The Biden government’s GDP just got improved, being revised upward, again, to 3.1% from 2.8%; but one should ask why we would believe that. How is it that GDP keeps coming in strong when all year we’ve read about major stores going out of business, such as Bed, Bath and Beyond, and Big Lots, shutting down everything in a big going-out-of-business sale? We’ve seen massive store closures by multiple companies everywhere throughout the year. That’s a big lot of losses!

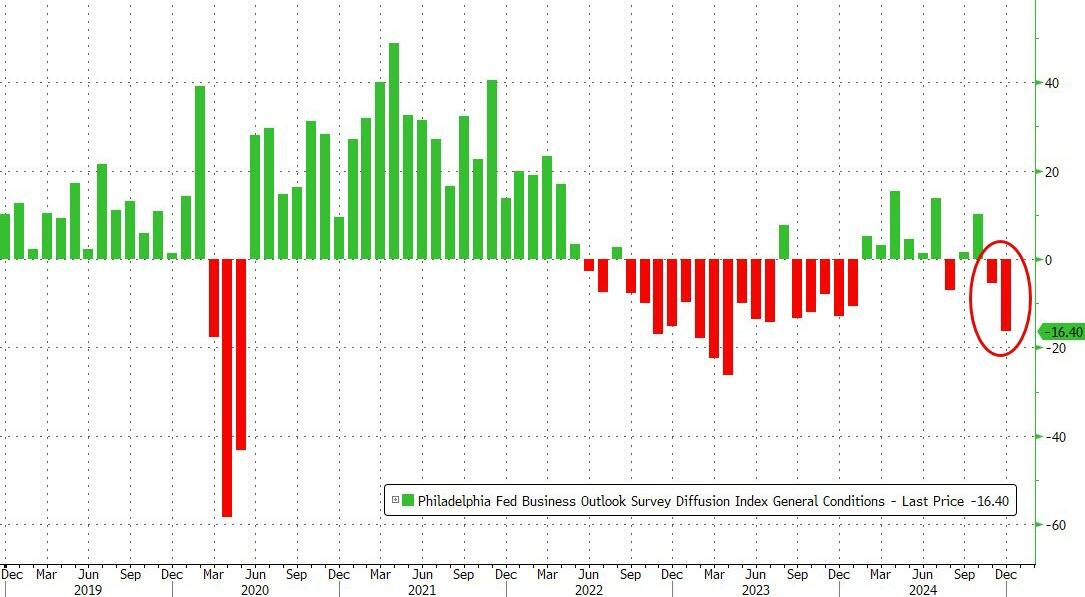

How is it that GDP is so strong when we have read for months now about a manufacturing recession all across America that just keeps getting worse? Even recently, another manufacturing survey absolutely collapsed.

The Philly Fed Manufacturing survey collapsed from -5.5 to -16.4 (dramatically worse than the +2.8 expected and far below even the worst analyst expectation).… On the ugly side, Prices Paid are surging while Prices Received are falling... that's a disaster for corporate margins...

It’s been a sea of Red in the Philly Fed’s region, especially in 2022 and 2023; but, if you average in all the regions reporting across America, there is even less green.

And, oh sure, we read that jobless claims have improved, but let’s take a look at what “improvement” actually means:

If you look at the non-adjusted claims (blue line), they fell dramatically, which would be good, EXCEPT this low is higher than all the previous highs for the past half a year. So, what we see is a large spike up that is higher than any high this year, and a low for now that is also higher than previous highs, going back half a year. So, clearly the trend holds for rising jobless claims, and it holds quite strongly.

If you look at the non-adjusted claims (blue line), they fell dramatically, which would be good, EXCEPT this low is higher than all the previous highs for the past half a year. So, what we see is a large spike up that is higher than any high this year, and a low for now that is also higher than previous highs, going back half a year. So, clearly the trend holds for rising jobless claims, and it holds quite strongly.

