In the first half of 2021, I bet my blog that the inflation I had been predicting would rise so hot through the year for so long that it would kill the stock market bull. It’s time to call the bet.

Kiplinger calls my bet

Technically, my bet cleared the minimum bar for being cleared off the table when the Russell 2000 index closed in a bear market, down 20.5%, on Thursday, but that is just the start. The NASDAQ closed teetering on edge of the bear precipice, as well — down 17% that same day.

I defined the minimum bar for “Kill the stock market” with specificity so that we’d know at what point my blog becomes safe from the risk I was intentionally creating (with no one paying off if I won, but me losing everything I’ve put into writing my blog for more than a decade if I lost). If the market did not attain that specific level, I said I’d stop writing this blog. This is what I set as the minimum bar my prediction had to clear:

Inflation will rise so high and so long that eventually it will kill the stock market bull (i.e., will cause, at minimum, a 20% crash into a bear market, though I think it will eventually be down by more than that).

“Shortages and Inflation Are Ripping the World’s Face Off“

I meant the crash of a major index, of course, not the crash of a single stock or some minor index — but an index that is regularly referred to as a “major index.” While I didn’t think to clarify that, obviously I have waited until one of the major indices crashed before claiming, “I won my bet.” Of course, winning comes with nothing, but I have strong reasons for having made the bet and now proclaiming it all happened as I said it would, and I will lay those out below.

I didn’t say which of the major indices would have to fall to the 20%-or-more level that is usually called a crash or a bear market, and I didn’t make the call, myself, when it did. Kiplinger made it for me:

The major indexes plunged from green to red Thursday, but small caps took the worst of it, with the Russell 2000 now more than 20% below its November highs. The small-cap Russell 2000 fell into bear-market territory Thursday as Lucy yanked the ol’ football away from Charlie Brown yet again.

My most deplorable critic might lamely attempt to say, “That isn’t good enough!” However, it meets the minimum bar I set. That does not mean this is as bad as everything I’ve been predicting. It’s just that you have to set in advance something as the base benchmark for determining when your bet has been satisfied.

I don’t place a bet on every prediction I make. In fact, I’ve only done this one time before when my blog was spared for the same reason — at least one of the major indices went down more than 20% in the fall of 2018 when I made this same bet. So, the blog lived on. While I have laid out many statements that this will become far worse than one index hitting a bear market, I didn’t place any bet on them, and I waited until Kiplinger called the bet as a totally impartial judge of what constitutes a minimum “bear market,” not me.

Regardless, I remain absolutely certain everything will continue in a train wreck to match up to my many other statements about what this collapse of the Everything Bubble will most likely look like, particularly as I make those views more clear in my Patron Posts now that that the wreck is piling up so we can start to see its trajectory.

Why I bet everything on something that has no payoff for me

Here is why I have been so resolutely emphatic about this prediction that I truly would have stopped writing on economics for good if none of the major indices hit a bear market due to the present ongoing rise in inflation. Why? Because I’m not a fear-monger or a permabear. I have zero desire at all, even with patrons supporting me, to scare people with doom porn. There isn’t anywhere near enough money in the work I put into this to make all this effort worthwhile just for cheap thrills.

I predict these things to warn people, and if I sounded the alarm as often and loudly as I did last year and proved dead wrong, I would be a detriment to people. I would have honored by bet and packed it in just to avoid being a false alarm on predictions as massive as the one I was making, especially given that it was so different from what almost every analyst and bank and the Fed, itself, was saying. I made the bet and repeated it often in order to make it abundantly easy for any critic to hold me to my word. I wanted to make sure any and every critics I might have saw it.

For proof, if you need it, look here, here, here, here, here, here, here, here, here, and here. At that last link, I also thoroughly proved the total falsity of my most insulting and staunchest critic, who told all of his 50,000-plus readers I always have said “inflation will kill the stock market” like a broken clock. As I proved in that post, I actually never made the claim that inflation would kill the stock market at any time until last year, nor had I ever talked about high inflation as even being a likely problem in any of the years I wrote, other than the first year back at the start of the Great Recession. That is how reckless and dishonest his public criticism in numerous articles has been. He is another reason I made this bet — to say, “I am so committed to what I am saying, that I’ll promise you to stop saying it entirely IF I am wrong!”

