Bill Bonner writes that Republicans have created “a big beautiful bill” to add another $2 trillion to the US national debt per year to bring it up to a nice rosy and round $40 trillion before the next mid-term elections. At which point, I’ll add, you should flush them all out of Congress. If this is all they can promise against the debt in the next year after the recent games of DOGE ball that have been knocking government employees out all over the playground, that is some pretty sad work.

American Betrayal

And what did Trump do in response to this Republican failure to believe in and apply the DOGE cuts against the debt, as he promised would happen, he ordered everyone to throw their balls at Representative Massie to vote him out in the next election, one of the few Republicans voting against the bill because it irresponsibly accomplishes nothing whatsoever toward Trump’s stated goals.

President Donald Trump “is at risk of blowing his second term before it has hit the two-month mark,” wrote National Review senior editor Charles C. W. Cooke to kick off his latest column about the president’s hectic last few weeks, criticizing him for getting distracted by “stupid, irrelevant indulgences” instead of the core issues that led voters to re-elect him.

One of those ‘stupid, irrelevant indulgences’ is Trump’s attack on Thomas Massie. He believes Massie has betrayed the MAGA cause. Almost alone among the yes monkeys in Congress, Massie sticks to the core issues. He wonders how any Republican can vote to continue spending money on wasteful and unnecessary programs — including those revealed by Trump’s own DOGE task force….

But that’s the charm of betrayal…it can work in both directions.

Massie believes it is he who has been betrayed. He thought the MAGA folks were going to drain the swamp. But there it was in front of him…a Continuing Resolution with more than 1,500 pages of boondoggles…bamboozles…and BS….

Mr. Trump, why not just tell Congress to come up with a balanced budget … or he won’t sign?

You can argue that Trump will put together such a spending bill after the DOGE cuts are fully implemented, but why would I believe you … or him after this? The secret of the last 25 years of inflating the government debt to Denali (or McKinley) size is that all congresses have put the spending cuts in future years while enjoying the fun of tax cuts now to buy the things they want, knowing full well that no future congress can be obligated by them to carry out the budgeted expense cuts down the road, and no congress ever has!

Ray Dalio warns that the US debt is the number-one thing that must be solved right away because the current debt now faces a “significant supply-demand problem.” He warns that the US has “to sell a quantity of debt that the world is not going to want to buy.”

And that was originally only a problem because the world didn’t have an appetite for that many US bonds. Now, with the Trump Trade Wars raging, the world will have even less need for US debt because US bonds are how other nations park their money in order to do currency exchanges on all that trade. With less trade, they need less of them. However, that isn’t even the bottom of the problem because another story in the news notes that investment money is actually fleeing the US right now and going to find a safer haven in the US.

According to The Telegraph, as recorded on The Drudge Report (where you can read the following part without having to subscribe):

Money is fleeing the US to Europe

The Continent is beginning to look like a safe bet against Washington's bedlam. Markets crave certainty; what they are getting from Trump's White House is chaos. From both a geopolitical and economic perspective, it's hard to know whether you're coming or going. Concern is growing over where this takes us. Even Trump now concedes that recession is a possibility. Ironically, the major beneficiary of the flight from US equity markets is Europe, an outcome Trump would surely not have wished for. Even the UK's previously unloved FTSE100 index has blossomed in recent months.

One of the things that is pushing US investors—especially bond investors—to look to Europe for safe havens, rather than to US bonds, is that many more US companies are being downgraded due to rising risk of corporate defaults because of the Trump Tariff Wars 2.0:

Growing fears of corporate defaults hit US credit markets

Worries about corporate credit defaults rose in the US for a second straight day on Tuesday, after US President Donald Trump threatened to ratchet up tariffs on Canada.

In derivatives markets, the cost of protecting corporate credit against default rose to the some of the highest levels in nearly seven months….

In junk, the Markit CDX North American High Yield Index, which falls as credit risk rises, declined as much as 0.45 point Tuesday to its lowest on an intraday basis since August.

Trump can cudgel other nations all he wants, but he cannot beat investors into doing what he wants in their response. He can beat down prime ministers of most favored nations, but he cannot beat down credit-rating agencies that are downgrading US corporate debt. Retailer Kohl’s particularly got lacerated in the news as credit-default swaps on its bonds rose 150 basis points in good part because of how tariffs will hit their business. Airline credit ratings are also taking a toll because fewer people want to travel to America … and so far, the airlines are not making up for the lost customers with flights of American exodus by all the citizens who want to expatriate.

“A lack of certainty around tariffs alongside concerns around growth have caused investor angst,” said Blair Shwedo, head of fixed income sales and trading at U.S. Bank.

In the new issue market market, around 20 high-grade borrowers were looking to sell bonds on Tuesday, but about half decided to delay their offerings instead. That marks the second day in a row that multiple issuers stood down to avoid broader market volatility.

That is what I’ve said about the cost of chaos. Yet, even that isn’t the bottom of the problem for US national debt, because other news says the world is rapidly joining arms in hating the US, so besides investors going elsewhere to find safe havens, many European investors will start refusing to invest in US debt solely for the purpose of punishing us. As I have written, you can beat other nations up because you’re the toughest bully and “hold all the cards,” but you cannot stop them from hating you. That is a problem because ….

