Gold loves chaos and should be hitting new highs, especially with inflation coming down and with it, two rate cuts likely before year’s end.

Gold generally does well in an environment of lower interest rates/ bond yields and the weaker dollar that usually accompanies them.

In this article we are asking: Who is better for gold? Trump or Biden?

Inflation down

The June inflation print was better than expected, with US consumer prices increasing by the smallest amount in a year, just 3%. The CPI has fallen for three consecutive months, going a long way to prove to the Federal Reserve that they have successfully tamed inflation and possibly paved the way for an interest rate cut in September, and perhaps a second in December.

As a result, the benchmark 10-year Treasury yield dropped to 4.1% and the US dollar index slipped to 104.5. A declining dollar and interest rates/ yields are both positive signals for gold.

On cue, the yellow metal scaled an intra-day high of $2,423 an ounce, Thursday, before slipping back to $2,413 as of 15:35 PST.

Source: Kitco

Source: Kitco

Gold under Trump and Biden

Historically, gold has averaged higher returns under Democrat-controlled congresses compared to Republican-controlled ones. Gold increases by an average 20.9% under the Democrats but only gains an average 3.9% under the Republicans.

That makes sense, because the Dems tend to spend more than the GOP, which adds to deficits and the debt, and weakens the US dollar. Trump cut taxes but also spent bigly and added to the debt, making him somewhat of an anomaly among Republican presidents.

Gold rose in the lead-ups to both the 2016 and 2020 elections.

While Trump was campaigning against Hilary Clinton, the gold price ran up about $50 and peaked just above $1,300 before the vote. Following Trump’s victory, gold fell to around $1,128 by mid-December, then rebounded above $1,200 in January, when he was inaugurated.

In the week before the 2020 election, gold traded around $1,900. After Biden’s win over Trump, it hit $1,951 on Nov. 6 then dipped below $1,800 amid vote recounts and legal challenges. Gold started climbing again in December, after Biden’s victory was confirmed, and after the infamous Jan. 6 attack on the Capitol in Washington.

While Trump was president, gold rose from $1,209 to $1,839. Factors included trade wars, geopolitical tensions and the covid-19 pandemic. Trump’s protectionism and MAGA rhetoric incited BRICS nations like China and India to move away from the US dollar as the global reserve currency, and increase their gold reserves, pushing gold higher.

Under Biden, gold prices continued their upward climb, reaching a record-high $2,450 on May 20. While Biden made efforts to mend relationships with allies, he presided over sanctions against Russia for invading Ukraine. The US and its allies also froze $300 billion of sovereign Russian assets, prompting many developing countries to buy gold to prevent the same thing from happening to them.

Central bank gold buying has accelerated under Biden and this, along with physical gold purchases in Asia, has been the main driver behind the gold price, despite a high dollar and elevated US Treasury yields. Both resulted from the Federal Reserve hiking interest rates to reduce inflation, which accelerated rapidly following the easing of lockdown measures implemented during the pandemic.

Biden has continued Trump’s policy of pressuring China. His Inflation Reduction Act and Chips Act aim to distance US dependence on China and seek to build Western supply chains for industries including electric vehicles and semiconductors. In response, China has accelerated de-dollarization, dumping US$50 billion worth of US Treasuries and other bonds during the first quarter of the year.

Events like the war in Ukraine, Israel’s pummeling of the Gaza Strip following Hamas’ Oct. 7, 2023 attack, the Israel-Hezbollah conflict, and the Houthis in Yemen have had nothing to do with Biden but have helped keep gold prices supported in 2024.

Feelings

According to pollsters the choice facing American voters couldn’t be more unappealing. In the above-cited Pew Research poll, nearly seven in 10 (68%) are dissatisfied with both candidates. A majority of voters describe both Trump and Biden as “embarrassing”. 37% of Biden’s own supporters describe him this way, with one-third of Trump supporters saying the same thing.

Their economic policies

If Trump is elected, he has vowed to slap a 10% tariff on all US imports, and up to 60% tariffs on Chinese imports.

