Stocks have tried to deny reality since the Fed made it clear in multiple statements there is zero chance of the Fed returning to looser monetary policy this year and every chance of it taking interest rates higher one or two more times before the end of the year.

Stocks have also being trying to ignore the immediate bond reality that took over when the debt ceiling was lifted, setting the US Treasury free to transform the bond market by selling bonds as quickly as elephant ears at a fair or ice-cream on a hot day at the beach. The chart above shows how earnings from stock-traded companies have slowly settled as yields from bonds have soared to where the risk premium between stocks and bonds has disappeared. That means pushing risky stock prices even higher when Treasuries provide equal risk-free earnings makes no sense. And the two are just now crossing over to where they will make negative sense … as in like opening an ice-cream cart at the North Pole.

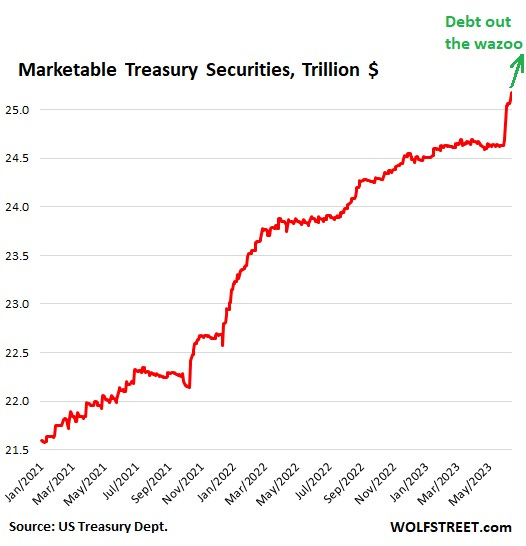

We can see how rapidly the Treasury has been flooding the bond market since the debt ceiling was lifted in the following chart by Wolf Richter:

The money flows into purchasing treasuries flows out of bank accounts, making liquidity tighter for banks, which leaves less liquidity available to invest in stocks. Moreover, the debt ceiling, by stopping all additional Treasury issuances for half a year, counteracted the Fed’s QT in which the Fed stopped buying additional Treasuries. It didn’t matter that the Fed was rolling Treasuries off its books and not buying additional Treasuries when the government wasn’t issuing additional Treasuries anyway. However, there is now a new game in town, and stocks have been denying that reality; but they won’t likely be able to for long.

Says Richter,

Now the Fed’s QT is running for the first time simultaneously with the TGA being refilled, and both are draining liquidity from the markets simultaneously, and this is happening with some lag effects, amid the usual ups and downs.

In other words, there are always lag effects, but now the Treasury and the Fed are essentially teaming up. Instead of the lack of Treasury issuances negating the Fed’s tightening, rapidly making up for lost time with new Treasury issuances means the Treasury will be doubling down on amplifying the effect of QT. Stocks may be going the opposite way from where they usually go under extreme Fed tightening, but the lag time to catching up with reality is not likely to be long.

Morgan Stanley’s Michael Wilson points this out in his statements today about the effects of the Fed and feds now running in parallel in terms of how their actions are simultaneously now draining massive liquidity from markets, rather than negating each other:

One of Wall Street’s most bearish strategists isn’t giving in to the bullish about-turn in equities, saying investors may be in for “a rude awakening.”

Morgan Stanley’s Michael Wilson, whose outlook for a market slump in 2023 has yet to materialize, said fading fiscal support, lower liquidity and falling inflation will weigh on the US equity rally in the second half of the year.

He’s also concerned that stocks are “as stretched as they can get” in a narrow performance that’s been driven by excess liquidity from March’s banking deposit bailouts.

The Fed’s bank bailouts back in March also offset its tightening, and those have now mostly wound back to where the Fed’s balance sheet was prior to all those bailouts. So, that countervailing force has ended.

“Given our fundamental view on growth, we find it hard to get on board with the current excitement,” Wilson wrote in a note Tuesday. “If second half growth re-accelerates as expected, then the bullish narrative being used to support equity prices will be proven correct. If not, many investors may be in for a rude awakening given the very big reach for risk we are seeing.”

According to Citigroup Inc. strategists led by Chris Montagu, the positioning in US equity futures is the most bullish since 2010.

So, stocks have become most bullish at a time when bond yields are back to rising due to massive new Treasury issuances and continued Fed roll-offs and when liquidity is being drained from bank reserves that already proved strained back in March due to rising bond yields (falling bond values), leaving banks and their customers less able to push money into stocks.

Wilson also notes that, while lowering inflation rates may help the Fed come to a stop on its tightening, they also mean lowering earnings because neither earnings nor revenue adjust for inflation, so they got an artificial raise by being measured in dollars that have fallen in purchasing power domestically.

Maybe today is a wake-up call as Bloomberg reports “Stocks Slip as Investors Face Gut Check on Rally.” So far this morning, they are falling hard with the Dow down more than 300 points and the NASDAQ down 100. That is in spite of a massive surge in housing construction reported this morning.

Investors caught between fear of missing out and concerns markets have run too far, too fast are contending with overblown valuations and economic headwinds. Bullish positioning in US equity futures grew last week, taking it to the most extended levels for the S&P 500 and Nasdaq 100 in data going back to 2010, according to Citigroup strategists.

They have a lot more to contend with because there is a lot they have been ignoring. There is little rational incentive to be buying up US equities when earnings are falling and bond yields are soaring with lots of room to soar higher still due to the massive shifts in bond supply.

Says one strategist, “the lagged effect of previous hikes will bite down harder with the passing of time.”

“In the short run, six to 12 months, we are navigating treacherous waters.”