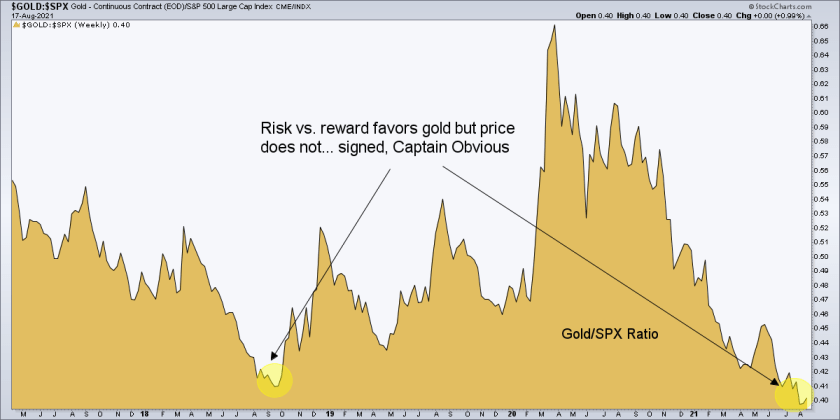

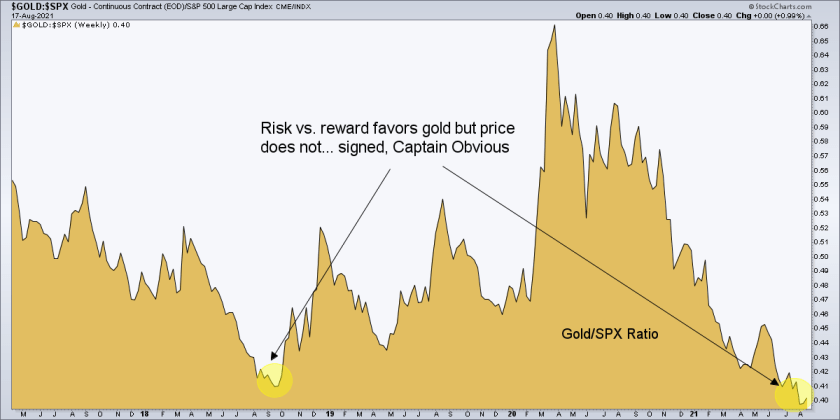

Gold’s potential reward vs. the risk in stocks is absolutely compelling now. That is not a comment on near-term price action, but it is something a real risk/reward investor would be all over. Here is a chart we use in NFTRH to keep an eye on this concept while managing the now year-long correction.

As a side note, you can tell who the promoters are because they are the people who touted loudest a year ago and never stopped cheer leading the whole way down. At the height of the pandemic panic gold was mega bullish and its risk vs. reward sucked. Now? Not so much.

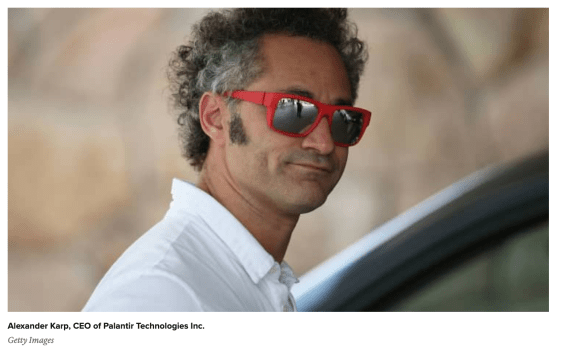

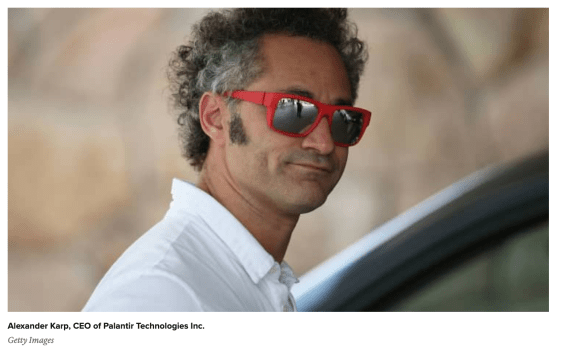

But this morning we have an interesting news bit stating that this guy’s company, Palantir (PLTR) bought $50 million worth of gold bars. Kind of hip in his red shades, and let’s hope he’s really hip, or at least prescient about gold. I think it will shake out that he is.

This is novel in the world of paper and digits. While companies fall all over themselves trying to board the Bitcoin train, Palantir bought a heavy, shiny rock. You go, red shades!

Palantir bought $50 million in gold bars in August as cash pile grows

I have never heard of this company, but I don’t hate its chart. A smart move like this could mean a smart company worth looking into. You never know.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by PayPal or credit card using a button on the right sidebar (if using a mobile device you may need to scroll down). Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter @NFTRHgt.

Testimonial

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas.

Follow via Twitter @NFTRHgt.

Subscribe to NFTRH Premium for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas. About NFTRH

Gary Tanashian of nftrh.com successfully owned and operated a progressive medical component manufacturing company for 21 years, keeping the company’s fundamentals in alignment with global economic realities through various economic cycles. The natural progression from this experience is an understanding of and appreciation for global macro-economics as it relates to individual markets and sectors.

Biiwii.com (RIP 2019 as there were just not enough hours in the day for two websites) was created in 2004 as a way to help communicate a message about deeply rooted problems with too much debt and leverage within the inflated financial system. Our concerns were confirmed and our message justified in 2007 as the system began to purge these distortions, resulting in a climactic washout extending from October, 2008 to March, 2009.

But the URL ‘biiwii.com’ came from the old saying ‘but it is what it is’ and this sentiment addressed the need to remain impartial about the markets, despite personal beliefs. Over the long-term, the world changes and any successful market participant should be ready to accept changes or revisions to a given plan.

Geek-like interests in technical analysis and human psychology, and various unique macro market ratio indicators were added to the mix, with the result being a financial market report, Notes From the Rabbit Hole (NFTRH), combining these attributes to provide a service that is engaged and successful in all market environments.

Since 2004 our work has been featured at financial websites including GoldSeek and SilverSeek.com