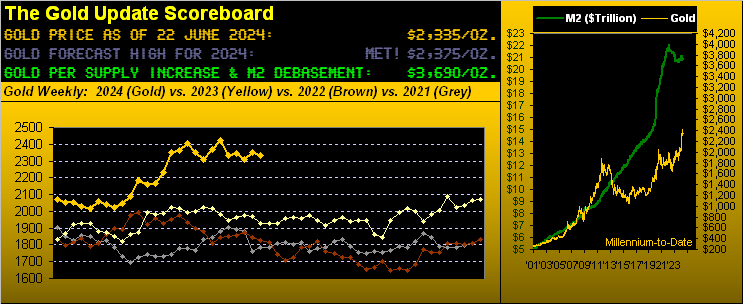

To be sure, our recent missives have been near-term negative for Gold, at least technically so, an eye to the 2247-2171 zone apropos. Still, as you know, Gold these past two weeks has been fundamentally grappling to gain grip, albeit settling this past week yesterday (Friday) down a dip at 2335.

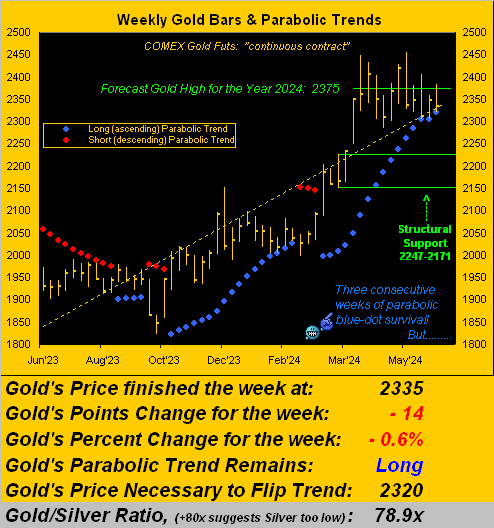

First, the Bad News: from the standpoint of Gold’s weekly “textbook” technicals (esoteric as they may be), the MACD (moving average convergence divergence) has furthered its negativity, and the Price Oscillator — whilst positive — is eroding, as too is the Moneyflow, its net inflow having completed a fifth consecutive week of weakening. Also as we’ll later see, Gold’s 16-week parabolic Long trend is all but at its end.

Second, the Good News: from the standpoint of Gold’s fundamentals — the most basic being currency debasement per the above Gold Scoreboard — we now sense the Federal Reserve is going to be forced to move with a rate cut per the Open Market Committee’s Policy Statement on 31 July.

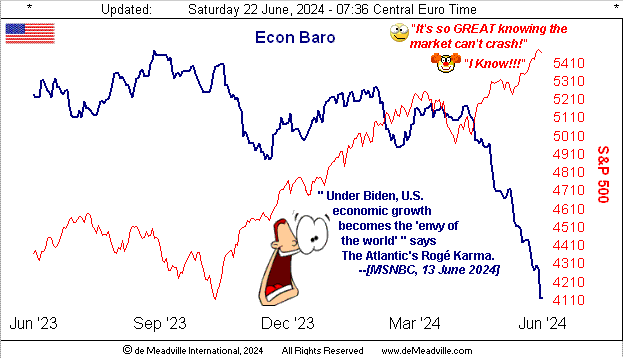

Why? Because as stagflationary as a rate cut shall be, the Economic Barometer already has fallen well into jeopardy. Once both the Fed and FinMedia figure that out, “Cut!” shall be the clarion shout.

‘Course, we all know inflation didn’t just suddenly vanish in May, despite Labor’s sway. The once mighty Barron’s rightly referred this past week to inflation as “sticky”, with Richmond FedPrez Thomas “Hearken!” Barkin inferring that ’tis still lingering.

But: must the Fed now cut if only for optics to rescue the economy? For as we “X’d” (@deMeadvillePro) this past Thursday, our Econ Baro is in comprehensive, abject plunge, even as this Investing Age of Stoopid rolls right along:

