My latest Deeper Dive did what I could to take down any remaining false hope that inflation is now over, but over the weekend I’ve found other articles that add support to my position, so I’ll share those now with all readers of The Daily Doom.

Let’s start with a summary statement from this article on Seeking Alpha where you have to be a member to be reader:

September CPI rises more than expected, indicating inflation risks remain

Disinflation appeared to stall in September as the Consumer Price Index rose +0.2% M/M, stronger than the +0.1% expected….Besides the increase in shelter, motor vehicle insurance, medical care, apparel, and airline fares contributed to the core CPI's M/M rise….

"This was a troubling inflation report because shelter rose by only 0.2%, and yet, the core CPI increased by 0.3% M/M, which was higher than expected," said SA Analyst Damir Tokic. "Given the strong labor market report, and two consecutive 0.30% core CPI prints, the Fed is likely to pause the easing campaign in November, which is not good news for the stock market."

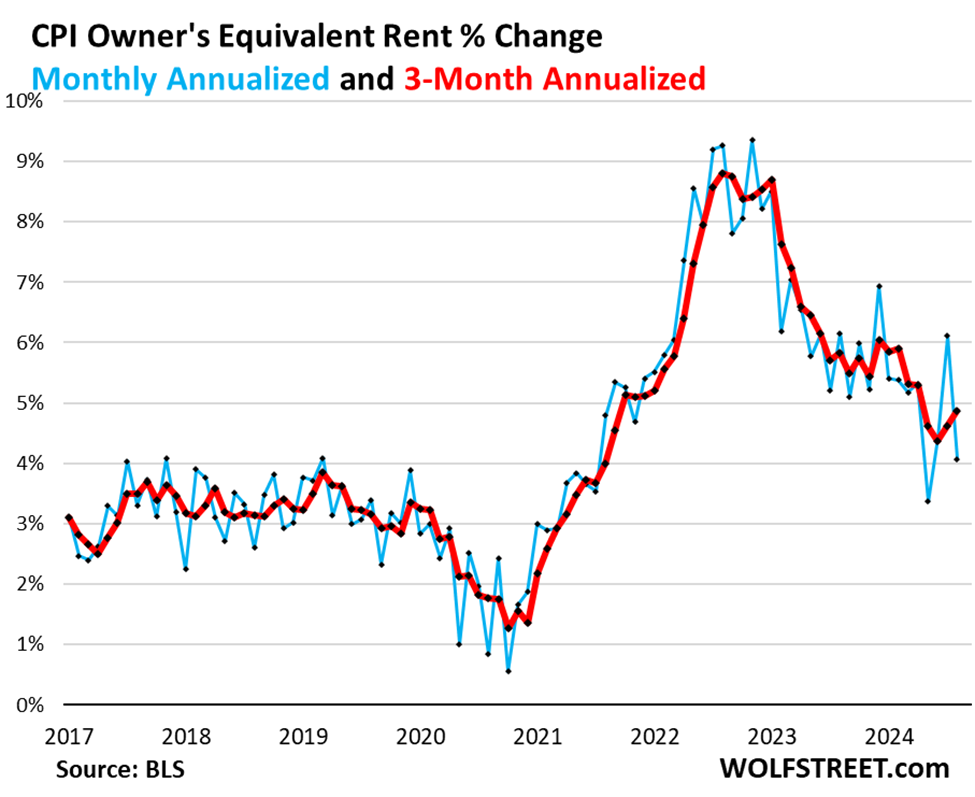

As with other articles I counted in my Deeper Dive, they lean on some hope from shelter. However, as I argued in that Deeper Dive, we already know that shelter increases are going to price through to CPI because their lag time is up. One lame financial writer wrote (because he’s not thinking things through at all),

This number might not be as bad as it looks because shelter slowed sharply. That’s important because housing costs have been the biggest lingering issue for inflation.

To which I countered:

Except that real shelter prices didn’t slow at all! And we all know that. So, shall we make-believe that the year of rising house prices that followed beyond the lag time that just started to price through with the two previous reports didn’t happen? We also know that homeowner insurance, included in this category, has pushed up a lot in many parts of the country lately; yet the cost of homeownership went down? It doesn’t add up at all.

Here, is what I showed happened with shelter, and you can see that one big down month (blue) did not reverse the new trend in the red line that is just started pricing through:

I won’t share any of the rest of that privileged content, but that gives the gist of my analysis of CPI.

