Bear-market rallies are always built on delusions. A breath of hope returns to the dying bulls, and all the testosterone and adrenaline rushes to their veins. There is typically no rationality to it. It is pure sentiment, so the rallies are strong, unthinking, and vicious toward anyone who shorted the market, making shorting a dangerous strategy even during times when we are clearly in a bear market.

And now it’s over

The bullheadedness of the recent stock rally has been just like all others during major bear markets, maybe a little stronger than the average because bulls have been force-fed on the Fed’s high-energy food and have been inhaling hopium for so many years, their brains are have turned to soup. They have a lot of recovery to do because the Fed has done a lot in recent years to create the delusion that it always comes to the stock market’s rescue — that saving stocks is its greatest concern — and most of these bulls have zero real-life experience with a Fed fighting inflation.

Powell clearly intended at his Jackson Hole meeting on Friday to turn himself into an inflation fighter in image of Paul Volcker with his last speech. Frustrated, I think, by a stock market that wouldn’t believe him on tightening so that it kept betting a Powell pivot was right around the corner, he laid it on thick and repeatedly. Wolf Richter summarized as follows:

Fed Chair Jerome Powell, in his to-the-point speech today at the economic policy symposium in Jackson Hole, appears to have attempted to pull the rug out from under the tightening-deniers that had been fanning out across the internet, the social media, and the TV circuits over the past few months, with their contorted theories of “pivot” and “rate cuts” and “dovish Fed” or whatever….

His speech was a series of hawkish comments that boil down to this: We’re going to crack down on inflation, and we’re going to “use our tools forcefully” and we’ll take “forceful and rapid steps,” to bring down demand, and there won’t be any “stop” or “pause” in the rake hikes until rates are “sufficiently restrictive” to “return inflation to our 2 percent goal.”

Powell even admitted the pain to come, taking back the hopes he created of a soft landing. If your plane lands hard enough to cause pain, that is not a soft landing, which I’ve claimed all along would prove to be impossible. To make the no-pivot message pointedly sharp because the addled market was bound to miss the point, Powell stated outright, the FOMC will continue to fight inflation “until the job is done.”

Here is a video of his speech if you missed it. It’s not long, but it is long on hawkishness compared to any other speech Powell has ever given: (I’ll recap the toughest points below in case you don’t have time to listen to the video.) It was certainly the most hawkish Fed speech since Volcker.

- Today my message will be … more direct.

- Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.

- Restoring price stability will take some time and requires using our tools forcefully.

- Reducing inflation is likely to require a sustained period of below-trend growth.

- [This] will bring some pain to households and businesses — the unfortunate costs of reducing inflation, but a failure to restore price stability would mean far greater pain.

- The labor market is particularly strong.

- High inflation has continued to spread throughout the economy.

- A single month’s improvement falls far short of what the committee will need to see before we are confident that inflation is moving down.

- We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%.

- Estimates of the longer-run neutral [interest rates] are not a place to stop.

- Another unusually large increase [in interest rates] could be appropriate at our next meeting

- Restoring price stability will likely require maintaining a restrictive policy stance for some time.

- The historic record cautions strongly against prematurely loosening policy.

- Median Fed funds to run slightly below 4% through the end of 2023.

- Our responsibility to deliver price stability is unconditional.

- Nothing diminishes the Federal Reserve’s assigned task of achieving price stability.

- We are committed to doing that job.

- No grounds for complacency.

- Must break the grip of inflationary expectations.… a particular risk today.

- We must keep at it until the job is done.

- Our aim is to … act with resolve.

- We are taking forceful and rapid steps.

- We will keep at it until we’re confident the job is done.

Schiff shifts to no-pivot Powell

Even Peter Schiff, who has maintained the Fed will chicken out early and who has often gone as far as to say it won’t tighten in any meaningful amount because it can’t, is now stating that Powell’s speech was far — very far — from dovish. Schiff is, in fact, emphatic about that: (First twelve minutes.)

