a crash as the inflationists got run out of the sector when they should have been buying (Q4, 2008, with a barely month old NFTRH advising ‘buy’ while I personally did so aggressively) as the fundamentals (portrayed here by Gold/SPX and Gold/WTI, but there were many others) screamed positive while the herds puked up the miners.

- The top in gold stocks in 2011 as the HUI/Gold ratio indicated that something was wrong. It was, and here I must publicly announce once again that I had a measured breakout target for HUI in the upper 800s, when viewing the situation with my TA cap on, as opposed to my macro cap. Well the macro, and the HUI/Gold ratio knew better. Gold stocks then entered a long and deserved bear market.

- That was, by the way, the era that you could spot a gold stock promoter a mile away, because he was touting cyclical inflation and she was touting ‘end of the world’ hallucinations as reasons to buy, and for a gold stock promoter it’s always a good time to try to froth the unwitting herds.

- The HUI/Gold ratio has today’s gold bugs bemoaning how the miners always under-perform the metal.

- Gold/SPX has been in a terrible bear market since 2011 and Gold/Oil has gone nowhere. The leverage in the gold miners tilted toward the negative. Hence, they were supposed to under-perform and they have.

- But if the more recent uptrends in gold vs. stocks and commodities that began in early and mid-2022 are real and other indicators beyond the scope of this article continue to evolve [edit: in this weekend’s NFTRH 754 their evolution is not only on track, but indicative of very high macro market risk], the leverage that the herds are trained to view as only negative will surprise them, the HUI/Gold ratio will actually rise and the best of the new bull market will be ahead.

Meanwhile, there is short-term and long-term. This article discusses a long-term situation that is in its early stages of evolution, and the potential for a macro pivot within that. On the shorter-term, there is management to be done of the pullback or correction that began right after this (now public) NFTRH+ update for subscribers advised traders (as opposed to investors *) consider taking profits:

If you are a trader, you might consider taking some profit.

So yes, there is short-term and long-term. Personally, I don’t like to suffer pullbacks, even those within bull markets, without at least making preparations, whether mentally or tactically. But it sure is a lot more fun managing corrections (AKA opportunities) within bull markets, which I think this will turn out to be.

Within the long-term bear market there were plenty of rallies and exciting phases. The ill-fated 2016 launch comes to mind as we noted on May 30th of that year that the fundamentals were degrading for the rally that would ultimately blow out and end a couple months later. The herd kept on buying as silver led gold, the miners, commodities and stock markets in a cyclical inflationary frenzy. You see? The herd bought inflation – the very thing that has foiled the sector eventually, every time it rallied or bulled along with the promoters’ bullhorns and the cheerleaders’ golden pompoms.

But the macro backdrop, in its disinflationary bond market signaling (ref. 1st chart above) that permitted chronic inflation operations by the Fed for decades, was never beneficial for the gold mining industry as cyclical inflated assets routinely out-performed gold and the miners leveraged that to the downside.

So now what happens if the macro has changed profoundly? Herds herd, and forward looking speculators take advantage. If you’ve been doped up on the dogma of the last 2 decades prepare to get clear headed and think for yourself. Years of drudgery may morph into something a lot more fun (and manageable). Manage it we will in NFTRH, as we’ve been doing since September 28, 2008 right into the jaws of a major speculative opportunity.

* Yup, I actually wrote the word “investors” relating to gold stocks. The herds would think that is crazy talk. The herds herd.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.