The languishing labor market has been the Fed’s path to peril, as I wrote yesterday in assessing how the Fed’s latest moves were perfectly predictable. I tried over the past year to lay out each step the Fed and the stock market would take together, and they followed those stepping stones like the Yellow Brick Road. Unfortunately, the market kept getting waylaid at the poppy fields, but that, too, was part of the predictions.

The languishing labor market has been the Fed’s path to peril, as I wrote yesterday in assessing how the Fed’s latest moves were perfectly predictable. I tried over the past year to lay out each step the Fed and the stock market would take together, and they followed those stepping stones like the Yellow Brick Road. Unfortunately, the market kept getting waylaid at the poppy fields, but that, too, was part of the predictions.

It is interesting to see how predictable the Fed’s tightening was — in spite of the fact that the Fed, itself, failed at every meeting, as Powell admitted yesterday, to accurately predict its own path as to how much it would have to tighten in order to fight inflation. Even the market’s denial about the Fed needing to actually tighten harder and faster, rather than pivoting back to easing, was predictable throughout the year.

What follows are some of the main stepping stones in my articles since last November so you can see how the Fed and Mr. Market took every move:

If money pours into the hands of businesses and/or consumers without resolving the supply-chain issues, it will greatly increase inflation without increasing the number of goods and services produced and sold. The Fed cannot create products. Right now, neither can businesses. So, the excess money goes to scrambling for the limited products and services that can be had.

“Warning Signs of Recession in GDP and Especially its Components” (November 5, 2021)

Anything the Fed does to save the stock market in this situation makes inflation worse. That, as I pointed out in that patron post is the key reason this time is different. That is the trap the Fed set for itself over time. When do you remember a time when the Fed was tapering or tightening as the economy declined when the Fed also had to battle scorching-hot inflation?

“How Bad Is the Stock Market Rout Now, and How Bad Will its Collapse Get?” (January 7, 2022)

Don’t expect the Fed to just rush back in and save crashing markets as it has so easily done in the past. I keep reading people who are confident the Fed will do that this time as it has in past times. It cannot do that without fueling the inflation death spiral. That is why this time is altogether different. Trying to save markets that cannot withstand the tightening the Fed now must do because inflation is forcing the Fed’s hand, would mean we would be starting down the hyper-inflationary path toward the Zimbabwe dollar. It’s not likely the Fed wants to see its money burn up like that.

“Why Inflation is Not Going to Give the Fed a Break” (January 22, 2022)

Why the Fed MUST keep tightening as stocks crash

During the present stock dump, it’s important to remember that, for the first time in the lives of many investors, there is no Fed safety net under the stock market to arrest its fall, and here is why: The Fed will continue to tighten under inflation, regardless of what stock and bond markets do, because it has to. The Fed has a LEGAL MANDATE to control inflation. It is one of the Fed’s only two mandates — to 1) control inflation while 2) keeping the job market strong and tight….

It will be hard for the Fed to argue the job market is not strong and tight (even though it isn’t) when all the metrics the Fed traditionally uses before congress show employers just cannot find enough laborers for the numerous jobs offered, and official headline unemployment is very low, making the job market really tight and beneficial to the wages of laborers. I have explained elsewhere why this is a false scenario, but it is the scenario the Fed has been presenting to congress for months now.

I spent the entirety of last year arguing against the Fed on that and against others who thought I was nuts, laying out heaps of evidence over many months as to WHY inflation was not transitory and would become scorching hot, as it has, and why that would kill the stock market. I believed that enough to bet my blog on it, saying I would stop writing on economics if inflation did not rise enough to force the Fed to tighten quickly and kill the stock market….

That is what is key to understanding why inflation WILL kill this stock market bull….

Of course, the stock market is going to lend the Fed a hand there by becoming the new money incinerator to burn that fuel off as money that only existed in computer accounts gets written down rapidly. Think of that as the “flash” tower in a refinery that rapidly burns off fuel when there is trouble in the system. What was mistakenly thought of as wealth is going up in curls of fire and smoke as I write. (I say mistakenly because this phantom wealth was all built on debt, making for easy stock buybacks and easy dividends, not on actual fundamental productivity and profits and capital investment for a more productive future. I am not saying there was no productivity or profits, but I am saying those are NOT what was paying for all those massive stock buybacks over the past decade that pushed up stock prices into bubblicious heights.) Easy come, easy go.

