Sell off in bitcoin and crypto currencies suggest gold and silver will now be able to break past key resistances of $1878 and $28.00. There will be a very quick rise on a break of these resistances.

Positives for gold and silver

- Inflation numbers (CPI and PPI) numbers in USA have risen sharply in April. Inflation outlook is also to rise in May and June.

- US April retail sales are as per expectation and on the higher side. US retail sale is expected to rise in May and June.

- Gold and silver are trading over one hundred day moving average of $1793.40 and $26.10.

- Investment demand for gold has started to rise.

- US dollar Index is weak as well.

Negatives for gold and silver

- Gold still has to break key resistance of $1878.00.

- Japanese yen (usd/jpy) trading over 111.10 can prevent gold and silver from a big rise.

- FOMC minutes (on Wednesday) can also be bearish for gold if it ignores inflation.

- US ten year bond yields rise sharply.

Silver will rise. Gold price rise is dependent on the ability/inability to break and trade over $1878. Yeah gold has to trade over $1877 till 16th June FOMC meet for continuance of short term bullish zone. Gold price will nosedive/sink by whatever word you can call IF $1877 does not hold.

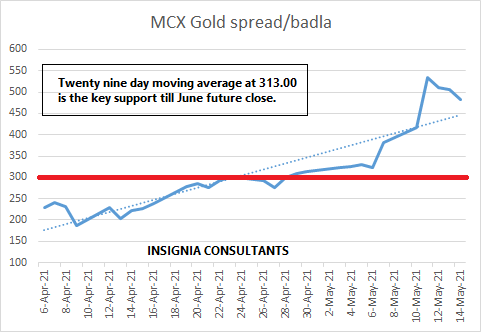

A bit on MCX Gold Spread/badla

The spread between MCX Gold June and MCX gold August started on a weak note partly due to non-believers in a gold price rise. Gold spread/badla started rising once there was confirmation that gold price has formed a medium term bottom in the month of March. MCX gold June is futures is expiring on 4th June. Traders are long and short as well. They will have to decide whether to roll over or square off their open positions in gold futures till the end of the month.

- MCX gold spread/badla on closing price of 14th May was at Rs.482.

- Low of Rs.187.00 was on 9th April.

- High of Rs.534.00 was on 11th May.

- Average MCX Gold spread/badla between 6th April and 14th May is Rs.313.00.

- 2021 Average MCX Gold spread/badla is Rs.240.00 (not there in the graph above).

- Key resistance till 4th June is Rs.655.00

- Key support is Rs.300 (assuming some undershooting from Rs.313.00).

Should one roll over his MCX Gold future investment now or wait till the end of the month?

Everyone will be thinking this since gold prices have risen. They are on the verge a big technical breakout. Before I give my verdict let’s take a look at key long term moving averages in MCX Gold June Futures.

- Four Hundred day moving average is at Rs.46104. This is the key long term support.

- Two hundred day moving average is around Rs.49008. This is the key long term resistance.

- One hundred day moving average of Rs.47211 is the immediate support.

Verdict: I will suggest to wait for a dip of MCX gold spread/badla to Rs.360 and then roll over. However if I am wrong and gold spread/badla rises then I will suggest to use a trailing stop loss of Rs.655.00. I do not expect MCX gold June-MCX gold August spread/badla to break past Rs.655. (Gold spread/badla will break past Rs.655 resistance only if MCX gold June future breaks past Rs.49650 before 31st May.)