My ten 2025 economic predictions are coming in as expected so far with today’s news advancing the first two of them—a rapidly developing recession and a stock-market crash—along with another projections that would have been on the list, except that it was last year’s prediction, and already started happening last year, which is another return to rising inflation. Not hard to predict what is already happening, so I left that off the list.

The inflation equation

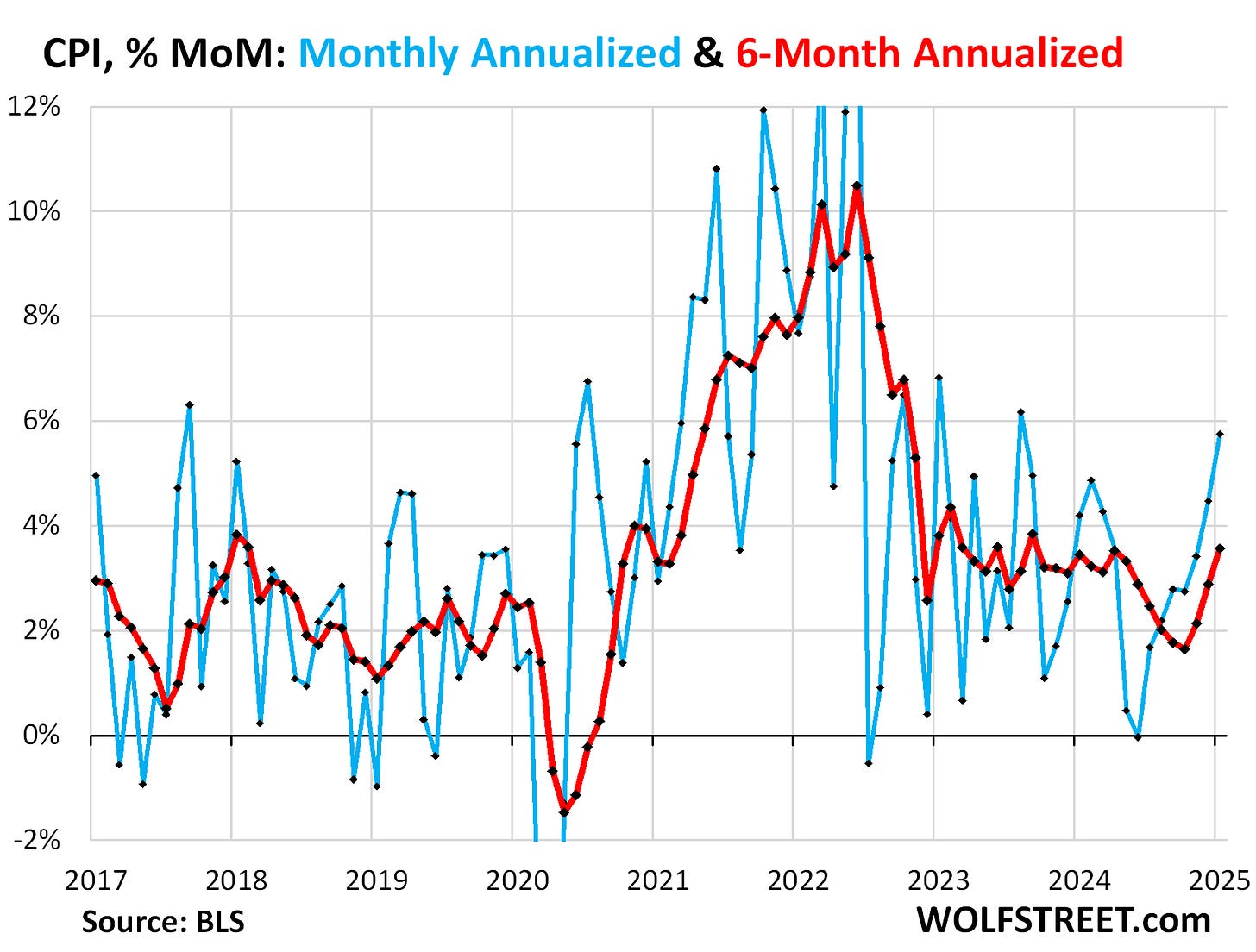

Let’s start with the last item that continues unabated from late last year because rising inflation will continue to be a driving force for some of the things I predicted for 2025. Two inflation reports came out this week, and both of them were hotter than expected (expected by others, that is). First, CPI came out, reporting the worst month-on-month inflation acceleration since August of 2023 when the Fed was still having to tighten hard against inflation.

