YESTERDAY in GOLD, SILVER, PLATINUM and PALLADIUM

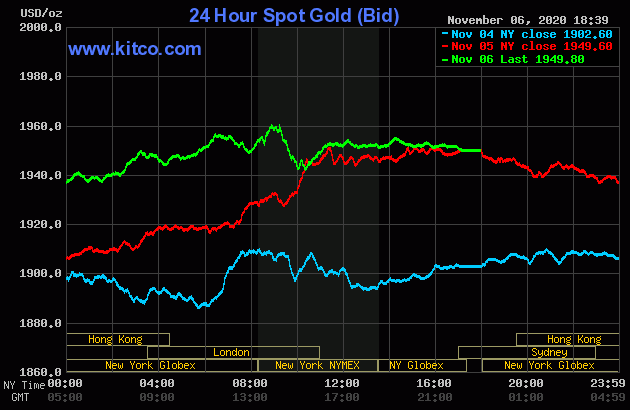

The gold price was sold quietly lower once trading commenced at 6:00 p.m. EDT in New York on Thursday evening -- and that lasted until shortly after 12 o'clock noon China Standard Time on their Friday afternoon. It traded flat until about 2:30 p.m. CST -- and then began to head higher. But it's obvious from the Kitco chart below, that every time it appeared that the rally was about to get too jiggy to the upside, there was someone there to sell if lower, with the final capping coming around 8:45 a.m. in New York. It was sold lower until around 10:20 a.m. EST -- and then edged higher until about 10 minutes after the 11 a.m. EST London close. From that juncture it crept quietly and a bit unevenly lower until the market closed at 5:00 p.m. EST.

The high and low ticks in gold were recorded as $1,961.80 and $1,937.20 in the December contract. The December/February price spread differential in gold at the close yesterday was $7.40...February/April was $5.90 -- and April/June was $4.50.

Gold was closed in New York on Friday afternoon at $1,949.80 spot, up the magnificent sum of 20 cents on the day. Net volume was very decent at a bit over 197,500 contracts -- and there was a bit over 44,500 contracts worth of roll-over/switch volume out of December and into future months...mostly February and April.

|

|

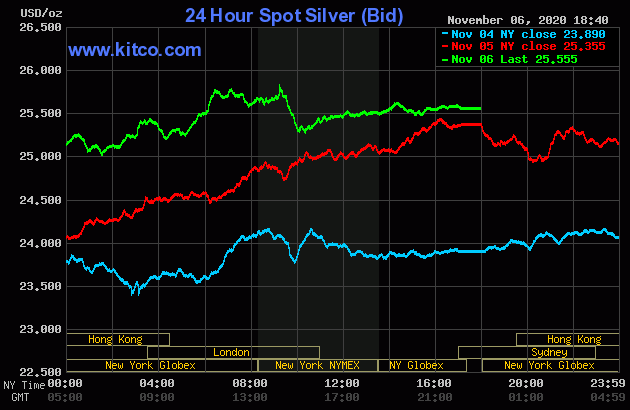

The price path for silver was guided in a similar fashion as gold's, with its high tick coming at 9:15 a.m. in New York as well, although its price was capped about thirty minutes before that. It was sold lower until 10:20 a.m. EST -- and from that juncture it crept a bit higher until around 2:15 p.m. EST in after-hours trading. It didn't do much after that.

The low and high ticks in silver were reported by the CME Group as $25.01 and $25.975 in the December contract. The December/March price spread differential at the close in New York yesterday afternoon was 14.9 cents...March/May was 8.9 cents -- and May/July was 8.4 cents.

Silver was closed in New York on Friday afternoon at $25.555 spot, up 20 cents from Thursday -- and miles off its Kitco-recorded $25.93 spot high tick. Net volume was pretty heavy at a bit under 92,500 contracts -- and there was a bit over 20,500 contracts worth of roll-over/switch volume out of December and into the New Year...mostly March and May.

|

|

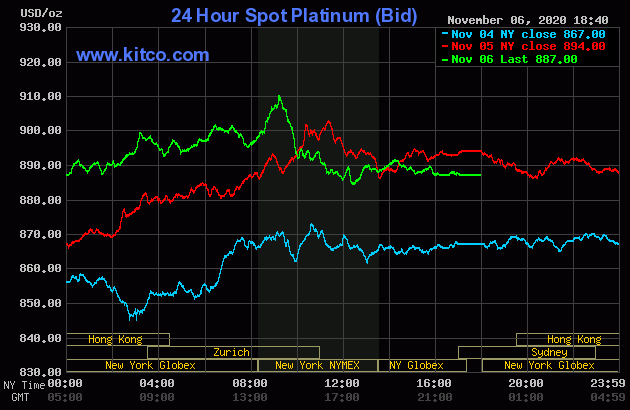

Platinum's price path was guided in a similar manner as both silver and gold, complete with the final price-capping around 9:15 a.m. in New York. It was then sold lower into the 10 a.m. EST afternoon gold fix in London and, like gold, was then sold very quietly lower until trading ended at 5:00 p.m. EST. Platinum was closed at $887 spot, down 7 dollars from Thursday -- and also miles off its Kitco-recorded $920 spot high tick.

|

|

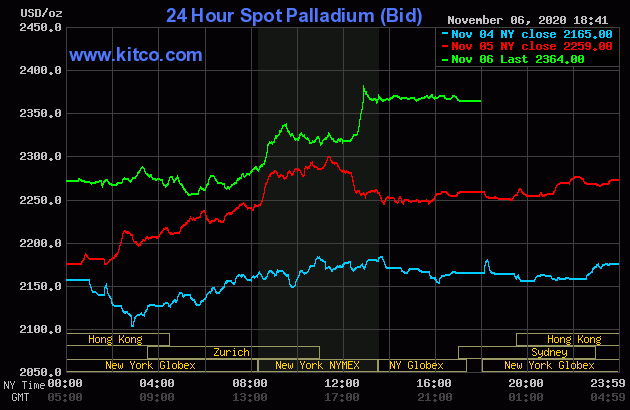

The palladium price traded quietly sideways until around 10 a.m. China Standard Time on their Friday morning -- and it then edged a bit higher at that point. From there it didn't do much of anything until around noon in Zurich/7 a.m. in New York. It then rallied a bit until ran into 'something' at the same time as the other three precious metals...9:15 a.m. EST. It was capped and turned a bit lower at that juncture -- and it then didn't do much until around 12:30 p.m. Then away it went to the upside in a parabolic move -- and appeared to go 'no ask' minutes before 1 p.m. EST. It was obvious that a not-for-profit seller appeared to cap the price and turn it a bit lower going into the 1:30 p.m. COMEX close -- and it then traded flat until 5:00 p.m. EST. Palladium was closed at $2,364 spot, up $105 on the day, but probably would have closed higher by ten times that amount if allowed to trade freely.

|

|

Based on the spot closing prices in both silver and gold, thanks to the kitco.com data posted above, the gold/silver ratio worked out to 76.3 to 1 on Friday...compared to 76.9 to 1 on Thursday.

There was a very large deposit into GLD yesterday, as an authorized participant added 313,382 troy ounces of gold. There was an even larger deposit into SLV, as an a.p. added an eye-watering 10,323,622 troy ounces of silver -- and it's a given that Ted will have something to say about all this in his weekly review this afternoon.

READ THE FULL ARTICLE

https://silverseek.com/article/huge-103-million-oz-deposit-slv-friday