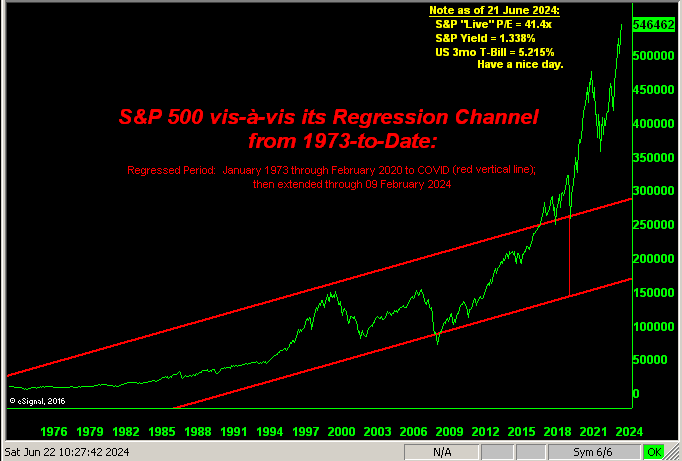

Yet how relieved we are that the S&P 500 (red line above) no longer is led by the Econ Baro! Else stocks would have crashed months ago! For as you veteran fans who’ve been with us since the 1990s know, throughout the Baro’s 26 years of existence, it provably had led the S&P 500 through the first 22 of those years, right up to COVID in 2020. Then the Fed flooded the monetary system with $6.7T — an increase to the StateSide liquid “M2” money supply of +43.8% in just two years — and as we’ve previously mathematically demonstrated, the market capitalization of the S&P increased by same: which means (duly acknowledging the benefit of hindsight) that the Fed never really had to print anything! And thus today with the system bloated in equities’ liquidity, the stock market is unable to crash. Reprise: ![]() “We’re in the money, we’re in the money…”

“We’re in the money, we’re in the money…”![]() –[Dance of the Dollars, Dubin/Warren, Gold Diggers of 1933, Warner Bros.] Still graphically, the S&P seems a little bit stretched, what? Hip-hip:

–[Dance of the Dollars, Dubin/Warren, Gold Diggers of 1933, Warner Bros.] Still graphically, the S&P seems a little bit stretched, what? Hip-hip:

Still as regards the stagflating economy, as we herein penned a week ago: “… ’twill be interesting to see just how negative for May the Conference Board’s Leading [i.e. “lagging”] Indicators shall be come next Friday…” followed by yesterday morning’s Prescient Commentary: “The Econ Baro, which has taken a terrific hit this week (indeed across the past two months), looks to May’s … Leading (i.e. “lagging”) Indicators, … [as] potentially quite negative given the dive in the Baro itself.“ That is because throughout the Econ Baro’s history, it regularly leads by weeks the Conference Board’s (with all due respect) misnomered “Leading Indicators” report. Worse, one wonders about the underlying consensii of economic “experts” properly doing their math: when we saw their May expectation for -0.3%, we anticipated a far dire result given the plummeting Baro … and so such came to pass at -0.5%.

Thus cue Captain Obvious: an economy in decline (understatement) upon comforted with a rate cut is a Gold Positive as it enhances the debasement of currency through the “creation of wealth” (i.e. loan-making). So as technically sensitive as the yellow metal may now be, fundamentally we decree: Buy Gold!

“But to buy ‘knowing’ — as you expect anyway — that the price may soon go lower, mmb?“

Squire, recall the late great Richard Russell: “There’s never a bad time to buy Gold.” ‘Tis the perfect place to put excess, unearmarked cash. After all, the Internet’s main sewer line (aka “social media”) goes on ad nauseum about everybody being so rich. Better still, timing the Gold market, (barring your being an in-and-out futures trader), is hardly a critical Gold-owning matter given that price (as historically eventuates) catches up to debasement value, again per the opening Gold Scoreboard.

Or to put it in easier perspective for you WestPalmBeachers down there, let’s quote Jack Lemmon in the role of Hogan from “Under the Yum Yum Tree” –[Columbia Pictures, ’63]:

“Well, it’s an economic necessity. The bank requested that I get rid of excess cash. It’s cluttering up their vaults.”

Yo, you rock, Jack baby: Go for the Gold! (‘Course, ’twasn’t Gold which Jack sought; but we’ll leave that to your viewing curiosity). The point is: as it all goes wrong economically, ’tis good to have a little (or a lotta) Gold.

As to Gold’s “now”, we turn to the weekly bars from one year ago-to-date. Note therein the three rightmost blue dots of the parabolic Long trend: price thrice saved by the dots! But now with just a wee 15 points separating price (2335) from its “flip-to-Short” level (2320), to maintain this uptrend that we love, Gold basically needs a straight-up week, else ’tis over. For as sang Martha Davis with The Motels back in ’82: ![]() “Take the ‘L‘ out of ‘Lover’ and it’s ‘over’…”

“Take the ‘L‘ out of ‘Lover’ and it’s ‘over’…”![]() :

:

And for those of you scoring at home, 15 points of “wiggle room” is very little to keep Gold’s Long drive alive: price’s expected weekly trading range is now a very volatile 83 points. Thus ’tis quite viable Gold soon visits the graphic’s outlined 2247-2171 structural support zone, should the parabolic (that 2320) this week break.

