- The main themes for the world’s major markets are the 2021-2025 war cycle, the inflation and interest rates cycle, the horrifying overvaluation of the US stock market, the rise of Chindian citizens as global economy leaders, outrageous debt, and the role of gold (and possibly crypto to a small degree) as the main store of wealth for savvy investors living in this discombobulated world.

As empires reach their “blowoff” stage, not only is debt-funded war mongering a key theme, but market overvaluation is ignored… and sometimes worshipped.

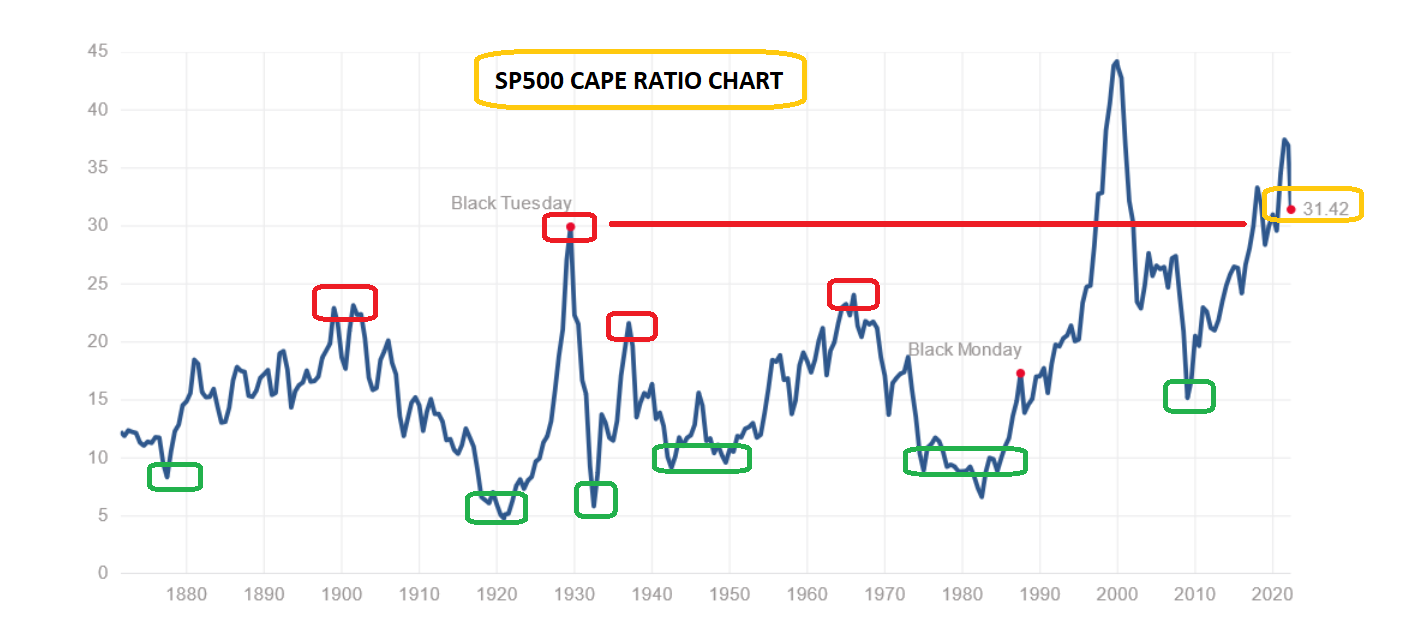

As empires reach their “blowoff” stage, not only is debt-funded war mongering a key theme, but market overvaluation is ignored… and sometimes worshipped.- In late 2016, “Super Trumpy Fiat Man” was elected, and while he did some great things, he failed to replace vile US fiat money with gold, and he failed to caution his worshippers as they charged into the stock market. They believed the CAPE ratio of 28-30 should be ignored (and many didn’t even know there was such a ratio), their hero would bless them with infinite stock market gains, and valuation numbers were irrelevant.

- Horrifically, the already massively overvalued stock market became even more overvalued, and even with the tumble that happened after I warned investors to liquidate in a major way, the CAPE ratio still sits at about 31… which is higher than where it was at the peak of the 1929 market!

- I called the Trump market a market to hold and sell into a final thrust to end times highs. I also warned that a coming war cycle would likely feature the end of the Trump saga, and the beginning of a much more ominous 2021-2025 period (for everyone except the gold bugs of the world), featuring a war mongering democrat sitting in America’s biggest chair.

- Please click here now. Double-click to enlarge. A massive H&S top is forming on the stock market, and it looks like my Aug 7 – Oct 31 “crash season” is the most likely time when the next (and most horrifying) down leg could occur.

