I still beg to differ with those who say the plunge from a positive 6.9% GDP growth rate in the last quarter of 2021 to minus 1.4% in the first quarter of 2022 is just noise. “It’s just a passing anomaly,” they say. On the contrary, I am certain the anomaly was the 6.9% reported for the end of 2021, created by everyone stocking up on everything they could get their hands on in a panic over the shortages we saw coming well before the sanctions over Putin’s invasion of Ukraine.

That big surge that made up for the lockdowns is over. It was a last hurrah for the economy. The third quarter of 2021, after all, had only seen 2.3% growth, putting the economy back at the mean for the past thirty years. 2.3% was a return to what had become the new normal since the Great Recession began.

It’s not reasonable to expect the post-pandemic-lockout blowout would last much longer than that. Clearly recovery from the most extraordinary quarantine lockdowns in history was the anomaly! It was an unexpected storm that created rogue waves throughout the global economy. In fact, 6.9% GDP growth is such an obvious outlier, in itself, that you have to go back more than two decades to find another quarter that matches up to it, excluding, of course, the one-of-a-kind anomaly that happened upon the immediate re-opening of the economy in the third quarter of 2020 after the first Covid lockdown.

So, let’s take a look at what is actually happening this quarter all around us without waiting for the next numeric GDP report. In order to understand the waters we are now sailing through, let’s gauge the sentiment of the captains of industry regarding their present circumstances, and let’s look at the way the passengers — consumers — feel about how their ship is tossing. In fact, look to your own gut-level churning as one of those passengers about the current rocking and rolling you can sense and see you if you don’t have a sinking feeling that the 1.4% drop in the economy last quarter was due to the ship you are riding in breaking up from all the storms that have already tossed it around.

Can you not hear the groaning of metal as it bends in the waves?

CEO confidence lowest since the start of the Covidcrisis

CEO confidence, as measured in a major survey sank 15 points from the first quarter. Yes, CEO’s, who should have a pretty clear sense of their own business conditions, see the present quarter as worse than the last quarter — the one where GDP took that 1.4% drop into a recessionary trough and, in fact, worse than anytime going through the pandemic. That’s pretty bad!

“A reading below fifty is consistent with slowing for sure and other metrics. So, I think we need to watch this closely … CEOs are really expecting slowing.”

They have not been passing all those costs on to the consumer … yet…. 54% of CEOs said they expect to still pass costs on…. Consumers are changing buying behaviors…. This set of circumstances is not likely to get better anytime soon.

The story told here is almost all about inflation and supply-chain issues! It’s not about stocks. It’s not about what the Fed is going to do. The story these mariners have to tell is all about inflation slamming into the hulls of their businesses, rising waves of higher wages, and falling circumstances like the supply-chain shortages, the war in Ukraine, and continuing Covid shutdowns. They are navigating a business environment full of hazards, piloting through a surging sea with rocks and cross currents everywhere.

So, let’s forget stocks and bonds and cryptos for the moment and get real here about the economic shitstorm on Main Street and in our households because that is where recessions happen, though I’ll note in passing that Zero Hedge says the mood on Wall Street has “never been more apocalyptic,” and Wednesday’s events in the stock market certainly demonstrated the truth of that. But let’s look at how Main Street feels:

Housing is capsizing

The housing market has begun to turn over at last. Demand for home mortgages has already listed 12% in just one week as homes, themselves, are not listing for sale. Sellers are not putting homes on the market because they afraid of being left adrift with nowhere to live that they can afford because they will have to refinance their replacement home at higher interest.

Mortgage applications to purchase a home declined 12% week to week and were 15% lower compared with the same week one year ago….

Mortgage rates have risen over 2 full percentage points since the start of the year, and home prices are up more than 20% from a year ago.

Prices swelling by that much compounded by interest rising that much is the kind of rogue wave that forms when two waves come together from different angles. That kind of action can lift a ship straight up and throw it right over on its back.

At the same time,

Inflation isn’t helping consumers feel particularly flush either.

“General uncertainty about the near-term economic outlook, as well as recent stock market volatility, may be causing some households to delay their home search,” said Joel Kan, an MBA economist.