Continuing unemployment claims dipped a wee bit, but they still form a trend pattern since September of higher highs and higher lows (red line):

No wonder the delusional stock market, which believes, as a marketing arm of the Federal Reserve, that it should climb only because the Fed is easing monetary policy, saw its second-largest jolt in volatility in history when it got just a little dash of reality as Boss Fed said the economy is strong, but it will be cutting back on rate cuts due to rising inflation! Do you mean to tell me so many people whose IQs are supposedly higher than that GDP number of 3.1 couldn’t see that inflation was rising enough to force the Fed to trim back its forecast for rate cuts? They apparently don’t read widely enough. (Feel free to use the following button to help them out with that:)

No wonder the delusional stock market, which believes, as a marketing arm of the Federal Reserve, that it should climb only because the Fed is easing monetary policy, saw its second-largest jolt in volatility in history when it got just a little dash of reality as Boss Fed said the economy is strong, but it will be cutting back on rate cuts due to rising inflation! Do you mean to tell me so many people whose IQs are supposedly higher than that GDP number of 3.1 couldn’t see that inflation was rising enough to force the Fed to trim back its forecast for rate cuts? They apparently don’t read widely enough. (Feel free to use the following button to help them out with that:)

There are, of course, actually that many people who think that way. I found it rare to find financial writers who would agree with me when I said inflation would be rising a second time this year, even though it’s practically just math.

It’s also almost non-existent that I find any writer or publisher in the mainstream media who will quote or publish my articles. They want to believe the trends are the anomalies and the one-time anomalies are the new trends. (And they probably don’t like my sarcastic tone.) So, they also were not the ones telling you over a week ago that the stock market was looking really shaky, as I laid out in my Dec. 7 Deeper Dive.

Yet, the selling was “rampant insider selling,” according to Jesse Felder. That tells you that the people who should really understand what their companies are worth—not what they tell you to believe they are worth—are getting out.

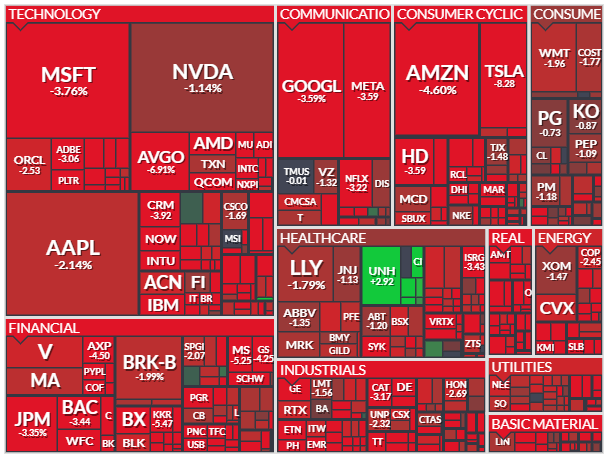

To see the breadth of the sell-off, take a look at this Christmas quilt of rising stocks (green) v. falling stocks (red):

With inflation rising, while stores have been closing left and right all year, manufacturing sinking deeper into a looong recession, and stocks now falling rapidly enough to show their critical weaknesses are real, I still have one word to describe this mess: “stagflation.” Typically, I use two: “stagflationary recession” to make it clear that inflation is happening during a time when the real economy is receding, contrary to government stats.

Oh, but GDP keeps saying it is not receding. Ah yes, but remember those reports come from a government that told us for four years Biden wasn’t receding. The Wallstreet Journal published a bombshell article (linked to below from a source you can read without a subscription, of course) that tells how the whole White House knew Biden was incompetently declining into dementia and reveals how they kept ol’ Bernie propped up to look alive for a lot longer than a weekend. (Watch “Weekend at Bernies” to get the allusion. And, yes, I get a sliver of a percent if you buy from Amazon with that link, regardless of what you buy, so you’re buying me a Christmas present at no cost to you if you do your Christmas shopping from that starting point, but that was all a shameless afterthought to making the actual reference.)

Yes, they knew Biden was diminishing as quickly as his economy. So, they scheduled as few appearances as possible, and asked all people meeting with him to keep their visits short enough to match his attention plan and stick to the big points that were the size of the triangles, circles, and squares he could still figure out how to fit through the holes in his favorite box. “Stay focused because he can’t” was essentially their motto.

