The stock market is smart in a dumb way, but it is currently unbelievably dumb in the way that it is smart. To understand that, you have to realize that today’s stock market is not a place for investing in businesses. It used to be that, but the players have all turned it into a casino for casting bets on what the Fed is going to do and then using the Fed’s money to do it. The stocks themselves — the little pieces that companies are carved into — are just chips. They are where and how you place your bets like setting your chips on squares on the craps table or roulette table.

So, investors have made their smartest moves (as measured in money made) by simply casting bets based on their knowledge that the Fed was creating money. It was the old “Don’t fight the Fed; buy every dip.” That is smart when no one is buying business anymore, but just betting on what all the others players are going to bet. It’s just a game, and in that game, bad news was always good news because it meant the Fed would create more money to play with.

It’s a much better casino to play than any in Las Vegas because the house (the Fed) tells you in advance how it is going to roll … if you believe it. Once in a very great while the Fed throws in a head fake, like it did in 2017 when Janet Yellen told everyone in the casino the Fed would put the roulette wheel on autospin for a few years so that it would keep popping up red. That made it safe to bet the economy and stocks would be in the red for some time. Just bet red. This she did by telling everyone the Fed would put quantitative tightening on autopilot for two or three years. That became a head fake, however, when the market played chicken and went red with the Fed, and the Fed chickened and stopped the wheel by hand as if were surprised the market bet everything on going red when it had just told the market everything was going red. The ball stopped back in the black.

This convinced the market it could not always trust the Fed to keep taking money away when it promises that is how it will be betting for a few years because the Fed proved to be a chicken. So, now, when the Fed is in the money-removal process once again, the market is inclined from recency bias to believe the Fed will chicken out and not do what it says it is going to do. So, this time, the players bet against the Fed, believing Yellen’s replacement would pivot again. It was unfortunate for all players when he reinforced his message by saying, “No, we’re moving forward with doubling down on the rate at which we take money out of the game.”

So, stocks crashed again. The players, and that is all they really are, should have known better because it is quite a different thing to go back to creating money in a hot-inflation environment when money is the fuel inflation is made of.

Of course, the game always has an element of chance to keep the casino fun because some old timers in the casino still cast their bets on whether or not certain companies will be making money, and those bets are run at risk from the general economy; but, as the economy tends to keep making money so long as truckloads of new money are being created and delivered, that has still been a fairly stable bet. It becomes problematic, however, when the Fed starts trucking money out of the casino at a time when the economy is, itself, a disaster. And that is now.

There’s a new game in town

This week, new economic disasters showed up in the global economy to join the nine months of the not-recession that looks in every way just like a recession, except that the labor market keeps tricking people to believe it is not a recession. The players bet so much bad news was good because it will, as bad news has done in the past, convince the Fed that did not pivot during all the recessionary bad news this year to pivot after all. So, bets went bounding back up in what appears to be another bear-market rally on the heels of the last bear market rally that occurred because the market that is smart in its stupidity (of betting that bad news is good news because it means the Fed will create more morey) but stupid in its smartness (in believing bad news is still good news in times of high inflation when the Fed says it cannot and will not pivot) bet, again, the Fed would pivot. It will be short-lived.

You see, the reason the big rollers started betting against the direction the Fed has promised again is because the casino next door was playing a similar game and just did a little shuck-and-jive in which the Bank of England head-faked the world to believe it was also going to start sucking the money away just like the Fed but instantly pivoted to run in the opposite direction before it even got started tightening, unleashing some of its largest quantitative easing because it suddenly learned, well, England is broke.

Almost out of nowhere, as I discussed in my last article, England’s supposedly most conservative investment funds started screaming they were all going to go broke in the space of something like twenty-four hours. Undoubtedly, the massive danger had been building for much longer, but no one was paying attention until the players in that geriatric, retirement corner of the London casino started screaming in unison, and then everyone ran over with terror in their eyes to realize, OH, MY GOSH, these gamblers are nearly broke!

At the same time, their casino was on fire with worse inflation than in the US; so, what did the BOE do? It did what any self disrespecting central bank would do, and grabbed a hose and started spraying gasoline on the screaming gamblers. Turns out the conservative pensioners had been making highly leveraged bets for years because of all the free money the bank had been hosing in their direction along with all the low interest the bank had established. Their bets to everyone’s surprise (and my surprise that anyone was surprised by this) all went foul when the bank started raising interest rates and everyone knew it was about to start taking the fuel away as well. That’s why the bank turned back on the fuel hose.

So, the Bank of England has chosen to spray gasoline on the flames of inflation by creating new money and giving it to the gamblers to save them all from themselves so they can go back to gambling up the values of their investments, which will simultaneously be devalued by the self-destruction of the money they are measured in. Thank God for this sudden and miraculous salvation! Well, probably not God, as he might not approve of this gambling, but thank the Bank of England if you’re one of the gamblers because that likely is your god anyway. It is certainly the entity to whom your good fortune is beholden.

