Whenever gold rises and I get excited as a gold investor, I’m often met with the familiar refrain: “Gold isn’t really going up—the dollar is just losing value.” I used to brush that off as a cliché or a semantics game, and honestly, it annoyed me. But eventually, I decided to dig deeper. I started analyzing the data visually—my favorite way to learn—and that’s when it really clicked: they were right. Gold wasn’t so much soaring as fiat or paper currencies were quietly eroding. Since then, I’ve made it a mission to help others see this clearly too—through compelling charts that drive the point home. And that’s exactly what I’m going to show you today.

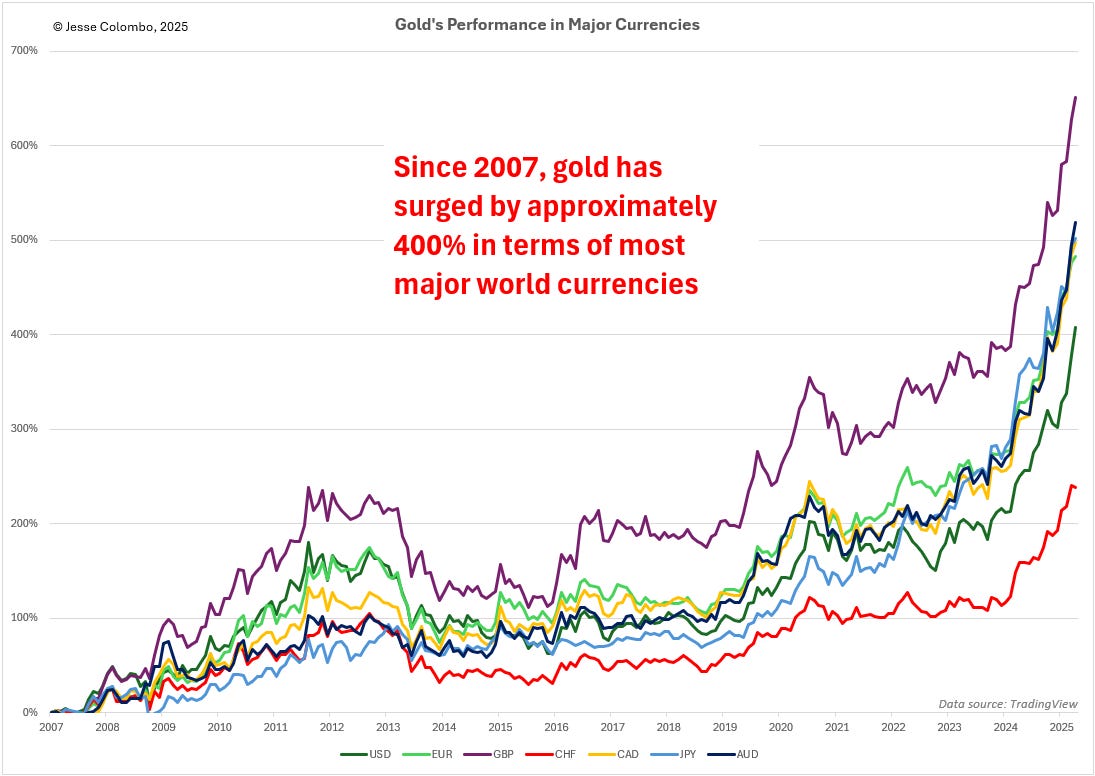

Let’s start with a clear visual: the chart below shows gold’s performance since 2007 in several major world currencies: the U.S. dollar, euro, British pound, Swiss franc, Canadian dollar, Japanese yen, and Australian dollar. While not an exhaustive list of global currencies, this group provides a solid and representative sample for the points I’ll be making throughout this piece. As the chart reveals, gold has surged by roughly 400% in most of these currencies—with gains ranging from a low of 238% in Swiss francs to a staggering 651% in British pounds.

