There are plenty of frustrated silver bugs. Gold is outperforming once again, and they wonder when silver will finally catch up.

History suggests silver will outshine gold in a bull market for metals. So far, that has not been the case for much of gold’s current bull run which began in 2015.

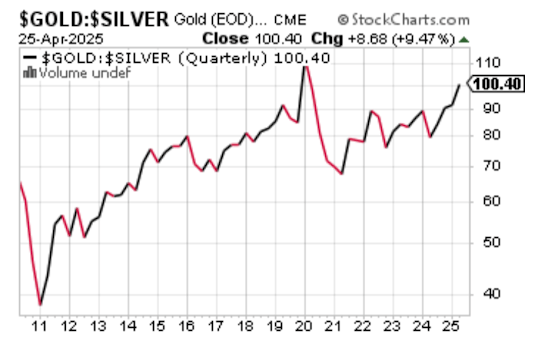

It isn’t certain whether this time will ultimately be different. Nine years into the run higher, silver remains way below the 2011 highs. Gold broke through its prior high five years ago. Recently the gold/silver ratio floated back above 100, an extraordinarily high figure. (See Chart Below.)

Why has gold fared so much better than silver?

The answer is complicated and some of it is guesswork. For example, it is not possible to gauge how much influence artificial forces such as bullion bank price rigging and algorithmic trading have had on current metal prices. The answer, in our view, is at least some.

But given the dwindling above-ground inventories of silver, the difficulties miners have in raising production, and the steadily growing demand for silver, the days of lower silver prices are numbered.

There are other forces which might help explain why gold has fared so well. Gold’s demand is more concentrated. The vast majority of buying comes from investors and from central banks. While silver has seen growing demand from investors, the metal isn’t something central banks are stockpiling.

Industrial demand is a far larger component in the silver market than for gold.

During periods when investors worry about the economy, such as early months of COVID and the more recent fears over tariffs, silver is likely to underperform. Investors anticipate less demand for the metal from manufacturers.

While slowing demand from manufacturers will weigh more heavily on silver prices, there is another key difference which accrues in silver’s favor.

Silver used in manufacturing is mostly “used up.” It goes into products which eventually wind up in a landfill. It is different for gold. Most of what is used in major applications like jewelry and dentistry is ultimately recovered and recycled.

There is no largescale recycling effort for silver. That could change as recycling processes improve, but silver prices will likely have to be much higher before it makes sense to try to recover silver from things like trashed electronic devices and solar panels.

Gold gets a lot more demand from institutional and very large investors. The fact is it would be hard to park $100 million on silver without impacting the price. Taking a billion dollar position without having to pay a huge premium would be impossible.

Gold benefited during recent weeks as huge sums of money shifted out of the equity markets, the bond markets and even the U.S. dollar.

For a lot of money managers making these big moves, silver isn’t even really among their options.

The safe-haven buying for silver comes largely from retail investors, not titans on Wall Street. This buying was frenetic from 2020 to 2023, it slowed down dramatically during 2024, and has only recently begun picking up.

An environment where there is strong demand from retail investors as well as solid industrial demand would be ideal for silver to catch up to gold. Whether or not silver bugs will be fortunate to get a market which fires on all cylinders is pure speculation.

The truth is the silver market doesn’t need that much help for the metal to be repriced dramatically higher relative to gold.

The setup in the futures market is explosive. The recent surge in imports from vaults in London and elsewhere provided some reprieve in the U.S., but annual deficits in new mine supply versus demand is problematic.

Deficits will almost certainly persist until higher prices start moving the needle on production, and this situation keeps a floor under silver prices.