Under those conditions, refinancing, of course, has plunged 76% from a year ago. There are two kinds of refinancing. One is to get a lower payment. Obviously, no one is likely to refinance their home now that interest rates are higher than they’ve been in years in hopes of a lower payment. So, there is not economic significance to that kind of drop in refis. The other kind of refinancing is for things like building additions and making improvements to homes. That kind has slowed way down, too, and that does have economic impact in the all-important home construction industry. Who wants to raise the entire payment on their home to twice interest rate just to fund a remodel project?

The worst part of this story is the darkness it shows on the horizon for some. Buyers are so desperate to get into a home they have done the dumbest thing you could possibly do at times like this. They have grasped for adjustable-rate mortgages — the very time bomb that swamped the housing market in 2008. You do not go for an adjustable-rate mortgage when interest rates are rising at the fastest clip in history! That’s financial suicide! Yet, ARMs have risen from constituting 3% of mortgage applications a year ago to 10.5% now. That still leaves a small aggregate of total mortgages that are ARMs compared to where we were in 2008, so it is not (so far) a time bomb for the entire market; but it will likely become a financial wreck for everyone who has entered one.

The inventory of homes on the market is growing, but not because more builders are building more homes or because more sellers are coming on the market, but simply because buyers are jumping out of the market in total discouragement. Those who are wise enough not to take the ARM-twisting necessary to afford a mortgage are abandoning ship. In this situation, rising inventories help no one. They are a rising tide that simply signifies the death of the housing market. There is just no way but suicidal finance to get into a house now … for most people anyway. Better to sit out the collapse and then buy in when things are in your favor.

The monthly mortgage payment on the median-asking-price home — which has risen to $408,458 — has hit a record high of $2,404 at the current 5.27% mortgage rate, per Redfin. That’s 42% higher than the $1,688 monthly payment a year earlier, when mortgage rates were 2.96%. “Homebuyers continue to be squeezed in nearly every way possible, which is causing some to take a step back from the market,” says Redfin chief economist Daryl Fairweather.

The plunge off the face of that wave has already began. As inventories rise, homeowners that are selling start cutting prices. 15% of homeowners are now starting to cut prices (not a lot, but some). That is opposed to 9% a year ago. Nevertheless, most homes are still selling above asking and in record time. So, this is only the start of things rolling over. It usually takes a long time for sellers to capitulate and lower prices because their home is their most important asset. So, waiting for a market of this size to overturn becomes an extended waiting game between sellers and buyers. I wouldn’t call this a crash, but we are listing away from the most significant economic driver in this nation — home construction. And with the cost of materials shifting faster than contractors can keep track of over the past year, it was already a perilous environment to navigate.

It is no wonder, therefore, that homebuilder sentiment has become as unsettled as CEO sentiment; yet, look at how far it has to plunge to catch up with the puking seen in homebuyer sentiment:

You can see builder sentiment usually tracks fairly close with what buyers are feeling because it has to in order to avoid major business mistakes. With five straight months of decline and a lot of catching up to the reality of homebuyers still to do, how is this quarter going to show better business growth in the nation’s main economic sector than last quarter? That fantasy makes no sense whatsoever. You can just look at what is clearly already happening — what people who are in that major market all feeling at both the buying and selling ends of the market — and say this quarter is not going to come out well for the nation’s most important business sector. People wouldn’t all be feeling so low if things were cruising right along.

So, as members of the Fed tell you, as they did yesterday, we have a strong economy, tell them to shut up!

And it is not as though the picture improves any on the commercial side of there real-estate market.

The news for the office sector of commercial real estate just keeps getting worse. Some tech and social media companies have announced hiring freezes…. Others have made cutting costs suddenly a priority, promising very constrained hiring…. Numerous startups are laying off people…. Mortgage lenders from Wells Fargo on down have started laying off significant portions of their employees as mortgage lending is now in the dumps….

In addition, there is the shift working from home for office employees, and hybrid models where employees show up at the office only every now and then….

Availability rates, which sounds … less bad than vacancy rates, have shot up during the pandemic, and in many cities have continued to rise through Q1 2022, and are now in the astronomical zone.