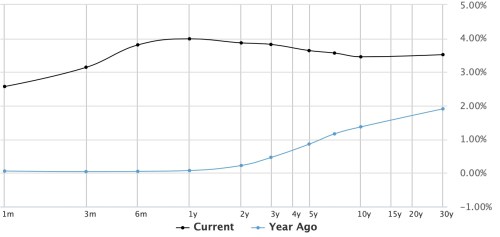

So, now the American banksters and others who play in New York New York are betting the Fed will follow suit. Why not? If merry old England can pivot, surely Papa Powell can do the twist or something. And he may have to soon. That’s a move where he creates lots of free money via Treasury purchases at one end of the maturity spectrum and sells a lot of Treasuries at the other end to try to keep from increasing his balance sheet in net while attempting to shake the yield curve back into a more normal shape. You see, US Treasury yields are suppose to slowly curve upward in interest as you go from short-term bills and notes up to long-term bonds, and, ever since the Fed has been tightening by refusing to refinance the Treasuries it owns, the yield curve has gone all wonky … like this:

Blue line, somewhat normal; black line, present

Blue line, somewhat normal; black line, present

The Fed likes the curve to climb a smooth grade over time, not slide down a slippery, bumpy slope.

At any rate, the marketeers are betting the Fed will now do like the BOE has done and pivot after all because the bond funds are having a really rough ride down that slope. So, the pivot bets came back on this week, stupid as they proved a couple months ago, the last time the gamblers started to bet against the Fed.

This is where investors who are smart to cast their bets wherever the Fed is going and who might be smart this time in betting the Fed is going to pivot are now dumber than dumb because the Fed has already told them again and again it won’t pivot until it’s too late to matter.

“But now,” they exclaim, “it will have to pivot because bond funds and pension funds are blowing up badly in England and will soon be doing the same thing here.” In one way, you see, they’re smart because they’re probably right about that. I’ve said throughout this bizarre period that the Fed won’t pivot or even pause until something breaks. So, they’re smart to bet something will break and force the Fed to change its policy because something definitely will break soon and well before the Fed gets inflation under control. As evidence of that,

New York Fed President Williams noted it may take years to get inflation back to target given the current supply and demand imbalance in the economy, and that the Fed still had ‘a way to go’, invoking the 4.6% fed funds dot for the end of 2023, specifically.

“Stock market bottom talk gets louder, but Fed pivot hopes look more pie in the sky“

That is, as the article notes, not exactly reassuring that the Fed is about to pivot, especially since Williams said this after the BOE just did pivot. However, it is assurance that something will break before the Fed does stop tightening (and a stop is not a pivot) because something will definitely break badly long before the end of 2023 and even before the start of 2023; and that may force the Fed to stop tightening or even go back to easing; but…

Dopes on the ropes

In Europe, we already have major banks like Deutsche Bank and Credit Suisse on the ropes, looking like Lehman wannabes. We also have thousands of major retirement funds — the so-called “smart money” — that just got a de facto BOE bailout, applied liberally to all who can get their hands on the cheap money. It was done at the cost of the little guy, of course, in order to save the little guy’s pension; but, it’s at his cost because the little guy will be hurt most by the extreme inflation that is going to be fueled by hosing large amounts of new monetary fuel into the middle of incendiary inflation.

And here is where all the gamblers are dumber than dumb even if this time it turns out they are right about the Fed and other central banks being forced to pivot because something is surely going to break soon, whether it is pension funds in the US, hedge funds, or a horde of zombie corporations storming toward us over Dead-Man’s Hill. Something is going to break. Something really, really big is going to default. Multiple Lehmans are lined up on the sidewalk right outside our door as we move toward Halloween; so, something wicked this way comes, and October loves a zombie surprise. So, the market gamblers are betting something is going to break soon, and that is as close to a sure bet as you get right now.

However, if the market is right, and the Fed is forced to pivot, is that a smart bet for stock prices? I’ve said all along, the Fed WILL likely pivot when something breaks but not until then; however we’ve been living in the Everything Bubble for years now. So, something breaking is more like Everything Breaking. If the Fed does pivot, it means the Fed, like the BOE, is going to be forced to start hosing gasoline into the flames of inflation, and it means the breakage is likely to be beyond anything you’ve ever seen.

Past is prelude … until it isn’t

You see, back in 2018 when the Fed flipped on Janet’s word and took the roulette wheel off autospin, the Fed had total freedom to rush back to printing money. All it had to lose was face. Even then it waited far too long, so we wound up in the Repocalypse, a little Halloween-timed monster of its own that was only tucked fully back under the bed when the Fed went to all-out quantitative easing due to the Covidcrisis. Even back then, you see, the Fed was reluctant to lose face, yet it had not said “read my lips” anywhere nearly as articulately as it has this time; and the cost of its reluctance to pivot was major interbank turmoil.

This, time, however, it has not only spelled out its resolve with nearly fist-thumping clarity (in Fed speak-softly terms), but it has those inflation flames all around it just when it will need to bring out the gasoline, and it knows that rushing in to save the gamblers means setting the entire casino and all the Fed’s money on fire. This, it is loath to do; so, something has to break really big, BUT it will. So, the gamblers may be right about that much.

