"The time has come for cuts," Powell said at the Jackson Hole Economic Symposium

Powell, of course, is counting on his plane continuing to glide down toward that soft landing on the tarmac as he gooses its economic engines just a little, slowing the rate of descent. In the past, when the Fed has attempted this kind of interest-cut maneuver while inflation was still above target after a period of battling high inflation, the plane took off before even touching down, and we rose right back into the inflated clouds in the skies far above.

Powell is hoping a gentler and more timely touch on the throttle will do the trick.

Inflation is forever

Many billionaires love inflation, The following is sourced from Rudy Haverstein:

"Our market rate multifamily portfolio experienced rent growth of 18% year over-year on new leases and mid-13% on combined new and renewal leases over the trailing 30, 60 and 90 days ended June 30, 2022."

[These are] highly leveraged commercial office investment groups we are talking about here…mortgaged to the gills to maximize real estate capital gains under eternal ZIRP that has ended and the only thing keeping the cash flowing was unsustainably low cost of money now cut off. Because if they had any more cash flowing they would have leveraged it into more property again. Basically, most of the market. The fast money flippers. The smartest guys in the room.

"If you're in commercial real estate you certainly want inflation, thank you very much."

The billionaire real-estate barons want inflation in the sense that it inevitably comes with keeping the huge flow of cash from the money taps wide open. In other words,“So long as you’re giving us the cheap money, we’ll take the inflation (whispering: because others will feel it more than we ever do, especially as we raise rents due to gaining control of more properties, but we won’t tell you that part).”

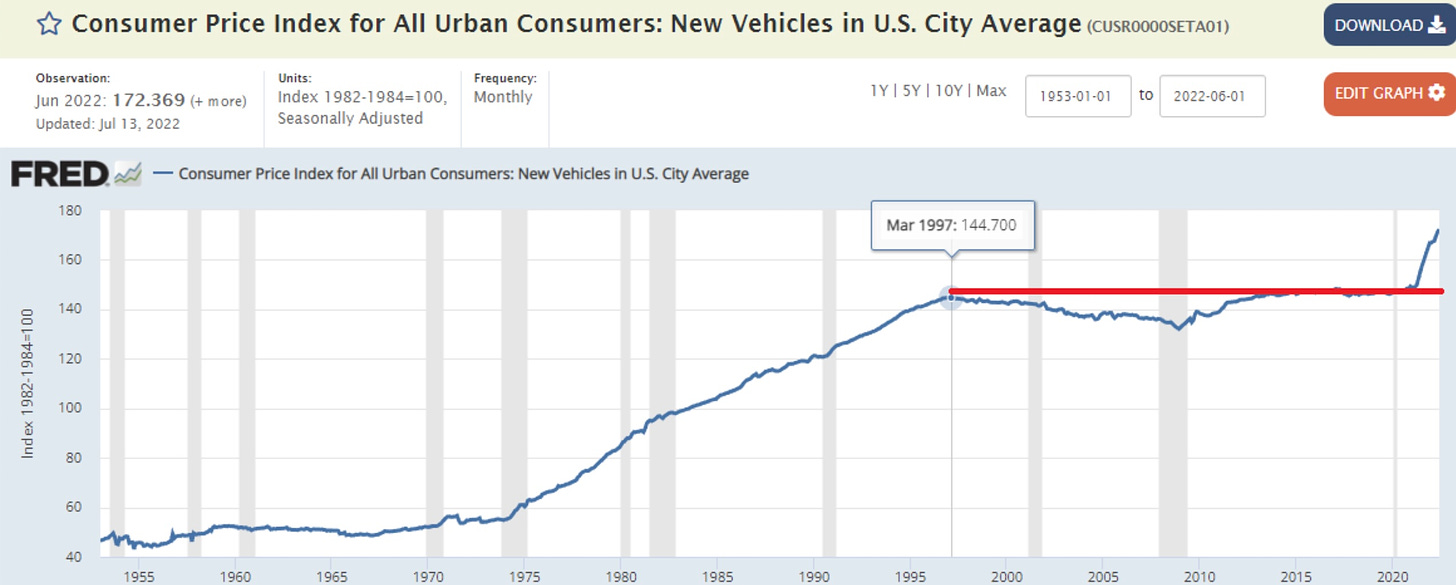

Did you know that new-car prices had not risen at all in twenty-five years until the governments of this world created the Covidcrisis? Bet you never experienced that, but here is what CPI says you experienced:

That is because cars have gotten so much better that you are now also buying alarms, cameras, video screens, and all kinds of other things for your money when you buy a car that you weren’t getting back in ‘97. So, CPI factors all of that in and says, since you are buying twice the car, it’s not the same old car it once was; you’re getting more for your money.

