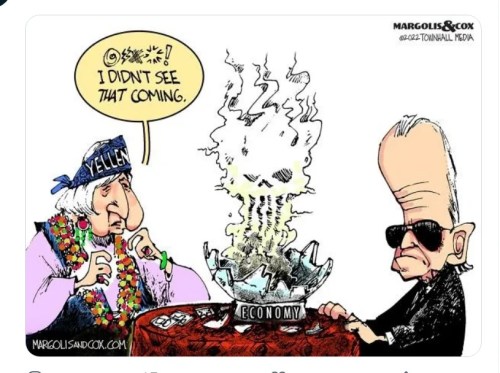

Even though the Fed was specifically chartered to help protect the US from massive economic collapses like we experienced in The Great Depression and to protect banks from major bank runs like banks experienced in the Great Depression, the Fed never sees these things coming. Not only does it fail to see them coming even when they ARE actually forming all around us, it fails to even believe in the possibility they could be coming. Worse still, the Fed is actually the entity that causes them to come. There is no failure in all of human enterprise greater than the Fed.

Therefore, I want to pass a new regulation that, at least, requires anyone who is creating banking regulations or proposing monetary policy to fill out one of these Captcha thingies before they are allowed to process any proposal because we know the only ones who could never figure out this Captcha would be robot-brained members of the Federal Reserve System.

Let me start off on memory lane by providing some resplendent recent examples.

A Fed Foto Album

One can provided the following evidence for every Fed head in recent years, but to keep things short, let’s just go Janet Yellen. As shown in this family photo, she is Larry Fink’s wife in that the Federal Reserve and BlackRock (Fink’s company) have been wedded at the hip for several years now:

There the lovebirds are seen at a cozy financial swaree, with Larry holding the wine list, happily doing what he does best, which is to hold his wife who has imbibed too much of the wine list from falling over. Well, really, what they do best as a couple is rigging the economy to serve their class of people ahead of everyone else. Almost nothing big gets carried out by the Fed these days that doesn’t go through the big man, Fink.

His partner, Janet, is uniquely skilled at fulfilling the Peter Principle, having graduated above the level of her competence several times. Based on her public statements, she isn’t even qualified to be treasurer of the Ladies’ Quilting Circle, much less treasurer of the entire United States.

As Bill Bonner recently explained,

Sticking with Ms. Yellen, she has been demonstrably wrong about everything. She was at the Fed when it caused the mortgage finance crisis of ’08-’09. She didn’t understand that low interest rates would inflate housing prices … or that a housing bubble would inevitably blow up, leaving mortgage holders with billions in bad debt.

Later, Ms. Yellen thought that tweaks to banking regulation – mostly, forcing them to buy more US Treasury bonds, as ‘reserves’ – would make the banks so strong that no further financial crises were likely ‘in our lifetimes.’ It was apparently inconceivable to her that Treasuries would go down in value, leaving the banks not only short on cash…but insolvent.

Now, I had suggested something similar to this in my predictions for my Patrons at the start of the year, only I thought the Fed might, at least, partially resolve the problem by unwinding some of the $2-trillion in reverse repos, it had laid in because those are loans that take cash out of bank reserves and replace that cash with the very Treasuries that just became a liquidity problem for banks because you cannot pay depositors off in treasuries when they are demanding cash. I thought the Fed might have laid in all those reverse repos so banks could quickly unwind them to get cash back into reserves by handing those Treasuries back to the Fed to retrieve the cash the Fed had borrowed out of their reserves when they were so liquid they were sloshing like a pair of overflown boots in a swamp:

Withdrawing too much liquidity could jeopardize control over short-term interest rates and trigger a repeat of the September 2019 market turmoil that marked the end of the initial balance sheet shrinking effort, also known as quantitative tightening. Then the Fed was forced to intervene in the markets and reverse course to rebuild bank reserves through renewed net bond purchases.

Fed officials and outside observers do not expect this to happen again. For one thing, Fed Chair Jerome Powell has already said he doesn’t want to test how far the Fed can shrink reserves. Meanwhile, the Fed has a new and untested facility called the Standing Repo Facility that can provide quick liquidity when financial firms need it….

New York Fed President John Williams said this month that the roughly $2 trillion parked overnight by money market funds and others daily in the Fed’s reverse repo facility is the “key” to the outlook. As markets adjust to rising interest rates, cash from this facility will flow into the private sector, effectively replenishing reserves, giving the Fed the extra runway it needs to continue reducing its holdings, he said….

The Fed appears to have pumped a lot of slack into the system, but no one has ever seen how this kind of slack plays out either. The Fed stacked in a tremendous amount of the exact opposite of repo loans — reverse repo loans, whereby it took excess cash out of bank reserves and replaced it with bonds as collateral….