Several major markets now have office vacancy rates above 30%. That clearly doesn’t speak of things getting any better in Q2 of this year. If anything that sector will weigh heavier on CPI than it did last quarter when the first decline happened. San Fran, which had been the nation’s hottest commercial market prior to the Covidcrisis, now has a vacancy rate of 26.8% — the worst the city has seen in its entire recorded office history. Things have shifted from “how are we going to find enough offices for all the business growth” to “maybe we can lease the space out for raising hogs.”

OK. It’s not quite that bad, but building owners now have to find alternative uses, or some buildings will go derelict and mortgages will default.

Naturally, pirate-infested, sand-flea-covered shoals like Chicago have the worst numbers, but that city has brought its extreme problems upon itself, thanks to having the nation’s ugliest mayor, Lori Lightfoot, whose name is aptly associated in ballads with the wreck of the Edmond Fitzgerald, which sank in the Great Lakes as Lightfoot’s city is doing in its own political and social flotsam.

Even Lord Blankfein, former pirate captain of that great merchant ship known as the Goldman Sachs says recession is …

a very, very high risk factor…. If I were running a big company, I would be very prepared for it…. If I were a consumer, I’d be prepared for it.”

Though Blankenstein is not saying recession is happening yet, he is evidence that even those at the top of the food chain feel the heaviness of recession in the wind.

Shipping has sunk

Sanctions now blanket the world. The EU has said it cannot handle any more. Suffering Shanghai may be showing signs that its port will no longer shanghai global markets but will reopen soon; however, worker shortages all over the world are keeping many docks closed or running below their normal volumes and keeping trains from running on time for now. Shipping companies are running out of ships, but it is not because there is so much traffic of goods. It is because so many of their ships are stalled at sea waiting to offload their cargo.

From Los Angeles to Hamburg, scores of containers ships are waiting for weeks to berth at ports, Nixon said… There’s currently a queue of 130 vessels waiting off the world’s biggest port in Shanghai, he said.

We needed Chinese ports to plug tight right now like we needed one of the world’s largest container ships, the Ever Given, to jam up the Suez Canal. It seems the world at present is ever given to one stoppage after another in the realm of the oceanic transport.

Ever Given blocking the Suez Canal

Ever Given blocking the Suez Canal

Maybe Shanghai clears, maybe it doesn’t, and maybe the Black Sea reopens its mined waters, and maybe months from now shipping traffic slowly unjams and starts to flow like normal. Lot’s of maybes. But the reality we have before us right now is that shipping has never looked this bad in world history, except maybe during World War II … maybe.

Diesel shortages and prices are raging. Some fuel pumps on the east coast were closed briefly due to being out of fuel, and truckers and trains are all upping their prices. Rationing on the east coast is anticipated by summer.

“It’s not happening yet, but it’s coming,” said William “Lewie” Pugh, an … executive vice president who worked as a leased owner-operator for 24 years, said of free-agent independent drivers either leaving the business or deciding to change the way they operate.

For owner-operators, the fat city of the past two years has lost some weight….

Diesel prices in the New England and mid-Atlantic regions, which are experiencing acute shortages of diesel, continued their climb. Prices in New England hit $6.43 a gallon, according to EIA data. Prices in the mid-Atlantic were reported at $6.38 a gallon…

Meanwhile, spot prices for dry van services have collapsed, falling an eye-popping $1 per mile year-to-date, as concerns rise that the pace of the pandemic-driven pull-through of consumer buying is leveling off. According to data published Monday by KeyBanc Capital Markets, dry van spot rates, ex-fuel, are down 30% from their late 2021 peak.

There is a lot of up-and-down action on the sea right now — costs way up, revenues way down. Doesn’t sound like we are skirting a stagflationary recession to me. Sounds like we are in the throes of one.

The same can be said for the cost of fueling all those ships idling at sea. These costs either get passed through, or people go out of business. That affects almost every good on earth. And the pass-through price war of survival is here to stay because high fuel prices are “here to stay” according to Oilprice.com. Most of the first quarter did not know those exorbitant costs because the invasion of Ukraine didn’t start until the end of February. So, how is it that a full quarter of higher fuels prices than we had in the first quarter is not going to raise the prices of everything and, therefore, reduce the demand for everything — or put people out of business — and, either way, bring GDP lower?