That is true. You are getting more for your money, and I supposed it is fair to make those “hedonic” adjustments; but here is the problem: try going out and buying less of a new car—one without any of the frills that have come along since 1997. You can’t. So, you are forced to be making much higher car payments today, whether you want to or not. You may be getting more car, but it is still just your essential transportation, and your car payment is double.

Manufacturers recognize consumers on average want all those things, or they wouldn’t add them on to make the newer models more attractive, BUT there is no lower path. So, you are forced onto an inflated budget. (Or you buy only used cars and get less longevity and less pristine prettiness due to the mileage and wear.)

Thus, when your Social Security rises due to a COLA, it does not rise anywhere near what your essential budget does because, if you buy the same single new car per decade you were used to buying to get to work, the new car will cost a whole lot more than CPI has shown for automobile inflation; therefore, SS won’t rise at all to assist with the new car prices because CPI says they didn’t rise. Thus, you become less and less able to buy a new car as you become priced out of the market on a fixed income. The same is true of numerous items that are adjusted for “hedonics” where you don’t have a choice but to buy an item with more frills, so your budget rises more than your income.

There was a recent time when almost no one at the Fed was even concerned that inflation was rising well above the Fed’s target. They didn’t seem concerned about inflation at all. Here are some old headlines:

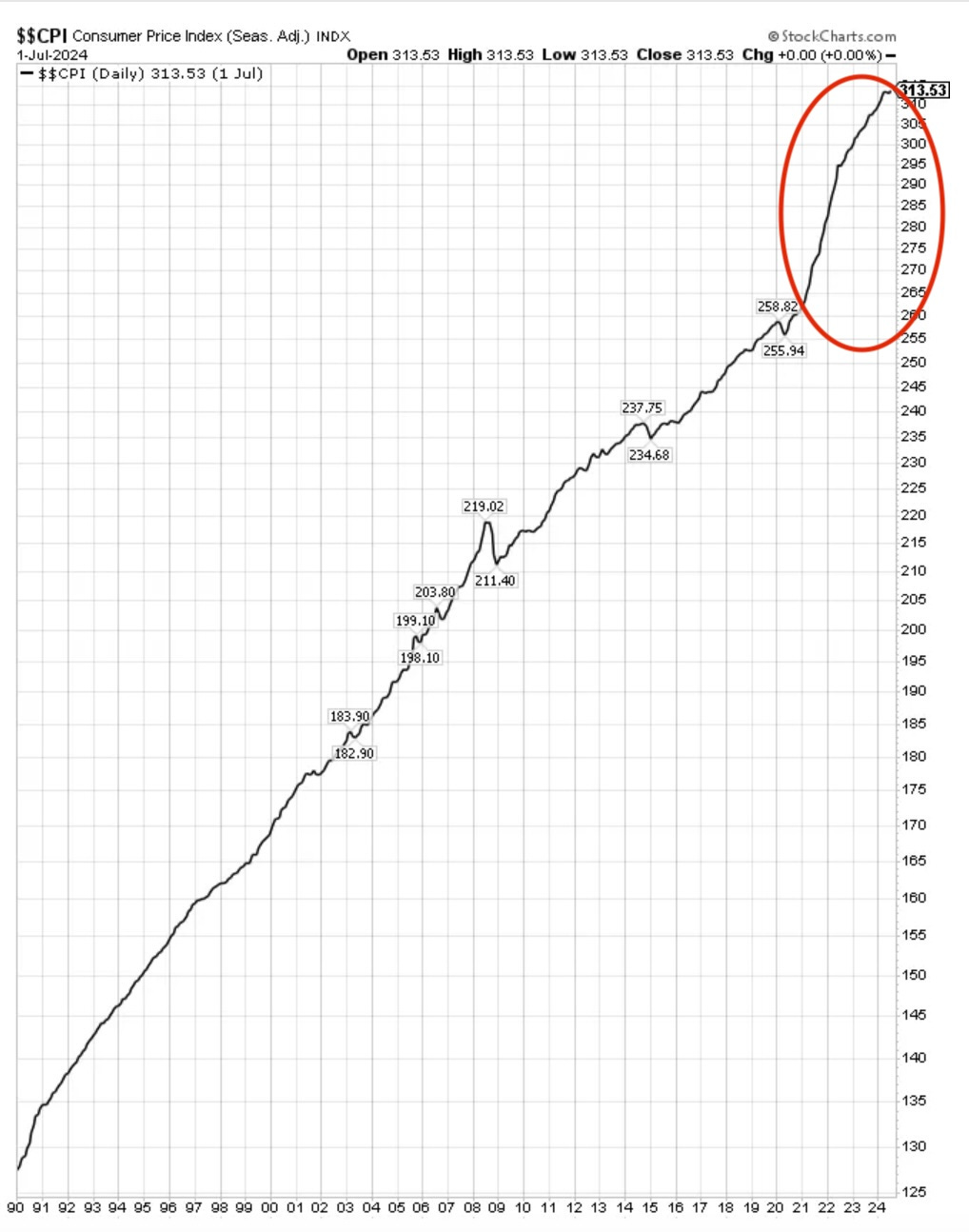

Well, we more than made up for the “shortfall” in inflation that Bullard said we needed to make up for:

In fact, it’s hard to see where this “shortfall in inflation” ever occurred, as the Fed’s Bullard described back in the days when inflation was clearly only “transitory.” Squint and you can find the downward blips that we supposedly needed to make up for.

The damage to you from the Fed’s mistake about inflation will never go away. There will never come a time when the Fed intentionally reels prices back down to the where they were before Covid shortages and massive money printing jacked them up far above their 2% goal. A deep recession or depression could bust prices back down, but not the Fed.

You can blame the Fed and feds in consort because inflation comes from too much money chasing too few goods, as was the situation we obviously had when the governments of the world forcibly shut down production and transportation, gumming up supply chains for many months, while doling out huge amounts of helicopter money created by Fed financing to rain down on the masses.

All future inflation will be from this new absurdly elevated base line up at the top corner of that graph, even after the inflation battle is ended, so even the old 2% target will never be what it was a few years ago in terms of its dollar impact because its 2% on the much higher number of dollars that everything costs. You are condemned to these prices for the rest of your life.