As Wolf Richter points out today, inflation has been going the wrong direction relentlessly since last June, so there is no question we cleared the bar for that prediction in 2024 without any trouble, which claimed inflation would return a second time during the second half of the year (meaning after the first return it made through the first three months of 2024). It was after those first three months that the Fed mistakenly thought it had the inflation genie back in the bottle enough to where it hilariously thought a couple months later it could start lowering interest rates again, which was also totally predictable for the Fed just like the Fed’s former belief that all this inflation was “transitory.”

Inflation dished out another bad surprise with a big increase in January from December, which wasn’t a surprise because inflation, once it gets going, is known to do that. This time, the hot spots were durable goods, fueled by the continued massive month-to-month increases in used vehicle prices, and non-housing services, such as auto insurance, admissions, subscriptions, etc. Food and energy prices also jumped in January. Rent inflation accelerated.

The solid return of inflation now looks like this:

Up, up, up, up … and up.

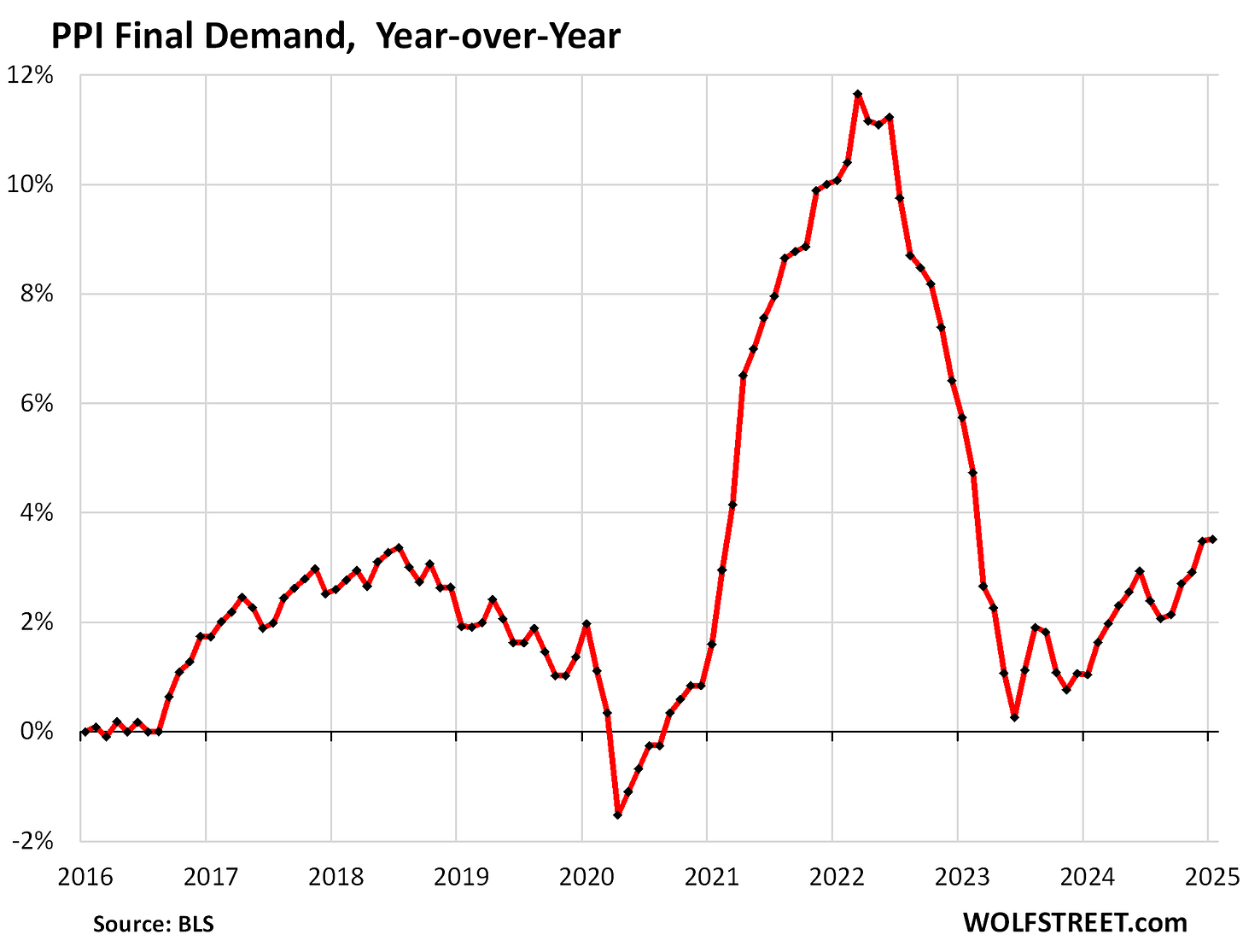

The second measure of inflation that came in hot this week was one of the metrics I use to predict when CPI will be rising, which is the Producer Price Index. That looks further up the pipeline to reveal what is coming. While it is not completely a no-brainer that inflation on the producer end will make it all the way down the pipe to the consumer, that is what tends to happen most of the time.

An example of when it did not was during the lead months of Trump’s initial tariff war. That was because the Fed had not been able to engineer inflation for many years. It often had not even been able to hit its 2% inflation target even with lots of money printing and the most ridiculously low interest rates in history. So, there was a lot of cushion in inflationary pressures. Inflation arrived in late 2020 when the Fed started really adding money in massive amounts due to Trump’s Covid lockdowns and when production fell, also due to the lockdowns, giving the perfect inflation scenario of massive money printing in the face of lots of shortages.

This time is different because this time we already have inflation that is rising more and more. There is no cushion in the system. Producers have already held off all they could on raising prices by taking down their profit margins. They are not likely to take down profit margins any further in many cases. Consumers, however, will fight back because they are done-in by all the existing inflation, too, and angry at seeing this hydra raise its many ugly heads again. It seems for each head you cut off, two grow back.

So, what is likely to happen is that inflation rises as much as producers can push prices through to retailers who push them through as much as they can to consumers, but then consumers just stop buying a lot of stuff and decide to live on trimmer budgets with bare essentials. That means production will slow down. Tariffs will also slow production down. The economy will slump, so we will see stagflation—the kind of recession that I’ve been saying we are already entering.

