The South China Morning Post reported in January that China is fast-tracking 102 major infrastructure projects in 2022.

Beijing is advocating for so-called “new infrastructure”, including 5G, ultra-high-voltage power transmission, big data centers, industrial internet and artificial intelligence.

A proposed new economic model for China creates a template that other developing nations can use to fund major spending initiatives they previously couldn’t afford, since it involved changing their currencies into US dollars, the world’s reserve (and most expensive to convert to) currency.

The upshot will be a global need for commodities that surpasses anything we have ever seen before, even the last commodities super-cycle in the 2000’s driven by China’s insatiable hunger for fuels, metals, building materials and foodstuffs, as its economy grew at double digits.

China, the world leader in electric vehicles and battery production, is moving forward rapidly on its plans to electrify and decarbonize.

President Xi Jinping in 2020 announced the country is aiming for carbon neutrality by 2060. (carbon neutral means emitting the same amount of carbon dioxide into the atmosphere as is offset by other means). The country says it will boost the share of non-fossil fuels in primary energy consumption to around 25% by 2030.

The Made in China 2025 initiative seeks to end Chinese reliance on foreign technology by investing in a number of key sectors, including IT and robotics.

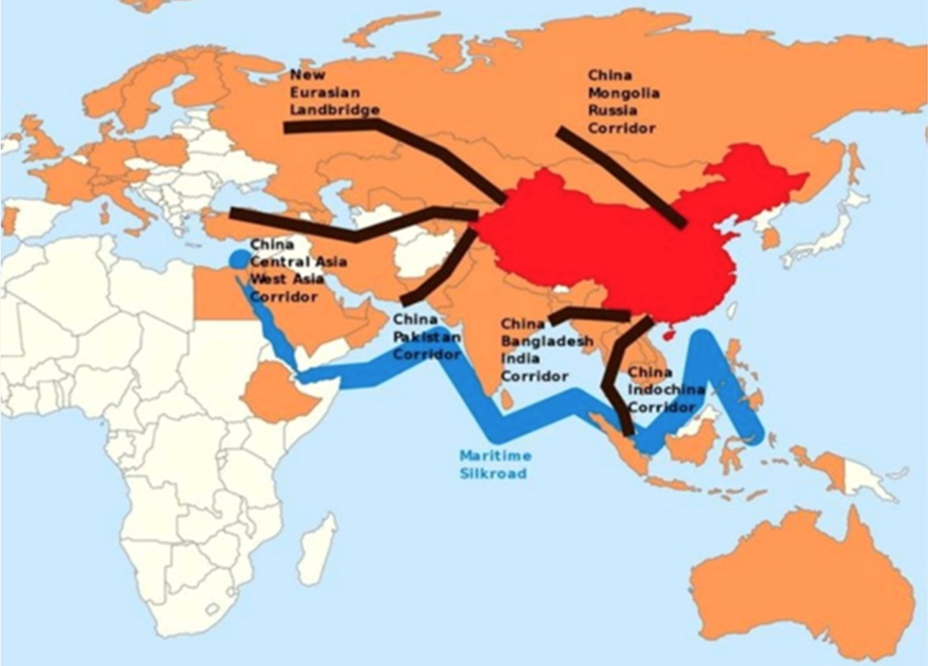

Both “MIC2025” and China’s Belt and Road Initiative (BRI) are part of Beijing’s most recent Five-Year Plan, which calls for developing and leveraging control of “core technologies” such as high-speed rail, power infrastructure and new energy, all of which require extensive minerals.

While the United States in November passed a trillion-dollar infrastructure package that includes money for roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways, China is looking to outspend it by a large margin.

At Beijing’s behest, local governments have reportedly drawn up lists of thousands of “major projects,” they are being pressured to see through. Planned investment in 2022 amounts to at least 14.8 trillion yuan (US$2.3 trillion), according to a Bloomberg analysis.

That’s more than double the new spending in the infrastructure package the US Congress approved last year, which totals $1.1 trillion spread over five years.

Notably, the focus of the stimulus spending will be on manufacturing, including factories, industrial parks and technology incubators. The construction push is part of the central government’s plan to meet its targeted 5.5% growth rate this year.

Now that China has secured most, if not all, of the minerals it needs to create what is essentially its own trading ecosystem, or sphere of influence, with BRI member countries, the work is beginning on how to build a manufacturing base from which to generate a huge range of products to sell to them.

It’s important to recognize that these aren’t the Chinese goods of old. No more cheap plastic toys and kitchen appliances. Statements from China’s leadership indicate the country is moving into high-technology sectors that will lead the world and relegate the US to second place.