Background inflation

The geiger counters that are ticking off about the background radiation levels of inflation are starting to buzz now. We can’t see what is happening, but we can hear about it, and it can burn us whether we see it in CPI yet or not.

What I’ll share today for everyone is the latest articles to come in that express the same view that says inflation is about to throw Powell & Company into the very perplexity I’ve long said was coming for the Fed—the corner they’ve painted themselves into.

Wolf Richter just wrote two more articles on the subject. One of them is titled right to this point:

That is exactly what we are going to get if the Fed does keep cutting rates as it indicated. They may stimulate us out of a recession, but I don’t think it’s going to be higher speed—just maintaining speed above stall speed for longer—but it will be at the cost of shoving inflation right back up to where we have to do this all over again. That would be a major loss for all of us.

Richter writes,

That scenario is re-emerging as a real possibility in recent economic data.

When the Fed cut its policy rates on September 18, it looked at labor market data showing a sudden slowdown of job creation to weak levels, and it looked at decent consumer spending data, so-so income growth, and a very thin and plunging savings rate. And the trends looked lousy.

But starting 11 days after the Fed’s decision, the revisions and new data arrived. And the whole scenario changed.

Wolf notes that consumers have held up because the Fed created a lot more money in their pockets than the data first showed, but those data points recently got revised to be reflected in the latest data:

Massive up-revisions of income and the savings rate resolved a mystery: Why consumers have held up so well. And they brought growth of GDP and GNI (Gross National Income) back in line by revising GDP growth up some and GNI growth up a lot.

Except that it looks VERY election-yearish for gross national income or also gross domestic income (GDI) to get revised up to match with GDP when there is a disparity between the two. GDP almost always winds up revised down to match GDI when the two drift as far apart as they did this past year. So, only in an election year…

I don’t think the true state of the economy changed by much, much less as much as the government is making out in this election season with GDP and now upwardly revised GDI and GNI. Richter trusts their data far more than I do, but we agree on his first statement here:

The magnitude of the revisions was astonishing, and we speculated here the large-scale influx of legal and illegal migrants – estimated by the Congressional Budget Office at around 6 million total in 2022 and 2023, plus more in 2024 – was finally getting picked up in some of the data. A big part of them have joined the labor force, and many of them are working and making money, and spending money, thereby increasing the income and spending data.

I guess that helps them, and certainly the revisions were astonishing.

Remember the jobs data that got a massive downward revision of 812,000 for the year that ran from March 2023 to March2024 because the government was grossly overstating jobs? Well, now this year’s jobs data has been hugely revised up in October just in time for everyone to feel good before the election. (I have no idea why anyone would trust upward revisions at this juncture when they just proved they overstated things for an entire year in 2023.