Asked whether the U.S. debt problem could lead to a period of austerity, Dalio said the issue could result in a restructuring of the debt, the U.S. applying pressure on other countries to buy the debt, or even cutting off payments to some creditor countries.

By the time the US gets to that point, the rest of the world will be so sick and tired of being pressured by the US that sovereign-wealth funds and foreign investors will simply flee all new US debt, rather than bow to even more pressure US to buy something that is not looking like such a safe haven. I saw that hatred of the US forming all over recent headlines.

Trump’s new steel and aluminum tariffs—which hit many, if not all, nations—drew a swift response from Europe. Just as US liquor distilleries were planning to offset the grassroots boycotting of US liquor in Canada by putting more effort into sales to Europe, Europe intentionally targeted them by putting its retaliatory tariffs on US whiskey, not just on US steel and aluminum, cutting the US liquor companies off at the pass. Europe may have helped US consumers out by accident; however, when they put a tariff on US beef, leaving more for the rest of us in a US market strained by shortages. The last rounds of tariffs under Trump Tariff Wars 1.0 caused a huge reduction in US herds that we still haven’t recovered from due to grain becoming more expensive as tariffs and the Ukraine war raised fertilizer and feed costs from outside the country.

Here is what that spreading hatred gets you: What we see in this story is that Europe is now tag-teaming with Canada to make Canada’s citizens’ rebellion against US products more effective. They know US liquor is getting nicked, not licked in Canada, but now they are making sure it gets slammed. You see, they know American distilleries were planning to take refuge from lost Canadian sales by selling harder into Europe, but now they’ve been cut off at the bar there, too.

They also know farmers are being hurt, and Trump says he loves his farmers, so they targeted US agriculture with their tariffs (not just beef) in addition to steel and aluminum from the US. (Now, it could be that the tariffs on US metals will help US manufacturers because US steel and aluminum smelters that cannot sell into Europe or Canada very effectively will be driven to sell more products in the US. Also, maybe not. We’ll have to see how that shakes out.)

The EU duties aim for pressure points in the U.S. while minimizing additional damage to Europe. EU officials have made clear that the tariffs — taxes on imports — are aimed at products made in Republican-held states, such as beef and poultry from Kansas and Nebraska and wood products from Alabama and Georgia. Yet the tariffs will also hit blue states such as Illinois, the No. 1 U.S. producer of soybeans, which is also on the list.

Their goal with soybeans is to clobber the little beans because soybean farmers are already getting busted by the huge loss of sales to the world’s biggest buyer of all things soy, China.

The EU move “is deeply disappointing and will severely undercut the successful efforts to rebuild U.S. spirits exports in EU countries,” said Chris Swonger, head of the Distilled Spirits Council. The EU is a major destination for U.S. whiskey, with exports surging 60% in the past three years after an earlier set of tariffs was suspended….

So much for that resurgence done by the damages of Trump Tariff Wars 1.0.

“We firmly believe that in a world fraught with geopolitical and economic uncertainties, it is not in our common interest to burden our economies with tariffs,” [European Commission President Ursula] von der Leyen said.

Trump said that his taxes would help create U.S. factory jobs, but von der Leyen said: “Jobs are at stake. Prices will go up. In Europe and in the United States.”

“We deeply regret this measure. Tariffs are taxes. They are bad for business, and even worse for consumers. These tariffs are disrupting supply chains. They bring uncertainty for the economy,” she said.

But you can’t expect them not to fight back. So, the war is fully joined now by Europe as well as China and Canada and possibly soon Mexico. Europe’s retaliatory tariffs, which were suspended under the Biden Administration, just went back on, but additional tariffs are being promised in a coming Phase Two on April 13th.

Europe has said it will coordinate its tariffs with Canada and other nations to gang up on the US for the greatest impact. That is what happens when the bully thinks he’s so strong he can pick fights with everyone at the same time. Former trading partners all become allies against you in the trade war. While none of them will be hurt by each other’s tariffs, the US will get hurt by all of their tariffs combined, bringing the “which nation is bigger” argument as to who will win the tariff war down to rubble. It’s anyone’s war now. Europe, China, and Canada may not win, but they are going to make sure the war hurts the US as much as they can since the US picked this method of fighting after having agreed to a truce just five years ago. And the worst part is, according to Trump, it’s barely even about trade. It’s mostly leverage for border enforcement and imperial border-busting in the conquest of neighboring lands.

Canada was already recruiting allies in anticipation of the Trump Tariffs:

Even before that widening of the trade war, Mélanie Joly, Canada’s foreign minister, had issued a warning to other nations. Watch what Trump is doing to Canada, she said. “You’re next….”

Joly … has suggested that she wants to work with allies to try and coordinate a wider response to tariffs.

Those other nations see it, and they know it is true. Recently, they became the next when Trump hit them with steel and aluminum tariffs, so they had already worked out how their tariffs could have the most impact alongside Canada’s responses.