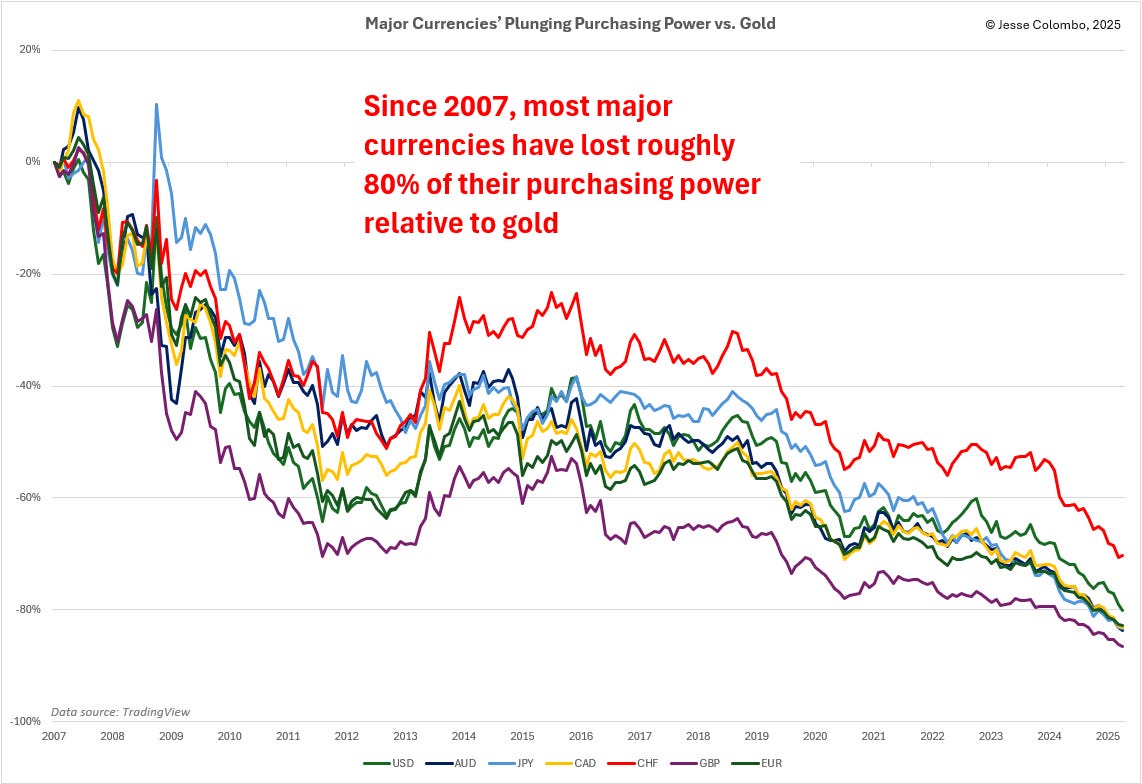

Next, I’ll present the same data from a different perspective—this time highlighting the purchasing power of each currency relative to gold, or in other words, how much physical gold each currency could buy over time.

Next, I’ll present the same data from a different perspective—this time highlighting the purchasing power of each currency relative to gold, or in other words, how much physical gold each currency could buy over time.

Since 2007, the major world currencies featured in this article have lost approximately 80% of their purchasing power when measured against gold. On the low end, the Swiss franc has declined by about 70%, while the British pound has suffered the most, with an 87% loss.

This chart offers compelling visual evidence of a critical truth: gold isn’t actually rising in value—fiat/paper currencies are losing purchasing power at an alarming rate:

So why are we using gold as the yardstick? Because it’s the most reliable monetary yardstick in history. For over 6,000 years, gold has served humanity as the premier form of money and store of value. While it temporarily fell out of favor starting in the 1970s, it’s now making a powerful comeback as the world begins to recognize the deep flaws in our fiat money and monetary system—flaws that have led to rampant inflation and terrifying financial instability. That’s why people around the globe are turning back to gold in increasing numbers, helping drive its price to nearly double over the past five years. And in my view, this move is still in its early stages.