It will break big. Remember, I said we are in the Everything Bubble, and the breaking of Everything at the same time is big — really, really big. So, here is where all the gamblers are dumber than a box of ear swabs. When the Fed pivots because everything breaks because it is still tightening ten months into a recession, the whole casino will be in flames just as the Fed starts to spray gasoline, so ALL BETS ARE OFF!

The value of the bets your money is measured in will become worthless when the chips and tables and even some of the gamblers are on fire. Many of the chips will vanish out of existence right off the tables in front of the gamblers as the zombie corporations they represent go up in smoke. Lehman monsters will pop up from under the tables where they have been hiding. These are companies everyone felt were fine, but they had skeletons they were hiding; and, so, the gamblers will run terrified for their lives with their hair on fire, leaving their bets on the flaming tables.

Now, of course that will not all play out as quickly as I can write it inside of a paragraph. Everything Bubbles, as I’ve said before, must surely be the biggest of train wrecks, and trains wreck almost in slow motion by continuing to pile up car after car. The train slows down, but the momentum from all that weight pushing from behind from a mile or more back just keeps the wreck happening. That is what makes train wrecks so spectacular: one car ramps up over another, another ramps over that and crashes on end, the fourth ramps over the first two and smashes into the one standing on end, knocking it over, and so on and so on until they look like an old-fashioned pile of pick-up sticks. So, the stupidity of the gamblers rightly betting that the Fed will pivot is that they are betting the economy all ends up like pick-up sticks because of how much is going wrong right now and how much it will take to get the Fed to throw gasoline on the flames of inflation.

Ah, they say, but the Fed will then have to rush in with more money to save the economy, so if bad news is good news, really, really bad news must be great news.

When the Fed steps in at that point, the economy won’t be saved. You see, when the problem was a housing crisis that formed when the Fed raised interest, the Fed could somewhat solve the problem (temporarily anyway) by dropping interest and reinflating the old housing bubble with massive quantities of new money. (Quantitative easing. Of course, we’d have to replay the problem all over again someday, as a result, and that day is today, but now that is only one of the massive problems.) When the problem was an economy that crashed because you locked down all the economies of the world by slamming off circuit breakers during Covid, politicians could somewhat fix the problem they created by slamming the circuit breakers back on a month or so later. We did, and partially solved it, but many things didn’t restart, and that is another one of the massive problems. When the bond market, which is much bigger than the stock market, is breaking down, as we saw in England, due to central-bank tightening at the same time the stock market has been breaking down all year, you have a lot bigger mess. However, when the only way the Fed has ever had of trying to help solve these economic crises individually is to create massive amounts of new money, but this time money is already burning a hole in your pocket as quickly as you can spend it due to inflation, now you have to spray all the burning pockets with gasoline, and that will be neither fun nor pretty.

Yet, that is just the start. The deeper, uglier reality is you can’t fix this broken economy with all the new money that can even be imagined, and you cannot turn it back on with a breaker. As I said in my earlier labor article, this economy is broken, in part, because labor is broken. It’s not coming back. It’s truly sick or dead. (I cannot explain that here, but that article will explain it for you if you haven’t read it yet.) On top of that, money doesn’t end a war that is adding to shortages. Money doesn’t end political sanctions that are adding to shortages. Money doesn’t end supply-chain problems due to ports closing due to China’s Zero-Covid policy or due to other ports becoming clogged every time those Chinese ports reopen. Money doesn’t create corn out of nothing the way money can be created out of nothing. It doesn’t create food where none grew. So, when the problem is that food didn’t grow due to war and lack of fertilizer and one of the worst drought years on earth, money doesn’t solve that!

But! What money does do is fuel the price of all of that when money is abundant while the supply of goods gets even shorter for all those reasons. So, if the Fed does pivot, your stocks will be going up in value because they are valued in dollars that are more rapidly than ever becoming worthless. Your gold will be soaring because it is valued in dollars that are becoming worthless, too; and, so, a bag of gold will buy you a loaf of bread while a pickup load of paper money will only serve as a mattress. You won’t need to hide it under one. You’ll be able to sleep on it out in the open.

That’s because the one thing that is not becoming worthless is the food you need to eat and a roof over your head. So, make sure you have some non-perishable food because your money won’t even buy you air if the Fed goes back to printing in this environment, and by then the World Economic Forum will probably be charging you for air, too, if they can find a way based on carbon taxes because humans breathe out a lot of carbon after breathing in air.

Now, I you want to bet stocks up based on all of that, go ahead … because that is where we’re headed, and we’ve done almost all of it to ourselves; and all the old solutions, if they are retried in this high-inflation environment, will do nothing to solve the problems we’ve created but everything to incinerate the value of money.

All year long, stocks have been catching down to the economy, but all year long the economy (as measured in GDP) has been falling further. So, catching down is hard to do. That means there is a long way still to go.

Remember, even big engines surge hard when they’re running out of fuel (free Fed funds), but it’s hard to refuel them when everything around them is on fire … and it’s hard to put out the fire when the big engine is what is powering the fire-hose pump.

So, if you are playing this market, just remember, in times like these, stocks don’t take the elevator down when things turn ugly; they take the firehouse pole.

Liked it? Take a second to support David Haggith on Patreon!