Throughout U.S. history, the concept of sound money has played a crucial role in shaping the nation's financial stability. Sound money, typically tied to precious metals like gold and silver, serves as a safeguard against inflation and government overreach in monetary policy.

The perspectives of U.S. Presidents on sound money have varied widely, reflecting their times and economic philosophies.

This article explores the stances of various U.S. Presidents on sound money, offering insights into how their policies impacted the nation's financial health.

Early Advocates of Sound Money

George Washington (1789–1797), the nation's first president, set the stage for a strong monetary foundation. Washington supported the Coinage Act of 1792, which established the U.S. Mint and a bimetallic standard, anchoring the U.S. dollar to gold and silver. John Adams (1797–1801) and Thomas Jefferson (1801–1809) continued this tradition, believing that a stable currency backed by precious metals was essential for economic growth and protecting citizens' wealth.

Andrew Jackson (1829–1837) stands out as a fervent supporter of sound money. His famous battle against the Second Bank of the United States culminated in the Bank's demise, and Jackson ensured that gold and silver remained the backbone of the American economy. His policies laid the foundation for a strong, metal-backed currency that limited government interference in the economy. Andrew Jackson’s Farewell Address is filled with mentions of his support for sound money and admonishing fiat currency.

Shifts in the Monetary System

The Civil War marked a turning point in the U.S. approach to sound money. Abraham Lincoln (1861–1865) faced immense financial pressures during the war and turned to paper currency, known as "greenbacks," to fund the Union’s efforts. This shift away from a gold standard marked a significant departure from earlier policies. Following Lincoln, Andrew Johnson (1865–1869) continued the reliance on paper money, weakening the nation's ties to sound money principles.

However, a return to sound money emerged under Ulysses S. Grant (1869–1877), who supported the Resumption Act of 1875, which aimed to redeem paper currency in gold and restore confidence in the dollar. Rutherford B. Hayes (1877–1881) and James A. Garfield (1881) upheld these principles, emphasizing the importance of a stable currency backed by precious metals.

The Rise of Fiat Money

The 20th century saw dramatic changes in U.S. monetary policy, particularly with Franklin D. Roosevelt (1933–1945), who moved the nation away from the gold standard during the Great Depression. Roosevelt's decision to confiscate gold and devalue the dollar against gold was a watershed moment in U.S. monetary history, effectively ending the era of sound money.

Subsequent presidents, including Harry S. Truman (1945–1953), John F. Kennedy (1961–1963), and Lyndon B. Johnson (1963–1969), continued to distance the U.S. from a gold-backed currency. The final break came under Richard Nixon (1969–1974), who ended the convertibility of the U.S. dollar to gold in 1971, marking the official transition to a fiat currency system. This shift allowed for greater government control over the money supply, leading to the inflationary pressures that sound money advocates had long warned against.

Modern Reflections

In recent decades, the debate over sound money has resurfaced. Ronald Reagan (1981–1989) expressed support for returning to a more stable currency system, though his administration did not fully embrace a return to the gold standard.

More recently, Donald Trump (2017–2021) voiced concerns about the dangers of unchecked monetary policy, signaling a renewed interest in the principles of sound money.

Ronald Reagan signed the Statue of Liberty-Ellis Island Commemorative Coin Act (Liberty Coin Act of 1985), and Donald J. Trump signed the 1921 Silver Dollar Coin Anniversary Act of 2021.

As the U.S. continues to grapple with issues of debt, inflation, and economic stability, the lessons from past presidents on sound money remain relevant. A stable, metal-backed currency can provide a foundation for economic growth and protect against the risks of government overreach in monetary policy.

Conclusion

The history of U.S. Presidents and their views on sound money highlights a recurring tension between stability and flexibility in monetary policy. While early presidents championed the principles of sound money to safeguard the economy, later leaders moved away from these foundations in favor of fiat currency and expanded government control.

The ongoing debate about sound money remains a crucial issue in the quest for a stable and prosperous economy.

As history has shown, the principles of sound money continue to offer valuable insights for the future of American financial policy.

Stay informed on sound money policies throughout the United States by visiting The Sound Money Defense League.