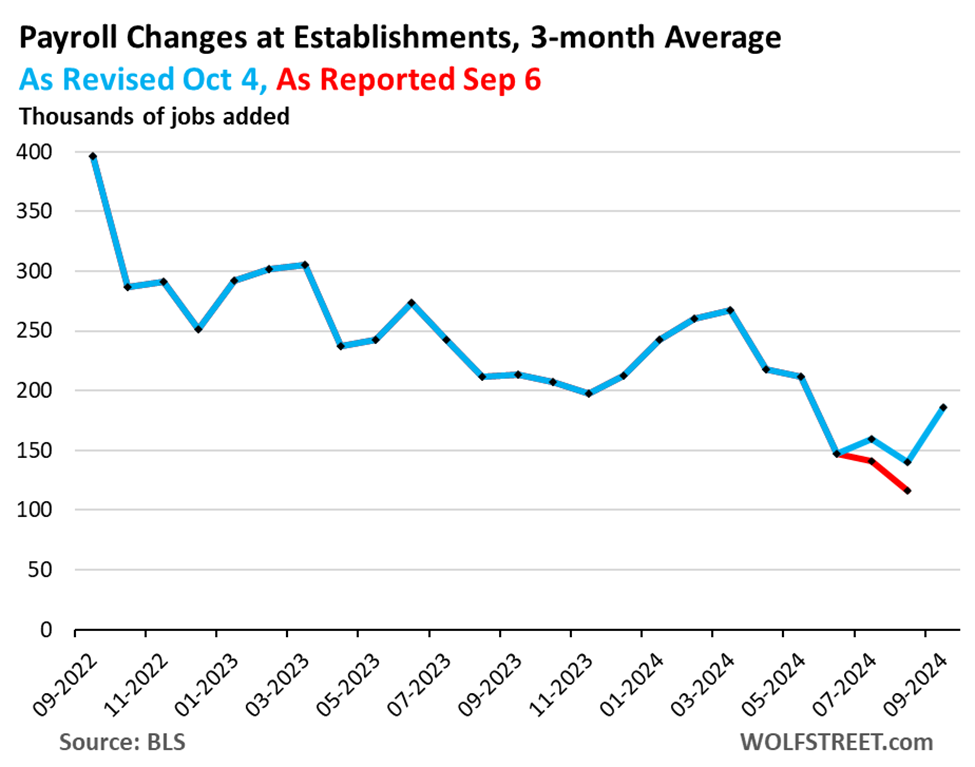

The primary reason cited by the Fed for the 50-basis-point cut was the sudden deterioration of the nonfarm payroll data: The three-month average of payroll jobs created had slowed dramatically in July and August in part due to downward revisions of prior data, and we pointed that out at the time, it was a disconcerting sight.

But with the strong September jobs report came the up-revisions of prior data that prompted this headline here: OK, Forget it, False Alarm, Labor Market Is Fine, Bad Stuff Last Month Was Revised Away, Wages Jumped. No More Rate Cuts Needed?

That’s if you believe anything the BLS reports anymore. It’s all too convenient if you ask me. And the very presence of such huge revisions in both directions says they don’t know what the heck they’re doing. Even Richter notes,

There is nothing like data whiplash.

And all revisions in the election direction; i.e, in the direction that will look good for the incumbent. Here’s where they took jobs: (Red is the old position.)

A downright cheery uptrend compared to the hole jobs were cascading into. Oh well, problem solved with revisions. Except that, for me, you have to convince me there is some reason I should trust your revisions more than your original math, which you are admitting was off … especially when the revisions so perfectly suit the message you really wanted to share but didn’t find a way to do so with the old numbers.

Moving right along …

Core CPI, which excludes energy products and services and also food, accelerated for the third month in a row in September to +3.8% annualized (blue line), which caused the 12-month rate to accelerate to 3.3% (red line).

Then Richter notes something I’ve been saying for months (as I’m sure he has, too):

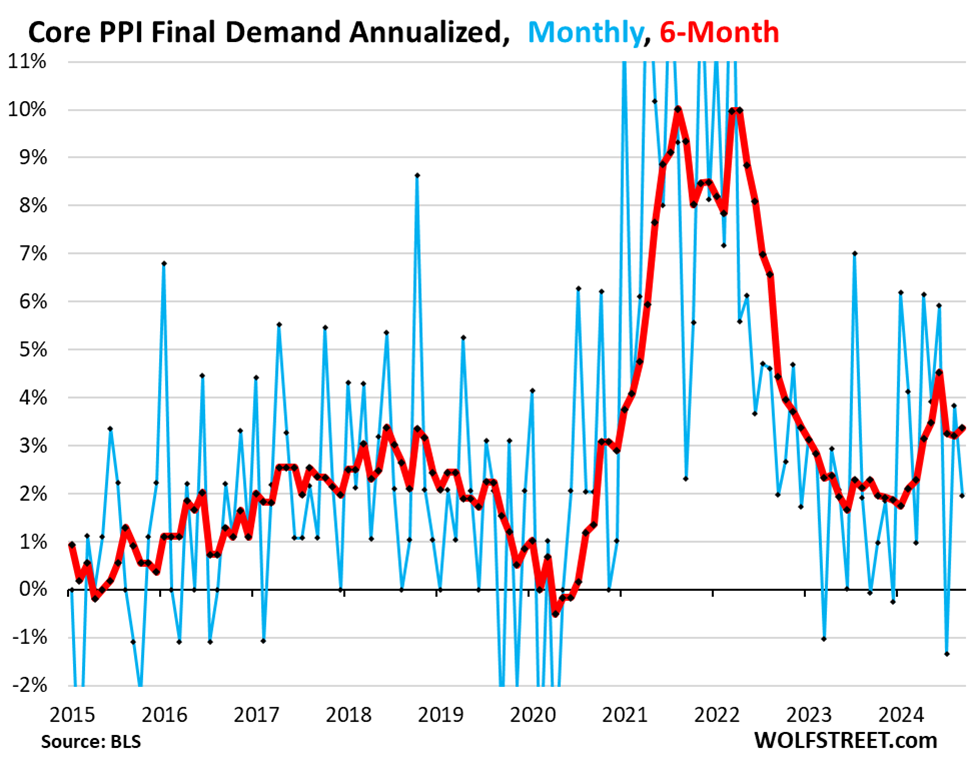

Inflation at the producer level – beyond the plunge in energy prices – has been going in the wrong direction all year, driven by accelerating inflation in services, after benign readings last year.