“The Money Pump is Working to Drain Stocks … and There is No Safety Shutoff!” (January 24, 2022)

Evidence is abundant that says millions of disenfranchised people abandoned the workforce for good. Suddenly we saw a huge gap up in job openings. Was it because the economy started booming? Were new factories being created? New service companies opening up? All the stuff that means we cannot be going into recession on the basis that an expanding economy is tightening up employment?

No. It was solely because millions of people did not return to work, including 3.5 million new retirees [as I originally thought, too], so those employers that reopened after the lockdowns had to relist those jobs to find help. Evidence of that is heard from the witness of countless employers complaining about how they cannot find workers even after they raise wages rapidly….

The labor market is NOT tight because the economy is strong. It is tight because the economy is broken. By “the economy” I do not mean the usual falderal of economic statistics. I am talking the actual skeletal structure and musculature of the economy — the things that make it work. It’s badly broken. Labor is not coming back, so there will be no improvement on the production end for a long time….

NORMALLY, we think inflation is hot because the economy is hot. That is not always the case and certainly is not now…. However, people in the US are used to thinking that is always why inflation runs hot to where, if the Fed has to fight inflation, it must be that it needs to cool the economy. And they find the metrics that support that, but they do not look under the hood to see if something is truly broken….

Inflation will remain hot while the economy remains less productive. That is the exact chemistry for a stagflationary recession where all the excess money the Fed and feds have pumped into savings does not jack up the economy because the economy is broken in ways that cannot be fixed just by throwing money at it….

The Fed can do NOTHING about the shortages that are keeping inflation high. And here is what makes it even worse: those product shortages are, in themselves, a factor, over and above labor shortages, in the slowdown of production.

The Fed cannot fix any of that. So, as I put out my next article that shows how rapidly evidence is changing to show we ARE going into a recession right now, bear in mind that the usual way of looking at a tight labor market and inflation as a sign of economic vibrancy, is not applicable at all right now…. This inflation is due to economic decline caused by the COVID lockdowns that shifted labor demographics considerably….

“This Tight Labor Market Actually Assures a Stagflation Recession” (February 1, 2022)

All of that was written before we got ANY economic report of declining GDP, but I kept saying the quarter would come in with negative GDP, as it did when reported two months after writing that last piece.

This is the third time the Fed has expedited its tapering schedule (once when it announced tapering sooner than most expected back in October when it had been saying until that moment “inflation is transitory,” then in December when it doubled down on its rate of tapering and set it to finish around the end of March, instead of June, and now that it has moved the terminus up to early March to squeeze it in ahead of the FOMC meeting so that the FOMC can leap straight into interest hikes). Thus, as I wrote all of last year, hot inflation will grow hotter, and the Fed will be behind the curve, so inflation will force the Fed to taper faster and then to taper faster still. Here we are….

And that’s why I said all of last year this inflation will heat up until it lights the Fed’s back on fire, forcing the Fed’s hand to stop inflation and kill the stock market and send us into recession, or inflation will do all of that for us if the Fed fails to act.

“Passengers Scream Recession as Powell Dives His Plane for a Soft Nose-Cone Landing” (February 18, 2022)

Then the first negative GDP report of the year came out, and I wrote the following:

Due to certainty about those shortages getting worse and inflation getting worse even back then, I also warned you to start laying in extra supplies of all the things you actually buy because, even if the shortages didn’t get too bad in your neck of the woods, you’d save money by purchasing ahead of the worst inflation you’ve likely ever experienced. I’ve never recommended that kind of prepping to my readers before, and I’ve never needed to (as it has turned out). That is because I’m not a gloom-and-doomer; I’m a realist….

It will be take more time for this recession to pull down inflation than the Fed has time politically to wait it out. The Fed knows it has to be seen as fighting inflation. Even if it cannot solve this kind of inflation, based in part as it is on shortages, it certainly cannot be seen fueling inflation even higher by dumping coal into the firebox….

Stocks have already entered the bear’s polar climate I predicted this inflation and the Fed’s tightening would take them into….