- Please click here now. For citizens, the most dangerous politician is a debt and fiat obsessed elderly draft dodger with a gun, and “Jackboot Joe” Biden certainly appears to fit that bill. He may be a five-time draft dodger. He’s using huge amounts of fiat debt to fund his late-in-life love of war, a love that is there as long as his own boots aren’t on the front-lines ground.

- At the same time as Joe ramped up his meddling in Ukraine, central banks began raising rates, and I urged metal investors to “tune in” to the juicy profits to be had (in the medium term) by shorting US bonds rather than buying more metal and mines.

- On that note, please click here now. Double-click to enlarge. Gold has struggled, silver is a disaster, and the miners have retraced most of their 2022 gains, while being “long rates”, as I urged, has been the winning play.

- Being long rates is a simple bet that even if central banks are unlikely to raise rates enough to halt inflation, let alone enough to stop government debt growth, they will at least do some token hikes to keep up appearances, and a lot of token hikes are needed just to do that.

- Short-term profits can again be booked, but this is likely a 10, 20, or even a 30year play. It’s a solid play to reduce the “tension” between rate hikes and inflation for all gold bugs, and especially for silver bugs and mining stock bugs… because their favourite investments are essentially “leveraged without debt” plays on gold.

- Please click here now. Double-click to enlarge this “ultimate” gold chart. There are two main scenarios for gold, and both involve gold rising to $3000. The first has gold bottoming in or near the $1835-$1775 zone that is the apex of the small triangle on the chart, surging to $2300, and ultimately to $3000. This rise likely features a modest reduction in Indian government’s barbaric import duty on gold.

- The second scenario involves a classic “Edwards & Magee” pullback to $1400, and then a much more violent rise to $3000. Both scenarios involve food riots in Europe and likely in America, but the latter scenario likely sees the US nation descend into outright civil war, as red and blue fiat-oriented combatants give up on the election process and decide to settle matters “mano a mano”.

- Clearly, a scenario that involves a drop (albeit very temporary) to $1400 for gold while interest rates skyrocket is a scenario where gold bugs need to be long the interest rates market. I don’t want to forecast one scenario as more likely than the other, but I am definitely a buyer of the miners in the $1835 - $1775 range, and expecting a huge rally from there!

- Gold is at the outskirts of that range and buy programs on solid miners could be initiated today. My flagship GU newsletter is guiding investors through the war cycle and markets mayhem. It’s priced too low at $199/yr, especially with real inflation in the 15%-20% zone. The Fed is failing to quell inflation, but my war cycle special does so: I have a special offer of $179/15mths for metal and mining stock bugs. Click this link to get the special, or send me an Email and I’ll get you a payment link. Thanks!

- For a look at the daily chart for gold, please click here now. Double-click to enlarge this enticing “gold bug buy zones” chart. I urged investors (and myself) to focus on $1835-$1775 area rather than $1920 or $1880, and that’s proven prudent.

- It’s almost impossible to know whether a gold reaction will stop just above a key buy zone (where it is now), at it, or deeper into it. So, my suggested tactics are to buy incrementally via my “PGEN” system into the zone.

- The more aggressive the investor is, the more they should buy right now. The more conservative they are, the more they should focus buys of size around $1775-$1750.

- What about the miners versus gold? Well, please click here now. Double-click to enlarge this important GDX versus gold chart. I’m not a big fan of using absolute ratio numbers or chart patterns to invest in the miners. That’s because of the obvious profits that can be had by buying and selling the miners at key gold bullion support and resistance zones.

- The channel breakout of GDX versus gold appeared to be “chart perfect” when it happened… and yet it failed miserably.

- If superb chart patterns are unreliable for mining stock investors, one can only imagine the danger of investing based on sub par patterns and oscillator signals!

- For mining stock investors who joined me in selling based on gold bullion resistance at $2000, handling the breakout failure was basically a cakewalk. For those who didn’t, well, it was probably quite concerning.

- Silver stocks? Please click here now. Double-click to enlarge this “juicy” buy and sell signals chart for the SIL ETF. Not much was predictable, but the profits were solid based on buying at the support and resistance zones for gold.

- As the US war cycle and accompanying mayhem ravages investors and markets, food riots and perhaps civil war are in the end of empire cards for fiat-obsessed America. Owning metals and miners while also investing in a “long rates” parachute was the best way for investors to fly in the 1970s, and it’s likely going to be the best way to fly with comfort again!

Thanks!

Cheers

St