In describing the ‘14th Five-Year Plan’, President Xi indicated that China will move away from its previous economic trajectory, stating that “we must strive to promote the common prosperity of all people and achieve more obvious substantive progress. … [We must] no longer simply talk about heroes based on the growth rate of GDP.”

The plan outlines a number of policies that are designed to support the development of scientific research and advanced manufacturing. According to the Hong Kong Trade Development Council, the Chinese government is looking to target such cutting-edge fields as: artificial intelligence (AI), quantum information, integrated circuits (ICs), life and health, brain science, biobreeding, aerospace technology, deep earth and deep sea, and implement a series of forward‑looking and strategic National Science and Technology Major Projects. (2.4.2) Support will also be given to Beijing, Shanghai and the Guangdong‑Hong Kong‑Macao Greater Bay Area (GBA) to establish global technology innovation centres, and to Huairou of Beijing, Zhangjiang of Shanghai, the GBA and Hefei of Anhui to develop comprehensive national science centres.

We know that China has big plans for manufacturing, i.e. the $2.3T infrastructure package consisting of thousands of major projects put forth by local governments.

As for how China pays for this massive infrastructure spend, according to recent media reports, China is moving forward by six months the sale of local government bonds. Beijing is mulling whether to allow municipalities to sell 1.1 trillion yuan, or USD$220 billion of the special bonds. If permitted, it would be the first time that local governments sold bonds before Jan. 1, when the new budget year begins.

Funds from the sale of government debt, similar to the issuance of US Treasuries, would be used mostly to pay for infrastructure spending, which is being presented as a way to shore up China’s beleaguered economy as it claws its way back from a severe covid-19 lockdown.

Commodities rallied in European markets on the news, with copper extending gains 3.6% to $7,789 a ton on the London Metal Exchange.

China’s resource grab

Russia supplies about one-sixth of the world’s commodities, and we have seen the dramatic effects that the war in Ukraine and sanctions are having on the prices of commodities like natural gas and wheat.

If you thought the West was dependent on Russia for its raw materials, let’s take a look at what’s at stake in China, and what could happen if Beijing, increasingly belligerent economically, politically and militarily, were to try and expand its territory like the Kremlin is attempting to do.

China has a stranglehold on lithium and graphite processing, meaning it can use them as a cudgel in trade talks with the United States, or it could freeze shipments of them during a war.

In 2010, a decision by China to restrict exports of rare earths sent the prices of most rare earth oxides into orbit. It could easily happen again.

Think of an important mineral and chances are China controls the mining and/or refining. The list includes iron ore, copper, lithium, graphite and cobalt.

How did China end up in such a dominant position regarding the world’s supply of mined commodities?

The mining industry’s experience of China locking up the world’s mineral resources testifies to how far the Chinese will go to ensure their ever-growing demand for mined commodities is met.

While iron ore and copper were the hot targets of overseas acquisitions by Chinese firms as they sought to feed an economy that up until 2015 saw double-digit growth, the Chinese have also gone after gold, nickel, tin, coking coal and oilsands. More recently the most desired metals are those that feed into the global shift from fossil fuels to the electrification of vehicles. This has meant a hunt for lithium, cobalt, graphite, copper and rare earths — metals used in electric vehicles, of which China has become the world’s leading manufacturer.

Two large Peruvian copper mines are owned by Chinese companies. Chinese state-run Chinalco owns the Toromocho copper mine, while the La Bambas mine is a joint venture between operator MMG (62.5%), a subsidiary of Guoxin International Investment Co. Ltd (22.5%) and CITIC Metal Co. Ltd (15%). The Chinese-backed Mirador mine in Ecuador opened in 2019.

Four out of the five major copper projects in the pipeline right now either have offtake agreements in place with non-Western countries (South Korea and China), or the mines are partially owned by Japanese companies that have a say in where some of the mined copper is destined. (i.e. Japan)

China long ago put a lock on much of Africa’s vast resources.

At Ivanhoe Mines’ massive Kamoa-Kaukula copper mine in the DRC, which recently came online, 100% of initial production will be split between two Chinese companies, one of which owns 39.6% of the joint venture project.

Among China’s other recent Africa mining investments,

- Shandong Gold in 2020 offered $221 million for Ghana-focused miner Cardinal Resources;

- Zijin Mining acquired a 50.1% stake in Tibet Julong Copper for $548 million.

- Privately held Yibin Tianyi Lithium Industry completed an AUD$10.7 million investment in AVZ Minerals, which has a project in the DRC.