And that has been a big part (but certainly not the only part) of why I’ve been saying we’re in for another run of rising inflation. Producer inflation prices through to consumers as products hit the shelves.

And on Friday, the core Producer Price Index was made a lot worse by big up-revisions of prior months, which caused the six-month average (red) to accelerate to +3.4% annualized for September. Last year, it had hovered nicely around the 2% line.

You can see in Richter’s graph that producer prices were running up through almost all of 2024, then they crashed for a month, but now they’ve returned to rising:

All of that upward section needs to price through. I said in my last article that the Fed would wind up having to make the transitory argument all over again if they reduce interest rates any further in the face of these rising inflationary pressures (but they’d need to find a new word to sell the argument because they already wore the first one out). Richter makes the same argument:

The Fed called this phenomenon “transitory,” and we called the Fed “the most reckless Fed ever….”

Fed governors have … diverging opinions on just how restrictive the current policy rates are – but they agree that they are restrictive, at least to some extent.

But what we’re seeing in the economic data is that policy rates may not be restrictive after all, that the “neutral” rate may be higher.

The rise in background inflation (producer inflation) certainly indicates we are not in a price-restrictive environment. We’re going to get burned by more inflation and then by more inflationary cures:

Some sectors have gotten hit really hard by those higher rates, especially commercial real estate, which has been in a depression for two years. For CRE, which had entered into a frenzy during ZIRP, financial conditions are strangulation-restrictive now. But that may be helpful in wringing out some of the excesses and in repricing properties to where they make economic sense….

But other sectors are flying high and are ascending further, including consumers….

The problem arises if inflation gets on a consistent path of acceleration. Powell and Fed governors have pointed at this risk many times. They’re fully aware of this risk. They’re leery of inflation going the wrong way again in a sustained manner. Inflation has been going the wrong way in recent months, but for a sustained acceleration, we’d need to see a lot more bad data, given how volatile the data is, to establish a solid trend. And they’re leery of that. They have not declared victory and have said so. But the media has declared victory over inflation, no matter what the Fed or the data say.

You won’t hear this financial writer making that false claim. Here you have consistently gotten the news that you can expect inflation to start rising for a second time this year at the end of summer due to these back pressures and other’s I’ve been bringing up—just like you got the news (before it happened) about how it was going to rise in the first three months of this year.

No matter how unpopular the truth is, it is the only thing I am interested in sharing … as best as I can suss it out from all the detritus in the mainstream financial press. That usually means looking at the numbers behind the numbers and reading between the lines of reports. I do the dirty work so you can just read it, hoping some will find that worth supporting.

Richter is a little friendlier to the Fed than I am in terms of how they can correct their mistakes if they loosen things up too much. I’m not inclined to forgive them at all. I’m sick of this ride, and the mere thought of having to begin even the last leg or two of the journey again is nauseating to me. Last time the Fed made such a mistake, however, we had to do the whole fight all over again because inflation leaped higher than where it had been when they first started the battle.

I say the Fed simply does not serve its mandate. Restrict its directives to just maintaining the currency at a stable level of a “symmetrical” 0% inflation. I have no sympathy for their argument that we are all better off if they reduce our net worth by 2% a year!

More where that came from

So, now we come to Richter’s latest article on inflation where he pull no punches about how ugly the latest turn really was (compared to how easily the mainstream press took it):

Here he goes over some of the points I made in my Deeper Dive, so I won’t cover all of that, but you can read his article to see the granular details if you wish.

It was not just that the latest core data in producer price inflation was revised upward, but a lot of earlier months were revised upward, too. It would seem naive to me to not expect those price increases to trickle down to the consumer. While wealth rarely trickles down as we all have learned through decades of failing to see it do so, costs almost always trickle down … and even get marked up.

The PPI tracks inflation in goods and services that companies buy and whose cost increases they ultimately try to pass on to their customers.

Obscene wealth

Now, let’s close by talking about why wealth doesn’t trickle down with an article in the news today that demonstrates why, using the man most likely to become the world’s first trillionaire.

At the start of 2020, Musk was worth about $28.5 billion, according to the Bloomberg Billionaires Index. By the end of that year, he was worth around $167 billion, and as of September, his net worth was valued at roughly $265 billion, according to the index….