I suggested maybe they were banking it as slack for when they started to tighten, should they need it. That money taken out of bank reserves on loan … can go immediately back….

The pile means there are still Fed money sources squirreled away that can rapidly backflow into reserves.

Hmmm. There must have been a back-flow check valve in the system that didn’t work to let the cash flow back into reserves when needed as Fed Pres. John William had stated was the intention and had said they would, in fact, do. But they didn’t! Either there was some back-flow preventer at work, or the reverse repos were piled in at the wrong banks … or the Fed was too dumb to think of this when they needed it, though Williams already had and so had I. Hard to explain.

That such a liquidity problem would emerge from bond repricing was, however, clearly a predictable problem; and it appears the Fed, as a whole, either did not see that as well as its one member, Williams, did, or its safety mechanism was just one more catastrophic fail.

Well, the quotes from Bonners were just for appies. To that short repartee, we can add Yellen’s following headline makers: (The video cover image says it all.)

and …

Thus, we should be concerned — very concerned — when “Let it all slide” Yellen now says repeatedly the banks are very solvent because the crisis of depositors leaving small and mid-sized US banks is “stabilizing,” and should the problem worsen, the government could provide further support. Would that be like this support:

Janet “Let it all slide” Yellen

Janet “Let it all slide” Yellen

I would apologize for that; but, since Yellen has never apologized for what she’s done, which is pretty well to wreck the world, I guess apologies are not necessary. In fact, she just keeps getting trusted, quoted as an expert, and then promoted to higher positions … and alway paid a whole lot more than I am. Once Dementia Diaper Man passes on from the White House, I wouldn’t be surprised to see her promoted right past Kamala to become his younger replacement.

The inflation nation

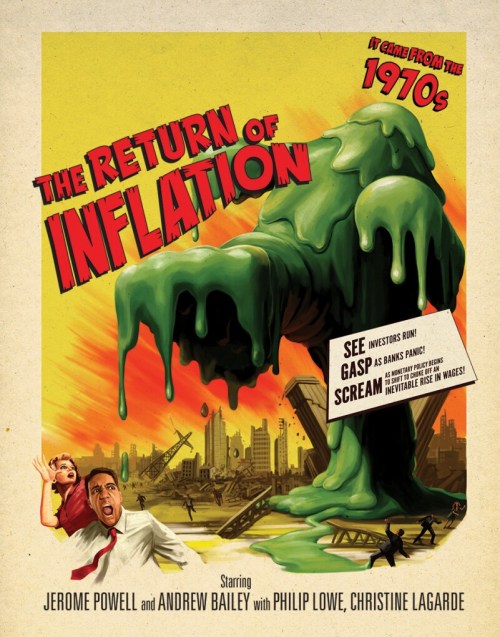

Not only did Janet Yellen infamously say inflation was transitory back when it was just getting started, but having had the opportunity to learn from her error, she has recently repeated it when saying that inflation is coming back under control. I took a different position, just to show one could see the coming return of inflation. You may remember the image I used:

In the article of 2023 predictions for my patrons, I wrote,

Inflation continues to be the driving story in 2023

Inflation will not resolve to the level the Fed needs to see to back its key interest rate down to a neutral level, but the Fed has told us clearly its goal is now to taper its interest increases to a pause where it will wait and see what the increases it has done achieve.

Inflation may rise again in the first few months of the year, pressing the Fed, once again, to tighten to a higher level than either the market or Fed expects.

The Fed cannot control shortages, which are a major factor in our present inflation around the world, and the Fed will need to create a lot of economic damage to get inflation down by sucking money out right when scarcity is driving up prices.

I think the most likely course is that the Fed holds interest levels at about 5.5% for as long as inflation looks like it is moderating until something major breaks. At that point, it won’t pivot directly to stimulus-level rates and not to QE either, but it may bail out the thing that breaks and will lower interest to what it considers a likely neutral level. (If breakage spreads wider, all bets are off.)

We are only at 5% so far, but the Fed it appears will be holding near the 5.5% level because something major has broken, and, as promised in my Patron Post, it did not pivot. It went right ahead with its next anticipated rate hike, since that still left us below 5.5% and went right to bailing out the things that broke with a massively expanded FDIC deposit insurance plan, made available only at its favorite too-big-to-fail banks.

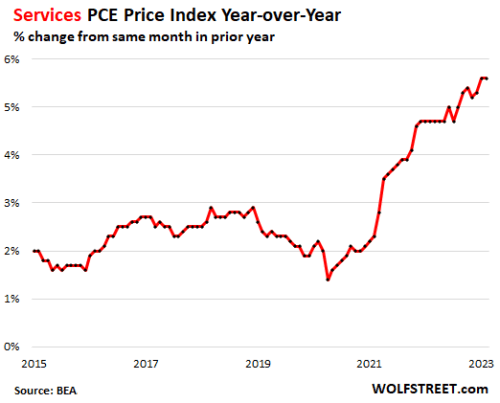

At the same time, inflation just got reported last Friday as coming in HOTTER for services, which is the main sector of the economy, while lower for goods, the smaller part of the economy:

The biggest contributor to the downside for YoY PCE was non-durable goods, but Services costs are accelerating….