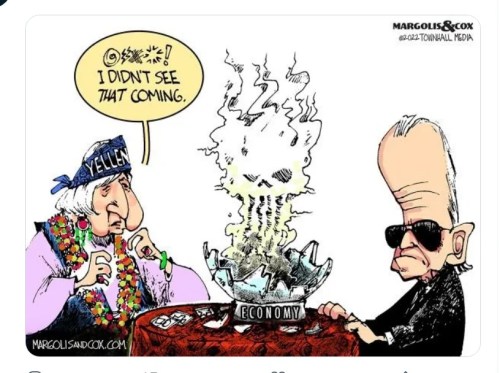

If you are inclined to listen to the people who have constantly misguided you like Jerome Powell and Janet Yellen and the “bearish” Deutsche bank or Goldman with all their Sachs of gold and all the far more sanguine banks when they tell you this recession is “transitory,” just remember they also all told you inflation was transitory when I kept calling them liars or fools for thinking so. So, you can believe in them because of their credentials, but you do so believing people who have been steering you wrong on all of this for two years. As the facts are now in, there is no excuse for believing anything more they have to say….

In spite of the stock market’s delusion today that the Fed can now go back to money printing in order to drive stocks up, inflation will do exactly as I have said — burn so hot up the Fed’s backside that it will force them forward into tightening even as we are now in a recession. That will make this the roughest “tightening into a recession” any of us have ever seen.

“US Economy Crashes Headlong into Recession!” (April 28, 2022)

If inflation in prices still exists as the economy recedes because goods are becoming scarcer even as money is not circulating as quickly, the Fed has two ugly options: Curb the inflation by cutting money supply to make money even more scarce, but that will turn the recession into an all-out depression by making people cling even tighter to their money….

The Fed is hoping to avoid the recession part of the demand-destruction that it has to engineer if its going to curb inflation by taking away money supply….

The picture I’m trying to paint is one that shows stopping this roaring inflation is a multi-dimensional mess because the Fed has no control over the global supply problems that are rapidly proliferating and causing recession, and it cannot both goose an economy that is slowing due to supply-side recession and cut money supply to curb demand and reduce inflation. Those goals are mutually exclusive….

There is no path here that works. In the past decade, if the Fed’s tightening caused problems, it rushed back in with astronomical amounts new money because it couldn’t seem to cause inflation to save its soulless self anyway….

This time, the masses will be banging the Fed’s door down for money because they’re hungry and food is pricy or because their stocks are falling in a time when the Fed cannot go back to that kind of general QE, distributed either via the federal government or via new Federal Reserve individual bank accounts (as we talked about in a much earlier Patron Post) when it has to fight inflation that people are also going to be screaming about. I keep hearing investors claim the Fed will rush back to QE based on its history, but it’s not as easy as that this time. This time truly is much different because of the supply problems all over the world, and I think the Fed knows that….

There is no monetary solution to a supply-side inflationary problem. Wars have to end. Sanctions have to end. Forced economic lockdowns have to end….

I’ll show you why the vast supply-side problems that are part of today’s kind of inflation are not going away this year, so the Fed can helidrop all the money on our little island it wants, but it’s not going to restore the coconut economy. It won’t float edible and desirable bananas into our republic either, even if it turns us into a banana republic by trying.

“Why the Fed will fail to fight inflation until the recession beats it down” (May 8, 2022)

“These people need to fight inflation as fast as possible and as hard as possible. And the market has consistently been behind the curve on trying to understand how aggressive this Fed was going to be….”

Hopefully, you are among those who have accepted the fact that the Fed is not going to ride in like the Lone Ranger and save the day and that this time is different than anytime most investors alive today have experienced due to searing inflation….

A Fed save is not going to happen — not until it is way too late to matter. The Fed will arrive like the cavalry when everyone on the battlefield is either dead or writhing in blood because it has to keep fighting inflation, which is ripping into everyone one the battlefield with its teeth and claws. So, the Fed can’t rush in with its usual medicine right now even as it is killing investors under friendly fire. It’s a mess.

The Fed will fight until it sees inflation retreating just as Powell has said. He cannot run from this battle because everyone expects him to fight it, whether he can do much about it or not. After two decades in which the world has watched the Fed’s various forms of loose policy pour money into markets and create bubbles that many warned about, no one will forgive him if he cannot wrestle inflation back to the ground as it destroys their retirement nest eggs and creates significant pain in their current costs of living. If Father Powell fails, the Federal Reserve’s sole proprietary product will become decreasingly significant….

Permabulls felt secure enough at the S&P’s top back in January to scorn those who warned them, having no concept of the slope to come, because they continued to believe Papa Powell would rush back in to save them as he always has. They should have known, based on inflation, that was not even possible. The Fed set up these expectations that are hard to break, however, and now it must break them….

And it is doing it when we are already sliding into a recession, which the Fed neither sees nor believes in any more than it saw or believed in inflation … hanging on to their delirious beliefs that the economy is swimmingly strong because jobs are strong.