It wasn’t meant to get to this point. For months, Joly, Prime Minister Justin Trudeau and other officials made a series of trips to Trump’s Mar-a-Lago resort and then to the US capital in an unprecedented charm offensive that aimed to avert a tariff war and address border-security concerns from Trump and his team.

It didn’t work. Trump imposed 25% tariffs on many Canadian products last week — citing drug-trafficking and the border as his reasons — then went ahead with steel and aluminum, too.

Trump has said more than once he will deploy economic measures to take other lands and as a new primary form of tax to replace the income tax. So, naturally, their efforts to do the things he used as his first excuse for the tariffs didn’t get very far. He has already stated ulterior motives.

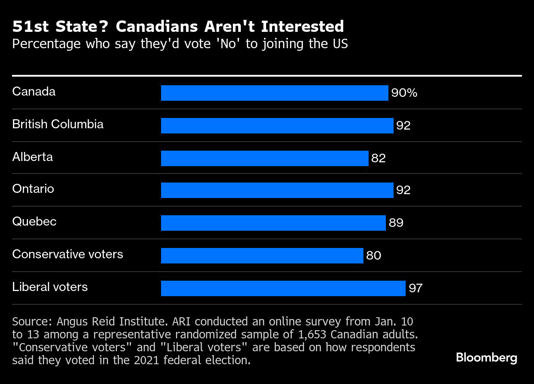

The mood in Canada has shifted over the past month as Trump and his officials followed through on tariff threats and continued to make taunts about turning Canada into the 51st US state. Public opinion in the nation of about 42 million has turned angry, with voters demanding politicians stand up to the US president.

It’s seen as a hostile takeover. You cannot stop the world from packing together and hating on you when you start throwing your weight all around the place and demanding their lands.

British Columbia Premier David Eby has worked overtime to relay the nation’s frustration, and his own. “We’re going to ensure that the Americans understand how pissed off we are,” he said….

“A good lesson to draw from Canada is building a sense of unity across those countries,” Milligan said. “They should push back, but push back in a united way, and that’s where you’re going to have the most chance for success.”

That message seems to have gotten across. Now, how do you suppose all that anger against the US is going to help the US national debt problem that Trump claimed he was going to fight, even though his first Republican budget does nothing but push the mountain volcanically higher?

It doesn’t help, of course, that Trump decided at the same time to push his imperialism to the maximum with this:

That’s one of Trump’s “stupid, irrelevant indulgences instead of the core issues that led voters to re-elect him.” Let’s stick our fingers in their eyeballs and twist them and see if they back down to our tariff wars with some land grants. No, that just got the fight up in them against both. They’ve probably figured out by now that the tariff wars are barely about trade anyway since they already had a Trump trade deal that Trump himself highly praised. They’re about trying to claim the prize from the "stupid, irrelevant indulgence” of Trump’s imperial quest—toward which goal Trump promised to put economic pressure on them to acquiesce to being State 51.

… patriotic fever [is] gripping the US’s northern neighbor, where the issue isn’t just about trade but also Trump’s statements that the country should be an American state and that he’d use “economic force” to make that happen.

We all heard him say it.

“It makes it very difficult to find those win-wins that you like to have, having raised the stakes like this,” said Milligan. “So we’re just going to push back as hard as we can.”

That means Trump is going to be backed hard against the ropes of our nation’s debt as most of the world starts fleeing US debt out of pure spite toward all of his roughhousing and imperialism, driving interest way up on all debt just to find enough investors. We now know China, Russia, Canada, and Europe are not going to help finance the debt mountain. Mexico might not either. Japan and other nations that are big buyers of US debt might retract like cut tentacles now that some tariffs have hit them, too.

As Dalio concludes,

“Just as we are seeing political and geopolitical shifts that seem unimaginable to most people, if you just look at history, you will see these things repeating over and over again,” Dalio said. “We will be surprised by some of the developments that will seem equally shocking as those developments that we have seen….”

“Be nationalistic, be protectionistic, be militaristic. That is the way these things operate,” he said….

“The issue is really the confrontation of all of this, the fighting of all of this. So, tariffs are going to cause fighting between countries,” Dalio said, adding that he was not necessarily talking about a military confrontation.

Trump loves a good fight, whether it is a boxing match, The Apprentice, or watching his cabinet members duke it out—something former cabinet members described during Trump 1.0 as Trump’s modus operandi—his relished leadership style. Since he thrives on negative energy, as I’ve always noted, expect lots of fighting; but it switched from being what some were saying would be an easy knock-out—US v. Canada—to US v. World. And that means the rest of us living in the States with Trump are going to have our own backs up against the national debt ropes, as the corporate debt is already experiencing. That is where it will really become complicated, as I warned in an early Deeper Dive on this subject.

Which all adds up to one of the easiest of my ten predictions made in my Deeper Dive for paying subscribers that I’ll share now:

Which means, yes, expect to discover that the chaos I forecasted a little early last year is finally and fully here like a storm that arrived a little later than forecast, but hit with all the fury predicted not long past its projected arrival! Trump is like a small-“g” god of chaos.

Let the wild rumpus begin!