We can now actually see with visual metrics what it looks like when the Fed keeps pushing against a badly broken job market that keeps pushing back. Unlike previous situations where there were far more jobs than workers, I’ve said the Fed’s usual labor metric is broken this time, so jobs will not move as the economy tightens until it is too late. The Fed will have to tighten the financial system long and hard to get the economy down enough to where the primary signals it looks at for gauging when it’s nearing the point where it can tighten no more will start to flash.

(If you haven’t read my argument for that, you can find it in these articles: “Everyone Sings the ‘Strong Labor Market’ Tune in Unison as the Band Plays on, and They’re All DEAD Wrong!” and “Powell’s Peril Lies in Lanquishing Labor Market.“)

Because so many workers have died, gotten chronically ill, retired early because of lockdowns that encouraged them to move their retirement choice forward and because of demographics we’ve long seen coming that warned us people would now be retiring faster than they are entering the labor force, we have an extreme worker shortage that has nothing to do with a strong economy or a resilient job market, as labor tightness has traditionally meant. We have a broken labor market that is unable to even meet normal labor supply requirements.

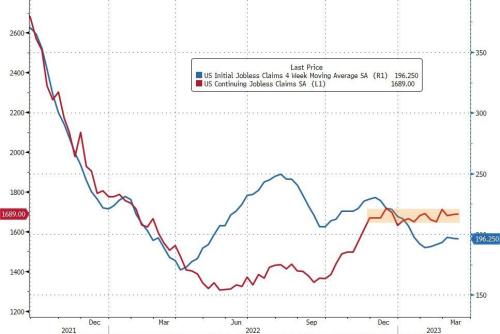

The following graphs shows us what the actual job outcome under the current tightening regime looks like:

As Zero Hedge summarized,

Continuing claims dropped very modestly but have basically gone nowhere in four months but initial jobless claims limped higher last week (from 191k to 198k), which was slightly worse than expected (196k)

For now, this is certainly not what Powell wants to see…

Sooner or later, reality has to hit this data….

Yes, later.

This is that timeframe where I said people who get laid off would readily shift into the abundant unfilled positions so that a rise in unemployment would happen much later than usual during the Fed’s tightening cycle, even as layoffs began. Labor is just backfilling into the excess jobs as existing jobs evaporate. Eventually, as the Fed tightens harder, more layoffs will mean the Fed’s tightening on economic conditions has finally eaten through the extra open positions, and then unemployment will start to rise.

Because of the huge shortage of workers to available jobs, this metric the Fed is relying heavily on will be slower than normal to respond to tightening. As a result, the Fed will not see that it has tightened as much as it can until it has gone beyond what the overall economy can bear. That means other things will break before jobs do, which means we’re in for a hard landing, not the soft one the Fed has talked about. Just like the Fed talked about soft (“transitory”) inflation but wound up with hard, enduring inflation that we all have to bear, we’ll find its soft landing anything but.

To be clear, the Fed has stated that taking down jobs is not its goal, nor necessarily even the path by which it intends to take down inflation. That is to say, The Fed is not specifically targeting a rise in unemployment. It is just that a rise in unemployment is eventually inevitable as you press down on the economy with tightening measures. Unemployment will, at some point start to rise, and when it does, it usually rises quickly. So, that marks the point where the Fed knows, by traditional measures, it is heading rapidly into the realms of overtightening if it doesn’t back off — or, to put it another way, when it knows it has done enough damage.

It is only when the second of the Fed’s two mandates kicks in (maintaining low unemployment) as unemployment rises that the Fed can even think about putting the brakes on it first mandate (maintaining a stable currency free of excessive inflation or deflation). So, until jobs give the Fed reason to back off, it won’t back off, as I just said in my last “no pivot” article.

The unresponsiveness of the jobless claims metric, where we now have a long enough time perspective to see it has been relatively uncooperative for over a year, as well as the total unemployment metric, means the Fed is more likely than ever to drive us into a hard recession. It also means the Fed is getting none of the usual help on overall inflation derived from clamping down on wage inflation.