Jobs are, in fact, not strong at all. That is a mirage created by the simple fact that there are a lot of people who quit the labor force with no intention of coming back…. Really, the jobs market is horribly, horribly broken because it is incapable of supplying the level of workers necessary to build production back to where we need it to be if we are going to end the supply shortages that are contributing so much to inflation — something the Fed can do nothing about….

That is not a healthy job market, and economists who say that, including the Fed (which says it all the time), are thinking with their headlines, not with their heads. It is a badly broken job market that cannot deliver the supply that is needed to break the back of inflation until inflation breaks everything, including them, and burns itself out. Nothing causes prices to rise so easily as scarcity. (And, may God forbid the Fed goes back to money printing because if you try to solve a shortage problem with money printing, you go up in the flames of hyperinflation along with your money.)

“It Was Hell Week, and the Fed Can’t Handle the Heat” (June 20, 2022)

…the stock market … ridiculously believes it can defy reality and continue to head upward … believes recession will cause the Fed to pivot and start to create new money again, even with inflation ripping Powell’s face off (and everyone else’s) with NO CONCEPT of how bad the recession, itself, will be. They will WISH they were in the days of good old-fashioned Fed tightening under normal recessionary times … because … the Fed is going to keep tightening until the recession is too obvious to deny!

“Unemployment is the Cloak under which this Dagger of a Recession Hides” (August 9, 2022)

When the big bear rally occurred mid-summer, I wrote,

Stocks are at a particularly interesting inflection point. Many see the current rally and have been speculating the onset of recession means the Fed will pivot. I’ve said, “Nonsense.” The Fed will not pivot — not in time to save the stock market. This time is different. In past times, the Fed’s back was not up against the wall due to being pushed forward by inflation….

So, another prediction: the stock market tunnels to a new low before the end of the year and likely begins its longest drop of all, and the Fed does not pivot in time to save it.

“Economic Predictions for H2 2022, Part 3: Battle of the New Currency Competitors” (August 7, 2020)

And so it did.

I could quote a lot more on all of that, but you can see enough of the stones laid along the way to know it was a totally consistent theme for over a year: Stocks will keep crashing. The market stays in denial. The Fed will not save stocks. No pivot. The Fed will keep tightening higher and longer through recessionary times.

The financial story of this year was all about inflation until the battle is done and the economy lies in ruins because of the Fed’s Great War against inflation. Investors are witnessing something that many of them never lived through, though I did my best everywhere to make them aware of that, but I am a tiny voice in a world filled with noise.

In the midst of all of that, I’ve pointed out all along that the labor market Fed’s blind spot as to far it can fight before its second mandate of preserving a good jobs market can kick in and give it cause that falls within its legal mandates to stop the inflation fight. By the time that happens, the economic wreckage will be severe, as even the Fed’s partner in crime, BlackRock, was quoted as pointing out out in my last article.

The Fed has built all of its recovery plans on mountains of debt that are increasingly expanding in size like Mauna Loa. But piling up debt at a faster and faster rate to engineer recoveries from the effects of your last boom-bust, irruptive pileup is not a sustainable plan. The Law of Diminishing Returns says you will gradually get less bang for the buck until the system collapses because it can no longer be sustained.

The Fed created this mess for all of us through years of financial profligacy in which our government let it try to solve everything by throwing more money into it, rather than fixing our deep economic flaws that still remain locked in the relentless grip of greed. Now with shortages piled up all around us for reasons the Fed did not create and with scorching inflation from far too much money being created out of debt in recent years meeting so many shortages all at once, the Fed is backed into a corner where it has to fight the inflation it fueled and cannot back down from the fight.

It turns out these stepping-stones were laid across a chess board of many pieces with many possible moves, but the path the Fed would take through that maze was highlighted all along the way into this very corner. Now we stand where the Fed’s plan to battle down inflation by curbing job growth to get in line with available labor means a lot of job destruction since there are 1.7 times as many job openings as laborers right now. That means even fewer actively working people in an already hugely diminished labor force, assuring even more production shortages and service shortages at a time when shortages are already a major contributor to inflation.

Checkmate, Fed.

Besides reading The Great Recession Blog to anticipate the steps of the journey, subscribe for free to The Daily Doom to keep up daily with the news about how the Great Collapse is playing out all over the world.

Liked it? Take a second to support David Haggith on Patreon!