If you can look at something and KNOW it is worse all over the nation this quarter than it was last, then you know it will be weighing on this quarter’s GDP. You don’t need the GDP report to know that fuel factors into the costs of all businesses and all products and the mobility of all consumers and the strength of their budgets. So, three months of higher fuel prices weighs down everything.

In the face of distress so widespread, I think the burden of proof lies upon those who do not believe this quarter will eventually print through a negative GDP number. How, with the broadest cost factor in all industries riding so high, is this quarter going to turn out better than last … other than for those who have oil to sell? The claims make no sense to me.

That ship has sailed … and not upon friendly seas.

This is a “perfect storm” of problems and if you don’t have enough food stockpiled, you should be learning and trying to grow whatever you can to be as self-sustaining as possible. This is going to impact the already hard-hit food supply and by the time the majority of the country figures it out, it will be too late.

Consumer sentiment sinks to deeply depressing lows

With all of that in view, how do you think people are feeling about this right now? We call them “consumers,” but they are people, and right now these people are feeling depressed and anxious — not a little, but a lot:

Americans are more stressed about money than ever, and it’s hurting our mental health.

Americans are more stressed about money than they’ve ever been, according to the American Psychological Association’s latest Stress In America Survey.

“Eighty-seven percent of Americans said that inflation and the rising costs of everyday goods is what’s driving their stress,” said Vaile Wright, senior director of health care innovation at the American Psychological Association.

More than 40% of U.S. adults say money is negatively impacting their mental health, according to Bankrate’s April 2022 Money and Mental Health report.

https://www.cnbc.com/video/2022/05/18/american-financial-stress-mental-health.html

https://www.cnbc.com/video/2022/05/18/american-financial-stress-mental-health.html

You’re telling me that that many people are at that level of stress over finances, and we haven’t even entered recession yet??? Some may need the numbers to figure it out, but I go by the environment, and this is recession if I’ve ever seen or felt it.

You may recall that I wrote several months ago that few people were caring much about inflation at that time because most had not lived through the stagflation of the seventies. That, I said, would change once they started to experience the daily stress of worrying about how seriously prices were going to stretch their budgets as incomes always grow slower than inflation rises.

Some things you have to experience in order to realize how they start to become a part of your daily thinking and feelings and decisions. This is what some writers meant when they warned months ago that the Fed’s slowness to deal with inflation could result in inflation becoming a new mindset that pressured spending downward and wages demands up, adding to the inflation spiral because of built-in expectations that would form, changing consumer behavior.

We have now sailed past a line of demarcation on that to where…

El-Erian Says US Can’t Avoid Stagflation Even as Fed Tightens

The US economy won’t be able to avoid a bout of stagflation and markets have yet to tune into the risk of a significant slowdown in growth, said Mohamed El-Erian, the chair of Gramercy Fund Management and former chief executive officer of Pimco.

“We’ve seen growth coming down and we’re seeing inflation remaining high….”

As for how investors should respond, he said they have still to price in a “significant slowdown in growth,” which means there’s more of an adjustment to make.

It can’t “avoid” it because it is already IN it! “Growth down – inflation high” is the definition of “stagflation.” “Significant slowdown” doesn’t sound like the economy will be pushing back up from that -1.4%. The burden of proof belongs to those trying to argue -1.4% is not the new trend when everything happening around us howls like the wind and groans like bending steel and certainly feels like things are falling apart badly. I say THAT is the new trend. You’ll have to try pretty hard to convince me it is not and that this fractured, battered, creaking economy is sailing along just fine over the bounding main and is not already a shipwreck.

Sinking sentiment equals sagging sales

That heavy consumer sentiment is what is now causing retail to tank in addition to lack of goods. And tank badly.

Yes, I know we recently got a retail report that said retail was rising. The government told us, in its Advance Retail Sales Report, that total sales rose 1% month-on-month. Whoop-dee-doo. Part of that was inflation because the measure used was dollars. The only thing they reported as falling in that dubious report was food. Apparently, people are tightening their belts after laying on the “Covid-19” around their waist and are eating less. It’s a little hard for me to believe food sales are falling (even measured in dollars when inflation, alone, should have shot them upward), but people are out buying electronics. Really? Something is fishier than Moby Dick in those numbers.

