As FOMC readies another rate decision, its irrelevance has never been more apparent

I started my market management service in 2008 with the imagery of the renowned children’s fantasy, Alice In Wonderland, for a reason. That reason being, in Alice’s words:

“If I had a world of my own, everything would be nonsense. Nothing would be what it is, because everything would be what it isn’t. And contrary wise, what is, it wouldn’t be. And what it wouldn’t be, it would. You see?”

Lewis Carroll, by way of Alice

That simple, confusing and wonderful quote is the essence of contrarian thought and a reflection of the sublime state of the debt-soaked fantasy that is the US economy and that of much of the financially interconnected modern world.

While a significant theme within Notes From the Rabbit Hole (NFTRH) is that in this alternate reality, the rules are the rules – absurd in a reasonable person’s estimation or not – and we need to resist actively fighting those rules while they apply (a quarter century and counting by my direct experience in the markets). In other words, you play the hand you are dealt or you avoid the whole thing; but you don’t fight it with your capital. That has been sound advice through cycle after cycle in which the “everything bubble” has endured.

But that does not mean people should just go to sleep and ignore the moral hazard. Quite the contrary. Active risk management along the way to speculating in this bubble (it simply should not be called investing) is required. As the bubble in confidence in policy-making (both fiscal by government, and monetary by central banks) continues, we note the absurdity here on another oh-so-important (fundamentally it’s not, as the Fed employs other means of liquidity regulation in the bond market) meeting of the eggheads at FOMC.

The Fed will likely hold rates and issue some kind of blather or other about the still firm economy, about vigilance on inflation, about risks to the economy and/or other mumbo jumbo that means little when you consider the mountain of debt the whole edifice is built upon (and capitalized upon by both major political parties, currently the Democrats).

John Rubino has a brief and very digestible article this week in which debt leverage is the main theme:

Recession Watch: Why isn’t “inevitable” becoming “imminent”?

As we note the massive services sector hiring each month, including an unusually long and intense streak of government hiring, while the official employment data smooth over issues like gig workers trying to make ends meet, people who want to work but can’t find jobs, people dropping out and just giving up, and other negative data, in service to a nice and healthy headline number each month (this election year… go figure), we note that a clock is ticking. Listen to Danielle Booth at the end of Rubino’s article. She’s not conspiracy theorizing. She is just calling what she sees… and it does not add up.

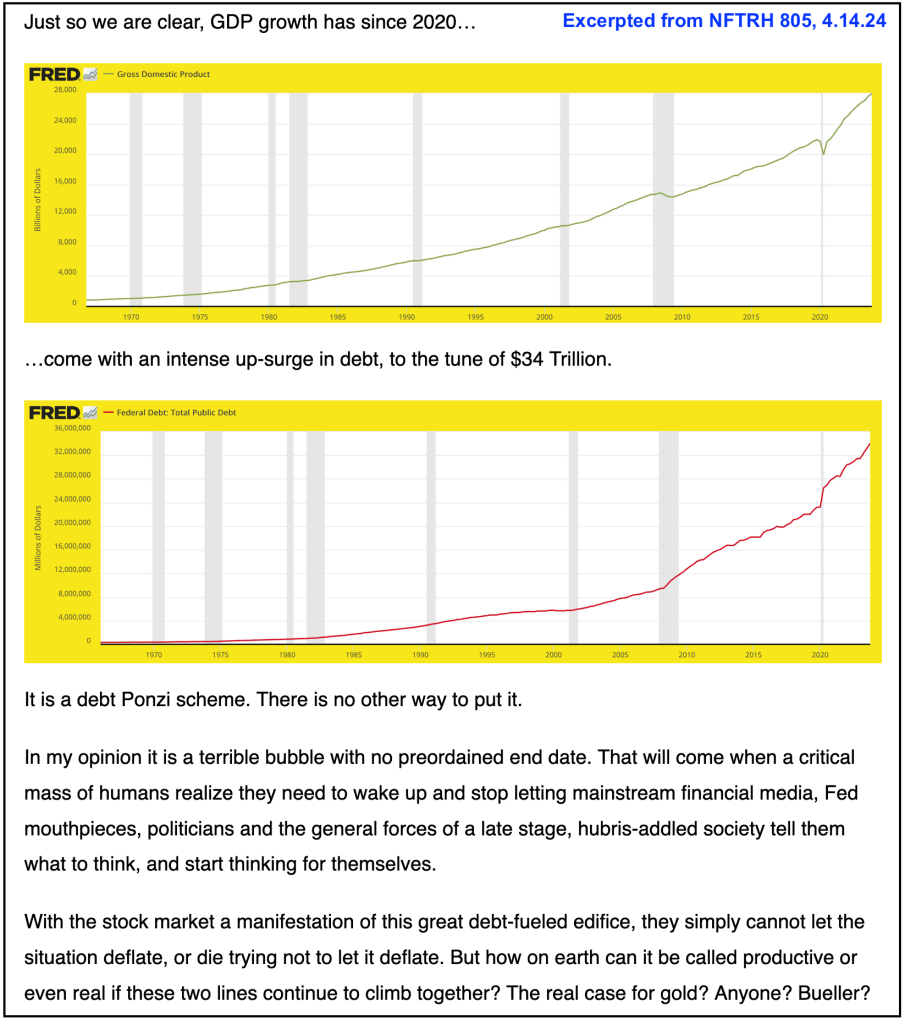

Here is something that does add up. It is a clip from NFTRH 805:

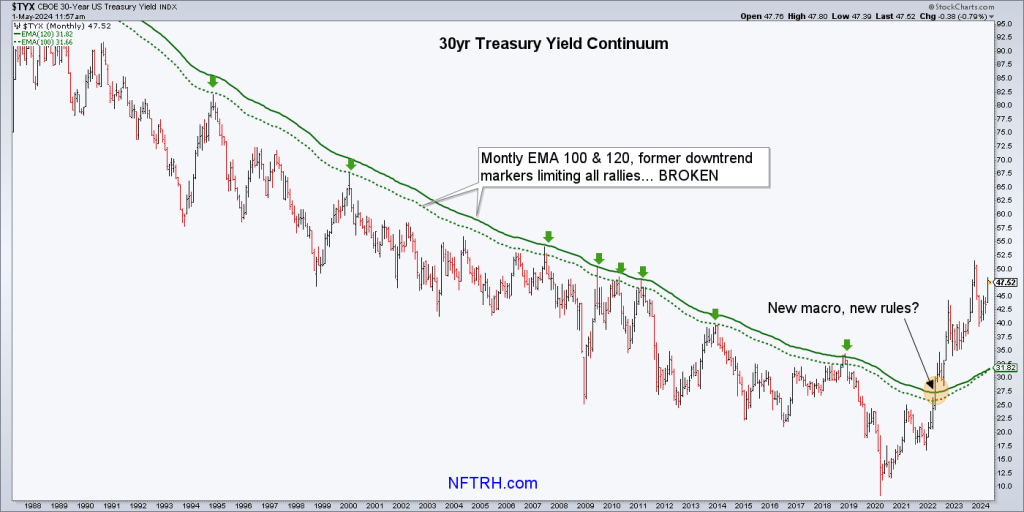

Our operating thesis is that after many years of having to be contrarian to a bullish view and against a bearish view, in spite of an ultimately unsustainable debt situation, things have long-since begun changing. I am not just guessing. I am using tools like the Continuum chart, which advises that where debt management is concerned, what has been for decades no longer is (as of 2022).

While the situation will unfold on its own timeline, not yours or mine, it is unfolding. The bond market is in a structural state of rebellion and it is rebelling against the forces of debt excess and the leveraging of that excess toward economic progress. The rebellion is also against the massive herds that still believe in children’s fantasies, other than one very important one, symbolically.

You might keep this in mind as some very important people render a very important decision that actually means very little, today. On a long enough timeline, we’re all dead. The same holds true for massive and widely accepted Ponzi schemes.