Comex copper slumped sixteen percent from the all-time high in May of $488.80 to $408.80 on 21st June 2021 and has pared some of its losses. Chinese government measures to prevent high base metal prices affecting its factories is the key reason for the slump in copper. Reduction in investment demand along with reduction in speculative long positions added to the slump in copper price.

There are worries that copper has formed a short term top. It will take many months for copper to break past $500.00. Demand side is very bullish for Dr. Copper for the rest of the year.

** June Comex July future close is of 21st June.

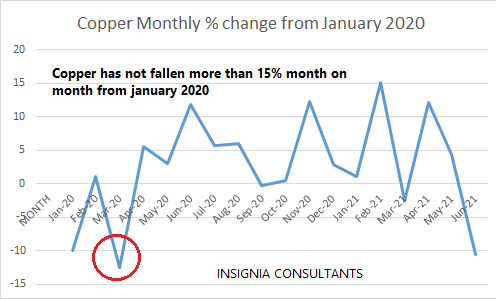

In the past eighteen months, month on month copper has fallen for just five months and risen in thirteen months. When the covid pandemic began supply issues and supply side pressures lifted copper from March 2020 low of $197.25. Copper got a big boost when Russia’s sputnik covid vaccine was announced in late August 2020. Thereafter copper has never looked back.

Global automobile shift from internal combustion engine (ICE) to electric vehicles (EV) is the key reason for the rise in copper price. EC charging infrastructure will also need copper and aluminum. Biden infrastructure plan, if passed and implemented, is going to consume a huge amount of copper.

New mines supplies of copper will be limited. The world will be in a copper deficit over the coming years. Only a sharp increase in recycled copper will also reduce the future deficit in copper. Long term fundamentals are very bullish for copper.

TECHNICAL VIEW OF COMEX COPPER NEAR TERM FUTURE

TECHNICAL VIEW OF COPPER

- Copper is trading over key long term moving averages. It needs to trade over $375.20 for the rest of the year to continue its bullish trend.

- April 2021 low of $394.35 is the key short term support for copper.

- Short term view: (1) Copper has to trade over hundred day moving average of $421.90 to rise to $469.10 and $496.80. (2) Copper will crash only if $443.60 is not broken in July to December quarter.

- Long term view: (1) Copper has to trade over two hundred day moving average of $375.20 to rise to $555.40 and $695.10. (2) Copper will crash only if it does not break $502.10 in the third quarter to $345.80 and $308.90. (this is the technical view just in case there is a crash.)

The next four weeks is very crucial for copper from a medium term technical perspective. Copper has to trade over $390-$410 zone to continue its bullish zone. Post June 2021 FOMC gold and silver price had crashed. All major moving averages and key long term supports were broken in less than twenty four hours. This can happen with copper too, given a bad day or some error of judgment by traders or global stocks move into a short term bearish phase. To me Dr. Copper has to survive the next four weeks over $390 to continue its bullish zone. All these forecasts of copper being the next gold will get dumped just in case investors sell every asset class and sit on cash.

Copper has a history of price consolidation for a very long time after a sell off followed by a fifteen percent one way price move. If copper rises then fifteen percent from the lows will be there.

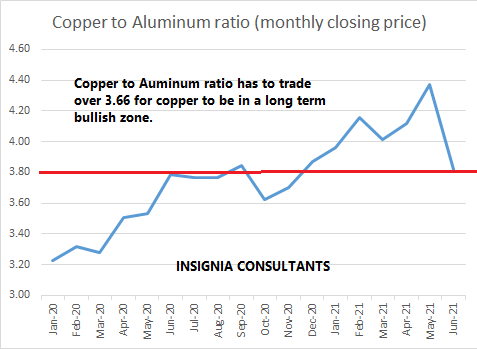

COPPER TO ALUMINUM RATIO (LME SPOT)

#### Data Source: www.investing.com

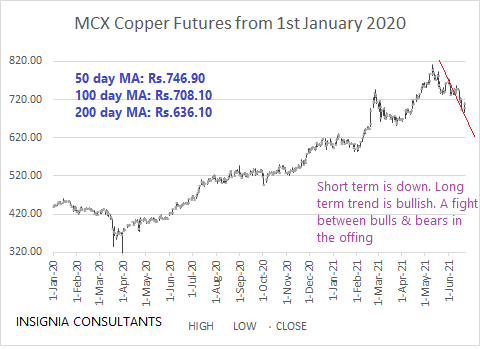

MCX COPPER FUTURE TECHNICAL VIEW

- MCX Copper future has to trade over Rs.688.10-Rs.708.10 zone to be in a short term bullish zone.

- There is a big technical support between Rs.671-Rs.688.10 zone. Copper needs to trade over this zone in the July to September quarter to rise to May 2021 high of Rs.812.60 and Rs.920.60.

- Bearish trend will be there if MCX copper future does not break Rs.777.60 in the third quarter to Rs.636.10 (two hundred day MA) and Rs.608.60.

Precious metals slumped in June. Industrial metals also corrected sharply in June. Crypto currencies were also sold in June. Bond tanked in 2020. Except for stocks every asset class has seen a price slump or a price crash over the past nine months. Energies are rising with all the fervor. There is expectation that post covid global economic growth will result in historically high consumer demand led global economic growth. It is this expectation that has resulted in investors investing in copper and commodities in whichever way they can. Commodity price hyperinflation will prick the expectation of post covid hyper global growth. When this happens global stock markets will plunge and move into a medium term bearish zone. A sustained stock plunge globally will puncture every asset class. Medium term trend of global stock markets is the key for copper and every asset class (except bonds).

One should buy naked far dated copper call options on any further price slump. The pace of rise of copper will slow and not the actual rise. I remain very bullish in the long term. Guarded optimism in the short term for copper.