Nor have I said every year, as he has also claimed, that the stock market would crash. This same critic even argued that inflation was not happening in 2021 and showed no signs that it would happen. This he based on his claim of superior credentials in economics and what he views as his big brain, while claiming I was something like moron to even think any significant inflation was happening, given that even the Fed was telling us that what little bit we were seeing would be transitory and that bonds clearly showed no sign of inflation. And then the Fed said it wasn’t such a little bit and was not transitory, so the Fed decided to release its grip on bonds JUST ENOUGH to let a little real price discovery start to slip in, and all hell broke loose for the stock market. So, the big brain went bust on every criticism he made!

Lame critics aside, I also wanted to have skin in the game for everyone reading me, so I made the bet to let everyone know this is how confident I was (and am) that this prediction would happen so that they would take heed and prepare themselves as they best saw fit. I wanted people to be able to realize, This guy really believes this so much that he’ll throw away more than a decade of work if he’s wrong on this one. I hoped putting some skin in the game might get some to pay a little attention to the warning.

Thus, I bet everything (in terms of this blog) on that one prediction in order to sound the alarm as loud as I could about how significant this event was going to be and how it would play out and why by putting something that has meant a huge amount of work to me behind my claim because when the time came — as it now has, though most still don’t see it — I wanted people to be able to understand what they are going through. Laying out the reasons it would happen is essential to that understanding. Laying them out in advance to it happening, I hoped would make it clear it was the right way to understand all of this.

For those reasons I made it my mantra for the entire year, just as I made the Fed’s Repo Crisis (with no stock market crash) my mantra for the year in 2019 and the Fed’s tightening leading into a market crash in the fall of 2018 my mantra throughout 2018.

So, I will not end my blog if no other indices hit bear markets because I never said they all would and because the path I laid out for all of this has happened so precisely on every beat, I am as certain as ever that we will go further down from here to where the technical nature of my win becomes a moot point. I hope this will make you certain of that, too, so you give the warning consideration.

How I said it would all play out

As I say, being able to understand what is happening now comes from my blog having laid out the how in advance. That, at least, was the goal. If someone gives you the pattern in advance, repeats it often enough for you to remember it (good teaching practice) and you, then, see it all forming, you may be more likely to accept the likelihood of the end result the pattern leads to.

Here is the precise manner I laid out as to “how” the downfall I was predicting would play out. These details were not something I bet on, though I repeatedly predicted they would happen, because I wanted people to understand the mechanism so that, as they saw it playing out, they would take whatever preparations they felt they needed to take:

- Inflation would rise in 2021 to such heat that it would cause the Fed to start to taper its QE sooner than the vast majority of investors and analysts were expecting back when I made the prediction.

- The Fed would too late in taking action against inflation because it believed (or desperately placed hope) in its narrative that inflation was transitory. The Fed’s belief in its own transitory narrative, which it convinced everyone else to believe in, would result in inflation growing hotter still to where the Fed would unexpectedly find itself forced to taper even faster, stunning investors.

- The Fed’s tapering would be tightening because bond investors would start raising bond interest ahead of the Fed, which would impact other interest, which would hit nearly all investors in an incredible blind spot that pervaded the market. Most investors and analysts fully believed the Fed’s “transitory” narrative on the basis that bonds were not pricing in any inflation. (They did not hear my many warnings that bonds COULD NOT price in inflation because the Fed had bonds tied up in the basement of the Eccles Building by sucking up more than 50% of all new treasury issuances.) The supposed experts somehow couldn’t figure out that the Fed was THE whale in the bond pool with unlimited capacity and that the exit of the whale would free bonds to price in inflation at last. That or they didn’t know what a whale was and what a whale does. This I laid out for all my readers (but first for those who support my writing) was THE KEY.

- Finally, the rise in bond yields as bonds were freed by the Fed backing out of its intense bond-hoarding market manipulation would crash the stock market.

And here is how things really played out:

The Russell began falling as soon as the Fed started tapering in November, which was earlier than many had expected. Along the way, the Fed suddenly dropped its “transitory” narrative and admitted it had been wrong about that all along. Then it doubled the pace of its taper only a month after it had set out the original schedule, scrapping its original schedule as one scraps a war plan shortly after the war begins because one discovers the enemy has other plans.

