Markets that I said seemed almost puzzled yesterday over how to deal with obviously rising inflation, got a second wallop over the head today to help them figure it out. That seems to have knocked a little temporary sense into them, though I supposed they will find a way to get back out of being sensible by Monday. Deranged stocks and bonds both seem to manage to find their way back to higher levels of lunacy these days.

All the major indices closed out their string of five weekly wins by ending this week down with the Dow falling 100 points today. The S&P fell 0.48%, which kept its head above the 5,000 elevation level, but still down for the week. It was the Producer Price Index that turned everyone’s head today when it had the audacity to show the same thing happening a little further up the price pipeline on the same scale as what already showed up in CPI yesterday.

Excluding food and energy, core PPI increased 0.5%, higher than the expectations for a 0.1% advance.

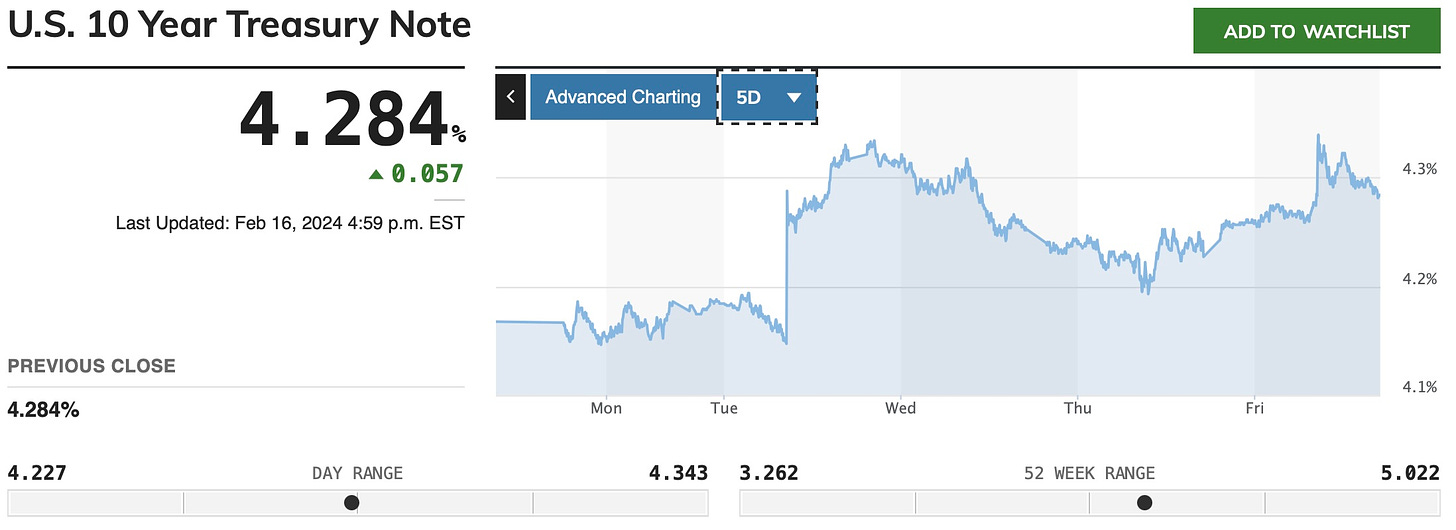

This finally rattled Treasuries back into rising to finish off a whipsaw week of indecisiveness and bewilderment by striking back above a 4.3% on the 10YR:

Yes, the mainstream press was forced to realize once again that there is, as I’ve written many times, zero chance of rate cuts in March, barring massive destruction to the economy or banking industry. (Always a more than latent possibility in these chaotic days.) And more signs of insidious destruction broke out on the surface today, as I’ll mention below.

Greg Bassuk, chief executive officer at AXS Investments, told CNBC that investors should brace for more near-term volatility ahead. Until recently, most investors were confident “that rate cuts would start in the first half of the year, and it’s looking more likely that the Fed will delay until the second half,” he said.

Yeah, and even that is enthusiastic.

Bassuk added: “The seesaw market is really reflective of this tug-of-war between high sticky inflation — which suggests no near-term rate cuts — and strong earnings and other signs of a robust economy, which underscores investors belief that there’s more growth ahead for stocks.”

They still don’t get it. It was definitely a seesaw market this week (or, as I called it, “puzzled”), and high sticky inflation is certainly the one thing that keeps monkey hammering markets down, but the other side that pulls them up is not “signs of a robust economy.” The other side that pulls markets up is delusions of a robust economy, as we’ll see below. First, more on this return of inflation that totally fits the bill for what you’ve been reading here.

Wolf Richter, writes,

PPI Inflation Spikes in Services and Finished Core Goods, Very Disconcerting

Reheating services inflation isn’t a surprise. But the PPI for finished core goods saps hopes for goods “deflation” to continue to hold down overall inflation….