While acyclical core inflation slipped, cyclical core inflation continued to march higher, which is a greater problem for the Fed. Cyclical core PCE inflation, which tracks inflationary pressures that are linked to the current economic cycle, is at the highest on record going back to 1985.

As Wolf Richter also noted,

The element that makes up nearly two-thirds of consumer spending – services – the element that the Fed has been pointing out for months, remained at the worst level since 1984, and it kept core inflation at nose-bleed levels at well over twice the Fed’s target….

The PCE price index for services jumped by 5.6% year-over-year in February, same as in January, and both are the worst since 1984:

So, upward pressure on inflation has started forming again. However, more to the CORE point, the reason goods were lower was the decline of the price of energy in the first quarter. While the Fed ignores the price of energy in the core-inflation gauge it looks at for determining its tightening, the rest of us don’t. Neither, in the end, can the Fed because energy, itself a good (a commodity), gets priced over time into many other goods and nearly all services.

In another article of predictions for all readers in 2023, I talked about how oil would likely be driving up inflation this year:

One major driver I reported in The Daily Doom today is that fuel prices are back on the rise.

That doesn’t mean much if crude prices do not continue to rise; however, there are reasons to think they will, and gasoline and diesel, of course, drive the price of just about everything because they are involved in the transport of all resources and all finished products. So, they are a major leading indicator of future price rises in all goods and services IF the rise in crude prices continues….

Crude price pressure looks likely to build for the following reasons….

“2023 Prediction: The Fed’s Inflation Fight is FAR from over!“

I, then, laid out a number of reasons related to the war with Russia that oil prices were likely to rise soon, including, particularly, the European gas caps on Russian oil prices.

This week The Daily Doom was flooded with news about oil prices rising as Russia’s OPEC+ partners decided to support their war-begon partner with large production cuts:

OPEC+ just made the Fed’s job more complicated….

Several OPEC+ members are set to tighten global production by an additional 1.16 million barrels per day until the end of the year, further burdening central bank efforts to curtail global inflation — but critically protecting the alliance’s broader output strategy from political pressures….

This adds to Russia’s existing intentions to trim 500,000 barrels per day of its own production from February output levels, now until the end of the year….

U.S. President Joe Biden’s administration has repeatedly lambasted the OPEC+ group for its production cuts, citing the inflationary toll on households and flinging accusations of camaraderie with sanctions-struck Russia. Curbs in production lead to smaller supply, causing higher prices at the pump in importing countries which then provides a boost for headline inflation figures.

So, that didn’t take long.

Apparently, Yellen does not understand that basic relationship between energy and inflation, or she would have been less confident that inflation was slowly coming under control, knowing how out of control energy could become during these warring times with major energy-producing nations.

As a result of the OPEC+ production cuts in solidarity with Russia, oil prices soared:

Oil prices notch biggest gain in nearly a year after OPEC’s surprise output cut

Oil prices soared after OPEC+ announced it was slashing output by 1.16 million barrels per day….

“The selected involvement of the largest OPEC+ members suggest that adherence to production cuts may be stronger than has been the case in the past,” Commonwealth Bank of Australia’s Vivek Dhar said in a note….

“OPEC+‘s plan for a further production cut may push oil prices toward the $100 mark again, considering China’s reopening and Russia’s output cuts as a retaliation move against western sanctions,” CMC Markets’ analyst Tina Teng told CNBC.

Teng noted, however, that the cut could also reverse the decline in inflation, which would “complicate central banks’ rate decisions.”

While billed as a “surprise” cut — you know, one of those things the Fed could not be expected to see coming because no one could — it should not have been any surprise at all:

OPEC Cuts Shouldn’t Be a Surprise….

While it is true that the timing of the announcement is surprising – it comes before OPEC’s scheduled meeting and without the typical pre-announcement hints – the cut itself should not be a surprise.

To quote the article we wrote all the way back in Octoberabout the Russian oil ‘Price-Cap’ scheme:…

“How do you think Saudi Arabia and the rest of OPEC will feel about having to compete with unrestricted volumes of legal Russian oil that sells at a guaranteed discount to market prices?…

“A $60 Russian oil price cap (or whatever the price cap is) would pull the whole market pricing towards that price as Saudi Arabia’s customers start demanding discounts to not switch to Russian crude.”