Peter Schiff talks about that today:

Another big thing I think is happening is I don’t think people are looking at the stagflation problem that’s starting to evolve in the United States. In real terms, stagflation is already here in the United States, but it’s all over the world. That’s why I pointed this out. That’s why Powell says the Fed has no plans for stagflation, and they’re just going to hope we don’t have it. That’s why in their stress tests, they don’t even stress test for stagflation because they know every major bank would fail. Stagflation is basically like kryptonite to Superman as far as the Fed is concerned. That’s exactly what we already have, and it’s going to get worse.

Exactly, my past prediction was that we would go into a stagflationary recession last year, and through the year, I said our trickling path into that recession was being masked by hugely erroneous labor statistics and dishonest inflation. We saw that last week when labor metrics were revised down for the past year by half a million jobs (again), and we see it this week when past inflation metrics got revised higher, giving us the graph now shown above. And, of course, even that level of inflation is not nearly as high as inflation would be if we measured it honestly like we did back in the seventies.

As Schiff continues to explain,

They only invented this concept [of the present measure of inflatinon] when they were able to report inflation rates below 2 percent. The only reason they could report rates that low was because the governments were lying about it. They had these rigged indexes that purported to measure in prices and it was all rigged.

I agree. In terms of the additional inflation coming down the PPI pipeline, producer prices, just like CPI, just hit, once again, their worst level in two years, except we’re talking worst year-on-year measure. As you know, YoY goes up more slowly than the month-on-month measure; so, really PPI just saw a worse increase than we saw yesterday in CPI.

And, again, it proves that the inflation taken out of GDP to derive real GDP during the Biden campaign years was fake, as I kept saying it was. Says Wolf Richter,

As has been the case for many months, today’s Producer Price Index for January included big up-revisions of the prior month, driven by a whopper up-revision for services which account for two-thirds of the overall PPI. On top of these upwardly revised December figures, the PPI rose further in January.

That looks like this:

That is all pressure further up the pipeline, and this is all happening PRE-tariff because it takes awhile for tariff taxes to make their way through to producer prices and then to consumer prices. After the tariff goes into effect, products have to be ordered from tariffed countries; then they have to ship to US ports; then get moved from US ports to US warehouses; then, in many cases, get incorporated into US products; then shipped to retail warehouses; then finally make it to retail shelves; and it is not until that last step that the consumer gets to find out how big the hit from tariffs was and how much the tariff, itself, got marked up as part of the “cost of goods” sold along the way.

That is another reason prices did not rise as soon as the Donald raised tariffs last time. Sure, some retail outlets import directly to their own shelves, so it only takes a month or two for those products to make their way through shipping and get priced upward at the shelf. Most, however, go through several more steps on their way to markets. They are parts or natural resources or materials that get warehoused, then get manufactured into products and then get moved to retail warehouses and then to shelves. So, expect inflation to keep rising slowly for some time in response to the tariffs that actually get placed. And that comes on top of the inflation we are seeing that is just a return of the old inflation that never got fully beaten down before the Fed got all giddy about lowering interest rates.

The six-month PPI, which irons out some of the spikes and dips, just saw its worst increase since October 2022. And this inflation is happening where consumers tend to hate it most—in food prices.

Stocks extremely precarious now

So much for inflation. Now we come to my 2025 economic predictions where I, among many other things, forecast a stock market crash and an unmistakable descent into recession:

Expect a rapidly developing recession due to mass layoffs and tariff wars in an economy that was already faltering on the edge of recession (if it was not fully in one during Biden’s term that was masked by fake statistics).

The stock crash, which was my lead prediction, will, as is typically the case, be part of that recession scenario. The two go hand in hand.

The Telegraph reported today (see highlighted links below) that the world is terribly understating the likelihood of a US recession:

When confidence exceeds fundamentals, the risk of downside surprises increases….

A close examination of fundamentals suggests some cause for concern.

Last year, US federal government borrowing reached close to 7pc of GDP while the unemployment rate was around 4pc. In the US’s entire post-Second World War history, there has never seen such a large differential between government borrowing and the unemployment rate.

So, for starters, they are saying that, with massive government stimulus under Biden, the US didn’t get much bang for the buck; and now much of that stimulus is being pulled by Trump. In fact, we are rapidly being pushed into reverse stimulus, so to speak, as entire branches of government are being shut down and parts of other branches are being trimmed way back. That is going to, as I also included in my ten 2025 economic predictions force a sizable rise in unemployment, which also typically goes hand-in-hand with a sizable recession, just like a stock-market crash.

Rapid US growth is underpinned [by] a self-reinforcing cycle of massive government borrowing, rising stock prices, and increased consumer spending.

That is now rapidly being reversed by Musk & Men, including particularly his favorite man, the nineteen-year-old geek who goes by the name “Big Balls,” whom I’ll renominate as “Great Balls of Fire.”

The US economy resembles a textbook government debt-fuelled bubble, where the strong GDP gains and outsized financial returns distort the perceived risk of handing piles of money to the government to finance an unsustainable borrowing binge.

From unsustainable to simply unsustained, as the taps on the government tits have just been turned off.

The risk comes if this process unravels, which is what makes Donald Trump’s trade antics such a risky gamble.

It is rapidly unraveling as I write.

The Telegraph properly notes that the last round of Trump tariffs happened, as I just stated above, in a much less hostile environment than today. Today, even high goosing with mega stimulus barely gave us any economic lift in the Biden days:

Financial market commenters are wrong to assume that the situation today is the same as in 2018 when Trump turned protectionist during his first term. From a position of strength, the US could sustain a long, drawn-out trade war. So too could the EU and China.

Back then, US price pressures were modest after a long period of inflation weakness, the federal deficit was below 4pc of GDP, and interest rates were low across the curve….

Russian gas still flowed cheaply, and still-strong Chinese demand for European exports had helped to push production to an all-time high. On the other side of the world, China was enjoying its last burst of rapid, feel-good growth.

Enter today:

Fast forward to 2025, and disenchanted voters across Europe are railing at anaemic economic growth caused by expensive energy costs following the Russian invasion of Ukraine, as well as misguided energy policies and weak global demand. Eurozone exports and production have declined precipitously since 2018.

In China, consumers are chronically pessimistic following the collapse in real estate activity, while steps to ease credit and reduce borrowing costs seem to be failing.

Translate that into no margin globally for error. No inflation cushion.

And unlike in 2018, when government debt markets were heavily tranquillised after years of massive global quantitative easing, today’s creditors are no longer so sedate. Instead, they are skittish and attuned to the potential inflation and growth risks coming from trade wars.

In fact, as I began pointing out late last year, creditors have begun to ignore the Fed’s interest targets entirely and started repricing interest upward, in spite of the Fed’s claimed goals, which is one reason inflation is only slowly eking upward, in spite of Fed rate cuts—markets have been ignoring the Fed and raising interest on their own to tighten the economy. Credit markets are not smoking what the Fed is smoking while it is out to lunch … or inflation would be even hotter.

That means already sensitive bond markets are not going to take well to tariff wars getting out of hand either because bond investors are the most sensitive to inflation, and they believe tariffs cause inflation (as do I).

In a worst-case scenario, escalating tariffs could once again stoke US inflation and trigger a surge in interest rates that pricks the US equity market bubble.

And that is on top of the pricking that Elon is doing to all the government hot-air that has tried to float the economy higher. Huge government spending that propped up a moribund economy is now being reversed by Musk & Men. We were barely above stagnant GDP with massive government stimulus. Now with the artificial fuel turned off, you’re going to feel the fall.

This brings us to my third economic prediction for 2025:

Therefore, expect this week’s reported dip in unemployment to prove to be a phantom. Expect unemployment, instead, to rise rapidly and continually as we move into spring.

From there, I laid out the fundamentals of the economic wreckage that will ensue—the cause and effects, as it were. Thus, we are right on track with the three triggering mechanisms.

Stocks and awe

The part about stock crashing came into sharper focus today as another article points out the extreme fragility of the stock market right now. The article refers to it as “record stock fragility”:

Rising instability among some of the biggest US stocks is driving a measure of single-stock “fragility” to record levels, with the market increasingly vulnerable to whipsaw patterns among clusters of shares such as occurred in the dot-com bubble of the late 1990s.

I’ve always maintained that the upcoming stock crash is going to be a lot like the dot-com burst as the rising stars in AI give way, just like the rising stars of the dot-com economy did. These are the very ones most people said couldn’t crash as the market leaders because they are the wave of the future, and I’ve pointed out all along that way that the same thing was true of all the dot-com businesses that went bust around the year 2000. Some eventually revived to become the mega-businesses of today, but not before taking a enormous fall from grace, from which it took them years to recover.

Stock fragility, a measure of a company’s daily share-price move relative to its recent volatility, is on track to reach its highest in more than 30 years among the largest 50 stocks in the S&P 500 Index, based on the average magnitude and frequency of such individual shocks so far in 2025, according to Bank of America Corp. strategists.

The stock-market crash, I predicted for this year, is imminent.

That’s as far back as their research goes, and covers not just the internet boom but also Russia’s default and the Asian financial crisis earlier in the ‘90s. The increasing jitters among single stocks flashes a potential warning for the broader market even as stock indexes hover near records — and combined with tariff and interest-rate concerns adds to a potentially worrisome mix….

“When you combine this with higher bond yields and concerns over tariffs, it has created a much higher level of uncertainty and nervousness than we usually see when the market is near an all-time high.”

Where we are seeing the greatest volatility is exactly in those AI and other high-tech market leaders just like in 2000. That fragility in the leaders, the article says, is now spilling over into other corners of the market. The takedown is beginning. The edifice is shuddering.

Now put that in a world where bank closures are already soaring at level that is being referred today as a “closure bloodbath.”

Major US banks shut more than 100 locations in just three weeks as the local branch bloodbath continues.

Banks are getting ready for the cashless society that is slowly emerging, closing down branches in anticipation of dealing with less cash and doing more or there business online.

Experts warn that 2025 could be the worst year yet for closures…. Last year, banks closed a total of 1,043 branches, leaving communities with dwindling local services…. The bloodbath of closures is also set to accelerate in 2025.

That means we already have rising unemployment in the banking industry and can expect more.

There's no doubt we're moving towards a cashless society.

That affirms a longer-term prediction of mine that is yet to be fulfilled in the years still ahead, but the momentum keeps building, albeit more slowly than I originally expected.

Meanwhile, a whopping 76 percent says that the current banking system needs small or major changes.'

They’re coming. That’s why I keep writing.

You can help spread the truth about the future and support writing that uses no crystal balls to present a crystal-clear trajectory for where we are headed. You can do that by sharing this article and by subscribing if you have not done so already. These predictions come from just applying objective good sense to the cause and effect of major patterns and Fed promises we see forming. If you become a paying subscriber, you will also be able see all my predictions at once, which will make it more clear how each one feeds into the others, creating a more solid picture for you of the road ahead; and you will be able to see all the headlines that these daily editorials are based on plus all the rest of the news I find interesting while doing my research each day. You’ll see where my head is swimming during the madness of the present days: