Monetary Metals pays investors interest on investor’ gold and silver. The availability of a yield on precious metals, instead of fiat currency, is a value proposition from which that all types of investors are benefitting.

An Old Idea Made New Again

Providing a yield on gold and silver may seem like a new phenomenon . But it’s more accurate to say that paying a yield on gold is an old idea, made new again. Before the federal government forced everyone to use irredeemable currency in 1933, yields on gold and silver were as common as the air you breathe.

Investors in our gold and silver yield program have been earning between 2-4% per annum, for a one-year commitment. Most clients are happy to be earning this kind of return on their metals.

The Alternatives to Earning a Yield on Gold

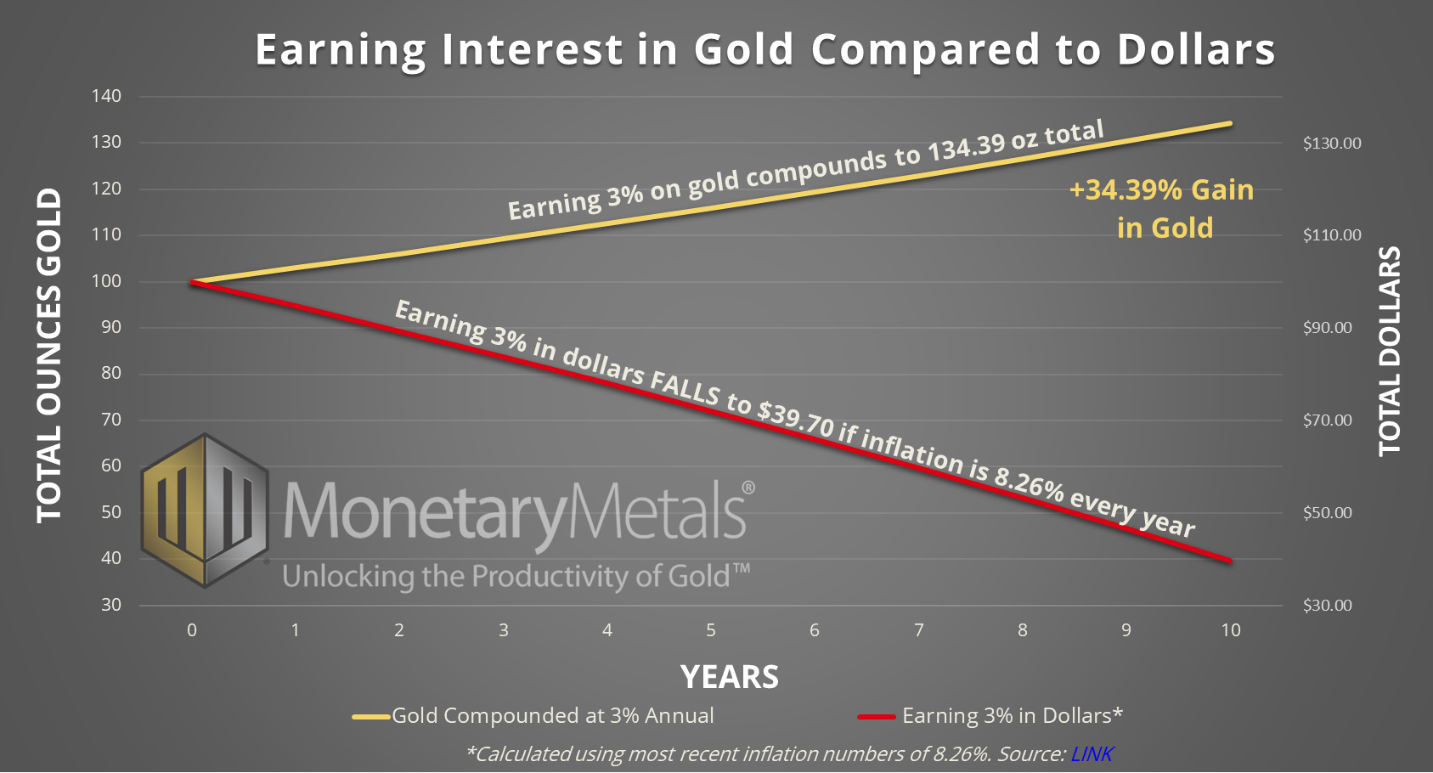

However, some investors balk at a gold interest rate of 2-4%. They feel this is too low, given CPI is trending up every month. In the present inflationary environment, earning a yield that will outpace inflation is becoming increasingly difficult, especially for those who rely on fixed income.

We get it and we emphasize. It’s not an easy environment to invest in, at all.

First, it’s important to take inventory of your options and alternatives. The alternatives are:

- Own gold and silver at home or in a professional vault depository

- Attempt to grow your wealth in dollars, and periodically convert those dollars to gold

- Earn a yield on gold and silver with Monetary Metals

- A combination of some or all the above

For #1, We believe everyone should take this first step. Own gold and silver, period. However, there is a limit to this. At some point, owning additional gold and silver at home becomes too risky since metal at home is uninsurable, and therefore at risk of loss. Owning it in a vault is better. But now you must incur storage fees to the tune of 0.75%, which eats into your gold year over year.

But there’s a broader point, - owning gold and silver, isn’t enough. It’s not enough to just protect wealth. You need a strategy to grow your wealth, to grow your gold.