Remember when the Fed, prior to Covid, struggled to get inflation to move up to 2% like it was something they just had to do, and Powell said he wanted to see it move a little above 2% for a considerable time in order to average all the prior years that had been lower to where the average would hit 2%? (A “semetric target” for inflation, he called it.) Do you suppose he now wants inflation to move below 2% for a number of years in order to average out all the excessive inflation he managed to create? I’m pretty sure his sense of symmetry never works that way—even though, by definition symmetry should. His talk of cutting interest rates while inflation is still 50% above his 2% target shows he’ll never do that. There was NEVER going to be symmetry. Otherwise, he’d be talking about the need to take inflation down to 1% or less for a good long while. That will never happen … at least, not by plan.

For all of us, letting the average from the past remain under 2% would have been practically a gift, compared to what we’ll have from this point forward, thanks to the Fed’s gross errors in judgment. There was no reason we needed to see inflation run a little over 2% to try to get the average up. How would raising a past average already set in place accomplish anything the economy currently (at the time) needed? They were all already saying “the economy is strong and resilient” and “the labor market is too tight” (too many jobs in their view). So, why did we need to raise inflation above 2% with more stimulus?

The Fed eventually had to move on bringing the soaring inflation they created down because, as Powell said, “People hate inflation. Hate it!” (His emphasis.) Politically, fighting inflation became necessary to avoid rebellion. He also had to do it because inflation would have gone completely out of control if they didn’t fight it.

(See Rudy’s article for a number of good video clips toward the end where you can see how forked their tongues are as they speak and hear the quote above.)

Inflation is a tax from the poor that goes to the rich

It comes from creating money for the rich to invest at low interest (often in the form of “carry trades” that became hugely popular), benefiting the rich by lowering the entry cost of their financing. It hits the entire income of the poor and much of the middle class because they spend every dollar they earn from month to month. What little they do save gets no interest. They don’t get to beat inflation with investments that provide more than inflation because they have little or no excess to invest. They cannot afford the risk. The rich, on the other hand don’t spend all their money. They invest most of it in investment vehicles (as opposed to used cars) that beat out inflation.

With that in mind, I’d ask to what disasters do excesses for the upper class and abuse of the lower and middle class lead? Let’s look back to the inflation of the Weimar Republic and the post-World-War-One days to find out:

The middle class was hurt more than any other, the savings of a lifetime and their small fortunes melted into few coppers. They had to sell their most precious belongings for ten milliard inflated marks to buy a bit of food or an absolutely necessary coat, and their pride and dignity were bleeding out of many wounds. Bitterness remained for ever in their hearts. Full of hatred, they accused the international financiers, the Jews and Socialists - their old enemies - of having exploited their distress. They never forgot and never forgave and were the first to lend a willing ear to Hitler's fervent preaching.

—Lilo Linke, ‘Restless days: A German girl's autobiography’