Remember, Trump started a trade war with China in his first term, enacting tariffs on a range of Chinese products. The Biden administration has mostly left them in place.

Financial Review quotes economist David Autor who found that the tariffs have “not to date provided economic help to the US heartland: import tariffs on foreign goods neither raised nor lowered US employment in newly protected sectors; retaliatory tariffs had clear negative employment impacts, primarily in agriculture; and these harms were only partly mitigated by compensatory US agricultural subsidies”.

Moreover, the tariffs would be hard on households. The Peterson Institute for International Economics has estimated that the typical American household would end up paying $US1700 ($2525) a year extra as a result, and the Tax Foundation estimates it will cost 684,000 full-time equivalent jobs.

Like his earlier trade war, Trump’s new tariffs threaten to upend the system of global trade. In his first term, the Chinese enacted billions worth of countervailing duties on US imports. A repeat of 2017 tit for tat tariffs is highly likely. Tariffs punish the importing firm, with higher costs passed on to their customers – a tax on the American middle and lower class.

Trump’s now-incarcerated trade advisor Peter Navarro has predicted that Trump will fire Federal Reserve Chairman Jerome Powell soon after being elected. (Powell’s second term expires in May 2026). In his first term Trump criticized the Fed for not cutting interest rates enough, since his goal was a low US dollar. It’s thought that Trump may undermine the Fed’s independence by aggressively pushing for monetary stimulus. This would light a fire under equities and commodities, including gold.

Both Trump and Biden have big fiscal plans that could blow out deficits and add to the already substantial $34.8 trillion national debt.

Biden has so far approved $6.2T of gross new borrowing, while Trump approved $8.8T of gross new borrowing during his term, according to the Committee for a Responsible Federal Budget.

Politico says If Trump wins, he could take a wrecking ball to Biden’s greatest legislative achievements: four laws containing $1.6 trillion in loans, grants and tax credits meant to green the economy, revive the country’s manufacturing base, repair its roads and bridges and challenge China for technological supremacy.

US Battery Belt Red states could be biggest losers in upcoming election

The four laws underpinning Biden’s legacy are the 2021 pandemic relief package, known as the American Rescue Plan; the $1.2 trillion infrastructure law; the 2022 CHIPS and Science Act; and the green energy-focused Inflation Reduction Act.

Of the $1.6 trillion in promised spending, $1.1T has been passed by Congress. Of the $884B provided by the infrastructure and pandemic relief laws, only $125 billion has been spent, according to Politico.

Biden proposes $5.1 trillion in tax hikes partly offset by new spending, with a net $3.3 trillion in deficit reduction by 2034.