We know from previous articles that China has been extremely active in acquiring ownership or part-ownership of foreign lithium mines and inking offtake agreements.

China of course, has also locked up rare earths and is the main player in a number of critical mineral markets including cobalt, graphite, manganese and vanadium.

This past December, China’s Zheijang Huayou Cobalt, the world’s biggest producer of the mineral that forms part of the electric-vehicle battery cathode, said it would pay $422 million to acquire the Acadia hard-rock lithium mine in Zimbabwe.

For years the United States and Canada didn’t bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends.

China recognized opportunity knocking and answered, seizing control of almost all REE processing and magnet manufacturing, in the space of about 10 years.

Currently nearly all graphite processing takes place in China because of the ready availability of graphite there, weak environmental standards and low costs.

Over half of the world’s cobalt — a key ingredient of electric vehicle batteries — is mined as a by-product of copper production in the Democratic Republic of Congo (DRC). In a $9 billion joint venture with the DRC government, China got the rights to the vast copper and cobalt resources of the North Kivu province in exchange for providing $6 billion worth of infrastructure including roads, dams, hospitals, schools and railway links.

China controls about 85% of global cobalt supply, including an offtake agreement with Glencore, the largest producer of the mineral, to sell cobalt hydroxide to Chinese chemicals firm GEM. China Molybdenum is the largest shareholder in the major DRC copper-cobalt mine Tenke Fungurume, which supplies cobalt to the Kokkola refinery in Finland. China imports 98% of its cobalt from the DRC and produces around half of the world’s refined cobalt.

Most of the metal produced under these offtake agreements will never come to the market anyplace other than in China. Those metals that do, can have their supply shut down any time the Chinese want.

Over the past few years, overt resource grabs by China in what used to be the US backyard, countries defined by ‘The Monroe Doctrine’, include:

- Shandong Gold partnered with Barrick Gold to purchase a 50% stake in the Veladero gold mine on the Chile-Argentina border for $960 million.

- Zijin Mining acquired Colombia Continental Gold and its Buritica gold project in Colombia for CAD$1.4 billion. This was followed by the purchase of Guyana Goldfields for CAD$323 million.

- Two large Peruvian copper mines are owned by Chinese companies. Chinese state-run Chinalco owns the Toromocho copper mine, while the La Bambas mine is a joint venture between operator MMG (62.5%), a subsidiary of Guoxin International Investment Co. Ltd (22.5%) and CITIC Metal Co. Ltd (15.0%).

- In 2018 China’s Tianqi Lithium purchased a 23.7% stake in Chilean state lithium miner SQM, despite concerns from regulators that the $4 billion tie-up would give Tianqi a near monopoly over the lithium market and unprecedented pricing power.

Often China’s modus operandi is to build mines in exchange for providing infrastructure that supports, and gains the favor of, the local population, such as schools, health clinics, roads and clean water systems.

East vs West

Indeed, Beijing has been very smart about courting developing countries by offering them financial support in exchange for access to minerals and regional influence. Excluding Mexico, which has a free-trade agreement with the United States and Canada, China is now Latin America’s largest trading partner, according to UN trade data from 2015-21. Consider this alarming statistic: in 2000 China’s trade with Latin America amounted to just $12 billion, but by 2019 it had grown 27.5X to $330 billion. By 2035 trade between China and Latin America/ the Caribbean, is expected to double again, to $700 billion.

Remember China’s Belt and Road, mentioned at the top? 21 Latin American and Caribbean nations have so far signed onto BRI, which has deepened China’s influence in the region to the point where it has translated into significant leverage. Over the past four years, for example, the Dominican Republic, El Salvador and Panama each switched their diplomatic recognition from Taiwan to China.

In comparison, President Biden’s pledge to counter China’s influence in Latin America and restore American leadership there, has so far amounted to little. The Biden administration’s answer to China’s Belt and Road, the US-centric ‘Build Back Better World’, was launched in June 2021, but it has yet to take off.

Beijing’s commitment to the region is also stronger than the US, with long-term cooperation promised partly due to the fact that 80% of China’s investments in Latin America comes from Chinese state-owned firms and other public ventures such as provinces and municipalities.

Another thing that makes partnering with China attractive, is the fact that Beijing doesn’t make an investment contingent on the country upholding human rights or democracy, as the United States does. For example at the recent Summit of the Americas, held in Los Angeles, the US did not invite undemocratic Cuba, Venezuela and Nicaragua.

Biden used the summit to announce a new economic partnership between the US and Latin America to rival China’s growing power in the region, but some commentators say it is too little too late.

