Strengths

- The best performing precious metal for the week was gold, up 1.33%. According to Canaccord, New Gold released an update on its ongoing exploration program at its New Afton mine, located in British Columbia. The results demonstrate the potential to incrementally add to existing resources and grow the mine’s life. Canaccord highlights that no resource exists yet for the K-Zone, which the company has now expanded to an area 50 meters wide and 300 meters strike length. The zone remains open in all directions and drilling is ongoing.

- According to BMO, Lucara reported the recovery of another 1,000+ carat diamond from its Karowe mine. The 1,094 carat rough diamond shares similarities with last year's 692-carat diamond, which yielded polished diamonds that were sold for $13 million by HB Antwerp.

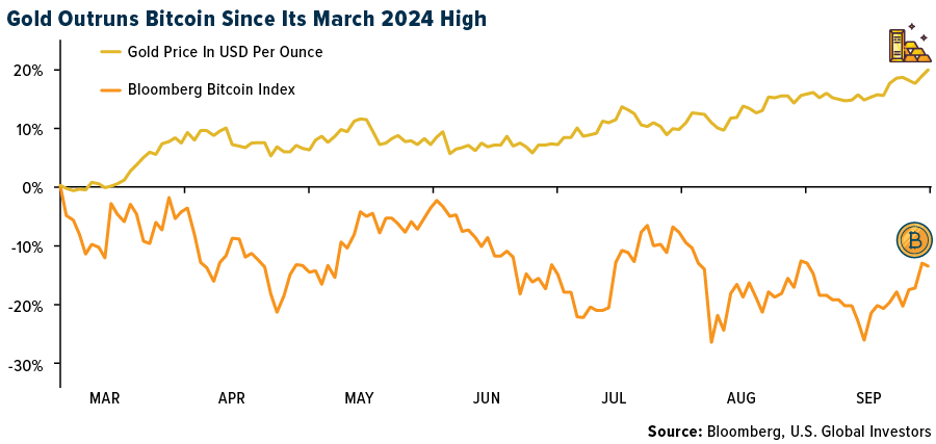

- Gold reached a new high of $2,622 an ounce on Friday as the Federal Reserve cut rates by an aggressive 50 basis points on Thursday, which triggered profit taking initially. Since the Bloomberg Bitcoin Index hit a record high on March 13, 2024, surrounding the various Bitcoin ETFs launchings, its performance relative to gold bullion has been underwhelming with a loss of 14% relative to gold’s gain of 20%.

Weaknesses

- The worst performing precious metal for the week was platinum, down 2.69%. Westgold Resources guided to group gold production of 400,000-420,000 ounces, which was 4% below RBC’s 426,000-ounce forecast. Production will be back-ended as the South Junction, Big Bell Deeps and Great Fingall projects are expected to commence production ramp-up in the second half of 2025.

- According to JP Morgan, Chinese demand for physical gold has remained subdued since May with net imports falling sharply in the last few months (-51% year-over-year in July) and onshore prices largely trading at a discount for most of the last couple of months.

- According to Morgan Stanley, the volume and value of rough diamond imports fell again in August, by 29% month-over-month and 54% year-over-year, and 26% MoM and 49% YoY, respectively. Both metrics remain below their five-year average range (ex-COVID), suggesting that the midstream producers are still in a de-stocking mode.

Opportunities

- According to Bank of America, gold has been creeping higher and they keep a call that the yellow metal should hit $3,000 per ounce once a sustained cutting cycle gets under way. Precious rallies have been driven by Chinese investors and central bank in recent months, while Western investors have not been major participants, so having the latter back is critical, as evidenced by the growing accumulation of new money flows going into the SPDR Gold Shares ETF.

- According to Scotia, in the junior mining space, there could be more sector mergers and acquisitions (M&A), project divestments/acquisitions, joint ventures (JVs) and minority investments. The average price-to-net-asset-value (P/NAV) valuation for their gold development universe is currently at 0.46 times earnings, which compares to 0.35 times earnings last year, a positive price change of 31% YoY, though still trading at a discount to their mid-tier producers at 0.65x P/NAV.

- In the past two weeks, the Precious Metals and the Denver Gold Forum have taken place at a time when we have had record gold prices. Attendance by industry members and was solid, but what was lacking was generalist investors on the scene. This highlights that despite the significant rise in gold bullion prices in recent years, there is a lot of money that hasn’t been paying much attention to the sector yet, and that is still the opportunity.

Threats

- Bank of America feels gold is getting into overbought territory, though it can stay there for a while. Meanwhile, ETFs have seen inflows, but assets under management remain comparatively low.

- According to Morgan Stanley, two U.S. senators have introduced a bill proposing to ban the import of critical minerals (including palladium, platinum, rhodium, ruthenium, nickel, copper and zinc) from Russia. As a result, unlike many other Western counterparties, the import data reflects that the U.S. has continued import sizable quantities of palladium sponge of Russian origin.

- Heraeus notes that “central banks are remaining committed to gold purchases, with net additions to reserves rising to 37 tons globally in June, despite the PBoC reporting zero purchases or sales for another month. Sales of gold fell to 4 tons in July and purchases also rose to the highest level since February. The Central Bank of Poland was the largest buyer in July, adding 14 tons during the month. High gold prices are not typically a headwind for central banks, which tend to buy gold as part of asset diversification programs and are therefore generally price-agnostic.”