Moreover, it certainly doesn’t square with what the captains of industry are telling us in their all-important stock reports in which you can be certain they do not want in such perilous times of falling stocks to send their stocks down harder with a message any worse than they have to tell by SEC rules. When the market is soaring, one might prepare for a quarter expected to be worse by lowering the sails to let a little air out in order to lower expectations a little, but these are not those kinds of times.

Yet, the heads of major retailers have sounded such alarm that they scuttled their own stock prices. Target shares plunged an entire bear-market drop and then some in a single rush down 25% after it reported inflation hits and resulting earnings misses. That was its worst fall since Black Monday, 1987. You’re going to tell me that happens without a recession? Of course, back then, Target’s stock values were much smaller, and making it even easier for smaller numbers to see major percentage drops than larger numbers. So, really, this was more improbable than the good-times plunge of ’87.

The massive Flash-Crash of ’87 is one of the few that happened outside of a recession. As you can see it looks like nothing, but percentage-wise (logarithmic scale) it was bigger than what is happening today, even in Target’s stocks. You can also see that the Fed’s “inflation probability” indicator usually doesn’t move until the recession hits, so it’s not much of an indicator, except to say, “We’re there” when it does show up. And remember, a gray-shaded recession area won’t show up for the present time at the end of the graph until more than two quarters after it began. THEN the present time will suddenly pop up gray as the officials finally say, “Oh yeah. We’re in a recession that started in the first quarter of 2022.”

Before I launch into this, I should note that generally these retailers stated their revenues were up. That would seem to indicate people were buying more, not less, but with two really big caveats. Using Target as an example, revenues were up about 4% over a year ago BUT inflation is up about 8%, so real revenues were down by 4%.

Secondly, earnings were way down, even without adjusting for this devaluation of the dollar being used to measure their business revenue because they were not able to raise prices enough to keep up with their growing expenses, which would indicate consumers are maxed out. Businesses have to run far less profitably (with shockingly lower margins) in order to keep customers coming. They did, however, raise prices some, so the price increases alone likely mean that, even with revenue up, they sold less stuff.

People actually bought less, but had to pay more for it, albeit not as much more as they would have if the retailer had passed along the full cost increases it has experienced. So, revenue was up, in spite of fewer purchases, but not up enough to keep up with inflation. With inflation this hot, you have to really watch the statistics being reported that are measured in dollars. Often the increase they seem to be showing is just the increase in the price of their goods or services and not an increase in the volume of sales.

That would also explain why some of these retailers who reported raising prices last year are also now reporting bloated inventories, in spite of their reported revenue gains. Merchandise is not moving as quickly even though people are paying so much more that revenue rises. And it would explain why consumer credit has recently gone through the roof. The only way consumers are keeping up with this is buying on credit. They’re not buying more stuff; they’re just paying more for it. Such is the insidious way inflation eats away at everything like rust on a ship’s hull.

Walmart made itself into the buoy bell of commerce this week, clanging away about forward earnings going down, instead of up as had almost always been the case and was certainly expected by those who don’t believe we are already in the thralls of a recessionary storm. As a result, it took it largest post-report plunge since … well, 1987, too! Apparently, it is a good time for major retail to crash like it was 1987, only from much greater heights. Walmart blamed rising labor costs, heavy inventories that weren’t selling and high fuel costs. Each accounted for a third of Walmart’s earnings shortfall.

Didn’t someone here say that the fourth quarter’s inventory build in 2021 was just sales brought forward by retailers that would not be happening again in the following quarter because customers had also stocked up? So, now we’re sitting on stockpiles. That’s good because we’ll need them as more shortages start coming through; but it doesn’t foreshadow good news for the economy today. For right now, Q4’s big inventory build is a bit plugged up. The fact that inventories have backed up even when shortages of a few products are starting to appear because some products are not being shipped, making inventory spotty, indicates those people who are eating less may be buying less of everything, in spite of what the government numbers reported.