“The United States is playing catch-up,” Voice of America News quoted Diego Abente Brun, director of the Latin American and Hemispheric Studies Program at George Washington University.

According to the Gatestone Institute,

The odds of Biden’s new plan winning over Latin American countries — where China has already massively invested in building roads, railways, harbors, bridges and a host of other infrastructure and communications projects, with no questions asked on the environment, climate or “inclusivity” — are probably low. Even Biden administration officials do not seem to harbor any illusions about the new plan’s ability to change facts on the ground. “As long as China is ready to put its cash on the table, we seem to be fighting a losing battle,” one US official, speaking on condition of anonymity, told Reuters.

China’s diplomatic push to gain the upper hand over the United States goes beyond Latin America, Africa and minerals.

Earlier this year, Beijing began promoting its “Global Security Initiative”, an alternative to the US-led security order. As explained by The Financial Times, the initiative is a collection of policy principles such as non-interference and grudges against US “hegemonism”.

Reading about the Global Security Initiative, it seems obvious that China is attempting to paint the United States as the villain in international relations, and itself as “the good guy”. In a video address to foreign ministers from the BRIC countries on May 19, China’s President Xi Jinping urged fellow BRIC members Brazil, Russia, India, South Africa, to “oppose hegemonism and power politics, reject cold war mentality and bloc confrontation and work together to build a global community of security for all.”

The FT reports China’s Foreign Minister, Wang Yi, has received declarations of support from Uruguay, Nicaragua, Cuba and Pakistan, adding to endorsements from Syria and Indonesia, where Chinese money is helping the archipelago nation to become a hub for the mining and refining of battery metals and electric vehicle auto-making. Chinese diplomats are also promoting GSI in a number of developing countries including India, the Philippines, Uganda, Somalia and Kenya.

Academics note the Global Security Initiative is a departure from China’s traditional role in international relations, which focused on development, and providing prosperity to troubled regions.

According to the FT,

This greater role played by security is evident in the Pacific, where China is rapidly expanding its influence at the expense of the western powers that have dominated the region. On a tour of eight Pacific island nations [in May], Wang [proposed] a co-operation deal covering everything from customs to fishing.

More recently, Wang traveled to the Philippines to meet with his Filipino counterpart, Foreign Minister Enrique Manalo.

The two nations have previously clashed over China’s territorial ambitions in the South China Sea, but according to a July 6 Reuters story, Marcos wants his country’s dealings with China to be about more than a maritime dispute. Wang said Wednesday that Beijing was ready to work with Marcos to help usher in what he called a “new golden era” in the countries’ relationship.

A more concrete example of China’s efforts to bring developing countries into its orbit, is the China-Thailand Railway. Once completed, the line will carry trains from Bangkok to the border town of Nong Kai, where a new bridge will connect it with the China-Laos Railway, making it possible to travel by train from Bangkok, through Laos, to Kunming in southwest China’s Yunnan Province.

As China shores up regional power & influence paid for by major infrastructure projects made through its Belt and Road Initiative, and actively promotes its Global Security Initiative, the United States and its allies are thinking up new ways to oppose China.

Last September, Australia, the US and the United Kingdom announced the new AUKUS security pact, widely seen as an attempt to strengthen regional military muscle in the face of China’s growing presence off Australia’s western coast.

Another example is “friend-shoring”. Friend-shoring presumes a world divided between free-market economies and countries that align with authoritarian regimes. The idea is for a group of countries with shared values, and at a similar stage of development, to source raw materials and to manufacture goods, from within that group. The goal is to prevent less like-minded nations from exploiting their comparative advantage, or in some cases, their monopolies, in key raw materials, technologies or products.

Clearly the target is China and Russia. The US wants to reduce dependence on authoritarian regimes like China that supply the majority of the world’s rare earths and magnets, and dominate the production of several battery/ electrification metals including copper, zinc, tin, lithium and graphite; and diversify away from Russian suppliers of critical commodities such as energy, food and fertilizer.

In a blog post for the Brookings Institution, authors Elaine Dezenski and John Austin say that “ally-shoring” will strengthen the economies of the US and its allies and that “working together to rewire supply chains and co-produce high-tech products in emerging sectors will serve to rebuild bruised alliances and US global economic and political leadership, as well as check China’s bid to extend their own authoritarian economic and political model across the globe.”

Two blocs

Economists argue that picking trade partners for geopolitical reasons could create a world of antagonistic blocs, similar to George Orwell’s novel ‘1984’, or the Cold War. As the Wall Street Journal maintains, the global economy could split into two hostile camps, the United States and China, thus hurting growth and accelerating inflation.