That brings us to point #2. You can continue earning in dollars and convert those dollars to gold periodically. However, we’ve shown that earning a reliable yield that beats inflation in today’s markets, is a difficult endeavor to say the least.

Finding productive opportunities to deploy capital is hard and becoming harder. Despite the fact that inflation has just surpassed the average return of the S&P 500 for the last 100 years, this remains the most popular option.

Let’s come back to the Monetary Metals’ alternative, earning a yield on gold and silver. We want to give a simple answer in response to the question of whether the yield on gold is enough.

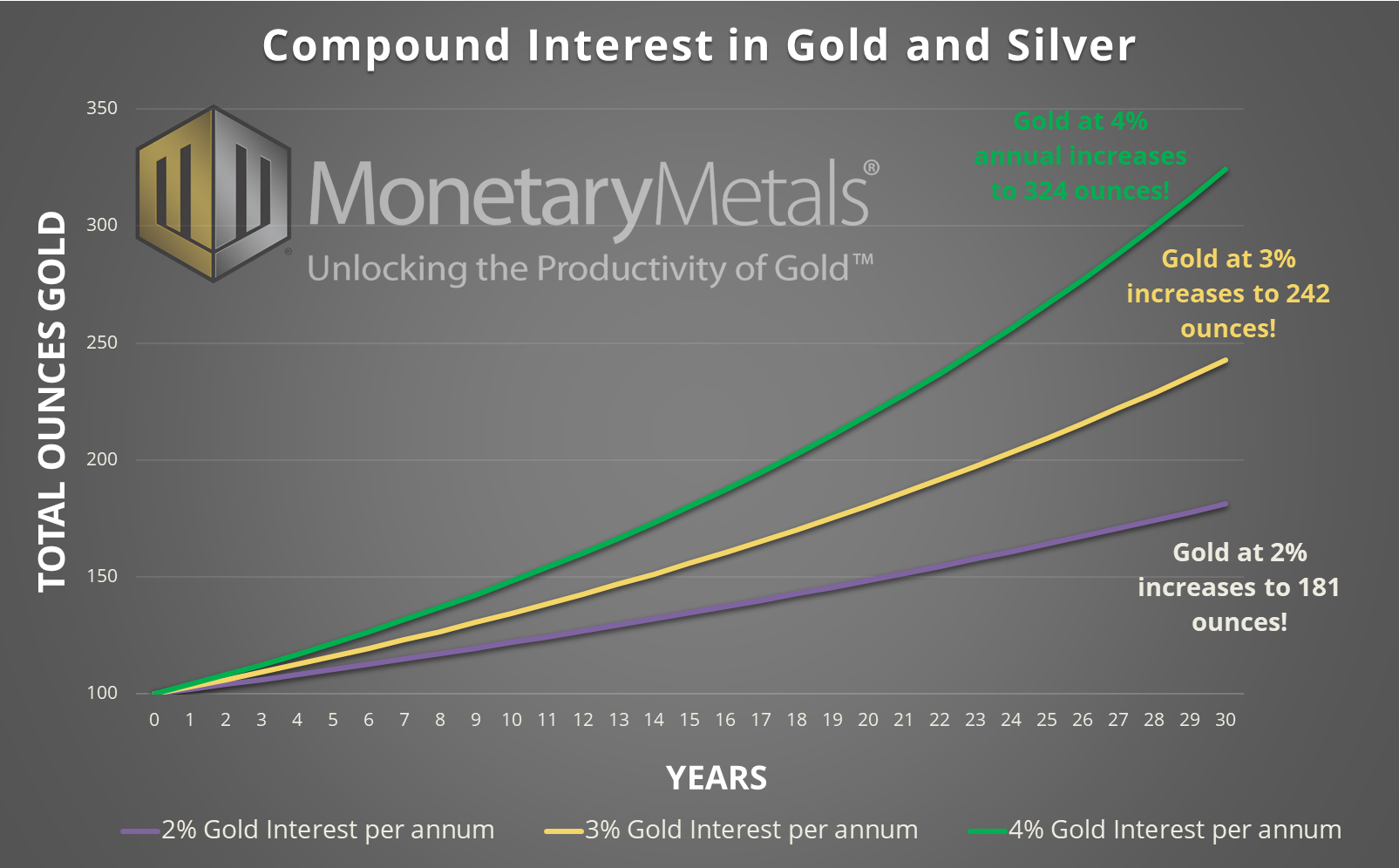

Albert Einstein famously said that compounding interest is the most powerful force in the universe. The chart below shows how earning a 2-4% yield on gold and silver every year can compound over a 30 year period.

When you zoom out, you see that earning a yield on gold and silver can make a substantial difference in the fight against inflation in your investment portfolio.

This is the real impact benefit of a yield on gold and silver for investors. Considering the alternatives of earning 0%, a negative yield because of storage fees, or trying to beat the market with dollars, we think diversification in the type of yield you’re earning is worthy of investor’s consideration.

Is the Yield on Gold Enough?

Will it be enough?

We don’t know the answer to that question, and neither does anyone else unfortunately. All we can say is that earning a yield on gold is a compelling alternative that investors should consider as they aim to meet their financial goals.

© Monetary Metals 2022