The Bubble Bubble Report is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

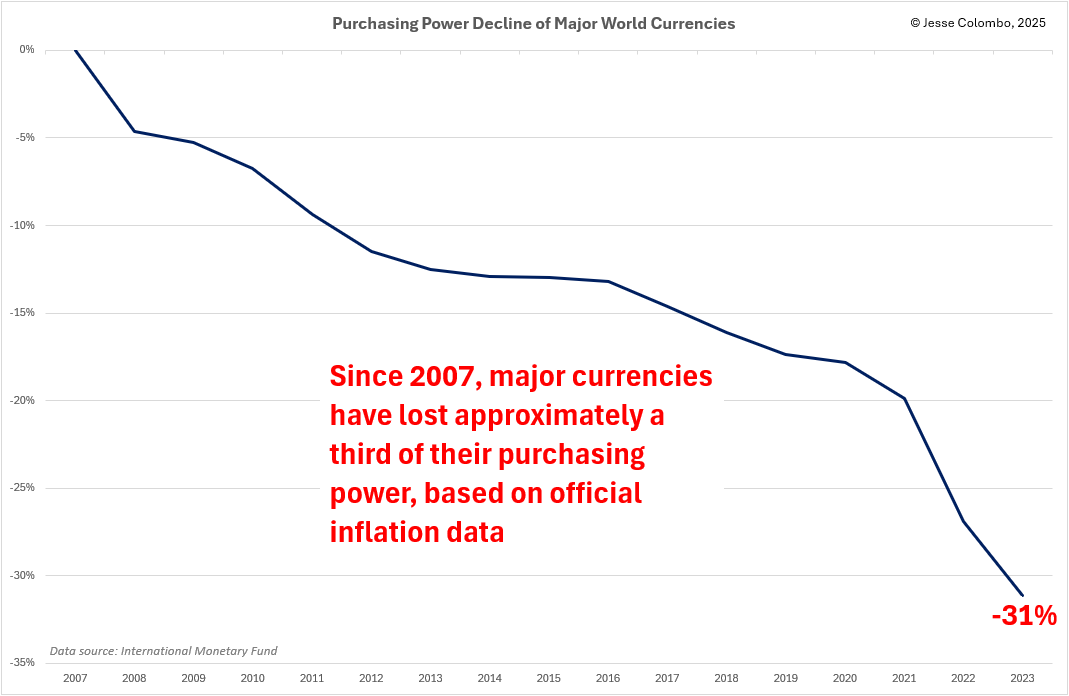

If you're skeptical about using gold as a yardstick for measuring currency purchasing power, rest assured—its decline is confirmed by other metrics as well. The most widely used is the Consumer Price Index (CPI), which tracks the average change in prices over time for a fixed basket of goods and services.

I calculated the average CPI for the major world currencies referenced throughout this article and found that, on average, they’ve lost 31% of their purchasing power since 2007. The resulting chart closely mirrors the gold-based purchasing power chart shown earlier, with the steepest declines occurring during two key periods: 2007 to 2012 and 2020 to 2023—both of which were periods of heavy monetary expansion during recessions.

Now, I realize there’s a noticeable discrepancy between the roughly 80% loss of purchasing power in terms of gold and the 31% loss according to official CPI data. My working theory is that this gap exists because CPI figures are based on government-reported economic data—and governments are notorious for understating inflation to make their currencies and economies appear healthier than they really are.

Now, I realize there’s a noticeable discrepancy between the roughly 80% loss of purchasing power in terms of gold and the 31% loss according to official CPI data. My working theory is that this gap exists because CPI figures are based on government-reported economic data—and governments are notorious for understating inflation to make their currencies and economies appear healthier than they really are.

Most people have noticed that the price increases they experience in the real world don’t line up with the tame inflation numbers coming from economists in ivory towers. Personally, I trust what gold is telling us—and it’s saying that official inflation metrics are understating reality. When it comes down to it, I’ll err on the side of gold.

Now let’s examine why currencies steadily lose purchasing power over time: inflation, or the persistent rise in the cost of living. It’s important to understand that inflation isn’t fundamentally caused by wars, tariffs, supply shocks, strikes, droughts, or energy crises—those may contribute to short-term price spikes, but they’re not the underlying driver.

At its core, inflation results from the debasement of currency—in other words, the dilution of a currency’s value through excessive creation of new money. As Nobel Prize–winning economist Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon.”