Then the bond vigilantes suddenly came out, and the news of inflation and rising rates in the bond market drove stocks down relentlessly one sledge hammer swing after another all the way to the Russell’s close in a bear market this week. The rise in bond yields has also driven mortgage rates up quickly as I said it would affect other important interest rates. And we’ve just begun!

You cannot quite call it a win if you win but the world lies in ruins around your feet because what have you won? This isn’t that kind of celebratory claim of a win. While that train wreck will take months to continue playing out, let’s just say this week reached a level that is minimally and technically enough to call the bet.

Now we have a fragile state of affairs

To demonstrate the market’s fragility because it appears it is not as obvious to some as it should be, I’m going to quote a part this week’s Patron Post without giving away any of its additional predictions about how bad this is likely to become and why:

What does it say of the market’s current fragility that the NASDAQ plummeted almost 700 points from its intraday high at the start of Powell’s speech to its lowest point near the end of his speech and then was still down 500 points from its high by the end of day, lying flat on the ground? The Dow did much worse plummeting almost 1,000 points during the day and closing down 124 points in a ditch below ground level.

Barron’s comments offer some perspective on that question:

“The Dow Jones Industrial Average has taken investors on a wild ride this week—the kind that only happens when there is a crisis afoot.… Those moves rarely occur alone—and rarely do they happen when there isn’t trouble afoot….”

These major gyrations, in other words, are not moves that keep company with good times, and the Fed’s taper is only halfway done while everyone claims (wrongly) “the economy is strong.” So, what is the big deal that is shaking markets at this kind of core level? All talk has been on inflation because of how it forces the Fed’s taper. I guess the taper must be devastating already, if the gurus are correct about the economy, and this “strong economy” is still running on high-octane Fed fuel that tops QE3! So, how much shakier do markets get when the Fed, again, doubles the rate at which it is tapering and then how much worse still at the end of March when all QE is down and done?…

Powell’s speech that sent all indices back down was as dovish as a tightening speech gets. He really didn’t say anything that everyone I was hearing didn’t already believe was the most likely scenario — that the Fed would be done tapering by the end of March and then would start interest hikes. Look at how high the market opened on pure hope at the start to the day yesterday from the day before, than look at what happened as Powell gave one of the mildest speeches one could hope for at a time like this when surely everyone knew the Fed would most likely take the course they did….

There were no surprises in the talk. It was just hearing that the Fed’s “accommodation” really is going to wrap up the way everyone thought was most likely that sent chills down the spines of all major market indices. It just suddenly got real for those who were floating on hopium, believing by denial that the end wasn’t somehow real.

“The Everything Bubble Bust Pt. 1: How Far Will the Stock Avalanche Fall?“

And that is what drove the final nail in Russell’s coffin that day and pushed the NASDAQ to the edge of the bear’s forest. Will we get the rest of the way to the kind of crash I’ve led people to believe this is going to be. Beyond all doubt, and I laid out a good number of the reasons why in that post.

To state the above a little more clearly than perhaps I did, the Fed chopped $30 billion off of the amount of QE it was adding to the economy in January, and the market broke down badly. It will chop the amount of QE it is still adding by another $30 billion in February, and it will chop another $30 billion from its addition to the economy in March and then end QE completely at the end of March. BUT all of that is still QE. Just less and less.

January showed how fragile the market is, in spite of all the testosterone pushing up sentiment because the market busted up into a bear market in one index and nearly in another while we are still at massive levels of Fed economic stimulus! The market simply couldn’t handle having that reduced a little and then be squared with the reality that the Fed is serious about continuing to do what it already said in December it would do! AND WE DON’T EVEN START DIRECT FED TIGHTENING UNTIL APRIL!

This is, nevertheless, the fastest and biggest transition out of easing the Fed has ever done! While we are still high on the easing opiates, remember the Fed started tapering QE3 in January 2014 and transitioned over the course of a full year to being done with QE on January 2015, AND that was tapering from a much slower and lower level of QE with virtually no inflation and NO plague and no busted up supply lines.

How bad is the stock-market crash so far?

Let me present a couple of graphs to verify we’ve hit minimal crash levels.