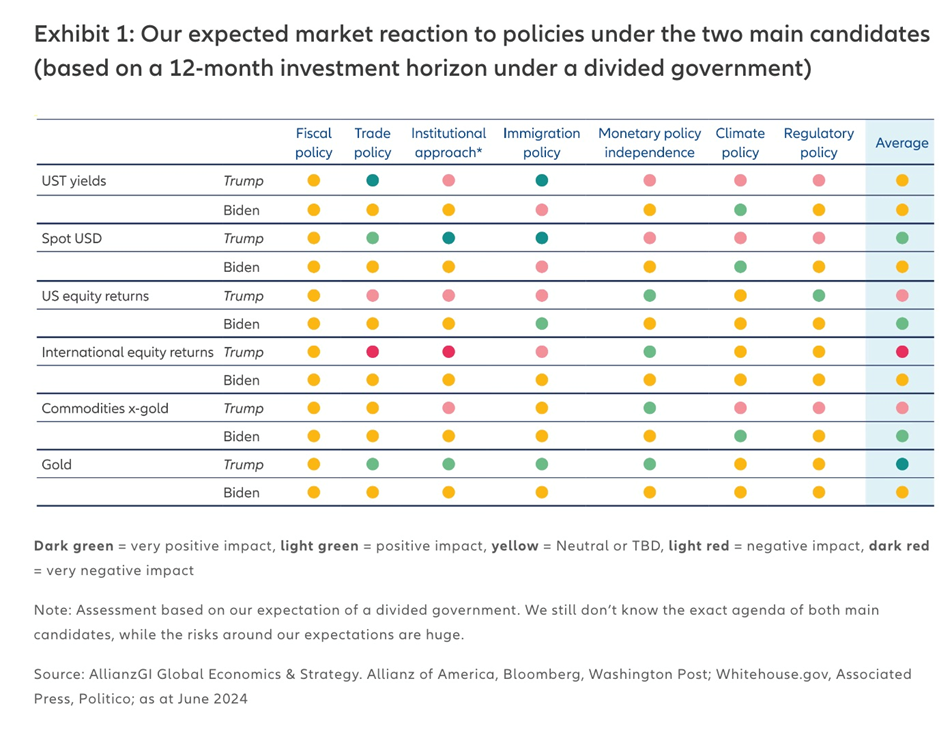

Trump would go the other way with taxes, seeking to make his 2017 tax cuts permanent. However, most of the tax cuts expire on Jan. 1, 2026, and under a divided government (no party controlling the presidency, House of Representatives and Senate) they are unlikely to be renewed. While the estimated $6.1 trillion cost of Trump’s tax plans may be partly offset by higher tariffs, a net reduction in the deficit is far from certain, states a column posted on Allianz Global Investors. High debt levels weigh on the US dollar and are gold-supportive.

However, Trump’s tariff raises could be inflationary and lead to a fresh round of interest rate hikes to hold inflation in check. Yields and the dollar would both move higher, creating headwinds for gold.

Trump’s plan to undo many of Biden’s climate policies and expand fossil fuel production could goose the US economy through cheaper energy costs and disinflation. If Biden wins, his continued support for the green energy transition could mean reduced oil and gas supplies, driving energy costs and inflation higher. The dollar, Treasury yields and commodities excluding gold could all get a boost.

Source: Allianz Global Investors

Source: Allianz Global Investors

The Allianz Investors’ column says overall, Trump’s policies are supportive of the dollar and gold, meaning no change from currently. The US Dollar Index (DXY) is presently sitting just above 104 and spot gold is trading at around $2,412.

Goldman Sachs has advised investors to buy gold as a hedge against Trump if he wins the election, citing his inflationary economic policies:

Rick Newman, a senior columnist from Yahoo Finance, explained in a ‘Morning Brief’ episode that Trump’s focus on reducing taxes while increasing tariffs (essentially taxes on imports) directly contributes to higher prices —thus, higher inflation. The straightforward equation here is that rising prices mean rising inflation. Newman also highlighted that Trump’s potential control over the Federal Reserve could lead to keeping interest rates lower, an approach generally not conducive to controlling inflation.

There is the possibility that Trump could enact a far more right-wing economic agenda, in whole or in part, than has been suggested here.

Project 2025 is a 900-page book of policy recommendations, essentially a blueprint for the “next conservative president.” Notably, it advocates the dismantling of the Department of Education, bringing the Department of Justice (DOJ) under presidential control, criminalizing abortion drugs and abolishing the Federal Reserve, among many other suggestions. (Global News, July 10, 2024)

For example, it would gut the federal public service and replace the fired workers with conservative appointees.

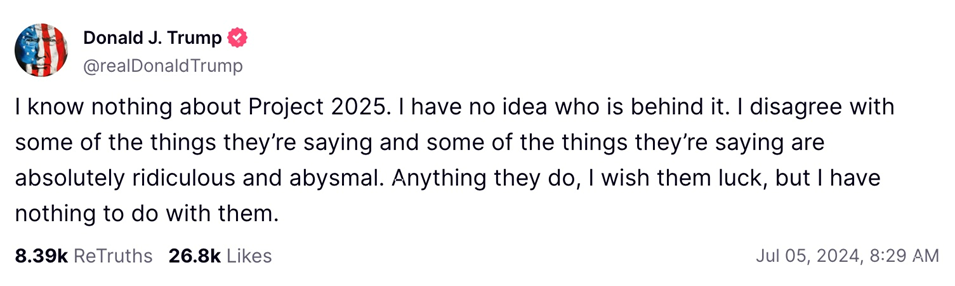

Trump has said he has nothing to do with Project 2025, published in 2023 by the Heritage Foundation, a conservative think tank.