Beata Javorcik, chief economist at the European Bank for Reconstruction and Development, calculates that the creation of a two-bloc world would lead to a 5% loss of global economic output over a 10- to 20-year period — equivalent to roughly $4.4 trillion.

An example of friend-shoring put into practice, is the Minerals Security Partnership (MSP), formed in June as a sort of “metallic NATO”. Members include the United States, Canada, Australia, Finland, France, Germany, Japan, South Korea, Sweden, the United Kingdom and the European Commission.

Theoretically open to all countries that are committed to “responsible critical mineral supply chains to support economic prosperity and climate objectives,” the MSP aims to help “catalyze investment from governments and the private sector for strategic opportunities … that adhere to the highest environmental, social, and governance standards,” reads a statement from the US State Department.

In fact, the MSP is defined more by who is not on the list — China and Russia.

Conclusion

Make no mistake. To a large extent, friend-shoring, and the other economic and diplomatic overtures mentioned here, including China’s Belt and Road, its Global Security Initiative, Biden’s Build Back Better World, the Minerals Security Partnership, the US trillion-dollar infrastructure plan, and China’s US$2.3 trillion “new infrastructure” spend, boil down to ensuring security of natural resource supplies, and bolstering each’s manufacturing base, in a hostile new two-bloc world divided between the United States and Russia/ China.

I agree with Bob Moriarty who in a recent commentary wrote “What we have is effectively a war between good and evil. The US, Nato and the WEF are on one side, Russia/China on the other side.”

As for who is winning this war, it certainly is not the US.

It doesn’t take a lot of economic analysis to determine that Russia is doing just fine, despite Western sanctions, while the rest of the world suffers due to record-high energy and food prices. Consider: two thirds of the world’s population live in countries that do not support the sanctions. But every country, especially those with a large poor segment that is disproportionately impacted by higher electricity and food prices, could face starvation and a potentially bitter winter. Meanwhile Russia is raking it in, selling food and fuel to the 65% of the world not supporting the sanctions.

For now, Europeans are bearing the brunt. In June, European power prices hit their highest level since December after Germany moved to ration natural gas supplies amid cuts to flows from Russia, its main supplier.

The German parliament on Thursday voted on a regulation to provide compensation to coal-plant operators if the supply situation deteriorates, allowing them to bring coal plants back online in an effort to conserve natural gas. So much for “Energiewende”.

Supply worries pushed German electricity prices up 25% this week, capping a 400% rally in the past year, Bloomberg said.

In Japan, which depends on fuel imports for heating and power, electricity rates in June surged 10% from a year earlier, according to Reuters rising at a record rate as the Ukraine crisis and a weak yen pushed up the cost of energy and raw materials.

As for China, Beijing’s refusal to condemn Russia for its actions in Ukraine has put it in a tricky position, diplomatically.

“Russia will gladly sell oil and gas, plus wheat and other grains, at lower prices to China. Russia will also likely be willing to pay higher prices for a wide range of Chinese products, from semiconductors to clothing, Gary Hufbauer, a senior fellow at Peterson Institute for International Economics, told VOA Mandarin.

Since the war in Ukraine started in February, Russia has become China’s biggest supplier of oil as the country sold discounted crude to Beijing amid sanctions. According to the BBC, imports of Russian oil rose 55% from a year earlier to a record level, displacing Saudi Arabia as China’s biggest provider.

Meanwhile, optimism seems to be returning to the Chinese economy, after months of stagnation due to the heavy-handed restrictions imposed on a number of Chinese cities following the return of covid-19.

In a stimulus package announced on May 31, the government rolled out 33 measures including moves to boost vehicle and appliance purchases, accelerate infrastructure spending and increase the availability of credit for housing construction.

In early June, Reuters said China appears to be boosting iron ore imports, with May cargoes totaling 97.6 million tons, the most since January. Iron ore is a key ingredient in steelmaking, which is often used as a barometer for an economy’s health.

Stock markets climbed in Asia on Friday, bolstered by the possibility of major stimulus in China, along with hopes that inflation can be controlled without causing a global recession.

The silver lining of a new two-bloc world split between the United States and its allies, and a Russia-China axis of evil, is higher commodity prices. While metal prices have recently pulled back, on recession fears brought about by central bank interest rate hikes, arguably the supply shortages are very much intact (shown by low London Metal Exchange inventories), and the destruction of consumer demand will not come close to matching the higher demand for commodities from all the infrastructure programs being rolled out globally.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.