Let’s talk gold. The Federal Reserve meeting will be over today. Gold price has risen this quarter on the back of rising inflation and very high probability of sustained hyper-inflation. A weaker US dollar Index. Bond yield forming a long term top between March 2021 and May 2021 is also supporting gold price. Gold has got competition from crypto currencies as well. I believe that crypto currency price moves affect only short term trend of gold. In the long term gold is still a buy on dips. Gold if invested as a safe haven is not a bad investment at $1762.

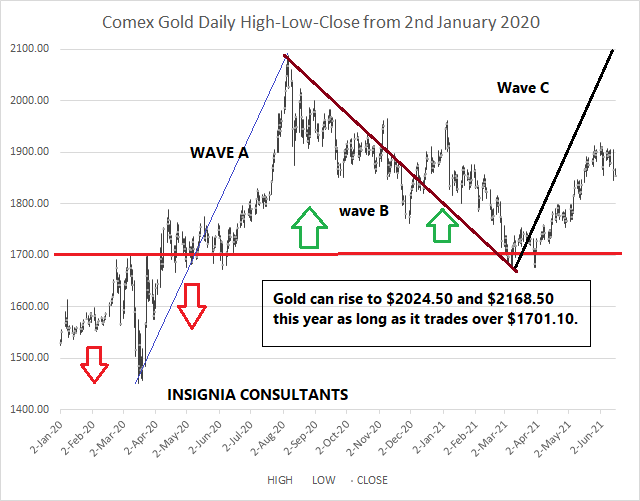

Let’s look at the Comex gold technical. This is an end of the day chart from 1st January 2020 to 15th June 2021.

- Fifty day moving average is at $1826.10.

- One hundred day moving average is at $1797.50.

- Two hundred day moving average is at $1844.10.

- Three hundred day moving average is at $1830.90.

TECHNICAL VIEW OF GOLD

- Long term moving averages are all concentrated between $1797 and $1844.

- Gold needs to trade over $1797-$1844 zone in the short term to be in a bullish zone and rise to $2024.10.

- In the past nearly eighteen months gold has not traded below $1700 for a very long time. $1700 is now the lower base price for continuation of medium term bullish outlook or trend.

- Gold has to trade over $1701.10 till Christmas to rise to $2168.50 and $2278.90.

- My experience is that convergence of moving averages sometimes can cause big one way price moves in any investment instrument. With respect to gold, a sustained fall below $1797-$1844 zone will pave the way for $1701.10 and $1590.70 in less than a week. This is based on my experience. But near term CME gold futures have to trade below $1797.50-$1844.10 for alteast six consecutive days for a bearish bombshell.

US dollar Index trend will affect the short term gold price moves and not long term. Hard assets investment demand will be equally high as compared to current demand for digital demand. Inflation, Hyperinflation, deflation, interest rates policy, monetary policy and other financial policy decisions of nations and central banks will come in and go out. Overall trend for gold is bullish. Short term traders will need to scrutinize everyday US economic data releases, daily global bond yield trend etc.

To me global cost of living has doubled in the past eighteen months. Gold price has not doubled. Gold price will match the global cost of living very soon. Once again I prefer physical over rest of gold investment avenues for the medium term to long term.

GOLD-SILVER RATIO

- Gold-Silver Ratio has to trade over 0.82 for gold price to outperform silver.

- Silver price is in a bullish zone as long as the gold-silver ratio is below 0.82.

- Gold is bullish. But pace of rise of gold will be very high if the gold-silver ratio breaks past 0.82 and trades over 0.82.

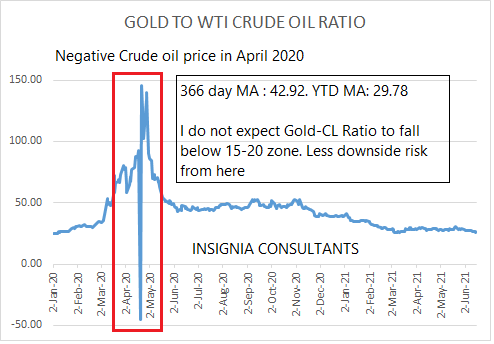

GOLD TO CRUDE OIL RATIO

- Gold to crude oil ratio has been in a falling trend since April 2020.

- Technically gold-crude oil ratio is oversold (not in the chart).

- Gold to Crude Ratio has to trade over30-35 zone for the rest of the year for crude oil price to reduce the pace of rise.

- Key long term resistance is 42.92.

MCX GOLD NEAR TERM FUTURE TECHNICAL VIEW

- 50 day MA: Rs.47925

- 100 day MA: Rs.46982

- 200 day MA: Rs.48605

- 300 day MA: Rs.48685

- 400 day MA: Rs.46693

- One hundred percent forward retracements are at Rs.49765 and Rs.51875. The next massive rally in gold will be only on a break of Rs.49765.

- Bullish View: Overall gold is bullish as long as it trades over Rs.46693 (four hundred day moving average) with Rs.51875 and Rs.53181 as price target.

- Bearish View: Gold can fall to Rs.46693, Rs.44626 and Rs.40348 in case Rs.49765 is by end July. (MCX gold August future close).

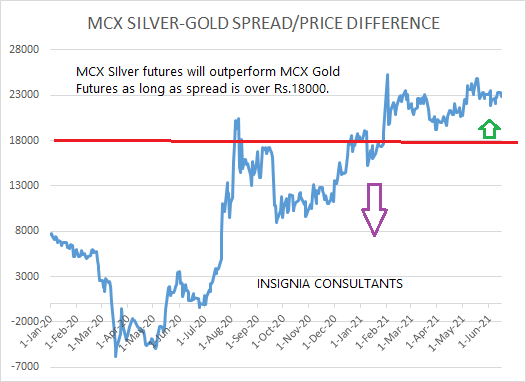

MCX SILVER-MCX GOLD SPREAD/PRICE DIFFERENCE/BADLA

- 374 day average: Rs.11445.

- Year to Date average: Rs.21281.

- Average from 1st April 2021 to 15th June: Rs.22254

- MCX Silver-MCX Gold Ratio has to trade over Rs.21281 (ytd average) for silver to be in a medium term bullish zone.

- In the long term silver is bullish as long as MCX Gold-MCX Silver price gap is Rs.18000 and more.

Spread trading can give good profit in intraday trading as well as long term trading. Spread trading is my favorite way to trade as risk is reduced. However I look at trend changing news and changes in technical factors and modify my trading strategy. Algo traders can set the spread/price difference parameters for trading. I prefer the end of day technical. Day trading algo traders should preferably use one hundred minute technical for jobbing and intraday trading.

There are fears that post pandemic extremely high growth rates can result in a selloff in gold price. Global political changes and global demographic changes under Biden will be a big contributor to causing unthinkable high prices in gold. Rise of digital assets, more and more industrial usage of gold will contribute to higher gold prices. Traditional demand factors will also remain high. However in the short term the sharp price correction up to $200-$250 will be part and parcel of the bullish trend. I will not be surprised if gold prices sell off first and then zooms and reaches the moon.