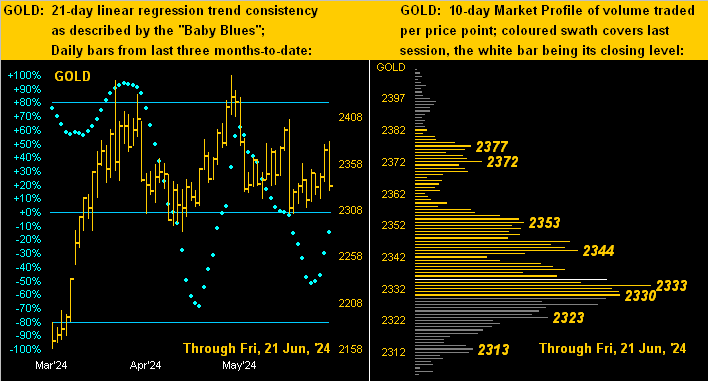

Now to our two-panel Gold display featuring on the left price’s daily bars from three months ago-to-date, the trend consistency therein denoted by the baby blue dots, and on the right the 10-day Market Profile of volume traded per price. As the “Baby Blues” rise toward their 0% axis, the trend becomes less negative (rotating to positive upon crossing the axis). However by the Profile, the 2030s appear as the last bastion of near-term support:

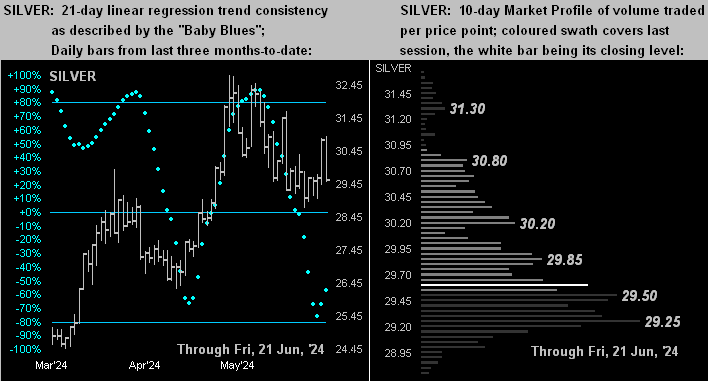

The like graphic for Silver is much the same, albeit at left the white metal’s “Baby Blues” were more beaten down than those of the yellow metal; and at right, Sister Silver’s Profile shows the mid-to-low 29s as her last support lines:

For the wrap, here is the stack:

The Gold Stack

Gold’s Value per Dollar Debasement, (from our opening “Scoreboard”): 3690

Gold’s All-Time Intra-Day High: 2454 (20 May 2024)

2024’s High: 2454 (20 May 2024)

Gold’s All-Time Closing High: 2430 (20 May 2024)

Trading Resistance: per the Profile 2344 / 2353 / 2375 / 2377

10-Session “volume-weighted” average price magnet: 2341: 2341

Gold Currently: 2335, (expected daily trading range [“EDTR”]: 37 points)

Trading Support: per the Profile 2333 / 2330 / 2323 / 2313

The Weekly Parabolic Price to flip Short: 2320

10-Session directional range: down to 2305 (from 2406) = -101 points or -4.2%

Structural Support: 2247-2171

The 2000’s Triple-Top: 2089 (07 Aug ’20); 2079 (08 Mar’22); 2085 (04 May ’23)

The 300-Day Moving Average: 2067 and rising

2024’s Low: 1996 (14 February)

The Gateway to 2000: 1900+

The Final Frontier: 1800-1900

The Northern Front: 1800-1750

On Maneuvers: 1750-1579

The Floor: 1579-1466

Le Sous-sol: Sub-1466

The Support Shelf: 1454-1434

Base Camp: 1377

The 1360s Double-Top: 1369 in Apr ’18 preceded by 1362 in Sep ’17

Neverland: The Whiny 1290s

The Box: 1280-1240

So as we glide into next week which culminates with the “Fed-favoured” Personal Consumption Expenditures Price Index, let’s give Jack the final word:

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro