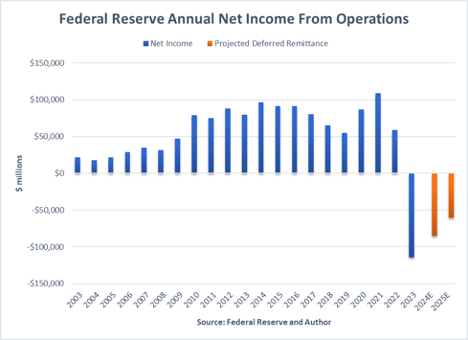

The Fed’s tightening regime just bit deeper into the national deficit. For the very first time in 108 years, the Fed just ran at a net loss, and it was huge. To be specific, the Fed reported a loss of $ 114.3 billion in 2023. Now, for the Fed, losses are no big deal because they own the money printers (at least the ones that just require entering digits in data fields on banking computer systems). However, for the US government, the loss is all theirs to shoulder.

The way this works is the Fed normally transfers all of its net profits to the US Treasury’s general account, and it has profits every year … until 2023. The Fed’s charter was set up so that IF the Fed EVER did experience a loss, AS IT FINALLY HAS, that loss would be handled as a debit against future profits the Fed hands over to the government. So, no profits from 2023 go to the US Treasury this year, and future profits will have to add up to $ 114.3 billion before the Fed again starts handing any profits to the government. In the meantime, that means the government has to add that shortfall to its debt.

While the Fed cannot realize any losses, itself, you might think the first loss in its entire existence would have a somewhat bone-chilling effect, as many people would wonder what was so exceptional about 2023 that it is the only year to have seen a loss in the Federal Reserve System. No matter what the US went through—the Great Depression, World War II, the Great Recession, the Covid lockdowns with their massive deficits—there was never a loss until the year just accounted for.

Moreover, the Fed is predicted to have losses for 2024 and for next year as well:

Seeking Alpha

Seeking Alpha

What gives here? 108 years with no loss and with some of the biggest net profits ever from the Great Recession all the way to the present, and now, BAM! right to the bottom? Moreover, this plunge follows the biggest year of profits the Fed ever realized in its history just two years ago.

Yet, apparently, the mainstream financial media either failed to notice or didn’t think you’d even care to know what just went down here. That, or their owners are friends of the Fed.

The answers to “What gives here?” lie in the rest of this Deeper Dive below the news headlines. So does the source of the Fed’s losses, which taxpayers will find to be a real ringer when they see how much they are paying to enrich banks, but I thought everyone should, at least, know the Fed just scored its first loss, and it is all yours to bear.