Even Zero Hedge has said repeatedly Powell will pivot, but now indicates Powell put an end to that plot line. I’ve always maintained, on the other hand, that the Fed will tighten even though it can’t because it believes it can, and it will tighten into a recession because it nearly always does, and it will tighten past going into a recession this time, which is why the Fed and the Biden Administration are both doing all they can to say we are not in a recession, even though we obviously are, so that the Fed can keep tightening because it has to get inflation down. It doesn’t have a choice.

Back in 2018, we saw the Fed tighten when I believed it was clear the Fed could not but would anyway (while Schiff was saying repeatedly it would not because it could not). The Fed’s actual intense tightening led to an overall bad year for stocks and ultimately to a major market plunge in the final quarter that was only arrested by the Fed losing face and finally — after a year of tightening — indicating it would shorten its timeframe considerably. It still tightened right into the Repocalypse of the final quarter of 2019, which only ended with a huge move back to easing that was easy because there was no inflation to battle. In fact, the Fed was actually hoping increase in inflation because old father Fed hadn’t been able to get it up for a long time.

Stock investors clearly believed during this recent rally that the Fed won’t tighten much because it can’t. I think it’s pretty clear based on all the writing and investor comments that most investors were just thinking Powell always chickens out, so he will this time, too.

However, we heard Friday that the Fed was going to follow the plot line laid out here all of last year. The Fed’s primary mandate forces the Fed to fight inflation, and the job market is providing Powell with no reason by the Fed’s second mandate (a strong job market) to back down from that — at least the job market as the Fed believes it to be (wrongly) based on the surface numbers. So the Fed’s back is to the wall. It’s trapped itself.

Teaser: Powell badly misunderstands the job market, which will be a huge miscalculation for the economy, and I will elaborate again in my next Patron Post as to why the job market is far from being as healthy as most economists believe with some recent news that finally explains what is really causing the Great Resignation and why that cause means the labor market will remain chronically disabled and, therefore underproductive. My Patrons will get first crack at that, but I’ll probably release it in a month or so to everyone because it’s really important to understand what almost no one is grasping … before the next Fed meeting in order realize how much the Fed is miscalculating.

Even the biggest Big Bank Bulls are starting to capitulate

It was an ironic twist: one week ahead of Friday’s Jackson Hole meeting, Goldman’s biggest trading desk bull, Scott Rubner, who steadfastly – and correctly – encouraged the bank’s hedge fund clients to keep buying the most hated rally until its peak just below the 200DMA, joined BofA’s Michael Hartnett in turning bearish and warning that it’s time to sell and that the response to the question “are we there yet”, is “yeah we are”

On the other hand, one of their biggest bears wimped out just before the Powell’s highly anticipated speech at Jackson Hole and went for the pivot:

“I am of the view Powell doesn’t have the stomach to be all out hawkish here, and will give himself room to maneuver…. At the risk of being overly specific: I think Powell will seem dovish on Friday.

He was dead wrong and should have stuck to his bearish ways. That is what happens when people start to cave in to the majority view, and the dogged belief in a Powell pivot starting to become visible at Jackson Hole was certainly the majority views.

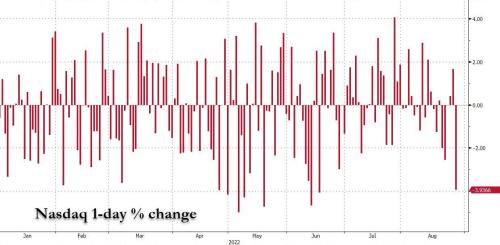

A lot of bulls were wrong, and that’s why we saw the NASDAQ plummet 4% on Friday, it’s biggest one-day plunge in two months. The fantasy trade hit a wall.