Those limitations were even placed on the top people counseling Biden on matters of war and economics, such as my personal anti favorite, Gramma Yellen, whom I suspect Biden more than once mistook for his own gramma with a big smile to see her again so many years after her passing.

The WSJ explains why the Afghanistan pullout was such a travesty. Generals only got minutes to talk with the president about this huge move and were restricted to telling him only the things he would like to hear about how it would go:

To adapt the White House around the needs of a diminished leader, they told visitors to keep meetings focused. Interactions with senior Democratic lawmakers and some cabinet members — including powerful secretaries such as Defense’s Lloyd Austin and Treasury’s Janet Yellen — were infrequent or grew less frequent. Some legislative leaders had a hard time getting the president’s ear at key moments, including ahead of the U.S.’s disastrous pullout from Afghanistan. . . .

Presidents always have gatekeepers. But in Biden’s case, the walls around him were higher and the controls greater, according to Democratic lawmakers, donors and aides who worked for Biden and other administrations. There were limits over who Biden spoke with, limits on what they said to him and limits around the sources of information he consumed.

And, from another writer who was lambasted for suggesting Biden was running three-and-half quarts low on brain lubricant (as I often suggested here):

That’s what Rep. Adam Smith of Washington found when he tried to share his concerns with the president ahead of the U.S. withdrawal from Afghanistan in 2021. Smith, a Democrat who then chaired the powerful House Armed Services Committee, was alarmed by what he viewed as overly optimistic comments from Biden as the administration assembled plans for the operation.

“I was begging them to set expectations low,” said Smith, who had worked extensively on the issue and harbored concerns about how the withdrawal might go. He sought to talk to Biden directly to share his insights about the region but couldn’t get on the phone with him….

Joe Biden was always the doddering, mumbling, stumbling, forgetful, and barely-functional-for-a-few hours geriatric that I and a lot of other Americans said he was, from the moment he reemerged on the public stage in the 2020 presidential primary. For pointing out what we could see with our own eyes and hear with our own ears, and for paying attention to the president’s schedule, we were called liars, conspiracy theorists, and purveyors of the “gross, lowest-common-denominator politics that drive people away from public life.”

The unwelcome truth is not rewarded even with new readers, which is my own unwelcome truth to me. That’s about as much accord as I got for pointing out how likely stocks were to tumble soon and how far they’d fall as well as how certain inflation was to rise, pressing the Fed back from cutting interest rates. Eventually, the Fed will need to actually raise rates in the middle of a recession.

That’s the response I got for saying for the past year we’re in a covert recession that is only covert because GDP is such a fraud … just like the president who stood, sturdy as a one-legged stork with gout, behind those numbers. It’s a fraud because the inflation the government bean counters back out is so intentionally understated. Stocks are also a fraud as a measure of the economy, being propelled upward for decades by easy Fed funding and formerly illegal (because they are manipulative) buybacks to where the Fed fraudster’s next moves get many times more attention in the press than business or economic facts. In that mix, the truth is as welcome as a fart at the Christmas party punch bowl.

No wonder Biden could smile so easily as he told us the economy was great while he did worse than fart in his diaper! It was the only thing he was allowed to hear from the puppet masters who dandled his strings! So, you can believe their “real GDP” gives the “real” inflation-adjusted state of the economy if you want; but just remember this news comes from the same gang who tried to run Dementia Man for a second term because they believed they could prop him up on drugs long enough to make it through a debate just so they could keep someone in power who powered off long-enough for power naps each day to allow them to run the country however they wanted. They were hoping to extend their weekend with Biden for a longer engagement.

The puppet masters should serve prison time for completely deceiving the nation about the puppet’s incompetence; but, of course, they’ll use his mouth to issue themselves prepartum pardons if they catch any whiff of trouble now that the WSJ has exposed their dirty little hind ends.

Though few people believe me, maybe they’ll believe the WSJ now that it finally got on the job … albeit just in time for Biden’s big exit.