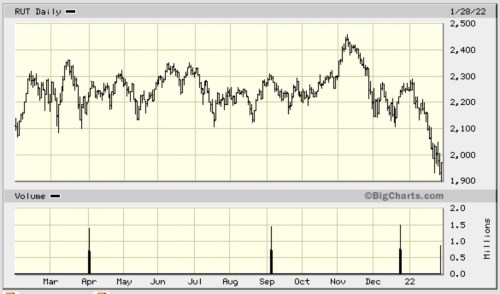

Primarily (the proof of my claim), here is the Russell 2000’s trip into the ground over the past year, now leaving it six feet under:

As you can see in the Russell’s fall from grace, Russell did nothing but churn on his death bed throughout the past year of rising inflation because it was already crimping his style, but he did not fall until exactly when the Fed started its taper in November where it had a micro-melt-up, and the all hell broke loose. Russell experienced a couple of relief rallies like an Alzheimer’s patient in December, and then January took him home to be with the Lord, as they say. Russel rests in peace. (Well, not really. He’s in hell and has a lot more perdition to come, but his decline in the end came relatively quickly.)

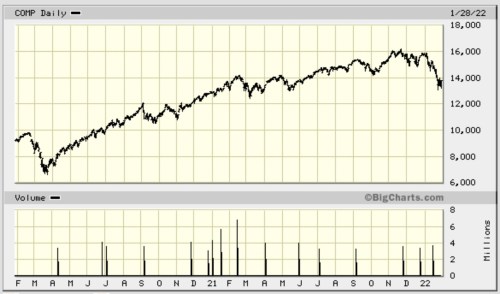

And here is the NASDAQ’s fall: You can easily see it is has taken a pretty spectacular plunge so far, trending slightly down as soon as the Fed’s taper began, and then going over waterfall as soon as the Fed significantly picked up the pace of its taper in January:

On a point basis and for shape and steepness, this January cliff-dive looks almost exactly like the spectacular and historically record-setting crash of 2020! Of course, on a percentage basis it is not, but it is still pretty darn bad at down 17% and bears the same shape and steepness. Because of how rapidly and hard it has fallen, I would expect some kind of relief rally is likely now that there is a little consolidation frothing at the bottom.

Unlike in 2020 when the Fed poured rocket fuel on the economy throughout the the market’s crash and the federal government joined it at the end to help with helicopter money to everyone everywhere, there is no rescue team at the bottom of this waterfall. So, don’t expect the rally to keep rising to new heights if we get one. There is nothing to help push it up. The last fall took the most extraordinary team-effort push in history by Fed and feds to get it back up.

As the Financial Times just declared,

Now investors large and small are watching the bets that defined a speculative craze deflate as the Federal Reserve retreats from the stimulus programme that has kept markets flying high for close to two years.

Prices of meme stocks, cryptocurrencies, cannabis companies and blank-cheque vehicles known as Spacs have all tumbled as the air hisses out of the assets that encapsulated that furious rally, leaving no doubt that the game in markets has changed….

The average stock in the Russell 3000, a broad gauge of the US equities market, is down about 35 per cent from its highest point in the past 12 months….

In the Nasdaq Composite, home to scores of fast-growing companies that were in vogue during the depths of the pandemic, the average decline is approaching 45 per cent.

In other words, a LOT of investors in individual stocks are feeling a lot of pain right now. The ones who simply ride the indices are being carried along by a handful of high risers, something I lay out in greater detail in my Patron Post.

Remember, we are only halfway through the taper with QE still running as strong as it was during any one of the three big QE cycles of the Fed’s “Great Recovery” from the Great Recession. As I said: in February, we cut that level of support by another $30 billion as happened in January; then we do that again in March, and then, at the end of March, we end it completely. Stomp, stomp, stomp. Only that is not even stomping. It’s just letting the air out; then the Fed starts stomping. The Fed hasn’t even begun to raise interesest rates or to actually unwind its balance sheet, sucking money out of the economy. So, the fun on this roller coaster is clearly just beginning!

“The huge intraday movements are indicative of the challenge that the market now faces, which is that financial conditions are going to be tightening,” said Yung-Yu Ma, chief investment strategist at BMO Wealth Management. “As new information comes in, as markets overreact in one direction or another, this type of volatility and some of these swings are probably going to be with us for some time, given the nature of what the market’s trying to price in….”