Source: Truth

Source: Truth

Color me skeptical, many of his top former advisors are heavily involved with it.

It’s been reported that 31 of 38 people who helped write and edit the manifesto served in Trump’s administration or were nominated to positions within it.

According to NBC News, Trump spoke highly about the group’s plans at a 2022 Heritage Foundation dinner, stating: “This is a great group, and they’re going to lay the groundwork and detail plans for exactly what our movement will do and what your movement will do when the American people give us a colossal mandate to save America.”

[T]he project is backed by over 100 conservative organizations, many led by close allies of Trump, including Turning Point USA, the Center for Renewing America, the Claremont Institute, the Family Policy Alliance, the Family Research Council, Moms for Liberty and America First Legal — the latter of which is led by Stephen Miller, a top former Trump adviser, NBC said.

Geopolitical shift?

Gold is already benefiting from geopolitical tensions but a second Trump administration is likely to boost its safe-haven appeal even further. Financial Review notes Trump could pull the United States out of NATO, give Putin a pass on Ukraine, and refuse to leave office when his term is up.

The Allianz column adds that Trump’s approach, including efforts to undermine NATO (Trump has said America would not defend NATO allies against Russia if they did not meet his definition of contributing enough defense spending), less consultation with US allies, and an end to support for Ukraine, could rankle investors. Equally concerning are Trump’s threats to sow internal divisions. He would likely try to terminate the remaining court cases against him, and pardon the convictions of those involved in the Jan. 6, 2021 attack on the Capitol.

“At the margin, these efforts may bolster global demand for safe-haven assets and weigh on international equities,” writes Greg Meier, a columnist for Allianz Global Investors.

Not that the world would be any safer under a second Biden presidency.

Under his watch, Putin’s army marched into Ukraine unopposed, the war between Israel and Hamas has spilled over to Iran-backed Hezbollah and the rush to retreat from a lost war in Afghanistan, abandoning it’s allies and friends to the mercies of the Taliban. Meanwhile, Putin has been engaging in shuttle diplomacy, with several authoritarian regimes, to build a coalition of like-minded nations opposed to the West.

Soon after Putin began his fifth presidential term in May, he flew to Beijing to meet with China’s President Xi Jinping. They pledged a “new era” of partnership and cast the United States as an aggressive Cold War hegemon sowing chaos across the world.

Xi greeted Putin on a red carpet outside the Great Hall of the People in Beijing, where they were hailed by marching People’s Liberation Army soldiers, a 21-gun salute on Tiananmen Square and children waving the flags of China and Russia. (Reuters, May 16, 2024)

The two met again recently on the sidelines of the Shanghai Cooperation Organization summit in Kazakhstan. Bloomberg reports that Xi, whose backing has helped Russia to withstand unprecedented Western sanctions over the war in Ukraine, said China “always stood on the right side of history” as he and Putin pledged to “strengthen comprehensive strategic coordination.”

Also at the summit, Putin met with Turkey’s President Erdogan. The two reportedly discussed booming Russian tourism and a nuclear power plant being built by Rosatom.

The Russian leader has also been shoring up support from India. Re-elected Prime Minister Modi made his first visit to Moscow this week in five years. New Delhi is a major buyer of Russian weapons, and has become the biggest buyer of seaborne Russian crude since the West halted purchases and imposed sanctions against Moscow.

Alarmingly to the West, Putin in June made his first trip in 24 years to North Korea, where according to Bloomberg, he signed a mutual defense pact with leader Kim Jong Un, who pledged “unconditionally” to support Russia in its war on Ukraine. The military partnership has fanned fears that Russia may provide advanced weapons technology to the isolated Communist state, which has been sending munitions and missiles to aid the Kremlin’s war machine.