“If you look at the list of the richest Americans, whether we’re talking about Elon Musk or Jeff Bezos, the reason people get super rich is they start a company and they grow that company,” said James Pethokoukis, economic policy analyst for the American Enterprise Institute. “And the reason that company keeps growing and growing is [it’s] producing something valuable that people want,” Pethokoukis added.

All well and good. If you do that, you deserve to profit. I have no issue with big profits if honestly earned. However, here’s the problem, and then I’ll show you how trickle-down economics flat out guarantees the problem will be as bad as it can be:

Wealthier individuals typically have larger portions of their assets invested in the stock market, while middle-income households tend to have more of their wealth tied up in real estate.

No problem with them having it tied up in real estate, except that they do not own this real estate as an investment asset. It is shelter. It’s the home they have to live in. For most of their lives, they don’t even own. They just keep making payments on it, so it is just a cost of living. They are lucky if their investment ever recoups all the interest they pay. Maybe someday they can sell it and capture the value gained. But the real problem is that ALL of their money is tied up in the real estate because it costs them every bit of their income they can manage to pay toward it, so they have almost no participation in stocks. Nor do they get to readily use the gains on their home as income.

So, we have this situation:

The wealthiest 1% of Americans own nearly 50% of all U.S. stocks, while the bottom 50% of Americans hold about 1% of all stocks, as of mid-2024, according to Federal Reserve data….

“Wealth inequality is very much driven by the prices of different types of assets,” said John Sabelhaus, a fellow at the Brookings Institution. “One of the things that will cause wealth inequality to go up as measured by wealth concentration is the stock market.”

So, why then, I ask, do blue-collar conservatives want so badly to see the 1% pay a lower tax rate on the money they make off of stocks when those workers will have no chance of doing the same??? Clearly, the average worker is not making much money, if any in stocks, but he’s happy to see wildly rich people pay a lower tax rate on money that they do very little work to make, especially if they have someone managing their funds for them. Is it because he fantasizes someday he will stand among them. Not likely since their special tax rate that he never realizes does a lot to make sure he never will.

There is also debate over the role of taxation in contributing to wealth inequality. While some … argue large compensation packages are the reward for creating a successful company, others … say loopholes in the tax system create an unlevel playing field.

They create a massively unleveled playing field. A special capital-gains tax rate gives the 1% a lower tax rate on the area where they make most of their money, and almost none of the population below them make any money in that area. On top of that, there are all the loopholes:

“Over the past quarter century in particular, changes in tax policy have made it much more difficult to tax the rich,” Sabelhaus said. “There are many more exclusions, many more ways to get around paying taxes.”

The worst of which is the special capital gains tax rate implemented under President Ronald Reagan in the first trickle-down economics that never trickled:

Many Americans primarily earn their income by trading their time and skills for a paycheck, which is taxed based on how much the individual earns.

Not so the rich. However, the majority of the working middle class and poor willingly allow the rich to pay less than the rest on the easiest money in the belief that it will somehow trickle down, in spite of forty years showing it never did, and they are willing to continue to allow that situation. You’d think there would have been a massive peasant revolt by now, but the peasants keep arguing against raising the tax rates of the rich up to match the top rate for hard-earned wages.

“If we think about income as being sort of the improvement in one’s ability to spend over time, you and I have paychecks. And those paychecks measure how much we can spend,” Sabelhaus said. “Musk … has a gigantic compensation package. But even that package, only a fraction of it shows up as taxable income because much of it is in bonuses and other ways of getting paid that make it easy to avoid taxation.”

Not only do Musk and the rest of the Muskateers pay a lower rate on the money they make from capital gains, but it is ALSO ALL ALREADY TAX DEFERRED LIKE A 401K. They pay no taxes on the money they are making until they take the profits, which may be decades down the road. In the meantime, it continues to compound tax free. That may be as it should be, but it certainly makes giving them a special discounted tax rate on top of that benefit when they finally do realize the profits OBSCENE.

The working class keep falling for it. You used to hear the all-time favorite of many Rush Limbaugh making the “conservative” argument that the rich already pay something like 70% of all the taxes, even though they amount to less than 10% of the population. He used that argument to claim taxing them harder was civilly unfair. It was just envy. However, the truth Rush never told was that they paid 70% of the taxes because they were making 80% of all the wealth—something few of his listeners ever guessed at because it was too obscene to imagine. That means, that if they only paid the same percentage as everyone else, they should be paying 80% of all the taxes!

It’s obscene.