The only wink of hope Powell gave to the stock market bulls was that “at some point” it will be appropriate to slow the pace of tightening. Hardly a pivot. Not even a pause to evaluate the results. Just … “someday we’ll slow our tightening down.” I think that day will come sooner than Powell might think because the economy will be deeply buried before he ever gets to the interest levels he likely thinks are necessary to curb inflation based on past levels of interest used and because he’s dead-wrong about the employment market being strong; so cracks are like to open up in the job market and throughout the economy sooner than he anticipates.

Nevertheless, any form of a Fed pause or pivot is a moot point because the economic wreckage will be baked in by the time Powell does pause to reflect.

In Powell’s view …

the FOMC will likely need to maintain “a restrictive policy stance for some time,” and … progress on inflation “falls far short of what the Committee will need to see before we are confident that inflation is moving down.”

(Emphasis mine to point out Powell was “far” from dovish.)

Powell said the FOMC’s median projection for the terminal rate of inflation-stomping interest is about 4%. Some are thinking it will take Volcker levels of interest to end inflation on the basis that interest theoretically needs to rise higher than inflation in order to stuff it down from the top; but I am certain 4% is all it will take because the economy and the stock market have grown utterly dependent on near-zero interest and boatloads of free Fed money being pumped into, which was not so much the case in the 70s ad 80s, and we all know that anything in a state of dependency is highly sensitive to withdrawal, so it will react extremely and quickly to any removal of the thing it is addicted to. The more dependent, the worse the withdrawal.

Powell also said the FOMC sees risk that data may not come out the way they hope before September so another 75 basis points is also still on the table. So, don’t expect anything softer if reports on interest turn out to be good. Just expect something tighter if they don’t turn out so well.

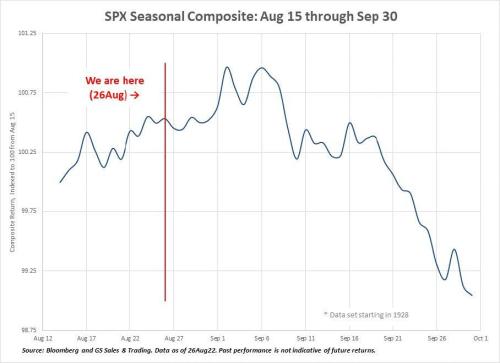

A September to Remember?

We are now about to enter the month that is seasonally the market’s worst month right when J. Powell took the wind out of the market’s fantasy sails. Gathering data since 1923, here is what the average September looks like for stocks:

Given the multitude of other things going grossly wrong in the world right now, maybe we should take Powell at his word on this one: “Pain is coming.“

The Powell no-pivot plunge began exactly as some ugliness is going to come to the market from commodity trading advisors, too. Goldman Sachs estimates that CTAs need to sell about $8.3 billion in equities this week if everything else in the world remains as is. However, they could need to sell as much as $46 billion if a black swan or two swoops in for a landing, which is not a long stretch of the imagination in the present world. GS says the month of September gets worse for CTA action if the economy makes a downturn, with GS projecting -$147 Billion if the world turns worse and simply a smaller minus if everything holds about as is.

So, the market started plunging Friday into a period with some necessary trade action bringing additional downward pressure that is baked into market positioning and with a seasonal track record of declining, even if all things in the world hold about as they are. On top of that, the largest buyers in the market — the stock-buyback corporations — will be entering their quarterly blackout on September 15. It was right at the doorstep of this seasonal environment that Powell decided to pull the carpet out from under market fantasy. I suspect he felt he needed to break delusions that were causing the market to act as a countervailing force to the Fed’s tightening and needed to try to let some air out of the obviously bloated stock bubble that was trying to reinflate — the last thing he wanted to see.

As an indicator that the bear may be poised to roar back into life, Lance Roberts from Real Investment Advice notes a little factor he calls “the Rule of 20.” According to Roberts,

The “Rule Of 20” says the “bear market” may just be resting despite much commentary to the contrary. In a recent Investing.com article, Bank of America strategist Savita Subramanian warned clients that stocks are still expensive despite this year’s drawdown…. Unfortunately, the last time the Rule Of 20 was overvalued was in 2007.

