|

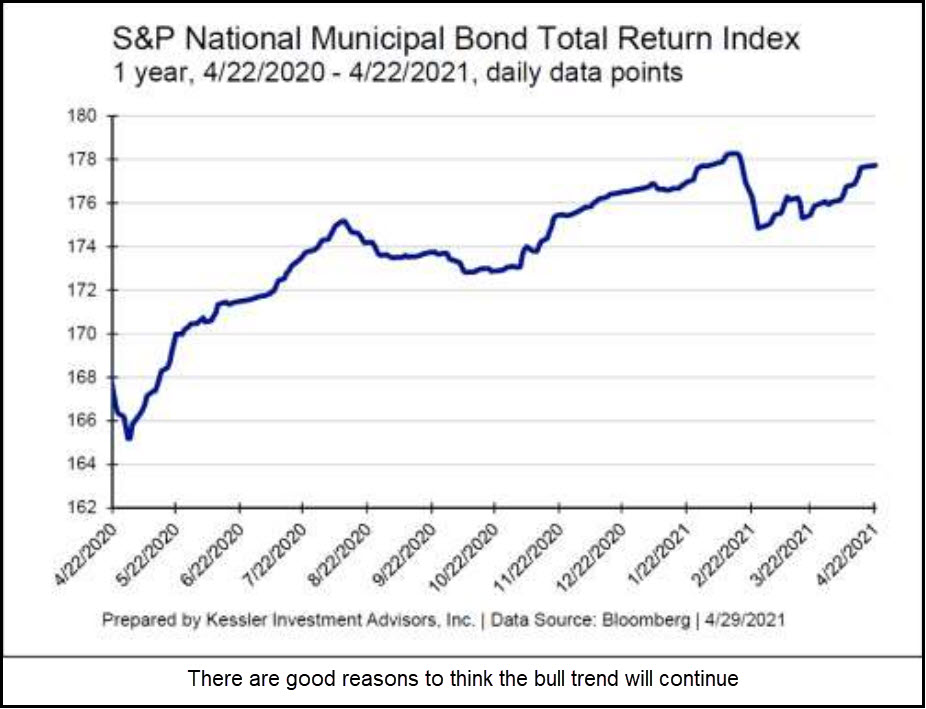

Investors who feared muni-bond defaults when the pandemic first hit created unusual opportunity for those willing to buck the tide. One of the winners was Doug Behnfield, a Boulder-based financial adviser at Morgan Stanley whose ideas have been featured here many times over the years. Doug is not only one of the savviest investors I know, he is one of the savviest guys. Now, he is quite bullish on municipal bonds for reasons spelled out in a report that went out to clients in April. He also thinks Fed Chairman Jerome Powell's confidence that the inflationary effects of stimulus and fiscal spending will be "transitory" is well founded and that their effects have already been mostly discounted by stocks and bonds. A Limited Supply There are additional factors that have made Doug especially bullish on municipal bonds. For one, they are exempt from federal income tax. Substantial tax hikes planned by the Democrats will therefore make municipal bonds even more attractive. Munis also are exempt from a tax that affects mainly the wealthy: the 3.8% levy on investment income under the Affordable Care Act. Limited supply is another reason muni bonds stand to do well over the next couple of years or longer, says Doug. Cities will not have to raise as much money with bonds because the states have received hundreds of billions of dollars in stimulus grants. You can access the full report by clicking here. |

May 24, 2021