Guess what happened? Oil prices fell to $65 a barrel within a three months of the $60 price-cap being implemented.

That drop to $65 per barrel was the part that brought energy prices down in the first couple of months of the year; but now, with OPEC+ aligned to make production cuts to fight this problem, prices soared and are going to remain at elevated levels for reasons readily explained:

Guess why OPEC was created? To avoid exactly such a market share fight among producers.

The Russian oil price cap deal is a direct and existential threat to OPEC and, as such, turns OPEC into an ally of Russia. It becomes imperative for all of OPEC, not just Russia, that the price cap scheme fails.

So what is the natural response of OPEC going to be to an attempt to kick off a price war via the threat of sanctions on an oil exporter? Obviously the response is to do exactly what OPEC announced Wednesday: dramatically reduce oil production and support prices.

With energy clearly out of control, there is little chance inflation is under control since, as I noted in this year’s predictions, energy gets priced into everything.

This OPEC+ decision, set in place for the remainder of 2023, will certainly bring in the rise of inflation I predicted for this year … as others are now noting in response to the OPEC+ decision.

When many others were foolishly believing and proclaiming the Fed’s inflation fight was nearing an end, so the Fed would be pivoting soon, I said over and over, “Balderdash on the pivot!” That even ran the other direction from Zero Hedge. Now, even the Fed gets it and admits it:

Bullard Admits OPEC Cuts May “Make [Fed’s] Job A little More Difficult”

“This was a surprise,” said St. Louis Fed President James Bullard when asked about the impact of OPEC+’s sudden and unexpected decision to cut crude production dramatically (prompting a spike in oil prices).

“No one could have seen this coming”

Oh, yeah, there it is — the Fed’s perennial surprise excuse; but it shouldn’t have been. If it was something one couldn’t have seen coming, how did others see it coming? How were others not “surprised” at all? Regardless, now that it has come, the Fed is pressed to admit it complicates their inflation battle:

A nasty surprise too, as we detailed previously, because while the US central bank is already trapped, and is desperately looking for any excuse to halt its tightening campaign now that inflation is accelerating to the downside not just because regional banks desperately need a lower Fed Funds rate to short-circuit the relentless deposit drain which won’t stop (and will lead to even more bank failures and resolutions) until their deposit rates can at least match those of the Fed … OPEC’s shocking shot across the Fed and Biden bow revealed in its intention to keep oil prices high even as central banks push the world into a recession, just made life for the central planners very difficult, as the sordid stench of stagflation is suddenly all over the place.

Well, that was a long-winded sentence; but, at least, ZH finally got there. It goes without saying, the Fed couldn’t see it coming. Janet Yellen, the former Fed high priestess certainly didn’t see it coming. Now, however, it’s here, and they must deal with it:

Bullard is aware of the potential for the trap above:

“Oil prices fluctuate around. It’s hard to track exactly. Some of that might feed into inflation and make our job a little bit more difficult,” he said.

Ya think?

But with oil prices spiking alongside China’s PMI miss overnight combined with US Manufacturing’s weakness this morning, stagflationary fears are really started to build… Central bankers’ greatest nemesis.

Which is exactly the kind of recession I’ve said repeatedly for the last two years we are headed into. It COULD even go hyperinflationary, depending on how the Fed ultimately decides to respond to the trap it blindly set for itself, as once again it creates the very problems it was originally intended to prevent for good, making it a total failure at its raison d’etre.

One of the things I said in my forecast back in January was that price caps in particular could backfire on oil prices:

Price caps have always been problematic and often backfire in ways that are not expected … [creating] plenty of possibility of supply shocks that can send prices the opposite of the way intended.

“2023 Prediction: The Fed’s Inflation Fight is FAR from over!“

But who could have seen that not going as intended?

Which brings us to this statement in that article:

One of the biggest factors that took down consumer price inflation in recent months was falling energy prices, but there is plenty of reason to think those won’t hold, so they could easily become one of the biggest factors driving inflation back up. And it is not just the “energy” component that will go back up in that case, but all components that use energy in their production and transport, which means everything.…

While the Fed can hope to have some impact on energy demand, it has zero control on the supply side, which is where all the problems are forming.

So, there is still lots of room here for CPI to rise if energy makes a sustained rise, and there are plenty of reasons to think that is likely.

But, no, no one could have seen this coming.

This week’s big news in The Daily Doom’s economic section was a massive change in OPEC policy over the weekend, said to be also made inevitable by European price caps set on Russian oil. No one ever saw any of that being possible.

OPEC’s new production cuts are expected to drive up the price of oil globally to around $100 per barrel which is where I figured oil could go this year. That will drive up the price of nearly everything; but this vaunted leader of the free world couldn’t see it coming, and neither could any of her followers:

Liked it? Take a second to support David Haggith on Patreon!