Roberts explains the Rule of 20 that is part of Subramanian’s analysis that the market is significantly overvalued:

The Rule of 20 helps us think about valuations and bull and bear markets. To calculate the Rule Of 20 we combine the P/E ratio and inflation rate. Over the years, markets have shown a distinct tendency to revert to a sum of 20 for these two metrics. The value of the markets is fair when the sum of the P/E ratio and the inflation rate equals 20.

Currently that sum is at 38, which is more overvalued actually than anytime outside of the beginning of the dot-com bust. So, yeah, a little overvalued still by this measure with plenty of room to fall for a long time. Thus Roberts concludes,

The math suggests forward 10-year returns will be substantially lower than the last….

With the Rule Of 20 very elevated, the Fed reversing monetary accommodation, and inflation and wages impacting earnings and margins, the risk of a further bear market decline is not entirely unreasonable….

As monetary policy becomes more restrictive and high inflation erodes economic growth, the market will have to reprice for lower sales, margins, and earnings. As such, if we are indeed in a bear market and not just a correction, then we have more work to do.

Right now, you can see the timing and size of the recent rally is actually perfect for a truly bad bear market, and you can see what that means for the bullish narrative that claimed a 50% rally meant the bear was over by looking at what has come next in the past — not that it has to happen that way again, but that it blows the doors of the argument that a rally this high at this point in the process proves the bear has died:

It tends to indicate exactly the opposite, which is why it always traps a lot of bulls who never see it coming.

With the Rule Of 20 elevated, the risk of lower returns is significant. Such is particularly evident due to the “pull forward” of returns over the last decade due to repeated global Central Bank interventions….

Outsized returns, above the rate of economic growth, are unsustainable. Therefore, unless the Federal Reserve remains committed to a never-ending program of zero interest rates and quantitative easing, the eventual reversion of returns to their long-term means is inevitable.

Well, the Fed has just reassured the market it is very far from returning to “never-ending zero interest and QE.” Hence Friday’s big plunge with plenty of downside left to come.

Proof that the bear’s obituary was written prematurely by rosy-eyed market prognosticators can be seen in the graphs of the major indices, which never broke above their 200-day moving averages and which stumbled right at the major down-trend of their past highest peaks.

After stalling at those key points in 2009, the stock market fell another 53%. Failure to reach the 200 DMA was also the turning point for the big bear-market rally in the 2000-2002 dot-com bust. Eventually that market wound up down 49%. During both of those massive bear markets, the downtrend line of the peaks was not broken. And that’s where we were just before the market turned south again.

The market also failed to beat the 61.8% Fibonacci retracement level from its trough (the supposed golden ratio the universe appears to be built upon like a fractal that runs through the whole system). For those who watch that popular marker as a sign of a bad fail — a major resistance level, hence reversion level for a rally to fail — this is the ultimate summit for major bear-market rallies. It’s the level above which some are convinced the bull has fully broken out and will keep on running. Well, it didn’t. It turned south just before notching that level and turned hard. THAT was the pivot, not Powell.

So, here we are, on the way back down again, having bounced off the downtrend and having failed to rise above the 200 DMA and then having faltered in the face of the famed Fibonacci line of demarcation, and now Papa Powell just whacked the market on the head to help it back down from its insanity. The bull trap has sprung. Why fight the Fed now if you didn’t on the way up unless you want to play endless whack-a-mole with Papa Powell. Hint: He’ll win! He has full monetary control on his side. You don’t. He’s on the Bear’s team, and these aren’t the Chicago Cubs.

Liked it? Take a second to support David Haggith on Patreon!

![]()

https://thegreatrecession.info/blog/no-powell-pivot-so-bear-is-back/