“The lows may not be in yet on this kind of correction….”

“And on Friday, the Fed’s hawkish tilt received as-expected support from another high inflation print.”

This early in the mere taper, Bank of America sees it even worse:

Bank of America’s view that the Fed is way beyond the curve when it comes to suppressing inflation has led it to a ‘bear case’ outlook for stocks and bonds that’s almost apocalyptic.

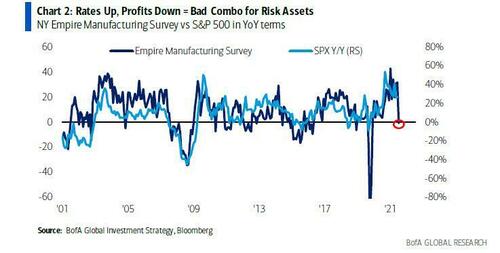

Hartnett has warned that untrammeled inflation will eventually lead to a growth-killing “rate shock” engineered by the Fed that will torpedoe valuations for stocks and bonds. Already, his team argues, rising Treasury yields contributed to the crashing ISM, which has turned out to be a “bad combo” for risk assets.

They share the following graph of the S&P’s tight correlation to the Empire State Manufacturing Survey, showing how the two just don’t break correlation, even over a spread of two decades:

[T]here are plenty of risks in the global economy, including geo-political events related to Russia or China, a renewed trade war, another policy mistake by the ECB and so on. However, in our view, the biggest near-term risk is right in front of us: that the Fed is seriously behind the curve and has to get serious about fighting inflation.

BofA notes the Fed hasn’t even BEGUN to fight inflation. It is, after all still doing as much as it has EVER done in the past to CREATE inflation. Think about that! It is still goosing the economy at QE3 levels. That is not even an attempt to fight inflation. That is just rolling back off the super stimulus sugar as quickly as it dares to make the transition in order to get to a point where it can fight inflation. The Fed is still supercharging the economy with shiploads of free Fed funds.

Today’s markets don’t even know what inflation fighting looks like, says BofA:

It has been a long time since markets have had to deal with a serious inflation-fighting Fed…. A central bank that signals that it will taper a bit faster and could exit zero rate six months from now is hardly fighting inflation.

Imagine what it is like, then, when the fight actually begins — a battle we haven’t seen since the late seventies and early eighties. Only, then the Fed was not facing a stock market that had risen on years of massive Fed float looking for a place to park. It didn’t have a dependent stock market to tangle with. Yet, during that time, we had two bear markets over the space of seven years, each lasting about two months, and at the end of that seven years, stocks were EXACTLY where they had been seven years earlier! That is quite a period of tribulation.

What does a real inflation-fighting Fed look like? The first step is to abandon the idea of a slow motion return to neutral. As long as the funds rate is below neutral, Fed policy will only mean an even tighter labor market…. It is possible that fading fiscal stimulus or some other headwind could do the trick; however, we are quite skeptical given the big tailwinds from massive accumulation of liquid savings and wealth.

The Fed hasn’t even started fighting inflation yet. It’s just getting positioned for the battle! BofA refers to the Fed at present as “an inflation skirmishing Fed” and say,

Hence we have them hiking faster and further than both their forecast and the consensus.

Imagine the fun when the real inflation fighting begins, much less when it gets more serious than either the Fed or the markets are currently projecting if BofA is right.

Coming up

All of my predictions in 2021 have have proven true down to the last detail, except the one that said we’d close the year with the final quarter sinking into recession. With the flaming burst in GDP growth just reported, I was wrong about that quarter. However, I am about to show you in my next article how really close I was and am, and I think you may forgive the error if it turns out I was one of the few predicting recession this soon and wind up only off by a quarter. I suddenly have several big hitters coming to my side on that out of the blue, as I’ll lay out in my next post.

More on that in my next post about this week’s big GDP reading, then it will be on to another Patron Post about the “Everything Bubble Bust.“

For now, this month’s collapse of the stock market began as unexpectedly for most travelers as this other event that happened today, except the stock bridge that spanned the Fed’s taper from last November to now has a lot further yet to fall:

Liked it? Take a second to support David Haggith on Patreon!