Protect your wealth from government-driven inflation caused by fiat monetary policies by investing in gold and silver from Money Metals Exchange.

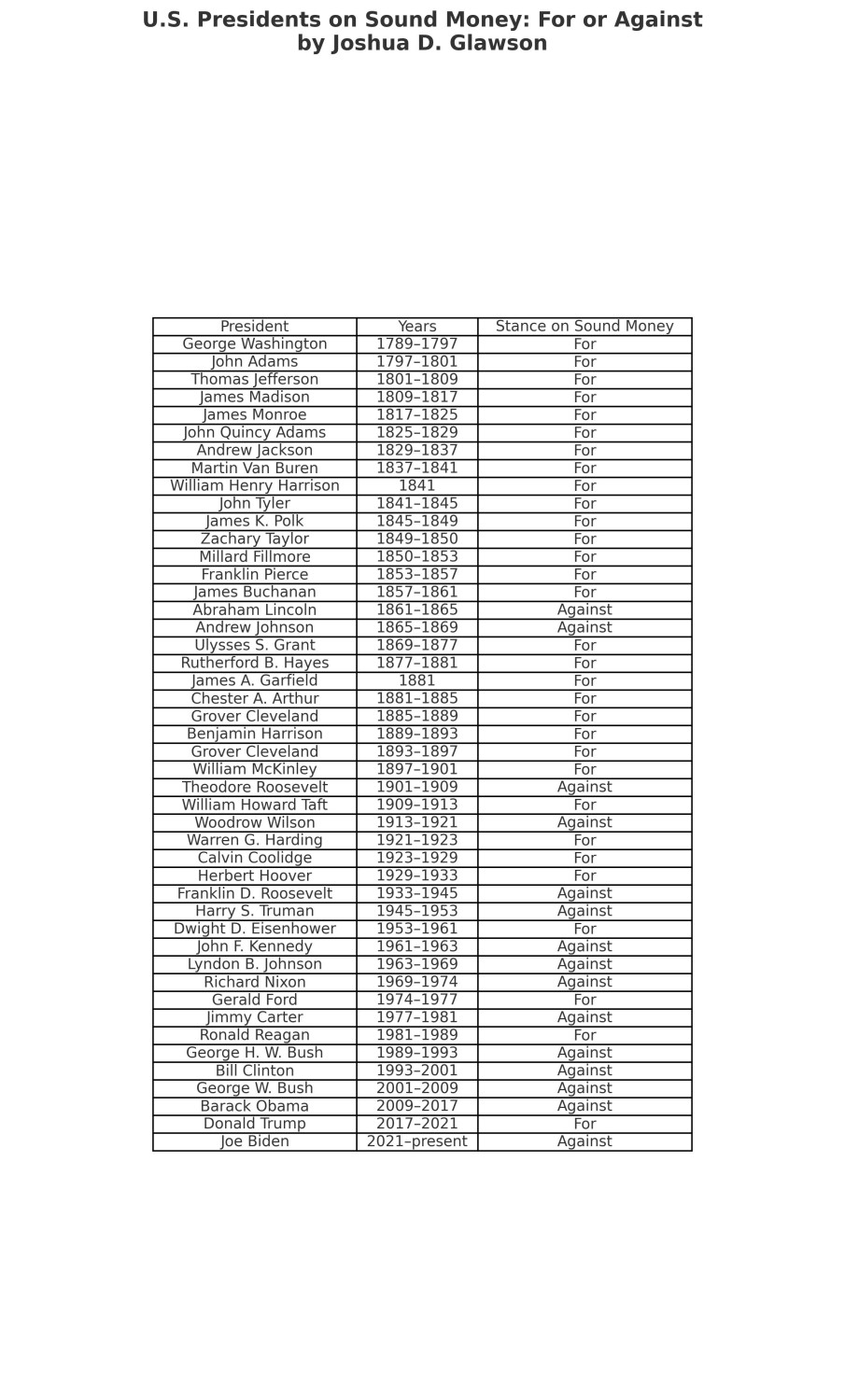

U.S. Presidents on Sound Money: For or Against

The following is a dataset of U.S. Presidents on sound money, marking whether they were 'For' or 'Against' sound money in the United States of America: