Is your state promoting sound money?

The links below detail pending state legislation where the Sound Money Defense League and Money Metals Exchange is actively working right now to defend the interests of taxpayers and precious metals investors.

We see some promising signs that additional states will remove sales and/or income taxes from the monetary metals in 2022 – and possibly even begin to accumulate gold and silver as a state reserve asset.

And not a moment too soon.

Now that irresponsible decisions by politicians and central bankers in Washington DC have sparked an inflation tsunami across the nation, Americans need to accumulate physical gold and silver bullion to protect their assets like never before.

Here is a rundown on pending state efforts so far:

Oklahoma to Consider Investing in Gold and Silver, Removing Income Taxes

Legislators in Oklahoma aim to protect state funds with physical gold and silver and remove capital gains taxes from gold and silver transactions… Keep Reading

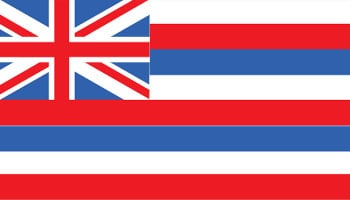

Hawaii Expected to Continue Effort from 2021 Session, Eliminate Taxes on Sound Money

After an abrupt ending to the 2021 legislative session, legislators in Hawaii hope to pick up where they left on and eliminate state taxes on the purchase of gold, silver, platinum... Keep Reading

Will Gold and Silver Finally Become Sales Tax Free in Tennessee?

After years of several stymied pro-sound money efforts, legislators in Tennessee are feeling confident that 2022 will be the year when citizens can protect their savings without being taxed for purchasing gold and silver… Keep Reading

West Virginia Seeks to Eliminate ANOTHER Tax on Gold and Silver

After already having exempted gold and silver from sales taxes in West Virginia, a pro-sound money legislator aims to take it a step further, eliminating capital gains taxes from the sale of precious metals and declaring gold and silver legal tender in th… Keep Reading

Washington State Aims to Remove All Tax Liability from Sound Money Transactions

Washington State Rep. Chase has introduced a bill to eliminate ANY and ALL tax liabilities that may arise when transacting in precious metals… Keep Reading

New Jersey to Consider Ending Sales Taxes on Precious Metals

Legislators from New Jersey are trying to restore sound money in the Garden State. Originally introduced in 2021 but carrying over to 2022, these house and senate bills would end the practice of taxing the purchase of the monetary metals… Keep Reading

Will Kentucky Become 43rd State to Eliminate Sales Taxes on Gold and Silver?

A representative in the Bluegrass State wants to make Kentucky the 43rd state in the union to restore sound money.… Keep Reading

Virginia Legislators Introduce Measure to Prevent Sunset of Gold and Silver Tax Exemption

Members from both chambers of the Virginia legislature have introduced measures to keep gold and silver tax free by extending the exemption that currently exists in the Commonwealth… Keep Reading

Mississippi Legislators Introduce Several Pro-Sound Money Measures

Several members of the Mississippi House of Representatives have introduced measures to eliminate the sales tax on the sale of precious metals in the state… Keep Reading

Alabama Asked to Extend Popular Sales Tax Exemption on Sound Money

The House of Representatives in the Yellowhammer State expects to hear a measure to extend the sales tax exemption on gold and silver that currently exists… Keep Reading

If you live in any of these states, please urge your representatives to vote for these bills. I can say with absolute confidence that grassroots contact really does make an impact.

If you want to see how your state stacks up currently, check out the 2021 Sound Money Index here.

And please keep your eyes out for Money Metals’ legislative alerts as these battles unfold!