The stock market is still purging some of its recent insanity this morning, but the real action has been in bonds. Fitch may have gotten everyone’s attention with its downgrade of US credit, but it has already turned into mainstream articles now pointing out what the financial media had been silent on. Today’s news is about the real dangers showing up in the US Treasury market, which are massive as I called out in my “Deeper Dive” earlier this week.

Prior to Fitch ringing the alarm bell this week, everyone was asleep at their financial media posts, paying no attention to how bad the deficit-debt-interest fire tornado has become. One story in today’s news presents a fitting image of what I wrote about debt creating its own weather. A volcano in Iceland is shown creating its own weather, as the heat that is rising from the lava whips up into a tornado that sweeps the mountain’s flanks. Shown in the picture above, it’s a spooky looking video to watch. That is what US debt is now doing to its own interest rates, something I had forecast a couple of months back would start to happen once the debt ceiling was raised.

While Fitch is getting plenty of criticism from the White House, the Treasury, and big bond market players, including JPMorgan’s CEO Jamie Dimon — just as S&P did back in 2011 with the nation’s first credit downgrade — it seems to me the critics are all talking their book. JPMorgan, for example, is the nation’s largest primary bond dealer. They are holding a massive amount of bonds they don’t want to see lose value; yet, losing value they are as Dimon tries to stop the plunge in pricing. And, of course, the US government, including the Treasury, doesn’t want to admit its massive deficits and credit shenanigans (on both sides of the aisle) are roiling credit markets.

That is all part of the problem. The people that actually get listened to because of their fabulous wealth and massive banks, are the ones most likely talking up what they have to sell, and none of them want to face the reality that Fitch has just gotten people to wake up to. It’s a much needed wake-up call, and if Fitch hadn’t started banging a few pots and pans, the whole nation would still be sleeping its way to catastrophe. It is not as if the tiny tinkle bell I ring in the “Deeper Dives” is going to rouse the sleeping world. It takes someone big like Fitch, actually finally doing its job, instead of waiting to downgrade credit until credit problems have already changed the market — which they are certainly about to do even without Fitch’s alarm.

The Dimons of hell, of course, are trying to put the world back to sleep by exhaling opium smoke all over everyone. However, as the world rouses a little from it slumber, the NASDAQ is losing some of its steam (at least, until Dimon and Larry Summers and quietly yelling Yellen can put the world back to sleep tomorrow).

The reality, though, as Wolf Richter points out and as I did in that “Deeper Dive,” is that a debt tsunami is just starting to sweep over America. US Treasury auction sizes are now forecast by the Treasury to rise 60% by next August! That is a lot of new market the Treasury has to attract during a time when the Fed is still raising interest rates.

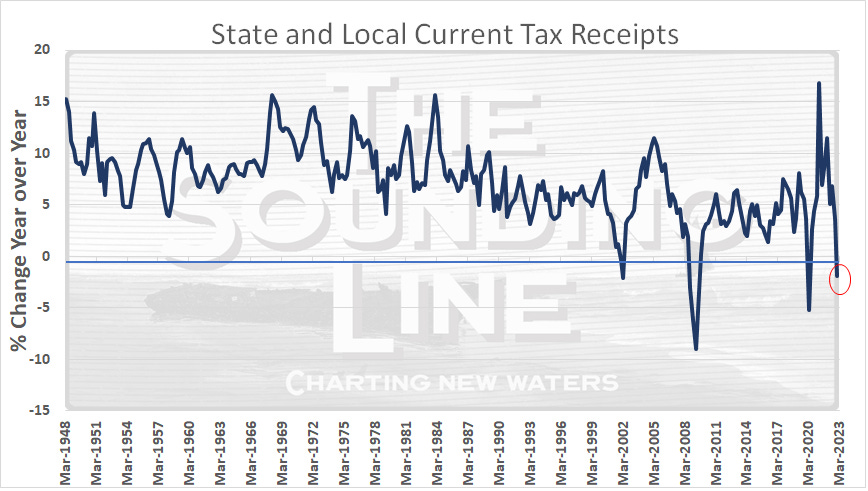

As I’ve predicted for months and as the news says again today, the Fed is catching no reprieve from its faulty labor-market gauge. Once again, jobless claims are hovering near their deep lows, and now state and local tax receipts are showing GDP is wrong like that “Deeper Dive” said about federal tax receipts. GDP is wrong for the reasons I laid out. Based on tax receipts, we are already in a recession that is going as deep as the 2000, 2010 and the super-steep-but-very-short (because artificially caused) Covidcrisis:

It is not that the labor gauges are wrong in what they are reporting about unemployment remaining low, it is, as has been my mantra, that the labor market cannot function as a reliable gauge for when the Fed should stop tightening because the market, itself, is broken. In other words, the gauge is reporting the truth, but the idea that a tight labor market means a strong or resilient economy is no longer true. That has historically always been the case, but it is not the case if labor supply breaks down, causing the tightness, rather than demand rising and outstripping strong supply.

It is not that the labor gauges are wrong in what they are reporting about unemployment remaining low, it is, as has been my mantra, that the labor market cannot function as a reliable gauge for when the Fed should stop tightening because the market, itself, is broken. In other words, the gauge is reporting the truth, but the idea that a tight labor market means a strong or resilient economy is no longer true. That has historically always been the case, but it is not the case if labor supply breaks down, causing the tightness, rather than demand rising and outstripping strong supply.

So, the Fed, based on the things it looks at, will keep tightening because GDP (one of those things it looks at), for the reasons I laid out, is lying. Many other major indicators like the one above are calling out GDP’s lies; but no one is willing to believe GDP could be wrong, even though the Fed finally questioned it and said something looks off there.

When the tax rates stay the same, but growth in federal, state and local tax revenues ALL go down to into negative territory, and corporate earnings plunge but keep all investors happy because they beat dismal expectations (always contrived to be lower than reality just so corporations can lower the bar and clear it in their next quarterly reports), and Gross Domestic Income, the corollary to Gross Domestic Product, falls off the negativity cliff (when it normally always correlates very close to GDP), and the yield curve is as inverted as a barn-storming biplane trying to impress the masses at the air show as the pilot shows he can pick a daisy from the fields while skimming his leather helmet nearly on the ground, then GDP is just plain wrong.

Ahead of the debt ceiling deadline, I had said that Congress felt confident it could play mumbley-peg with US credit because members of congress knew they would never actually default. I said they were fools for thinking they even had to actually default for credit agencies to say they had enough with the games and then to downgrade US credit. While I ventured a downgrade could happen for that reason before the nation even hit the deadline (noting that an actual default was legally impossible as there are other alternatives that are not illegal, such as immediately cutting spending), it looks like the credit agencies are even willing to downgrade credit after the credit deadline has passed, stating it is in part because of the inept ways in which the government is handling its debt deadlines. In a way, that is even worse. It says, “We were patient while you played the game; you managed to get something passed before your deadline as we all knew you would, but we’re downgrading you just because you are such a bunch of pathetic children in how you handle the nation’s debt that you cannot be trusted to be responsible with it."