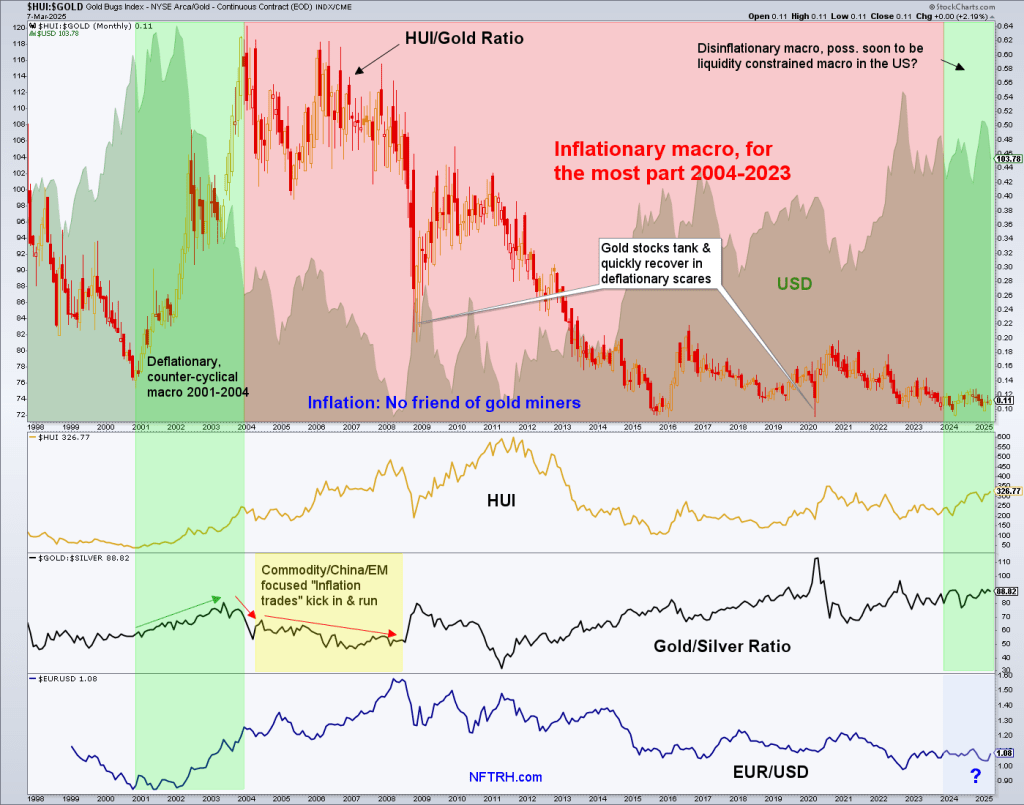

One chart shows the details of an important historical analog for gold stocks

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold price in a positive way, there were very clear reasons for that failure. Reasons why it was not only logical but probable that gold stocks would continue to underperform vs. their product.

The primary driver to gold stock underperformance was a new era of ever more monetary (Fed) and fiscal (Government) policy meddling that began in 2001 and probably blew off in the inflationary panic of 2020. I called it the “Age of Inflation on Demand “.

At every point of systemic stress, our policy heroes would spring into action to put out the fire (with gasoline, AKA inflationary policy). This is why I have called the long macro bubble a bubble in policy more than a bubble in assets. Bubble policy never met a market it did not want to prop and inflate. That is because, in a debt-driven Keynesian experiment, debt must not be allowed to unwind.

As a side note, this makes Trump’s stated war on the national debt all the more interesting (and a commentary for another day).

In NFTRH, we have been looking at the historical analog of 2001 to 2004. Please relax your gaze and behold the beauty of what went on beginning in 2001 and what we have the makings of today. Of course, no analog is going to play out exactly, assuming it does generally play out. But I have been looking for an end to the ill-conceived bellyaching about what many view as a perma-decline in the HUI/Gold ratio.

Here is why…

The intent of this article was to be brief, so take a good long look above, form your own conclusions, and I’ll add my bullet-pointed conclusions as well.

- Gold stocks (HUI) bottomed in 2000, turned up in 2001, and began to lead gold (rising HUI/Gold ratio) that year as well. HUI eventually tacked on well over a 300% gain while most stock markets were bearish.

- This occurred as the Gold/Silver ratio, an indicator of failing market liquidity, also turned up and rallied.

- The Gold/Silver ratio has, much more often than not, impaired gold stocks when rising during the long, inflation-fueled years of 2004-2024.

- But elements in play back in 2001-2004 are similar to today, at least partially, and almost by definition, they are different than the 2004-2024 phase. Although the process, if it plays out, is still in its early days.

- As for today, HUI is already rising (per our ongoing bull market theme),

- The Gold/Silver ratio is merely bull-biased, not definitively bulling.

- The US dollar has only recently kicked off a hard correction and has not confirmed a bear market (although it has failed a base breakout and is thus on watch for a potential bear market or hard bear phase within its long-term [post-2008] bull market. If this plays out, it could unfold with very strong interim bounces.

- Though the equity bear market was the product of a deflation scare in 2001, back then, money did not flee to the US dollar, as it has at every market liquidity crisis since 2008. Capital fled to the Euro, the Aussie dollar, and the Canadian dollar, primarily, where paper currencies were concerned (obviously there was strong flight to gold as well).

- The chart shows the Euro in the bottom panel. Currently, it has not made a trend change to up, but if you view a daily chart of EUR/USD, you’ll see a big spike this past week. Maybe sustainable, maybe not. If the coming weeks/months bring relative strength to the Euro, Aussie, and Canadian dollars, it would be in line with the analog.

- If the current bear phase proves sustainable, recall that a failing USD did not mean “all-clear” for stocks back in the historical phase, and it may not this time, either.

- We’ve been trained to think that way for the last 17 years, since Armageddon ’08.

You can try to “quant” any given macro picture to make it say what you want it to say. So that is a caveat. But my belief is that the gold mining sector, long ago cast out of the asset party and kicked to the curb, has a great chance to be seen as a value and as a macro-fundamental go-to, all at once.