Putin has also met with Viktor Orban of Hungary, the most pro-Russian leader of the 27-member European Union.

Russia and Iran are close to signing a “comprehensive agreement” furthering military cooperation, updating a 20-year agreement inked in 2001. Experts told Breaking Defense the agreement will “formalize” their defense collaboration against Western security interests.

Even Iran’s arch enemy, Saudi Arabia, has been cooperating with Russia, with the two countries in 2023 agreeing to withhold a combined 1.3 million barrels of oil a day from the market.

Earlier this year, Saudi Arabia reportedly hinted that it might sell some European debt holdings if the Group of Seven decided to seize almost $300 billion of Russia’s frozen assets.

Putin is also being emboldened by perceived (and real) chaos in the Democratic Party regarding its presidential nominee.

It doesn’t seem to matter to Putin and his ‘friends’ what the US (and NATO) thinks or does – they perceive the United States as weak under Biden, and NATO ununified, undersupplied, underfunded and under committed.

On Monday, July 8, Russia slammed a missile into a children’s hospital in Kiev, killing two adults and a child. The casualties happened during a widespread bombardment targeting the Ukraine capital and four other cities. At least 31 died and 125 were injured. This happened at the start of the NATO 75th year summit hosted by President Biden and cannot be considered as anything but a huge sign of disrespect to both the US and NATO.

Conclusion

Russia and China are leading an anti-Western cabal of authoritarian governments loosely affiliated with the BRICs but also including certain Middle Eastern countries. The countries oppose US interference in their affairs and fear that the US could freeze their dollar assets like Washington did to Russia. Many are buying gold and seeking “de-dollarization”.

Arguably this horse has left the barn and Trump won’t be able to close the door. If Biden gets re-elected, expect more defections from the dollar, and anti-American sentiment from the pro-Russian/China bloc.

Central bank buying has been the main factor behind rising gold prices. Indeed the gold price has been kept elevated despite a high US dollar and high US Treasury yields.

Trump’s economic policies would appear to be more inflationary than Biden’s. He is threatening greater trade protectionism and promising tax cuts. He would fire Fed Chair Jerome Powell and replace him with someone more accommodating to monetary stimulus, which would be good for the stock markets but terrible for inflation — just as prices are moderating. Over the past three months, the CPI has declined. It is now sitting at 3%, only 1% away from the Fed’s target rate.

The Federal Open Market Committee meets soon after the election so it will be interesting to see whether the second interest rate cut happens, presuming the first one goes through in September.

Gold has done well, even amid high inflation and the Fed’s rate increases. The danger of Trump getting re-elected is that his inflationary policies will cause the Federal Reserve to go back to hiking rates rather than cutting them. That could be disastrous for gold prices.

Biden should be bragging about how his spending has created jobs — even in so-called red states — and not really had much of an impact on inflation. The Treasury and the Fed have successfully brought inflation to heel. They engineered and, so far, pulled off a “soft landing”.

AOTH’s bottom line? Forget everything we think we know. A cognitively compromised president is vowing to fight on, while Trump waits in the wings, ready to implement the Heritage Foundation’s ‘Conservative Mandate for Leadership’ manifesto. Read it.

The Constitution of the United States divides the federal government into three branches: legislative, executive, and judicial. This ensures that no individual or group will have too much power.

If Trump is elected, President Trump would have control over the Executive branch, the Fed when Powell’s term ends, and he already owns the Supreme Court. He would appoint a new Attorney General to head the DOJ. The Presidency will then be fully weaponized. The Senate and House are the wildcards.

I believe implementation of the conservative plan to drastically alter not only the government of the US, but the very fabric of the country, is going to cause countrywide violent civil disorder in the US, the country will end up tearing itself apart. Enemies will be further emboldened.

It’s a good time to be invested in gold and silver.