Who are you going to believe? The government, where Biden’s ruling party faces elections this year, or the companies that are crashing their own stocks with frightful, stock-pounding news that I’m sure they would do anything they could to avoid giving? Walmart, by the way is the largest retailer in the world and one of the least expensive, which makes it a bellwether for the rest of the industry. Prior to Covid, at any rate, it was double the size of Amazon, though those numbers have clearly changed a lot since Covid drove customers to buy more online:

Walmart is, as stated in the tweet above, a strong indication of how 2/3 of the retail economy is doing; and, as goes the retail economy, so most likely are going the lives of everyone’s customers, and so is going the “consumer-driven” economy of the US.

Here is another measure that says this is the right way to gauge where the economy is now: The average customer is not as well off financially as many think because consumer debt has recently spiked way, WAY up! That kind of truly HISTORIC rise indicates an emergency. Consumers have used up their savings and are now buying on credit, even when the cost of credit is rising to where buying on credit is clearly less desirable.

Given that American consumer credit is suddenly doing this …

… I think it is pretty clear the American consumer is tapped out. And, yet, we have a lot more months of inflation to come! We’ve never seen that before, and it matches up to what the Fed’s personal savings data is also showing us:

While the savings “rate” is not the same as the aggregate in savings, but is how much of a person’s income they are banking each month or quarter, it is pretty likely that if people are putting away less money than anytime since the Great Recession, they are depleting their savings … and right when prices are going through the roof!

No wonder such a large percentage of people are worried. Back in the Covidcrisis, they were banking those stimulus checks, and some were making megabucks on Robinhood. Now they’re losing it on bad stock bets and have likely spent out the stimulus money. Just when things were looking hopeful, the wind swung around the other other way, and just that soon they are looking quite bleak.

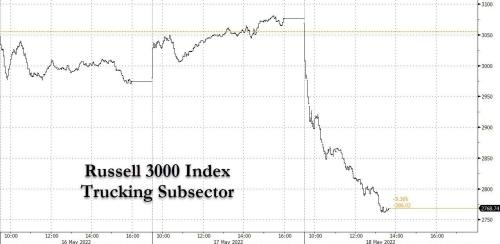

The other sector to fall hard in stocks on Wednesday (-10%) was trucking. What? Only months ago we couldn’t find enough truckers or trucks. Then a week ago, Freightwaves spoke of a coming trucking recession, due in part to soaring fuel costs. Few believed them, given how backed-up shipping is, but I guess investors became believers on Wednesday. Trucking stocks submerged deep below the briny surface because Target and Walmart stocks fell. Everyone Wednesday seemed to become, at last, believers in a world where fewer products will be moving around due to shortages, screaming fuel costs, and general inflation across the board slowing down consumers.

So, oh yeah, Deutsche Bank boldly predicted, as I reported a couple of days ago (see “The Fed is Still Spiking the Inflation Punch Bowl, but the Party is in Recess Anyway“), that we will be sailing into a recession a year and a half from now! What are these pirates smoking? How can anyone believe this badly foundering economy still has a year-and-a-half of clear sailing ahead??? I just shake my head and ask, “Can you not feel the roiling sea washing over the deck you’re standing on.” This ship is already on the rocks!

Denial is an amazing thing.

So, we talked stocks today only to the point of showing how poorly retail is actually doing, gaining some sense by those stock reports that turned great vessels upside-down in the market of how most of the hardest hits seem to be coming in the “consumer” sector now. All of the hardest pounding on Wednesday came in retail or areas that serve retail, such as trucking. All were hard enough slams to wash you right off the tilted deck! In an economy that is mostly “consumer-driven,” that sounds like recession to me.

Cisco — the big internet equipment company — also did a faceplant today, falling a massive 20% in seconds. So, Big Tech is still taking the waves broadside, too.

I can feel the recession in the fusty, gusty air all around me now. I can hear it in the groaning steel. I can taste the salt of it on my lips and the sting of it in my eyes. I can feel the flexing deck shivering and rolling beneath my feet. Can’t you? Trust your feelings! This is what sinking into the tides of stagflation feels like — stagnant economy but with sweltering inflation. If the next GDP report comes out positive, it’ll be a miracle … or a lie. I have never experienced anything that looked or felt more like a truly perilous, global recession than right now. Have you? Trust your instincts and find a lifeboat before they are all full or have gone down with the ship.

Liked it? Take a second to support David Haggith on Patreon!

Source: Are You Sure We’re Not Sinking into Recession Already? Or Has this ship already sunk?