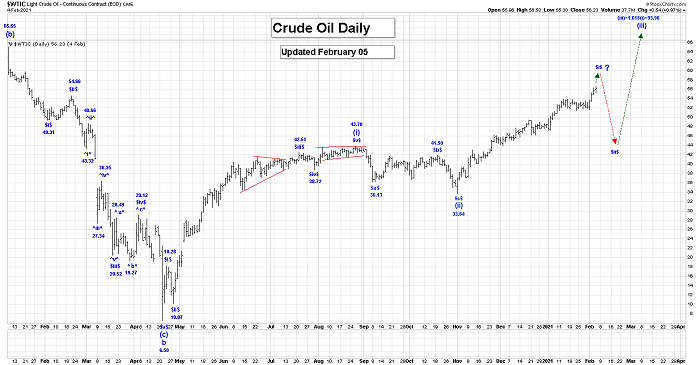

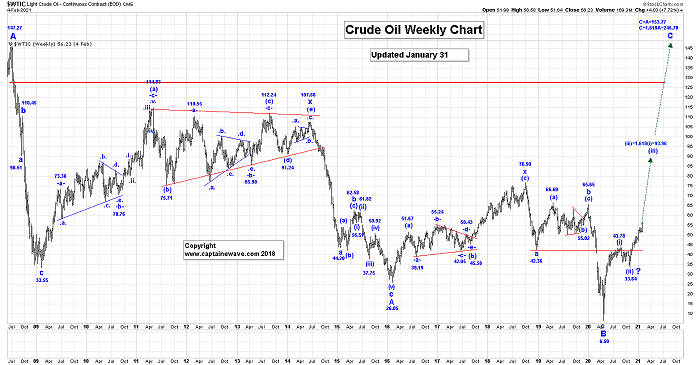

Crude Oil:

We continue to rally sharply higher in wave (iii), which the following longer term projected endpoint:

(iii) = 1.618(i) = 93.96.

It now looks like wave $i$ of (iii) is extending higher.

After wave $i$ ends we expect a wave $ii$ correction that should retrace between 50 to 61.8% of the entire wave $i$ rally.

Active Positions: Long crude with put options as a stop! Long Suncor!

Silver:

We continue to work on our wave (ii) drop that has the following retracement levels:

50% = 20.78;

61.8% = 18.62.

Within wave (ii), wave -b- of (i) of our irregular type correction ended at the 30.35 high. We are now dropping sharply in wave -c-, as shown on our daily chart.

Our minimum target for the end of wave -c- is the wave -a- low of 21.81, but we expect we should drop lower into our retracement level for all of wave (ii) which is:

50% = 20.78

61.8% = 18.62.

Active Positions: Long using put options as a stop. Adding to long positions at 19.50!

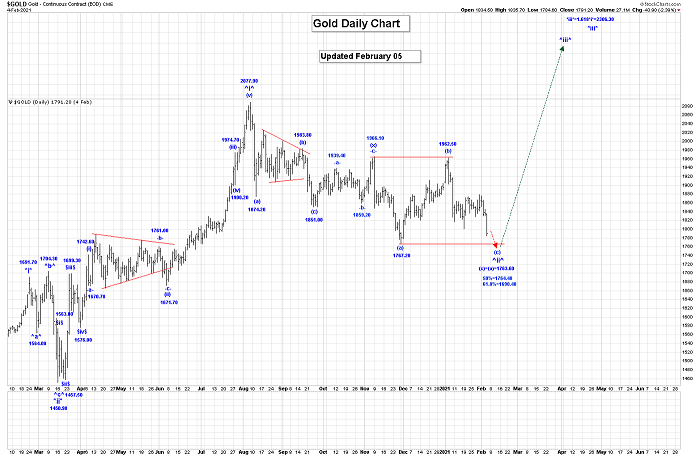

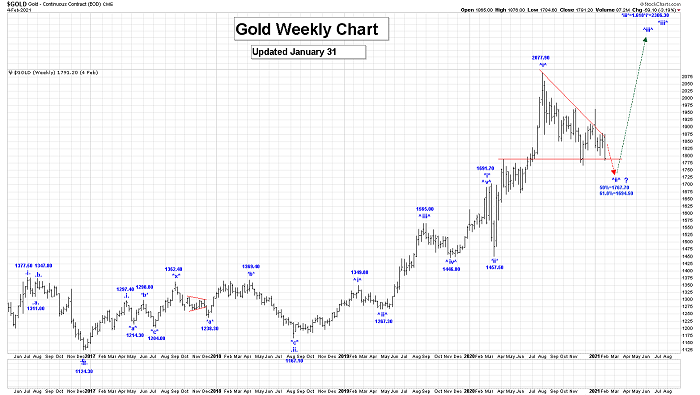

Gold:

We continue to believe that all of wave ^ii^ is not complete at the 1767.20 low, that has the following retracement levels:

50% = 1764.40;

61.8% = 1690.40.

It looks like wave ^ii^ is a double 3 wave corrective pattern as shown on our Daily Gold Chart with our second wave (b) being complete at the 1962.50 high.

We are now falling in our second wave (c) which has minimum target of 1767.20, but likely lower into our noted retracement noted above. We have a projection for the end of wave (c) as:

(c) = (a) = 1763.60.

Longer term our current projected endpoint for all of wave *iii* is:

*iii* = 1.618*i* = 2306.30.

We have higher projections also.

Active Positions: We are long, with puts as stops! Adding to longs at 1735.00!

Thank-you!

Captain Ewave & Crew