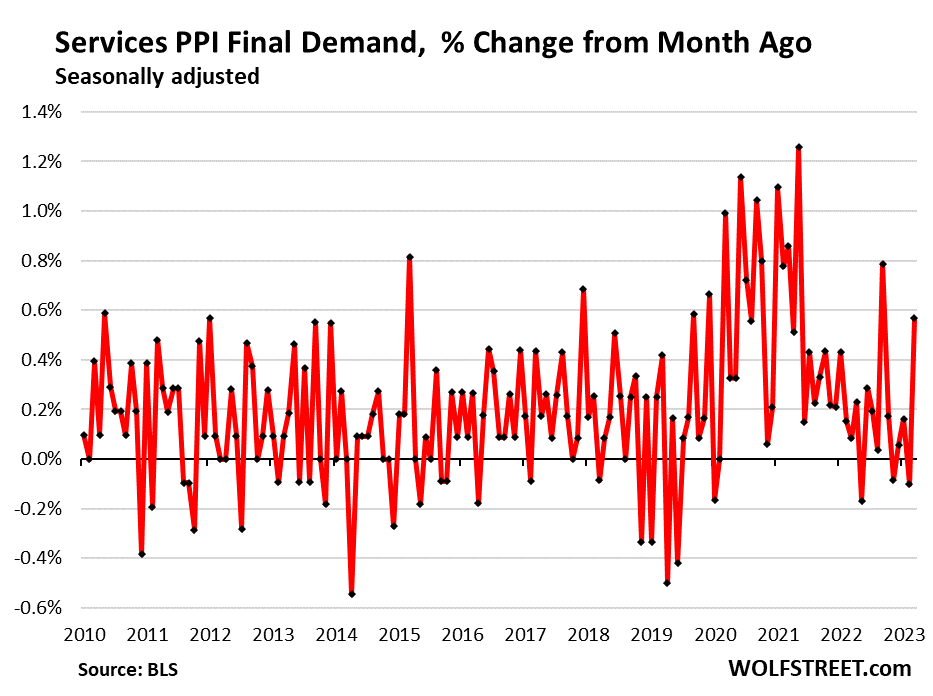

So now there’s the sudden surge of inflation in services that producers use, after months of benign readings. Since the red-hot days of early 2022, there has only been one higher reading, in July 2023.

Yes, we’re now looking at solid pictures of the type of rising inflation I’ve warned everyone to expect, which I’ve said would wither away the market’s hopes of Fed rate cuts:

That’s the second-largest spike in the last two years.

This was the first big jump in the services PPI in months and it parallels developments over the past few months in the CPI for services, and so the warning lights are blinking….

On the consumer-side of the economy – the prices that consumers pay directly – the surge of services inflation in the CPI has been reheating for months and in January spiked from there.

There is someone pointing out what I have been pointing out for more than half a year—that there were incremental changes each month in CPI that were reheating inflation, which would eventually show in in YoY or in longer annualized measures of inflation.

The rise in PPI means more is coming:

So now services inflation hit producers, not just consumers. And producers are going to try to pass it on.

The good news had been that, while services inflation was slowly and secretively edging back up, inflation on goods was staying down. Not so anymore:

Finished core goods inflation suddenly reheats as well.

The spike is a breakout from the prior 7 months when the core goods PPI remained in the same benign range, after the long plunge from the 2021 spike.

This is disconcerting because the whole disinflation momentum in consumer prices (CPI) last year was driven by drops in prices of durable goods (negative inflation or deflation) and the plunge in energy prices. This PPI data on finished goods is now throwing some cold water on the hopes that goods-deflation will continue, and will continue to hold down overall inflation measures.

The surge of services inflation, and the possible reheating of core goods inflation is a very disconcerting development.

But it is exactly the development I’ve been forecasting, though it has taken awhile to start to clearly reveal itself above the surface.

And, so, the mainstream press today notes these reports on inflation as as “hot producer prices,” making “rate-cut hopes wane.” Vindication on something where almost no one in the press agreed with me (or that is what it felt like for the last half year). What I showed slowly building beneath the surface is now clear breaking out and crashing the market’s delusional hopes that the Fed’s inflation fight was over, and the Fed would be cutting interest soon.

As I said on Goldseek Radio recently, I’d give better odds to a rate increase in March than a cut (though I don’t really think the Fed will be that brave), but inflation clearly needs another light tap on the head if the Fed wants to win that battle. So do markets that helped turn inflation back up with the wealth effects from their big rallies.

More bad economic news poured in today

So, this week, we saw retail sales plunge, CPI rise much more obviously, jobs giving the Fed no latitude for rate cuts, and now PPI rising by about the same amount as CPI, and it is PPI that feeds future CPI. Today, however, we also add the following economic bad news to counter the other part of the market’s goldilocks narrative, which is the belief in a “soft-landing” or, increasingly, even in a recession-free landing.

On the same day we get news that the UK has fully entered a recession in a downward move of its GDP worse than anytime since the Great Recession (which is saying a lot considering the Covid bloodbath that everyone’s GDP took), we also hear that …

- Fed regulators are now giving a more attentive eye to the prospects of banking troubles coming out commercial real estate.

- Mortgage rates just shot up to a two-month high.

- New home construction in the US is plunging its most since the Covidcrash that knocked housing to the ground for a brief period and then left it a weirdly broken mess ever-after.

- And the former CEO of Home Depot warns of a “tremendous shift” in the labor market that will cause more inflation and economic destruction.

Nardelli, who also served as CEO of Chrysler and now runs his own investment and consulting company, XLR-8, is also skeptical that the U.S. will sidestep a recession in the face of high inflation and interest rates….

“I think we’re still in an inflationary period, and I think we’re not going to see a soft landing.”