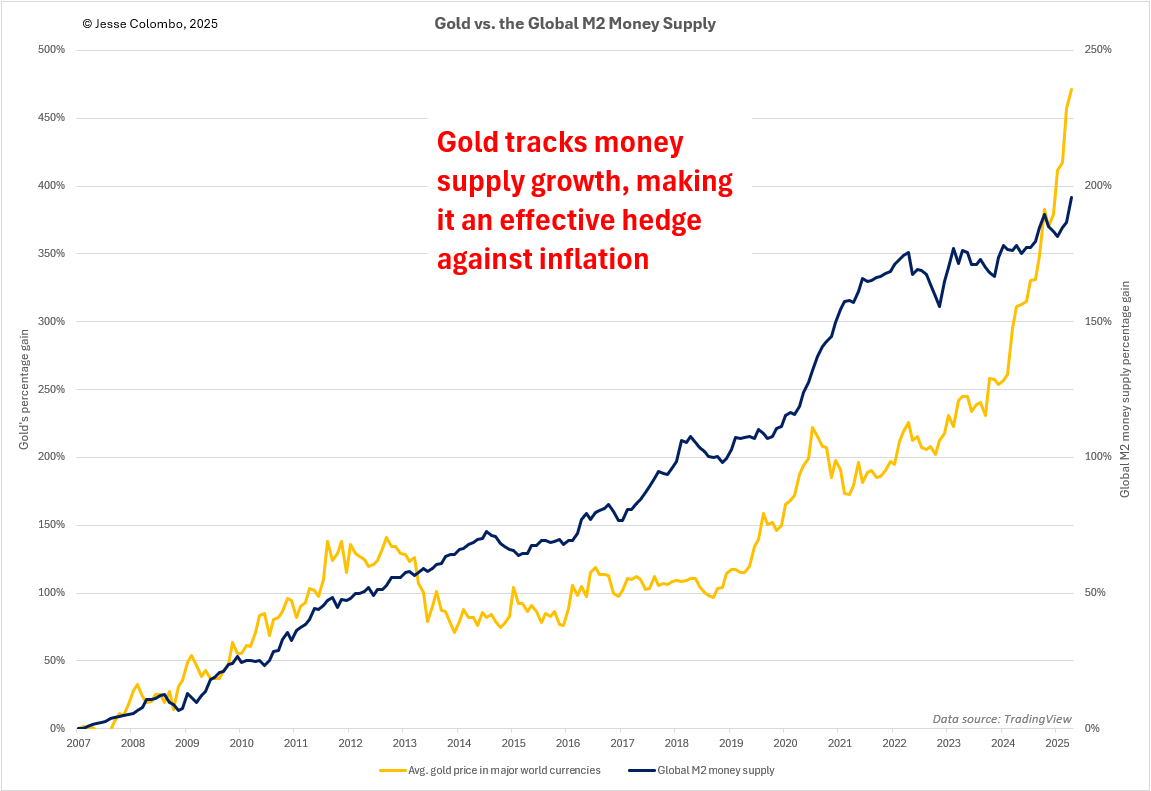

As the chart below illustrates, the global M2 money supply—one of the most widely used measures of total currency in circulation—has surged by 200% since 2007, skyrocketing from $38 trillion to a staggering $111 trillion. This massive expansion of the money supply is the driving force behind the soaring cost of living worldwide—and a key reason why the price of gold has surged in every major currency across the globe.

The next chart demonstrates how gold’s price closely tracks the growth of the global M2 money supply over time—the primary reason why gold remains the most effective store of value and hedge against inflation:

The next chart demonstrates how gold’s price closely tracks the growth of the global M2 money supply over time—the primary reason why gold remains the most effective store of value and hedge against inflation:

Although nearly everyone alive today has lived their entire lives in a world of persistent inflation, it’s important to understand that this condition is not an inevitable feature of life or capitalism. Instead, it’s a direct consequence of fiat money—paper currencies that are not backed by gold or silver, as they were prior to 1971.

Although nearly everyone alive today has lived their entire lives in a world of persistent inflation, it’s important to understand that this condition is not an inevitable feature of life or capitalism. Instead, it’s a direct consequence of fiat money—paper currencies that are not backed by gold or silver, as they were prior to 1971.

Once the world abandoned the gold standard—that is, the practice of backing currency with gold—governments and central banks gained the power to expand the money supply without restraint. And that’s exactly what they did. The result? A relentless rise in the cost of living.

If you’re interested in exploring this topic further, including some fascinating long-term data showing how the U.S. dollar has lost 97% of its purchasing power since 1913, be sure to check out this article I wrote.

Another key point to highlight is this: as long as the world remains on a fiat money regime, inflation isn’t going away—and gold will continue to rise. That’s because fiat currencies all suffer from the same terminal flaw: over time, they devalue, deteriorate, and eventually die. History shows that no fiat currency has ever escaped this fate—and neither will the dollar, the euro, nor the yen. It’s not a question of if they fail, but when.

The Bubble Bubble Report is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

One of the most alarming forces sealing the fate of the world’s fiat currencies is the explosive growth of global debt, which has surged tenfold since the late 1990s, reaching an estimated $224 trillion. This towering debt burden is the ticking time bomb that will ultimately bring fiat currencies to their knees.