This persistent “labor market tightness,” as it keeps being referred to, is exactly why the Fed didn’t believe GDP for the first half of last year that was saying we had entered a recession. It’s likely why the NBER, which calls recessions, also did not call one for the first half of 2022 — thinking that, if there are a lot more jobs than people to fill them, the economy must be strong, in spite of what GDP was showing. They would both be wrong. In fact, there were just a lot fewer people. The labor force was broken, and that leaves us less productive with a weaker economy. If they had understood the Covidcrisis anomaly they were facing, they would have realized that what was actually happening beneath the surface in labor did match up with GDP — a lot fewer workers translating into lower gross domestic production, which is economic decline, not economic strength.

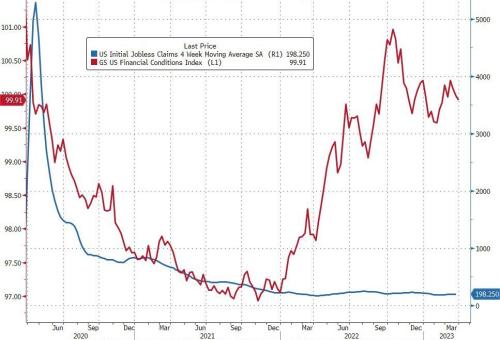

So, today’s graphs are a teaching opportunity to show how all of this is actually working out. What we see is that, while job conditions have flatlined, completely unresponsive to all the Fed has been doing for months, the tightness in economic conditions has skyrocketed:

Economic conditions are now as tight as they were at the peak of the Covidcrisis, and yet jobless claims (and hence total unemployment) have refused to turn up, just as I warned would be the case.

If you wonder where the ups and downs went from the first chart to the second for the blue line (which is measuring the same four-week moving average for jobless claims in both charts) they disappeared because, in order to fit the massive changes in both jobs and economic conditions that happened in 2020 onto the chart, the scale for the change in job metrics becomes so compressed you cannot even see the recent changes. That is just how insignificant those changes in jobs in the top graph really were on the broader scale of the big picture. That really highlights how unresponsive jobs have been to how greatly financial conditions have already tightened.

And that is how we got to the point where banks are going broke here and in Europe while jobs have not begun to move at all.

By the time the Fed sees jobless claims and unemployment rising in the months ahead enough to give it cause to stop, the economy will be badly broken. It already is. Add to that the lag time of, at least, half a year between Fed fighting and a change in economic conditions, and we’ll be in a recession as deep as the Great Recession, which is where I said we’d wind up after all of the Fed’s fake recoveries. In fact, I think we’ll wind up in the Second Great Depression.

And, why do I say the Fed’s recoveries were all fake, even though the economy was hot at times? Because they were never sustainable recoveries. We didn’t really recover because we were on life support (ultra low interest and massive money creation) throughout all of the better times. Each period of economic growth depended on the Fed continuing to highly suppress interest rates and pump massive amounts of money. The Fed was making the economy completely dependent on Fed intervention and baiting investors to take on more risk and to become over-leveraged by the time the Fed did start raising interest.

Meanwhile, the federal government did nothing to fix the underlying causes of our economic crashes — too many risky actors getting away with their madness through bailouts and lack of prosecution; too much debt everywhere weighing us down and requiring endlessly low interest to sustain that debt; stock buybacks that manipulate the market, which used to be illegal and should be again; the removal of Glass-Steagall, which turned banks into giant speculative enterprises; the special capital gains tax that only benefits people rich enough to make most of their money in stocks and other capital investments that NEVER trickle down (real wages having remained stagnant since the Reagan era); and a Fed that has too much power over the economy because of its jobs mandate, which should be sent back to a single mandate of just managing money for zero inflation and nothing else — to name only a few things.

Until then, we’ll keep repeating the same boom-bust cycles that are assured by the Fed’s economic interference and by our failure to correct any of the real flaws in how our economy operates. Each cycle becomes more extreme than the last.

Franklin Delano Roosevelt Memorial, Washington D.C.

Franklin Delano Roosevelt Memorial, Washington D.C.

Bust the Fed, Bust the Cycles!

Bust the Fed, Bust the Cycles!

Liked it? Take a second to support David Haggith on Patreon!