As debt levels spiral out of control, they begin to choke economic growth and destabilize entire financial systems. Eventually, governments and central banks are left with little choice but to fire up the printing presses to service that debt and pay their bills. The result? A tsunami of rapidly devaluing paper money and a skyrocketing cost of living—a classic setup for hyperinflation.

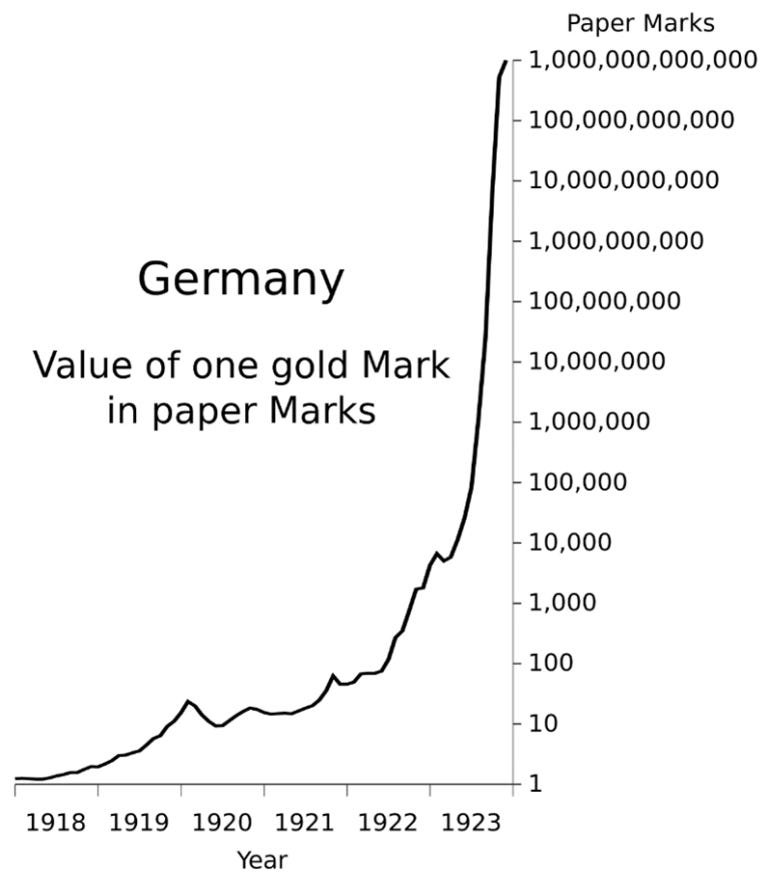

The chart below illustrates how, during Weimar Germany’s infamous hyperinflation of the early 1920s, physical gold—such as a single gold Mark coin—not only preserved its value but skyrocketed when priced in the rapidly devaluing paper Marks of the time. This happened because the Reichsbank, Germany’s central bank, was running the printing presses at full throttle to prop up a collapsing economy and cover massive government deficits.

The chart below illustrates how, during Weimar Germany’s infamous hyperinflation of the early 1920s, physical gold—such as a single gold Mark coin—not only preserved its value but skyrocketed when priced in the rapidly devaluing paper Marks of the time. This happened because the Reichsbank, Germany’s central bank, was running the printing presses at full throttle to prop up a collapsing economy and cover massive government deficits.

That chart is a historical preview of what will unfold in the years ahead, when gold hits $4,000… $5,000… $7,000… $15,000… even $20,000 per ounce—and, ultimately, some mind-boggling figure like $20 quadrillion, when the dollar and other major fiat currencies are on the brink of worthlessness.

Source: Wikimedia Commons

To conclude, I hope I’ve made it clear that when gold soars in price across global currencies, it’s not gold that’s truly gaining value—it’s paper currencies that are rapidly losing theirs. As a passionate advocate for gold and a heavy investor who avoids mainstream assets like stocks, bonds, and real estate in these times, I can’t deny feeling a surge of excitement when I see gold’s price—and the nominal value of my portfolio—rising sharply, as it has over the past year.

But that excitement is tempered by a sobering reality: gold is soaring because fiat currencies—including the U.S. dollar—are taking yet another hit to their purchasing power. Still, I’d much rather be watching that unfold from the safety of owning gold than from the sidelines without it.

If you found this report valuable, click here to subscribe to The Bubble Bubble Report for more content like it.